- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

392 Statutory courses

Register on the Child Protection Annual Refresher(2022) today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as proof of your course completion. The Child Protection Annual Refresher (2022) is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Child Protection Annual Refresher(2022) Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Online study material Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Child Protection Annual Refresher (2022), all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 1: Child Protection and Safeguarding Basics Child Protection and Safeguarding Basics 01:36:00 Module 2: Types of Child Abuse Types of Child Abuse 01:54:00 Module 3: Child Sexual Exploitation and Abuses Child Sexual Exploitation and Abuses 01:51:00 Module 4: How to Respond to Disclosure and How to Report How to Respond to Disclosure and How to Report 01:36:00 Module 5: Recent Challenges, Pandemic and Safe Working Practices Recent Challenges, Pandemic and Safe Working Practices 01:33:00 Module 6: Recent Changes in Child Protection Legislation, Statutory Guidance and Government Advice Recent Changes in Child Protection Legislation, Statutory Guidance and Government Advice 01:45:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Register on the Child Protection Annual Refresher(2022) today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as proof of your course completion. The Child Protection Counselor is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Child Protection Annual Refresher(2022) Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Online study material Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Child Protection Counselor, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 1: Child Protection and Safeguarding Basics Child Protection and Safeguarding Basics 01:36:00 Module 2: Types of Child Abuse Types of Child Abuse 01:54:00 Module 3: Child Sexual Exploitation and Abuses Child Sexual Exploitation and Abuses 01:51:00 Module 4: How to Respond to Disclosure and How to Report How to Respond to Disclosure and How to Report 01:36:00 Module 5: Recent Challenges, Pandemic and Safe Working Practices Recent Challenges, Pandemic and Safe Working Practices 01:33:00 Module 6: Recent Changes in Child Protection Legislation, Statutory Guidance and Government Advice Recent Changes in Child Protection Legislation, Statutory Guidance and Government Advice 01:45:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course Online

By Lead Academy

This course will help you understand the aspect of child safeguarding welfare and safety in EYFS including how to support children with SEN. This course also explains the EYFS legal framework, the EYFS cycle, as well the principles and theories of EYFS. This Course At A Glance Accredited by CPD UK Understand the fundamentals of EYFS teaching and paediatric first aid Demonstrate the EYFS statutory frameworks Learn how to protect children's welfare and safety in the EYFS Know how to evaluate the growth and educational progress of the kids in your care Determine the experience, competencies, and potential career options of EYFS teachers in the UK Learn about the advantages, exceptions, and educational ethos of the EYFS Identify the EYFS's methods of teaching and comprehend how adults participate in it Understand how to assist young children (ages 0-5) with special educational needs Know how to register for the Ofsted and understand the standards for children's learning and development Understand the principles and function of a first responder and know how to handle a crisis Learn how to deal with a baby or toddler who is not responding Learn how to manage and control diabetes, asthma, allergies, and seizures Learn how to assist someone who is about to nearly drown Learn first aid skills to help prevent common illnesses and injuries. Know how to handle common wounds like burns, scalds, poisoning, wounds, and cuts, among others. Understand how to treat rashes and insect bites and handle an eye, spinal, and foreign body injury Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course Overview This Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course is ideal for you whether you're interested in beginning a career as an EYFS teacher or Childcare Worker or simply want to increase your understanding of teaching and paediatric first aid. In addition to developing your skill and knowledge of paediatric first aid to handle any minor emergency circumstances in a classroom and childcare setting, this course will provide you with a solid foundation that will enable you to instruct and manage emergencies involving children between the ages of 0 and 5. You will also be guided through the Ofsted registration process and the standards for children's learning and development. This course will provide you with in-depth knowledge of the first aider's role and guiding principles while also preparing you with simple emergency management techniques. You will also know how to prevent certain common illnesses and injuries, including poisoning, choking, diabetes, burns, allergic reactions, seizures, and bug bites. Upon successful completion of this Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course, you will be prepared to expertise as an efficient EYFS teacher by having the skills and knowledge needed to support your students' learning and development as well as provide them with first aid assistance in case of an emergency throughout their early years of education. Who should take this course? This course is primarily aimed at: SENco SEN tutor Parents Caregiver / Childminders Nursery Workers Social Care Workers Sports Instructors SEN teaching assistant Aspiring EYFS teacher Early years / supporting practitioner First aider in a teaching environment Teachers responsible for teaching children ages 0-5 However, this course is not restricted to any certain profession or line of work. Anyone interested in learning more about the early years foundation stage and paediatric first aid is also encouraged to enrol in this course. Entry Requirements There are no academic entry requirements for this Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course Online, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course Online assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Course Curriculum EYFS Statutory Framework EYFS Statutory Framework Working as an EYFS Teacher in the UK Working as an EYFS Teacher in the UK EYFS Teaching Methods EYFS Teaching Methods Principles and Theories of EYFS Principles and Theories of EYFS The EYFS Cycle The EYFS Cycle How to Support Children having Special Education Needs in Early Years How to Support Children having Special Education Needs in Early Years Safeguarding Child Welfare & Safety in the EYFS Safeguarding Child Welfare & Safety in the EYFS Adults Role in Early Years Foundation Stage Adults Role in Early Years Foundation Stage The EYFS and Educational Philosophies, Benefits and Exemptions The EYFS and Educational Philosophies, Benefits and Exemptions Early Years Ofsted Inspection and Quality Enhancement Early Years Ofsted Inspection and Quality Enhancement The New Version of the EYFS Framework The New Version of the EYFS Framework Principles & Role Of A First Aider Principles & Role Of A First Aider First Aid Basics First Aid Basics Managing An Emergency Managing An Emergency Unresponsive Infant/Child Unresponsive Infant/Child Allergic Reaction Allergic Reaction Asthma: 'Shortness Of Breath' Asthma: 'Shortness Of Breath' Burns & Scalds Burns & Scalds Cuts & Wounds, Bleeding & Shock Cuts & Wounds, Bleeding & Shock Choking Choking Diabetes Diabetes Insect Bites & Rashes Insect Bites & Rashes Eye Injury & Foreign Body Eye Injury & Foreign Body Head & Bone Injuries Head & Bone Injuries Near Drowning Near Drowning Poisoning Poisoning Seizure Seizure Spinal Injuries Spinal Injuries Assessment Assessment - Early Years Foundation Stage (EYFS) Teaching and Paediatric First Aid Training Course Online Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Certificate of Achievement Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Diploma in Teaching Assistant Course Online

By Lead Academy

This course will help you gain a complete understanding of the academic curriculum, learn how to create your teaching assistant portfolio, and learn how to improve yourself. You'll discover how to assist kids so they get the most out of their academic experience and classroom-based personal growth. This Course At A Glance Accredited by CPD UK Endorsed by Quality Licence Scheme Know how to become and start your role as a teaching assistant Know how to create a supportive learning system Master the art of teaching and understand how to culture your presence Understand the pupils and school curriculums Know how to design an effective portfolio and improve yourself further Understand SEN and demonstrate its statutory and regulatory context Know how SEN affects pupil's learning and participation Understand how to apply teaching strategies and approaches for pupils with SEN Develop a whole-school policy on assessment Understand inclusive education for students with SEN Understand the national minimum standards for residential special schools Demonstrate the role and functions of the board of management Know how to do education planning for individuals Diploma in Teaching Assistant Course Overview The Diploma in Teaching Assistant Course Online is suitable for anybody who wants to work as a teaching assistant in a primary, secondary, or special needs school or who is currently employed in a position that supports students learning. This course will help you deal with kids who have learning disabilities and promote improved social behaviour. You will understand how to start your role as a teaching assistant, become a part of the school and master the art of teaching. You will also master various teaching strategies, techniques and approaches for people with special educational needs and learn how to develop inclusive whole-school policies and procedures for SEN. This Diploma in Teaching Assistant Course Online also provides a concise insight into the role and responsibilities of the board of management and leadership for special schools. Finally, you'll discover how to offer support for learning based on an individual's requirements and needs. Upon successful completion of this Diploma in Teaching Assistant Course Online, you will gain a solid foundation to become a confident teaching assistant and contribute to making both students with and without special needs' lives better so they can have more fruitful lives. Who should take this course? This Diploma in Teaching Assistant Course Online is primarily aimed at: SENco SEN tutor Teaching Assistant School Staff Aspiring Teaching Assistant SEN teaching assistant Aspiring SEN teaching assistant Learning support assistant Parents of children with learning disabilities Anyone associated with the SEN teaching industry However, this course is not restricted to a specific industry or field of employment. This course can be taken by anyone interested in acquiring knowledge about effective teaching methods and strategies. Entry Requirements There are no academic entry requirements for this diploma in teaching assistant course online, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This Diploma in Teaching Assistant Course Online assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Course Curriculum Module 1: Becoming a Teaching Assistant Becoming a Teaching Assistant Module 2: Starting Your Role as a Teaching Assistant Starting Your Role as a Teaching Assistant Module 3: Becoming a Part of the School Becoming a Part of the School Module 4: A Supportive Learning System A Supportive Learning System Module 5: The Art Of Teaching The Art Of Teaching Module 6: Culturing Your Presence Culturing Your Presence Module 7: The School Curriculums The School Curriculums Module 8: Understanding The Pupils Understanding The Pupils Module 9: Your Portfolio as a Teaching Assistant Your Portfolio as a Teaching Assistant Module 10: Improving Yourself Further Improving Yourself Further Module 11: Conclusion Conclusion Module 12: Introduction to Special Educational Needs (Sen) Teaching Introduction to Special Educational Needs (Sen) Teaching Module 13: Statutory and Regulatory Context for SEN Statutory and Regulatory Context for SEN Module 14: Understanding How Special Educational Needs & Disabilities Affect Pupils' Participation and Learning Understanding How Special Educational Needs & Disabilities Affect Pupils' Participation and Learning Module 15: Teaching Strategies and Approaches for Pupils with Special Educational Needs Teaching Strategies and Approaches for Pupils with Special Educational Needs Module 16: Drawing Up Inclusive Whole-School Policies and Procedures for SEN Drawing Up Inclusive Whole-School Policies and Procedures for SEN Module 17: Developing a Whole-School Policy on Assessment Developing a Whole-School Policy on Assessment Module 18: Inclusive Education for Students with Special Educational Needs Inclusive Education for Students with Special Educational Needs Module 19: Leadership of Special Schools Leadership of Special Schools Module 20: National Minimum Standards for Residential Special Schools National Minimum Standards for Residential Special Schools Module 21: Role and Functions of the Board of Management Role and Functions of the Board of Management Module 22: Education Planning for Individual Students Education Planning for Individual Students Assessment Assessment - Diploma in Teaching Assistant Course Online Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Quality Licence Scheme Endorsed The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. Certificate of Achievement Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Dive into the vital world of electrical safety with the 'PAT Training' course, a compelling blend of theoretical knowledge and regulatory compliance. Imagine possessing the power to ensure safety in every plug and cable, a guardian against the dangers of faulty electrical equipment. The course opens with an introduction to Portable Appliance Testing (PAT), leading you through the critical statutes that govern this essential practice. As you navigate through the modules, you become the sentinel of electrical safety, entrusted with the well-being of workplaces and public spaces. With each step forward in the curriculum, your mastery of risk assessment and hazard control strengthens, transforming you into a key player in maintaining operational integrity. Your journey advances with in-depth explorations into appliance classification, rigorous testing procedures, and meticulous reporting techniques. This is where you learn not just the 'how', but the 'why' behind each inspection and test, ensuring that every piece of equipment under your watch meets the highest standards of electrical safety. Learning Outcomes Comprehend PAT's significance and the legal frameworks that underpin it. Conduct thorough risk assessments and implement strategies to mitigate hazards. Classify electrical appliances and determine their maintenance requisites accurately. Perform detailed visual examinations and utilise testing instruments proficiently. Adhere to British Standards, adapting to recent modifications and maintaining meticulous records. Why choose this PAT Training course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the PAT Training Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this PAT Training course for? Aspiring safety professionals with a focus on electrical appliance compliance. Technical personnel responsible for workplace equipment maintenance. Compliance officers looking to expand their knowledge in electrical safety regulations. Engineers seeking a detailed understanding of PAT procedures and standards. Facility managers tasked with overseeing electrical safety and equipment integrity. Career path PAT Tester: £18,000 - £25,000 Health and Safety Officer: £25,000 - £40,000 Maintenance Engineer: £27,000 - £45,000 Electrical Compliance Officer: £30,000 - £50,000 Facilities Manager: £26,000 - £40,000 Quality Assurance Technician: £22,000 - £35,000 Prerequisites This PAT Training does not require you to have any prior qualifications or experience. You can just enrol and start learning.This PAT Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to PAT Introduction to PAT 00:25:00 Module 02: Relevant Statutory Provisions for PAT Relevant Statutory Provisions for PAT 00:25:00 Module 03: Safety Responsibilities & Maintenance Provisions Safety Responsibilities & Maintenance Provisions 00:20:00 Module 04: Risk Assessment Risk Assessment 00:30:00 Module 05: Reducing and Controlling Risks Reducing and Controlling Risks 00:30:00 Module 06: Electrical Units and Appliance Classification Electrical Units and Appliance Classification 00:20:00 Module 07: Equipment Coverage & Maintenance Needs Equipment Coverage & Maintenance Needs 00:25:00 Module 08: Initial Visual Examination Initial Visual Examination 00:25:00 Module 09: Instruments for Testing and Equipment Inspection Instruments for Testing and Equipment Inspection 00:20:00 Module 10: Electrical Installation Testing Electrical Installation Testing 00:35:00 Module 11: Lead & RCD Testing Lead & RCD Testing 00:20:00 Module 12: Safety Precautions in Electrical Testing Safety Precautions in Electrical Testing 00:30:00 Module 13: Reporting and Record-keeping Reporting and Record-keeping 00:25:00 Module 14: Testing for New or Used Equipment Testing for New or Used Equipment 00:15:00 Module 15: British Standards and Latest Changes British Standards and Latest Changes 00:25:00

The Portable Appliance Testing course or PAT testing course as it is more commonly known is one of our most popular courses as it does not require you to have any formal previous qualifications and once completed, will enable you to offer your services. In the commercial setting, the law places a responsibility on all employers to ensure that the electrical equipment to be used by their staff and the public, should be fit for purpose and safe for use. Hence, all portable appliances have to be regularly checked and maintained by a competent person.

The course is designed to help improve your understanding of the legal requirements, the theoretical and practical principles for both the initial verification and certification of an electrical installation, further your knowledge and practical skills in the testing and inspection of a range of existing electrical installations, and help improve your understanding of the legal requirements, the theoretical and practical principles for the periodic inspect and testing and certification of an electrical installation.

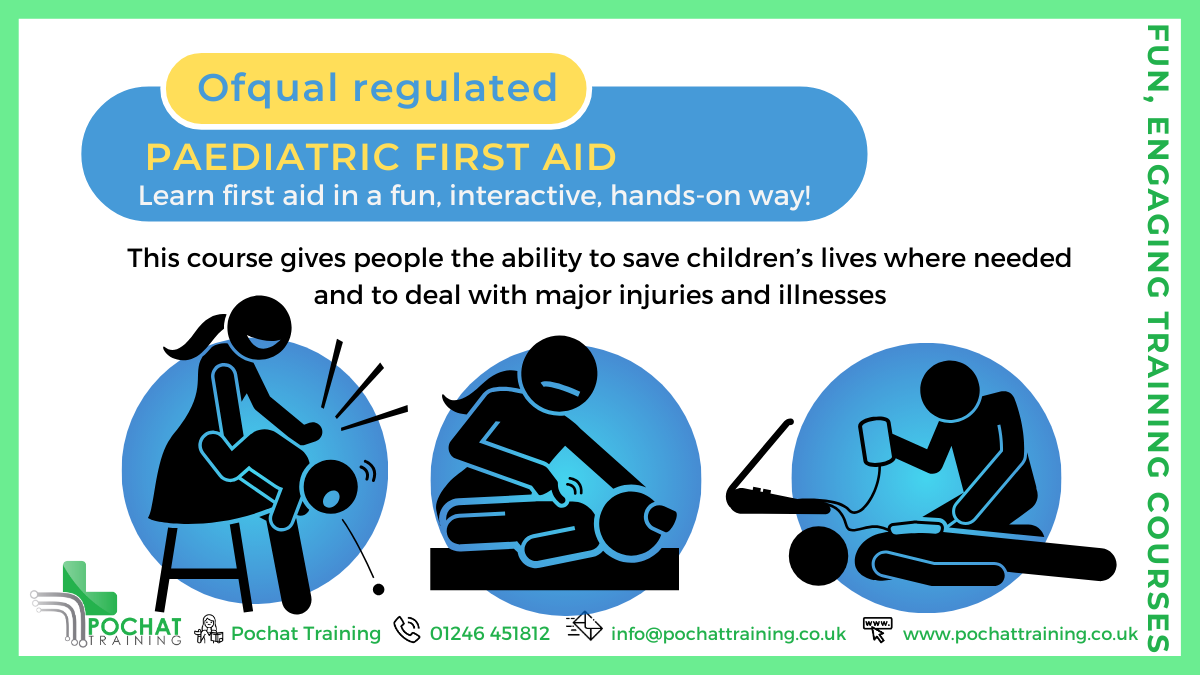

QA Level 3 Award In Paediatric First Aid (RQF) This page is here if you'd like us to run this course for you and your people, at our venue or yours (within 45 minute drive from Chesterfield, Derbyshire). If you'd like us to run this course for you and you're further away, please contact us direct for a quote. If, instead, you're interested in an open/public course, please go here. Two day course HSE highly recommends this course for those who work with children in a childcare setting Being able to deal with peadiatric emergencies can make the difference between the life and death of children, and save them a lot of suffering Course Contents: The Roles and Responsibilities of an Emergency Paediatric First Aider Assessing an Emergency Situation Accident Recording Minor Injuries Cuts, Grazes and Bruises Minor Burns and Scalds Managing an Unresponsive Infant and Child Recovery Position Infant and Child CPR Infant and Child Safe Use of an AED (Automated External Defibrillator) Choking Anaphylaxis Seizures Wounds and Bleeding Hypovolaemic Shock Head, Neck and Back Injuries Sprains, strains, dislocations and fractures Meningitis Asthma Diabetes Eye, Ear and Nose Conditions Poisoning Electric Shock Bites and Stings Hot and Cold Temperatures Benefits of this course: Would you know what to do if you saw a child in need of First Aid? Children are prone to minor injuries, but suffer from serious injuries also In 2014, 2,269 children in the UK were so badly bitten by an animal they had to be admitted to hospital More than 2 million children have accidents in the home for which they're taken to A&E - every year, with Under 5s accounting for 7% of all hospital emergency treatments Being able to deal with peadiatric emergencies can make the difference between the life and death of children, and save them a lot of suffering. This QA Level 3 Award in Paediatric First Aid (RQF) qualification is ideal for: - Parents/carers or family members who want to learn key paediatric first aid skills - those who work with, or intend to work with children in a childcare setting as it is designed to fulfill Ofsted’s First Aid requirements for early years teachers, nursery workers and childminders (as defined within the Statutory Framework for the Early Years Foundation Stage (EYFS) 2014 and within the Child Care Register guide) Childcare settings who are working towards Millie’s Mark We also run a Paediatric Annual Refresher to keep those life-saving skills up to date Accredited, Ofqual regulated qualification: Our Paediatric First Aid at Work course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards.This means that you can be rest assured that your Paediatric First Aid certificate will fulfill the legal requirements. It is a very good way to make sure you and your employees are trained in First Aid for Children and Infants (babies).The Ofqual Register number for this course is 603/0785/7

Register on the Clinical Governance in Adult Care today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Clinical Governance in Adult Care is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Clinical Governance in Adult Care Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Upon successful completion of the final assessment, you will be eligible to apply for the Quality Licence Scheme Endorsed Certificate of achievement. This certificate will be delivered to your doorstep through the post for £119. An extra £10 postage charge will be required for students leaving overseas. CPD Accredited Certificate After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Clinical Governance in Adult Care, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Unit 01: Legislation and Statutory Guidance Legislation and Statutory Guidance 00:16:00 Unit 02: Legislation & Accountability Legislation & Accountability 00:17:00 Unit 03: Purpose and Functions of Different Models Purpose and Functions of Different Models 00:16:00 Unit 04: Management and Governance of Service Delivery Management and Governance of Service Delivery 00:16:00 Unit 05: Innovation and Alignment in Service Delivery Innovation and Alignment in Service Delivery 00:15:00 Unit 06: Internal Governance Procedures Internal Governance Procedures 00:16:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Search By Location

- Statutory Courses in London

- Statutory Courses in Birmingham

- Statutory Courses in Glasgow

- Statutory Courses in Liverpool

- Statutory Courses in Bristol

- Statutory Courses in Manchester

- Statutory Courses in Sheffield

- Statutory Courses in Leeds

- Statutory Courses in Edinburgh

- Statutory Courses in Leicester

- Statutory Courses in Coventry

- Statutory Courses in Bradford

- Statutory Courses in Cardiff

- Statutory Courses in Belfast

- Statutory Courses in Nottingham