- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Forex Trader Complete Bundle - QLS Endorsed

By Imperial Academy

10 QLS Endorsed Courses for Forex Trader | 10 QLS Hard Copy Certificates Included | Lifetime Access | Tutor Support

Beauty (Lash Lift, Eyebrow Microblading, Eyeliner, Brow Lift, LIPS, Nail Technician)

5.0(2)By Institute of Beauty & Makeup

55 in 1 Exclusive Bundle! CPD Certified | Audio Visual Training | 550+ CPD Points | Training by Expert | Lifetime Access

Do you want a fulfilling career in accountancy? Have you passed AAT Level 3 or an equivalent accounting qualification? We can help you reach your goal by studying AAT Level 4. This level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. About AAT Level 4 Diploma in Professional Accounting Entry Requirements To progress comfortably on this course, you’ll need to have good accounting knowledge and be able to perform all the financial and management accounting tasks which are tested on the AAT Level 3 course. Plus you’ll need a good standard of English literacy and basic Maths skills. We recommend you register with AAT before starting this course. This will give you your AAT student number, which enables you to enter for assessments. AAT Level 4 Diploma in Professional Accounting syllabus By the end of this course, you’ll be able to apply complex accounting principles, concepts, and rules to prepare the financial statements of a limited company. You’ll also learn management accounting techniques to aid decision making and control, prepare and monitor budgets, and measure performance. This level consists of compulsory and optional units: Compulsory unitsDrafting and Interpreting of Financial Statements (DAIF) The reporting frameworks that underpin financial reporting How to draft statutory financial statements for limited companies How to draft consolidated financial statements How to interpret financial statements using ratio analysis Applied Management Accounting (AMAC) The organisational planning process How to use internal processes to enhance operational control How to use techniques to aid short-term and long-term decision making How to analyse and report on business performance Internal Accounting Systems and Controls (INAC) The role and responsibilities of the accounting function within an organisation How to evaluate internal control systems How to evaluate an organisation’s accounting system and underpinning procedures The impact of technology on accounting systems How to recommend improvements to an organisation’s accounting system Optional units (choose two)Business Tax (BNTA) How to prepare tax computations for sole traders and partnerships How to prepare tax computations for limited companies How to prepare tax computations for the sale of capital assets by limited companies The administrative requirements of the UK’s tax regime The tax implications of business disposals Tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue and Customs Personal Tax (PNTA) The principles and rules that underpin taxation systems How to calculate UK taxpayers’ total income How to calculate income tax and National Insurance Contributions (NICs) payable by UK taxpayers How to calculate capital gains tax payable by UK taxpayers The principles of inheritance tax Audit and Assurance (AUDT) The audit and assurance framework The importance of professional ethics How to evaluate the planning process for audit and assurance How to evaluate procedures for obtaining sufficient and appropriate evidence How to review and report findings Cash and Financial Management (CSFT) How to prepare forecasts for cash receipts and payments How to prepare cash budgets and monitor cash flows The importance of managing finance and liquidity Ways of raising finance and investing funds Regulations and organisational policies that influence decisions in managing cash and finance Credit and Debt Management (CRDM) The relevant legislation and contract law that impacts the credit control environment How information is used to assess credit risk and grant credit in compliance with organisational policies and procedures The organisation’s credit control processes for managing and collecting debts Different techniques available to collect debts How is this course assessed? The Level 4 course is assessed by unit assessments. Unit assessment The Level 4 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 4 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the AAT and the results are released after six weeks Getting your results Assessment results will be available in your MyAAT account when they are released. Grading To be awarded the AAT Level 4 Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 4 content with the use of all other levels, allowing you to recap previous levels at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After you’ve passed this level, you can work in a variety of jobs including forensic accountant, tax manager, accountancy consultant, or finance analyst, earning salaries of up to £37,000 as you advance and gain experience. AAT full members (MAAT) and fellow members (FMAAT) are eligible for exemptions that allow you to take the fast track route to chartered accountant status. You can stay with the same training provider. Eagle offers affordable courses approved by the ACCA (Association of Chartered Certified Accountants) to which you can subscribe. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission, and exam fees, are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 4 Registration Fee: £240 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

***24 Hour Limited Time Flash Sale*** Lean Six Sigma Green Belt Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Lean Six Sigma Green Belt Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Lean Six Sigma Green Belt bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Lean Six Sigma Green Belt Online Training, you'll receive 40 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Lean Six Sigma Green Belt Career Bundle: Course 01: Lean Six Sigma Green Belt Course 02: Lean Process and Six Sigma at QLS Level 5 Diploma Course 03: Lean Six Sigma Black Belt Course 04: Lean Six Sigma White Belt course Course 05: Lean Six Sigma: Toolkit Course 06: Professional Lean Management: Service Industry Course 07: Agile Scrum Master Course 08: Project Management Course Course 09: Process Improvement Course 10: Operations Management: Process Mapping & Supply Chain Course 11: The 7 Basic Tools of Quality Course 12: Quality Assurance (QA) Manager Training Course 13: Logistics Management Course 14: DIPLOMA IN OPERATIONS MANAGEMENT Course 15: Change Management Course 16: Facility Management Course 17: Diploma in Purchasing & Procurement at QLS Level 5 Course 18: SAP Controlling (CO) - Product Costing S4HANA Course 19: Commercial Law Course 20: Business Development Course 21: Financial Analysis Course 22: Financial Modelling for Decision Making and Business plan Course 23: Internal Audit Skills Course 24: Business Productivity Training Course 25: Payroll Administrator Training Course 26: Negotiation Skills Certificate Course 27: Creative Marketing Plan Course 28: Presentation Skills Guideline Course 29: Sales Skills Course Course 30: Delegation Skills Training Course 31: Customer Service Training Course 32: Public Speaking Diploma Course 33: CSR - Corporate Social Responsibility Course 34: Middle Manager Management Course 35: Cross-Cultural Awareness Training Course 36: Communicate and Work With People From Other Culture Course 37: Time Management Course 38: Critical Thinking in The Workplace Course 39: Compliance Risk and Management Course 40: Workplace Confidentiality With Lean Six Sigma Green Belt, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Lean Six Sigma Green Belt today and take the first step towards achieving your goals and dreams. Learning Outcomes: Identify and eliminate waste through various Lean tools and techniques. Implement Six Sigma methodologies to reduce defects and improve quality. Lead process improvement projects and drive positive change within your organization. Analyze data to make informed decisions and identify root causes of problems. Utilize Lean Six Sigma tools such as value stream mapping, five-why analysis, and control charts. Apply Lean Six Sigma principles to various industries and functional areas. Why buy this Lean Six Sigma Green Belt? Free CPD Accredited Certificate upon completion of Lean Six Sigma Green Belt Get a free student ID card with Lean Six Sigma Green Belt Lifetime access to the Lean Six Sigma Green Belt course materials Get instant access to this Lean Six Sigma Green Belt course Learn Lean Six Sigma Green Belt from anywhere in the world 24/7 tutor support with the Lean Six Sigma Green Belt course. Start your learning journey straightaway with our Lean Six Sigma Green Belt Training! Lean Six Sigma Green Belt premium bundle consists of 40 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Lean Six Sigma Green Belt is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Lean Six Sigma Green Belt course. After passing the Lean Six Sigma Green Belt exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Lean Six Sigma Green Belt course is ideal for: Students seeking mastery in Lean Six Sigma Green Belt Professionals seeking to enhance Lean Six Sigma Green Belt skills Individuals looking for a Lean Six Sigma Green Belt-related career. Anyone passionate about Lean Six Sigma Green Belt Requirements This Lean Six Sigma Green Belt doesn't require prior experience and is suitable for diverse learners. Career path This Lean Six Sigma Green Belt bundle will allow you to kickstart or take your career in the related sector to the next stage. Lean Six Sigma Green Belt Process Improvement Manager Quality Assurance Manager Project Manager Operations Manager Consultant Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

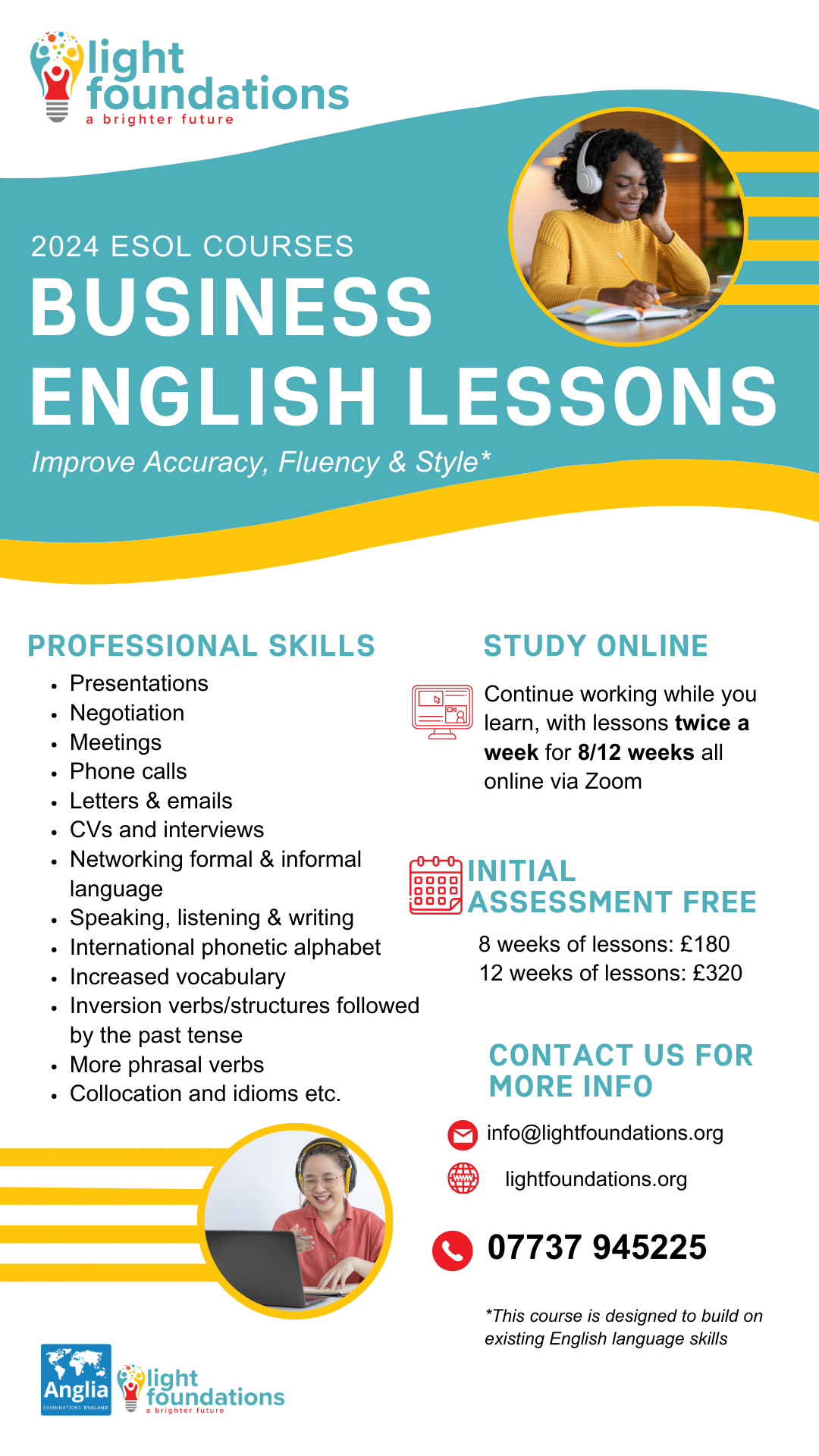

ESOL Business English Course

By Light Foundations

Enhance your professional communication skills with our Business English ESOL Course. Master presentations, negotiation, meetings, phone calls, report writing, letters & emails, and formal & informal networking. Designed for those with a foundation in English, our online program offers flexibility and convenience. Join us for twice-weekly Zoom lessons for 8/12 weeks, with a free initial assessment. Elevate your business communication skills from anywhere. Enrol today and unlock your potential!

Massage Therapy Bundle - QLS Endorsed Training

By Imperial Academy

10 QLS Endorsed Courses for Massage Therapy | 10 Endorsed Certificates Included | Lifetime Access

Our 12-month training course provides everything you need to qualify in Teaching Assistance. Once you have completed your training session you will gain an accredited certification Certificate included in the cost Exam included in the cost CPD 12 CPD hours / pointsAccredited by The CPD Standards Office Description Boost your skills in teaching with this online diploma now available for students wanting to develop their career as a teaching assistant. Candidates who desire to make an impression are required to have an understanding of key Teaching Assistant principles. What’s Included 12 months full access to the course content Professional certification Digital certification included Learn industry-leading skills and stand out from the crowd. Information-packed training starting from basics to advanced Teaching Assistant techniques. Best suitable for beginners to advanced learners Course content designed by considering current techniques used by professionals. Course Syllabus Supporting The Teacher Supporting the pupil Supporting the curriculum Supporting the school Supporting ICT in the classroom Supporting pupils with special education needs Supporting literacy development Supporting numeracy development Working with others Assignments *Terms Apply Assessment: To pass the course learners are required to successfully pass an online examination. Who is this course for? People who want to enter a Teaching Assistant career Entry-Level candidates Students Currently Studying or intending to study Teaching Assistance or want to refresh knowledge People who are already working in the industry but want to gain further knowledge Requirements There are no formal entry requirements for this course.

Our 12-month training course provides everything you need to qualify in Tax Accounting. Once you have completed your training session you will gain an accredited certification. Certificate included in the cost Exam included in the cost CPD 12 CPD hours / pointsAccredited by The CPD Standards Office Description Boost your skills in Tax Accounting with this online diploma now available for students wanting to develop their career in accounting. Candidates who desire to make an impression are required to have an understanding of key UK Tax Accounting principles. What’s Included 12 months full access to the course content Professional certification Digital certification included Learn industry-leading skills and stand out from the crowd. Information-packed training starting from basics to advanced UK Tax Accounting techniques. Best suitable for beginners to advanced learners Course content designed by considering current techniques used by professionals teaching UK Tax Accounting Course Syllabus UK Taxation, Tax on Individuals Benefits and Allowances National Insurance & Income Tax Taxation in the UK PAYE, Payrolls and Wages Value Added Tax (VAT) Exporting and Importing goods and services Double Entry Accounting Management Accounting and Financial Analysis Tax Organizations and Standards *Terms Apply Assessment: To pass the course learners are required to successfully pass an online examination. Who is this course for? People who want to enter a career in finance Part Qualified, Freshly Qualified candidates Entry-Level candidates Students Currently Studying or intending to study UK Tax Accounting or want to refresh knowledge People who are already working in the industry but want to gain further knowledge Requirements There are no formal entry requirements for this course.