- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

338 Technician courses in Mountsorrel delivered Live Online

Acrylic Nail Extension Course

By NextGen Learning

Acrylic Nail Extension Course Course Overview: This Acrylic Nail Extension course is designed to equip learners with the essential skills to master acrylic nail extension techniques. From understanding nail anatomy and product chemistry to advanced nail art, this course covers everything you need to know about acrylic nails. Learners will develop proficiency in applying acrylic nail extensions, performing maintenance, and ensuring client care and safety. By the end of the course, students will have the knowledge and expertise to apply various nail techniques, making them confident in offering professional services. Whether you are a beginner or seeking to refine your skills, this course provides all the necessary knowledge to build a successful career in the beauty industry. Course Description: This comprehensive course offers a detailed exploration of acrylic nail extensions, starting with the basics of nail anatomy and product chemistry. Learners will delve into essential techniques such as applying tips, overlays, and creating nail art. With modules focusing on nail diseases, disorders, and proper maintenance, the course ensures learners can safely and professionally care for their clients' nails. The course also includes in-depth modules on client communication and salon safety, making sure that students can provide excellent customer service while following industry best practices. Upon completion, learners will have a complete understanding of acrylic nail extensions, from application to removal, and will be equipped to confidently enter the beauty industry with practical skills and a professional approach. Acrylic Nail Extension Course Curriculum: Module 01: Nail Extension Techniques: An Introduction Module 02: Nail Anatomy Module 03: Nail Diseases and Disorders Module 04: Nail Product Chemistry Simplified Module 05: Nail Extension Techniques Module 06: Acrylic Nail Extension: Part-1 (Applying Tips to the Nails) Module 07: Acrylic Nail Extension: Part-2 (Applying Overlays) Module 08: Art in Acrylic Nails: Basic to Advance Module 09: Hands-on Nail Art Training Module 10: Maintaining Artificial Nails Module 11: Acrylic Nail Removal Module 12: Health and Safety in Beauty Salon Module 13: Client Care and Communication (See full curriculum) Who is this course for? Individuals seeking to master acrylic nail extension techniques. Professionals aiming to expand their beauty industry skills. Beginners with an interest in nail care and beauty treatments. Beauty enthusiasts looking to enter the nail extension field. Career Path Nail Technician Beauty Salon Specialist Freelance Nail Artist Nail Care Educator Beauty Consultant Spa and Salon Owner

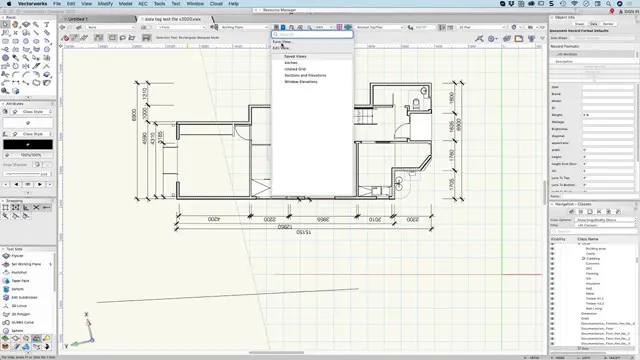

Vectorworks Evening Introduction Training Course

By Real Animation Works

Vectorworks Evening Course face to face One to one

Tax Accounting

By NextGen Learning

Course Overview The Tax Accounting course provides a comprehensive introduction to the UK tax system, covering key areas such as income tax, corporation tax, VAT, and inheritance tax. Designed to equip learners with up-to-date knowledge of tax regulations and processes, this course offers valuable insights into tax administration, individual and corporate responsibilities, and submission of tax returns. Learners will develop a solid understanding of fundamental and advanced tax principles, payroll, and financial analysis. By the end of the course, participants will be able to navigate the complexities of taxation confidently and apply their knowledge in professional contexts. Whether aiming to launch a career in tax accounting or broaden existing financial expertise, this course supports learners in achieving their professional development goals and gaining skills that are in high demand across multiple sectors in the UK. Course Description This Tax Accounting course delves into the structure and operation of the UK tax system, offering detailed modules on personal and corporate taxation, VAT, capital gains, and national insurance contributions. Learners will explore both basic and advanced income tax calculations, understand payroll systems, and gain familiarity with self-assessment and double-entry accounting methods. The curriculum is structured to promote a clear and methodical understanding of tax reporting, compliance obligations, and financial analysis. With a strong emphasis on technical knowledge and regulatory frameworks, this course supports learners in building the analytical and accounting skills essential for a successful career in finance and taxation. Throughout the course, learners will benefit from clear explanations, real-world examples, and guided study that align with industry standards. By completion, participants will be well-prepared to pursue opportunities in accounting firms, corporate finance departments, and tax advisory roles. Course Modules Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Advanced Income Tax Module 07: Payee, Payroll and Wages Module 08: Capital Gain Tax Module 09: Value Added Tax Module 10: Import and Export Module 11: Corporation Tax Module 12: Inheritance Tax Module 13: Double Entry Accounting Module 14: Management Accounting and Financial Analysis Module 15: Career as a Tax Accountant in the UK (See full curriculum) Who is this course for? Individuals seeking to develop a strong foundation in tax accounting. Professionals aiming to enhance their accounting and financial expertise. Beginners with an interest in taxation, finance, or business management. Entrepreneurs wanting to understand tax obligations for businesses. Students planning a career in accounting, auditing, or tax consultancy. Career Path Tax Accountant Payroll Administrator VAT Specialist Income Tax Advisor Financial Analyst Management Accountant Corporate Tax Consultant Self-Assessment Practitioner Tax Compliance Officer Accounting Technician

Medical Terminology Training Courses - Level 2

By Mediterm Training

This course leads to the Mediterm Intermediate Award in Medical Terminology (Level 2), studied over approximately 12 weeks (taking more or less time dependent on learner requirements). This course is suitable for those already working in healthcare or those who wish to start a new career in healthcare.

Become a professional in the Telecomms industry with our EUSR SHEA Telecommunications Card Training Overview Our Energy Utilities Skills Register Safety Health Environmental Awareness EUSR SHEA Telecommunications Card Training is designed for professionals working in telecommunication-related industries, such as Telephone Exchanges, on the network, customer properties and more. The course equips participants with essential knowledge and skills to ensure safe and environmentally responsible practices on work sites near telecommunication environments. Upon completion, you’ll receive the coveted EUSR SHEA Telecommunications Card.

BOHS P903 - Management and control of evaporative cooling and other high risk industrial systems

By Airborne Environmental Consultants Ltd

BOHS P903 - Management and control of evaporative cooling and other high risk industrial systems is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in Evaporative Cooling and other high risk Industrial type systems. It is a requirement of this course that candidates have successfully completed P901 - Legionella- Management and Control of Building Hot and Cold Water Services. Where both P901 and P903 courses are run on subsequent days or as a combined course then this prerequisite is waived.

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems

By Airborne Environmental Consultants Ltd

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in leisure, display, therapy and other non-industrial water systems. It is a requirement of this course that candidates have successfully completed P901- Legionella- Management and Control of Building Hot and Cold Water Services [Syllabus GM.1]. Where both P901 and P904 courses are run on subsequent days or as a combined course then this pre-requirement is waived.

BOHS P901 - Management and control of building hot and cold water services

By Airborne Environmental Consultants Ltd

P901 - Management and control of building hot and cold water services is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in domestic type hot and cold water systems. (This course is also a pre-requirement before undertaking course P903 - Management and Control of Evaporative Cooling Systems and other High Risk Industrial Systems or P904 - Management and Control in Leisure, Display, Therapy and other Non-Industrial Systems.)

BOHS P901 Online - Management and control of building hot and cold water services

By Airborne Environmental Consultants Ltd

P901 - Management and control of building hot and cold water services is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in domestic type hot and cold water systems. (This course is also a pre-requirement before undertaking course P903 - Management and Control of Evaporative Cooling Systems and other High Risk Industrial Systems or P904 - Management and Control in Leisure, Display, Therapy and other Non-Industrial Systems.)

Ophthalmology for HCAs

By M&K Update Ltd

Develop essential knowledge and appropriate skills in the quality treatment and management of the patient with an eye problem