- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

213 Self Assessment courses delivered On Demand

UK Self Assessment Tax Return Mini Bundle

By Compete High

The UK Self Assessment Tax Return Mini Bundle is your shortcut to standing out in the high-demand world of tax, accounting, and small business support. Whether you're seeking work in a practice, starting your own service, or helping SMEs stay compliant, this bundle is your power move. Built to get you noticed by employers and clients alike, this is your edge in a competitive financial market. Description Today’s finance industry demands professionals who do more than crunch numbers. From data entry roles in bookkeeping firms to freelance specialists handling UK tax filings, there’s a rising need for those who blend tax and accounting skills with fluency in Sage, a practical grasp of data entry, and awareness of business law. This bundle makes your profile instantly more hireable—especially as small businesses increasingly outsource their tax responsibilities. Whether you're positioning yourself for an in-house tax role, offering virtual accounting services, or looking to transition into the UK self-assessment sector, this bundle proves you’re capable of handling complex processes end-to-end. Tax deadlines won’t wait—and neither will job offers. Secure your competitive advantage in tax, accounting, Sage systems, data entry, and business law before someone else takes the role. FAQ Who is this bundle ideal for? Anyone aiming to work in tax, accounting, Sage software, data entry, or business law within the UK market. Can this help me become self-employed? Yes, especially if you want to handle UK self-assessment tax return tasks as a freelance service provider. Does it support corporate career paths? Definitely—those applying for accounting firms or tax consultancies will benefit from the combination of tax, accounting, and Sage. Is previous knowledge required? No—this bundle is designed to enhance your employability whether you're starting or levelling up in tax or accounting. Do the certifications add weight to my CV? Yes. With qualifications across tax, Sage, business law, data entry, and accounting, your CV becomes application-ready. Why enrol now? Tax seasons don’t wait. Equip yourself with in-demand skills in tax, Sage, accounting, data entry, and business law—before your competitors do.

UK Self Assessment Tax Return: 20-in-1 Premium Online Courses Bundle

By Compete High

In the world of finance and tax compliance, employers want more than familiarity—they want readiness. Whether you’re preparing to handle personal tax returns or work in finance departments, this bundle positions you as a multi-skilled, hireable candidate for the UK market. Description The demand for professionals fluent in tax compliance, data systems, and financial reporting continues to grow—especially during Self Assessment season. This all-in-one UK Self Assessment Tax Return bundle offers a strategic training mix for roles in accounting, payroll, SME finance, and freelance tax services. Combining finance software fluency with analytical and regulatory knowledge, this bundle is your shortcut to becoming job-ready in both employed and freelance contexts. It’s particularly valuable for roles supporting sole traders, contractors, small business clients, and tax departments. Why take one course when you can get 20 hiring-friendly certifications in one affordable package? Train now—before the tax deadline rush hits and your competitors beat you to the role. FAQ Q: Who should enrol in this bundle? A: Ideal for aspiring accountants, tax support workers, freelancers, payroll officers, and finance assistants. Q: Which industries is this bundle relevant to? A: Accounting firms, tax consultancy, self-employment support, banking, business services, and fintech. Q: Do I need prior tax experience? A: No, this bundle is suitable for beginners and those switching into finance-related roles. Q: Will I earn a certificate? A: Yes—each course awards an individual certificate to strengthen your CV. Q: Can I study on my own schedule? A: Yes—lifetime access is included, allowing full flexibility.

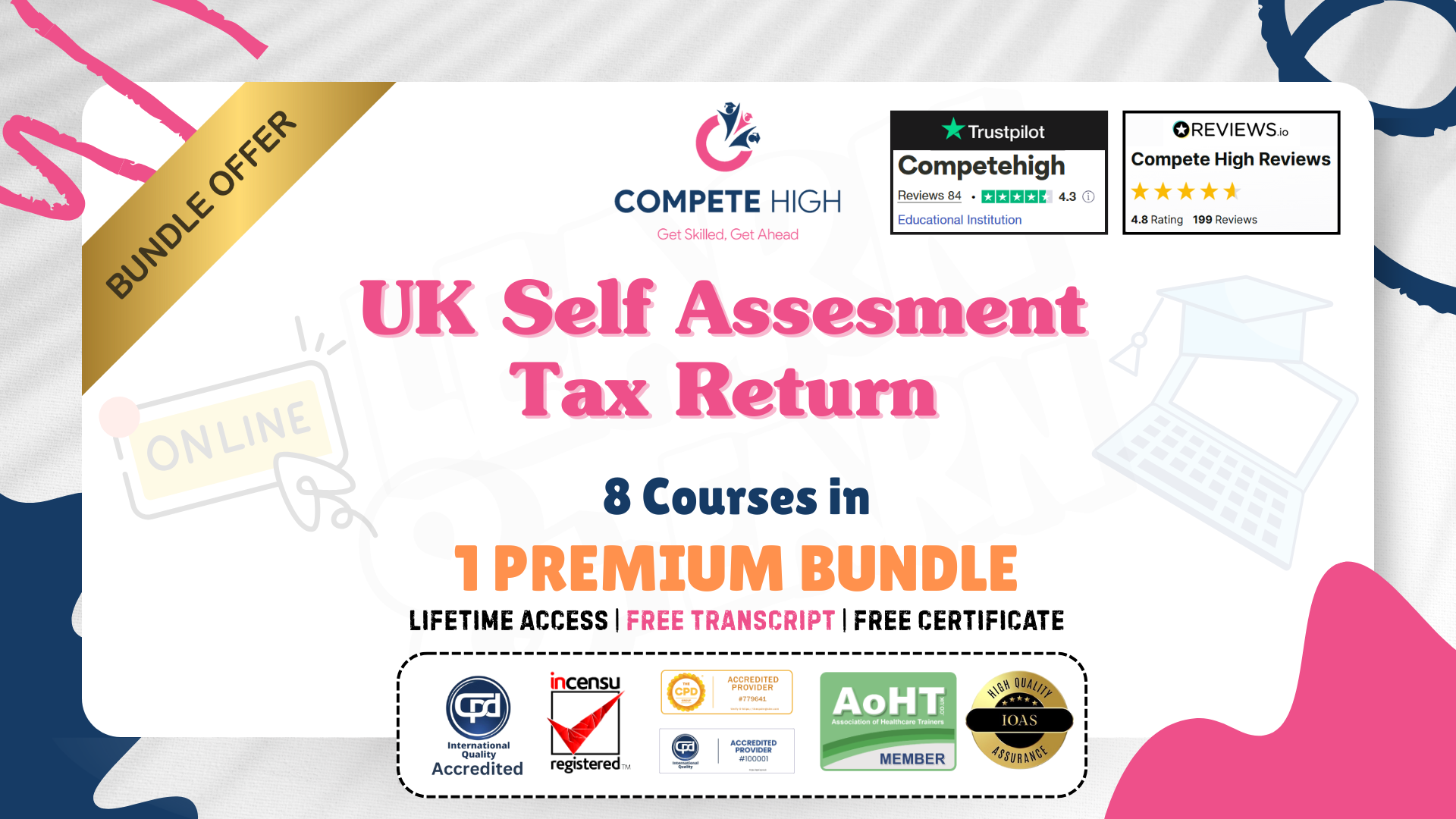

UK Self Assessment Tax Return: 8-in-1 Premium Online Courses Bundle

By Compete High

Make taxes your superpower. The UK Self Assessment Tax Return: 8-in-1 Premium Online Courses Bundle is perfect for anyone seeking roles in tax, finance, freelancing, or accounting support. 💼📊 🧾 Description Featuring high-demand topics like Sage, Xero, Power BI, Excel, data analysis, and tax, this bundle is tailored for work in accountancy, tax return filing, self-employed finance, and data entry. 🧾 Job tracks include: Self-Assessment Assistant Freelancer Finance Support Bookkeeping Clerk Tax Return Specialist Accounting Assistant 🚨 Filing season waits for no one. Equip yourself today. ⭐ Compete High has 4.8 on 'Reviews.io' and 4.3 on Trustpilot ❓ FAQ Q: Can this help with freelance tax filing? A: Absolutely! It’s designed for both self-employed professionals and admin staff. Q: Do I need experience with Excel or Sage? A: Not at all—you’ll get started from scratch.

Personal Tax Training on Tax Return and Self Assessment Mini Bundle

By Compete High

Learn how to handle tax returns and self assessment online. Understand Sage, Power BI, and accounting with this flexible training bundle. 🔹 Overview: This Personal Tax Training Mini Bundle brings together five solid pillars of individual tax know-how. Whether you’re looking to untangle self assessment, make sense of Sage software, or simply stop avoiding spreadsheets, this bundle delivers just the right level of information—without the late-night panic. From tax logic to financial analysis and visual reporting with Power BI, each course is designed for clarity and structured learning. You’ll get to grips with the numbers, the narratives behind them, and the systems that keep everything ticking. All accessible online, no calculator batteries required (unless you're feeling nostalgic). 🔹 Learning Outcomes: Understand the structure and rules behind personal income tax Learn how to use Sage for personal tax accounting tasks Build Power BI reports to analyse financial tax data Explore financial analysis techniques in tax-based scenarios Gain working knowledge of personal self assessment processes Apply accounting principles to personal finance case examples 🔹 Who is this Course For: Self-employed individuals handling their own tax submissions Small business owners wanting better control of their finances Those seeking insight into personal tax rules and allowances Accountants brushing up on self assessment tools and theory Individuals interested in Sage and Power BI for tax use Finance students exploring personal taxation applications Freelancers wanting more clarity on income declarations Anyone afraid of the word "HMRC" and looking for confidence 🔹 Career Path: Tax Assistant – £23,000–£30,000 per year Self-Assessment Specialist – £25,000–£34,000 per year Accounting Technician – £24,000–£32,000 per year Bookkeeper (Sage) – £22,000–£29,000 per year Power BI Analyst (Finance) – £30,000–£40,000 per year Personal Finance Advisor – £28,000–£38,000 per year

Learn how to navigate the UK tax system effortlessly with our UK Tax Return Simplified course. Master the process of submitting a Self-Assessment Tax Return, understand income tax, deductions, and tax planning strategies. Perfect for individuals, business owners, and finance professionals. Enrol now and take control of your taxes!

Give a compliment to your career and take it to the next level. This Indirect Tax The UK VAT bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Indirect Tax The UK VAT bundle will help you stay ahead of the pack. Throughout the Indirect Tax The UK VAT programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Indirect Tax The UK VAT course, you will get 10 premium courses, an original hardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Indirect Tax The UK VAT Bundle Consists of the following Premium courses: Course 01: Self Assessment Tax Return Filing UK Course 02: Accounting and Tax Course 03: UK Tax Reforms and HMRC Legislation Course 04: Financial Analysis : Finance Reports Course 05: Introduction to VAT Course 06: Pension UK Course 07: Budgeting and Forecasting Course 08: Financial Investigator Course 09: Internal Audit Training Diploma Course 10: Certificate in Anti Money Laundering (AML) Course 11: Business Law Enrol now in Indirect Tax The UK VAT to advance your career, and use the premium study materials from Apex Learning. The Indirect Tax The UK VAT bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Corporation Tax Return UK expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Course Curriculum of Indirect Tax The UK VAT Bundle: Course 01: Self Assessment Tax Return Filing UK Introduction to Self Assessment Logging into the HMRC System Fill in the Self Assessment Return Viewing the Calculation Submitting the Assessment Conclusion ------- 10 more courses------ CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Indirect Tax The UK VAT bundle. Requirements This Indirect Tax The UK VAT course has been designed to be fully compatible with tablets and smartphones. Career path Having this Indirect Tax The UK VAT expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course Self Assessment Tax Return Filing UK absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost

No more scrambling around, wondering how to navigate the HMRC system. This course walks you through the entire process, step-by-step. From logging in to understanding what information needs to be filled out, you'll gain the knowledge to complete your return accurately.

Level 5 Diploma in Tax

By Compliance Central

Ever feel lost navigating the complex intricacies of the UK tax system? Are you an entrepreneur, aspiring accountant, or simply someone who wants to make informed financial decisions? Look no further, because this course is your ultimate passport to understanding and confidently navigating the fascinating world of taxation. This comprehensive course takes you on a journey through the intricate tapestry of UK tax. From understanding the basic framework and administration to mastering individual and corporate tax intricacies, you'll gain a solid foundation in crucial areas like National Insurance, self-assessment returns, and essential tax types like income, VAT, and corporation tax. But it doesn't stop there. Delve deeper into advanced tax concepts like capital gains and inheritance, and explore international considerations with modules on import and export. You'll even gain insight into the accounting principles that underpin tax, with modules on double-entry accounting and management accounting. Empower yourself with relevant knowledge. Enrol in our Level 5 Diploma course today! Learning Outcomes: Master the UK tax system, its administration, and key principles. Confidently handle individual tax matters, including self-assessment. Understand National Insurance and its implications. Acquire skills in double-entry accounting and financial analysis Analyse capital gains and inheritance tax considerations. Course Curriculum Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamental of Income Tax Module 06: Advanced Income Tax Module 07: Payee, Payroll and Wages Module 08: Value Added Tax Module 09: Corporation Tax Module 10: Capital Gain Tax Module 11: Inheritance Tax Module 12: Import and Export Module 13: Double Entry Accounting Module 14: Management Accounting and Financial Analysis Module 15: Career as a Tax Accountant in the UK Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for Free to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Who is this course for? Tax Accountant Payroll Specialist Accounting Technician Bookkeeper Corporate Finance Analyst Requirements To enrol in this course, all you need is a basic understanding of the English Language and an internet connection. Career path Tax Advisor: £25,000 to £60,000 per year Tax Consultant: £30,000 to £70,000 per year Tax Analyst: £28,000 to £55,000 per year Tax Accountant: £35,000 to £75,000 per year Tax Manager: £45,000 to £90,000 per year Certificates CPD Accredited Hard Copy Certificate Hard copy certificate - Included CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each CPD Accredited PDF Certificate Digital certificate - Included QLS Endorsed Hard Copy Certificate Hard copy certificate - Included

Explore the intricacies of tax strategy and financial planning for beginners in this comprehensive course. From income tax to VAT, gain insights into key topics like accounting, capital gains tax, and self-assessment. Master tax compliance and optimize your financial decisions with expert guidance. Start planning your financial future today!

Sales Skills-CPD Approved

By BAB Business Group

The course will start by providing an overview of the basic rules for sales people, along with the right mindset, self-assessment and the goals you’ll need in the short, medium and long term. It’ll cover cold calling, including how to prepare, what to say and how to deal with gatekeepers as well as walking you through a typical face-to-face meeting. You’ll learn how to start a meeting, the questions you need to ask your prospect, practical tips for presentations including, staying relaxed, getting across your main messages, handling questions and using presentation aids. We’ll also be analysing how you can sell by stressing the results prospects can expect if they buy, and how best to play to their emotions. We’ll take a look at negotiation. We’ll highlight how you can avoid it, what to say if you’re drawn into it, and how you can use your negotiating skills to land the sale and much more.