- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Essential Oils supporting Autism and Sensory needs workshop

By Taylor, Jackie

I'd like to invite you to my workshop where we will be sharing the uses and benefits of using doTERRA essential oils for autism and sensory needs disorders, this workshop is not where we diagnose a treatment or cure for autism, we always recommend you to speak to a medical professional, but it is a workshop where we can learn, share and experience how customers and colleagues in our community have been using essential oils to support their children and themselves. You will learn how safe, and effective essential oils are and you will learn ideas that have been successfully used by both parents and children. We recognise and will discuss something we call 'triggers', example 'triggering' situations, a visit to the supermarket or getting dressed, a change to routine. How essential oils can be used daily as a routine and when to use them when there are signs of a 'trigger'. Also, suggestions that can help when full blow 'triggers' are happening, often referred to as 'meltdown'. Essential oils are not only supportive, but they are also empowering. If you would like to learn more, come along to my FREE workshop. Please note, this class is for my existing customers of our team and for those new to doTERRA essential oils. If you already have an account then please speak to those that introduced you to doTERRA about this topic and available workshops, if you aren't sure, then please reach out and I will try to help you. jackie.purpletrain@outlook.com

Certified Scrum Product Owner: Virtual In-House Training

By IIL Europe Ltd

Certified ScrumMaster®: Virtual In-House Training This course is an introduction to Scrum and the principles and tools required to be an effective Scrum Product Owner. You will come away with a good understanding of the Scrum framework and the underlying principles required to make effective decisions regarding the application of the Scrum framework to different situations. Participants successfully completing this course earn a Certified Scrum Product Owner® (CSPO®) designation. The Scrum Alliance certification includes a one-year membership with Scrum Alliance. What You Will Learn You'll learn how to: Use the principles, practices, and tools required to be an effective Scrum Product Owner Make effective decisions regarding the application of the Scrum framework to different situations, including: Setting product vision and goals Chartering the project Writing user stories and structuring your product backlog Scaling the Product Owner Estimating for forward planning Applying prioritization techniques Planning and tracking release progress Getting Started Introduction Course structure Course goals and objectives Agile Principles and Scrum Overview Process control models Incremental and iterative development Shifting the focus on product management Overview of the Scrum process Agile principles Lean principles Scrum Roles and Responsibilities Scrum roles Cross-functional teams Product Owner Responsibilities The Scrum Project Community What happens to my traditional role in Scrum? Chartering the Project Establishing a shared vision Elevator Statement Data sheets Product Vision Box Magazine Review / Press Release Product Backlog and User Stories Product uncertainty and progressive refinement User role modeling User Stories Product backlog characteristics Getting backlog items ready Slicing User Stories Using the product backlog to manage expectations Sprints Done and Scaling Done The Scrum process in detail Sustainable pace The Product Owner's role in each of the Scrum meetings Scaling the Product Owner Scaling Scrum Approaches to scaling the Product Owner Estimation for Forward Planning Why comparative estimation works Planning Poker Affinity Estimation Prioritization Techniques Additional Product Backlog Prioritization Techniques Kano Analysis Theme Screening Release Planning and Tracking Progress Velocity Release Planning Tracking release progress

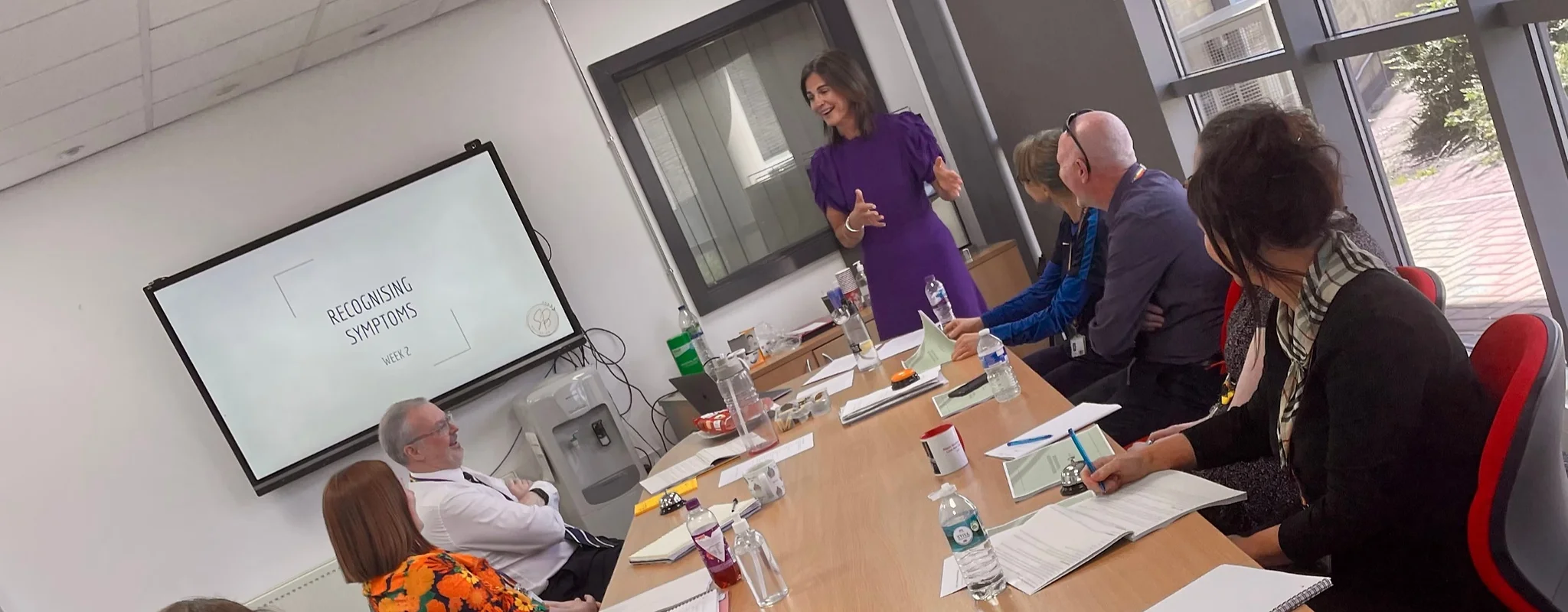

SB Wellbeing - Corporate Training

By Eat Train Love

CORPORATE TRAINING There are currently 13 million women going through menopause in the UK. 4.3 million of them are aged between 45-55 years old, which is the fastest growing demographic in the workforce SB Wellbeing provides training for companies who are serious about providing support for their female staff going through menopause. Also, up-skilling managers and leaders on what they need to know. Manager training includes what menopause is, how it can affect the individual at work, as well as the bigger picture of how it can impact the business, and how best to support them. Colleague training is for anyone going through menopause or supporting someone who is. It's fully inclusive and highly interactive. The two programmes can be run back to back or separately and be delivered via webinar or in-person. For more information and to book your training please get in touch. Here's what people are saying... " Thank you Sally for an amazing presentation yesterday – I had lots of the team say how good it was and how much they had learnt." - Leonard Design Architects, Nottingham "Just to say everyone absolutely loved training session 1!! The feedback from the second session was ace!! - Co-op Academy, Failsworth "Open & frank conversation. Very factual and a great all round guide" - tp bennett, London "The more staff that have this training the better, especially principle/director level." - tp bennett, London

Meditation Online Course - Jangama Meditation

By Jangama Meditation

Learn how to substantially reduce stress and improve concentration, focus and energy with a simple, powerful meditation technique.

5 Benefits of Using a 'Do My Assignment' Service

By Assignment help Online

Get Assignment help and Writing Services Online by University Experts.

Children and Essential Oils Workshop

By Taylor, Jackie

60 minute class covering topics of children's health and essential oils, example topics, colic, anxiety and worry and hyper activity.

The intricacies of financial reporting and compliance in the UK

By FD Capital

Financial reporting best practices involve adherence to accounting principles, regulatory requirements, and industry standards. CFOs should stay informed about evolving accounting standards and regulatory changes. Regularly review updates from regulatory bodies such as the Financial Reporting Council (FRC) and International Financial Reporting Standards (IFRS) to ensure compliance. Engage with industry associations and professional networks to stay abreast of best practices and emerging trends in financial reporting. By actively staying informed, CFOs can adapt their processes and policies to meet changing requirements. Regulatory compliance is a key aspect of financial reporting. How do CFOs navigate the landscape of regulatory requirements and ensure compliance within their organisations? Navigating the regulatory landscape requires a proactive and diligent approach. CFOs must develop a deep understanding of the relevant regulations, such as the Companies Act, UK GAAP, or IFRS, depending on the reporting framework. They collaborate with legal teams and auditors to interpret and apply the regulations correctly. Implementing strong internal controls, conducting regular compliance assessments, and engaging in external audits are essential steps to ensure compliance and mitigate potential risks. Compliance is an ongoing process. CFOs should establish a culture of compliance throughout the organization, emphasizing the importance of ethical practices, accuracy, and transparency in financial reporting. Training programs, internal communication, and regular compliance reviews help foster a compliance-conscious culture. By creating a framework that promotes adherence to regulations, CFOs establish a solid foundation for accurate and reliable financial reporting. https://www.fdcapital.co.uk/podcast/the-intricacies-of-financial-reporting-and-compliance-in-the-uk/ Tags Online Events Things To Do Online Online Seminars Online Business Seminars #financial #compliance #reporting #uk #intricacies

Ethics Matters: Corporate Governance and CFOs

By FD Capital

Ethics Matters: Corporate Governance and CFOs,” the podcast where we dive deep into the critical intersection of corporate governance. Sustainability and ESG reporting have gained significant attention in recent years. How do CFOs incorporate these considerations into their financial strategies and decision-making? CFOs recognise that sustainable practices and ESG considerations are not only ethical imperatives but also critical for long-term business success. We incorporate these considerations into financial strategies by assessing the environmental and social impacts of our operations, supply chains, and investment decisions. By incorporating ESG factors into our financial analyses, we make more informed decisions that align with our company’s values and stakeholder expectations. Furthermore, CFOs play a pivotal role in ESG reporting. We collaborate with cross-functional teams to collect relevant data, establish reporting frameworks, and communicate the company’s sustainability initiatives to stakeholders. This transparency fosters trust and accountability while allowing investors, customers, and the broader community to evaluate our commitment to sustainable practices. Board engagement is essential for effective corporate governance. How can CFOs contribute to building a strong relationship between the CFO and the board of directors? Building a strong relationship with the board of directors begins with open and transparent communication. CFOs provide timely and accurate financial information, strategic insights, and risk assessments to the board. We actively participate in board meetings, present financial reports, and engage in discussions about financial performance, strategic initiatives, and potential risks. By demonstrating our financial expertise and ethical leadership, we contribute to a healthy and productive relationship with the board. It’s also crucial for CFOs to provide independent perspectives and challenge conventional thinking when necessary. By offering well-informed insights and raising critical questions, we contribute to robust board discussions and decision-making. This collaborative approach fosters an environment where diverse perspectives are valued, and ethical considerations are thoroughly examined. I would encourage fellow CFOs to prioritise ethics and corporate governance as integral components of their roles. Embed ethical considerations into decision-making processes, ensure robust governance structures, and actively engage with stakeholders. By doing so, we can drive sustainable, responsible, and successful organizations. https://www.fdcapital.co.uk/podcast/ethics-matters-corporate-governance-and-cfos/ Tags Online Events Things To Do Online Online Conferences Online Business Conferences #event #ethics #matters #cfos #corporategovernance

Technology and innovation and its profound impact on financial operations

By FD Capital

Technology and innovation and its profound impact on financial operations Technology adoption indeed comes with risks, particularly around data security and privacy. As CFOs, we must ensure robust cybersecurity measures and adhere to strict data protection regulations. It requires ongoing investment in secure systems, staff training, and proactive monitoring to mitigate risks and protect sensitive financial information. Change management is also crucial. The adoption of new technologies requires proper planning, training, and cultural adjustments. As CFOs, we need to foster a culture that embraces innovation and continuous learning. Clear communication about the benefits and objectives of technology adoption is essential to gain buy-in and drive successful implementation. Fantastic insights! Now, let’s discuss the future. What emerging technologies do you foresee shaping the future of finance functions? One area that holds immense potential is blockchain technology. Its decentralised and transparent nature has the potential to streamline financial transactions, enhance auditability, and revolutionize supply chain finance. We’re closely monitoring blockchain’s development and exploring pilot projects to leverage its benefits. I agree, blockchain is a game-changer. Additionally, as the internet of things (IoT) expands, we anticipate new opportunities and challenges. CFOs will need to adapt to the influx of real-time data from interconnected devices, leveraging this information to optimize financial processes, enhance risk management, and improve operational efficiencies. Before we wrap up, any final thoughts or advice for our CFO audience? Embrace technology and view it as an opportunity rather than a threat. Invest in understanding the technological landscape and its implications for finance. Stay curious, adapt, and be open to change. Technology will continue to evolve, and as CFOs, we must evolve with it. Absolutely. Collaboration is key. Engage with IT teams, industry peers, and external experts to stay informed about the latest technological advancements. By fostering partnerships and sharing knowledge, we can collectively navigate the ever-changing technology landscape and drive innovation within our organisations. https://www.fdcapital.co.uk/podcast/technology-and-innovation-and-its-profound-impact-on-financial-operations/ Tags Online Events Things To Do Online Online Conferences Online Science & Tech Conferences #technology #innovation #financial #impact #operations

Customer Service Specialist Level 3

By Rachel Hood

A professional for direct customer support within all sectors and organisation types.