- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3001 Sup courses delivered Live Online

C&G 2391-50, Initial Verification of Electrical Installations

4.7(1243)By Technique Learning Solutions

The City and Guilds 2391-50 electrical course has been designed to meet the needs of the electrical installation industry, and is aimed at practising electricians who have not carried out inspection and testing since qualifying or who require some update of training before going on to other City and Guilds qualifications. Candidates who achieve the City and Guilds 2391-50 qualification could progress on to the City and Guilds 2391-51: the Level 3 Certificate in Inspection, Testing and Certification of Electrical Installations. The City and Guilds 2391-50 course will focus on the teaching and learning of initial verification and certification of electrical installations. In order to claim the full City and Guilds 2391-50 qualification, students must successfully complete: One 1 hour 30 minute online multiple choice test to be completed during the courseOne 3 hour 30 minute practical test to be completed after the course, broken into two sections as follows:Task A – Initial Verification and Certification of the Complete Installation – 2hrs and 30minsTask B – Short Answer Questions – 1hr To further support this course, we offer a 1 day practical workshop (at the cost of £120.00 Net VAT) available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical exam. Most students who take this option elect to complete this the day before their practical assessment. The City and Guilds 2391-50 course costs include examination entry fees.

C&G 2391-51, Periodic Inspection and Testing of Electrical Installations

4.7(1243)By Technique Learning Solutions

City and Guilds 2391-51, level 3, is ideal for people with limited experience of periodic inspection of electrical installations. If you are already working as an Electrician, but have not carried out inspection and testing since qualifying, or you require to update before moving onto other qualifications, then this 5 day City and Guilds 2391-51 course will be right for you. City and Guilds 2391-51 Course Content: Principles, practices and legislation for the periodic inspection, testing and condition reporting of electrical installations. Requirements for completing the safe isolation of electrical circuits and installations Requirements for inspecting, testing and recording the condition of electrical installations Requirements for completing the periodic inspection of electrical installations Differences between periodic inspection and initial verification Requirements for safe testing of electrical installations which have been put in to service Requirements for testing before circuits are live. Requirements for testing live installations Understanding and interpreting test results Requirements for the completion of electrical installation condition reports and associated documentation Confirmation of safety of system and equipment prior to completion of inspection, testing and commissioning Carrying out inspection of electrical installations prior to them being put into service Ability to test electrical installations prior to them being put into service Produce a condition report with recording observations and classification In order to claim the full City and Guilds 2391-51 qualification, students must successfully complete: One x1 hour 30 minute online multiple choice (Open Book) Exam to be completed during the course One x3 hours 30 minute practical test to be completed after the course, broken into sections as follows: Task A – Visual Inspection – 30mins Task B – Periodic Inspection and Test – 2hrs Task C – Short Answer Questions – 1hr To further support this course, we offer a 1 day practical workshop (at the cost of £120.00 Net VAT) available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical exam. Most students who take this option elect to complete this the day before their practical assessment. The City and Guilds 2391-51 course costs include examination entry fees.

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Power BI® - Business Data Analytics

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This 3 full-day training course will introduce participants to the Microsoft Power BI® software solution for extracting, manipulating, visualising and analysing data. This is a very practical, hands-on course that takes participants through a series of exercises which help users understand the Power BI® environment, how to use the key areas of functionality, and how to apply the tools it contains to design and produce analyses of their own data. The first two days focus on learning the key concepts and practising these using clean, simple datasets. The third day provides participants with the opportunity to apply what they've learned to their own data. This makes the course far more relevant and meaningful for them, it allows our facilitator to help them structure their data models, queries and DAX formulas correctly, and it allows our facilitator to help them solve any additional problems that may arise but which were not covered as part of the standard the course. In addition, at the end of the day, each participant walks away with something of real, practical use for their job role. Many previous participants have remarked that they obtained the most value from the course during the third day because otherwise, they wouldn't be able to do what they need to do. This is an introductory course and although it does not assume any prior experience with Power BI®, participants will gain much more from the course if they have at least used Power BI® a little prior to attending. Participants who have taught themselves Power BI® will also benefit from attending as the course will fill-in a number of gaps in their knowledge and will also extend what they know. A general understanding of databases, Excel formulas, and Excel Pivot Tables is useful though not essential. Comprehensive course notes, exercises and completed solutions are included. Microsoft® PowerBI® is a trademark of Microsoft Corporation in the United States and/or other countries. Training Objectives Upon completion of this training course, participants will be able to: Confidently use the Power BI® solution, including Power BI® Desktop, PowerBI®.com and the Power BI® Gateway Extract data from a variety of data sources and manipulate the data extracted so it is ready for analysis Combine data sources together and gain an introductory understanding of the M language Write formulas using the DAX language for generating custom columns, measures and tables Design reports and dashboards using a wide range of both built-in and custom visuals Publish reports and dashboards to PowerBI®.com Share reports and dashboards with others using PowerBI®.com Customize reports and dashboards so that different user groups automatically see their own personalized views Target Audience This training course is intended for: Financial Analysts Accountants Budgeting and planning specialists Treasury Risk Managers Strategic Planners This is an introductory course and although it does not assume any prior experience with Power BI®, participants will gain much more from the course if they have at least used Power BI® a little prior to attending. Participants who have taught themselves Power BI® will also benefit from attending as the course will fill-in a number of gaps in their knowledge and will also extend what they know. A general understanding of databases, Excel formulas, and Excel Pivot Tables is useful though not essential. Comprehensive course notes, exercises and completed solutions are included. Course Level Basic or Foundation Trainer Your expert course leader has a Masters (Applied Finance & Investment), B.Comm (Accounting & Information Systems), CISA, FAIM, F Fin and is a Microsoft Certified Excel Expert. He has over 20 years' experience in financial modelling, forecasting, valuation, model auditing, and management reporting for clients throughout the world. He is skilled in the development and maintenance of analytical tools and financial models for middle-market companies to large corporates, at all levels of complexity, in both domestic and international settings. He has trained delegates from a wide variety of Oil & Gas companies including Chevron, Woodside, BHP Billiton, Petronas, Carigali, Shell, Nippon, Eni, Pertamina, Inpex, and many more. He provides training in financial modelling for companies throughout the Asia, Oceania, Middle East and African regions. Before his current role, he spent 6 years working in the Corporate and IT Consulting divisions of a large, multinational Chartered Accounting firm. He is the author of a number of white papers on financial modelling on subjects such as Financial Modelling Best Practices and Financial Model Auditing. Highlights from his oil and gas experience include: Development of economic models to assist Decision Analysts modelling for a wide range of scenarios for multinational oil & gas assets. Auditing and further development of life of project models for Chevron's Strategic Planning Division analysing their North West Shelf assets. Development of business plan and budgeting models for multinational oil & gas assets. Development of cash flow and taxation models for a variety of oil gas companies. Consulting on Sarbanes Oxley spreadsheet remediation and risk assessment. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

TOGAF® EA Course - Foundation and Practitioner (Level 1 and 2)

By Advised Skills

This course is designed to enable candidates to develop the knowledge of the terminology and basic concepts of TOGAF Standard, 10th Edition and principles of Enterprise Architecture. Candidates will also be able to analyze and apply knowledge of TOGAF Standard.

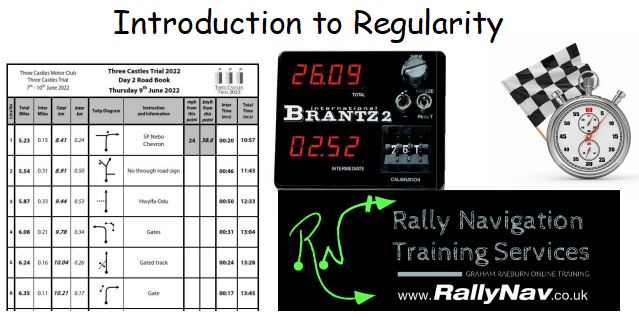

Rally Navigation - Introduction to Regularity Timing

By Rally Navigation Training Services

Historic Road Rallying training webinar on Regularity focusing on the Jogularity and Cumulative Speed Table styles.