- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2606 Risk Management courses delivered Online

Professional Certificate Course in Project Feasibility and Risk Management in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course is designed to provide a comprehensive understanding of feasibility analysis and project risk management, including the different types of feasibility analysis, the characteristics of risk management, the significance of risk analysis and assessment, the need for project risk calculation, its various steps, and the challenges of global project management. Feasibility analysis and project risk management are essential components of successful project management. This course is designed to provide participants with a comprehensive understanding of feasibility analysis and project risk management, including the different types of feasibility analysis, the characteristics of risk management, the significance of risk analysis and assessment, the need for project risk calculation, its various steps, and the challenges of global project management. After the successful completion of the course, you will be able to learn about the following The meaning and type of feasibility analysis. The concept of project risk management and its characteristics. The significance of risk analysis and assessment. The need for project risk calculation and its various steps. The challenges of global project management. Feasibility analysis and project risk management are essential components of successful project management. This course is designed to provide participants with a comprehensive understanding of feasibility analysis and project risk management, including the different types of feasibility analysis, the characteristics of risk management, the significance of risk analysis and assessment, the need for project risk calculation, its various steps, and the challenges of global project management.Participants will learn about the different types of feasibility analysis, including technical, economic, operational, legal, and schedule feasibility. The course will cover the process of conducting a feasibility study, including analyzing project requirements, identifying stakeholders, assessing project risks, and evaluating project success criteria. The course will also cover the fundamentals of project risk management, including identifying, assessing, and managing project risks. Participants will learn about the characteristics of risk management, the significance of risk analysis and assessment, and the importance of implementing risk management plans to mitigate project risks.The course will conclude by discussing the challenges of global project management, including cultural differences, language barriers, time zone differences, and regulatory requirements. Participants will learn about strategies for overcoming these challenges to ensure project success. The course is delivered through a mix of theoretical content, practical case studies, and interactive exercises. Participants will work individually and in groups to develop their understanding of feasibility analysis and project risk management, and to apply their learning to real-life scenarios.By the end of this course, participants will have gained valuable knowledge and skills to become effective project managers. They will have a comprehensive understanding of feasibility analysis and project risk management, the ability to identify potential project risks, and the skills to create strategies to mitigate them. Participants will be equipped with the knowledge and skills needed to overcome the challenges of global project management and ensure project success. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Project Feasibility and Risk Management - N Self-paced pre-recorded learning content on this topic. Professional Certificate Course Project Feasibility and Risk Management Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Project Managers Project Coordinators Project Analysts Business Analysts Team Leaders Department Managers Executives overseeing projects Consultants Engineers IT Professionals Marketing Managers Human Resources Managers Financial Analysts Operations Managers Supply Chain Managers Product Managers. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Professional Certificate Course in Investment Risk Management in London 2024

4.9(261)By Metropolitan School of Business & Management UK

Learn how to navigate the uncertain waters of investing with confidence and security through the power of effective Investment Risk Management. After the successful completion of the course, you will be able to learn about the following; Describe the nature of investment risk and its potential impact on investment outcomes. Identify and differentiate between the types of investment risks, such as market risk, credit risk, and liquidity risk. Explain the nature and process of risk management, including risk identification, risk assessment, and risk mitigation. Analyze the nature of a risk mitigation plan and identify the key components that make it effective. Evaluate various risk mitigation methods used in investments, including diversification, asset allocation, and use of derivatives. Examine the concept of hedging in investments, including hedging strategies and using futures and options for speculation and arbitrage. Investment Risk Management is a crucial aspect of any successful investment strategy. In this course, you will learn how to navigate the complex world of investing with confidence and security by effectively managing investment risk. You will explore the nature of investment risk, the different types of investment risks, and how they can impact investment outcomes. Through practical examples and case studies, you will understand the nature and process of risk management and how to develop a risk mitigation plan that works for your investment portfolio. This course will equip you with the knowledge and tools to manage investment risk effectively. You will learn various risk mitigation methods, including diversification, asset allocation, and the use of derivatives such as options and futures. You will also delve into the concept of hedging, including hedging strategies and using futures and options for speculation and arbitrage. By the end of this course, you will have a thorough understanding of the best practices for managing investment risk, enabling you to make informed investment decisions and maximize your returns while minimizing your risk exposure. This course will equip the learner with the knowledge and tools to manage investment risk effectively. You will learn various risk mitigation methods, including diversification, asset allocation, and the use of derivatives such as options and futures. You will also delve into the concept of hedging, including hedging strategies and using futures and options for speculation and arbitrage. By the end of this course, you will have a thorough understanding of the best practices for managing investment risk, enabling you to make informed investment decisions and maximize your returns while minimizing your risk exposure. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Introduction to Investment Analysis Self-paced pre-recorded learning content on this topic. Investment Risk Management Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Risk Manager Investment Risk Analyst Portfolio Manager Chief Risk Officer Investment Analyst Quantitative Analyst Risk Management Consultant Compliance Officer Financial Advisor Hedge Fund Manager Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

ISO 31000 Risk Manager

By Training Centre

The ISO 31000 Risk Manager training course helps participants acquire the knowledge necessary and ability to integrate the risk management guidelines of ISO 31000 in an organization. It provides information with regard to the risk management principles and their application, as well as the core elements of the risk management framework and steps for a risk management process. In addition, it provides the basic approaches, methods, and practices for assessing risk in a wide range of situations. Upon completion of the training course, you can sit for the exam and gain the "Certified ISO 31000 Risk Manager' credential. The credential demonstrates your knowledge and ability to apply the risk management process in an organization based on the guidelines of ISO 31000 and best practices. Who Should Attend? Managers or consultants responsible for the effective management of risk in an organization Individuals seeking to gain knowledge about the risk management principles, framework, and process Individuals responsible for the creation and protection of value in their organizations Individuals interested in pursuing a career in risk management About This Course Learning objectives Understand the risk management concepts, approaches, methods, and techniques Learn how to establish a risk management framework in the context of an organization Learn how to apply the ISO 31000 risk management process in an organization Understand the basic approaches, methods, and practices used to integrate risk management in an organization Educational approach The training course is based on theory and best practices used in risk management. Lecture sessions are illustrated with practical examples. The participants are encouraged to communicate and engage in discussions and exercises. The exercises are similar in structure with the certification exam questions. Course agenda Day 1: Introduction to ISO 31000 and risk management and establishing the risk management framework Day 2: Initiation of the risk management process and risk assessment based on ISO 31000 Day 3: Risk treatment, recording and reporting, monitoring and review, and communication and consultation according to ISO 31000; the examination. Prerequisites A foundational understanding of ISO 31000 and knowledge of risk management What's Included? Official Study materials Coffee's/Teas, refreshments and Lunch (Classroom courses only) The Exam fees Our Guarantee We are an approved IECB Training Partner. You can learn wherever and whenever you want with our robust classroom and interactive online training courses. Our courses are taught by qualified practitioners with commercial experience. We strive to give our delegates the hands-on experience. Our courses are all-inclusive with no hidden extras. The one-off cost covers the training, all course materials, and exam voucher. Our aim: To achieve a 100% first time pass rate on all our instructor-led courses. Our Promise: Pass first time or 'train' again for FREE. *FREE training and exam retake offered Accreditation Assessment The examination is delivered in a 10 question essay type format, to be completed within 125 minutes and with a 70% pass mark. Exam results are provided within 24 hours. Provided by This course is Accredited by NACS and Administered by the IECB.

By completing this course, students will appreciate the importance of compliance and risk management for governance, strategy, and operations. They will acquire skills to establish compliance programs, promote ethical cultures, and use risk management techniques in their own organisations.

ISO 31000 Lead Risk Manager

By Training Centre

Delivered in either Live Online (4 days) or in our Classroom (5 days), the ISO 31000 Lead Risk Manager training enables you to acquire the expertise to support and lead an organization and its team to successfully identify, understand and manage a risk process based on ISO 31000. During this training course, you will also gain comprehensive knowledge of the best practices used to implement a Risk Management framework that provides the foundation for designing, implementing, monitoring, reviewing and continually improving a Risk Management process in an organization. About This Course After mastering all the necessary concepts of Risk Management, you can sit for the exam and gain "Certified ISO 31000 Lead Risk Manager' credential. By holding this Certificate, you will be able to demonstrate that you have the professional capabilities and competencies to effectively manage a risk process in an organization. Learning principles; Acknowledge the correlation between ISO 31000, IEC/ISO 31010 and other standards and regulatory frameworks Master the concepts, approaches, methods and techniques used to manage risk within an organization Learn how to interpret the ISO 31000 principles and guidelines in the specific context of an organization Learn how to establish an effective risk communication plan and a risk recording and reporting process Acquire the expertise to support an organization to effectively manage and monitor risk based on best practices Prerequisites A fundamental understanding of ISO 31000 and comprehensive knowledge of Risk Management. What's Included? Refreshments & Lunch (Classroom courses only) Course Slide Deck Official Study Materials CPD Certificate The Exam Who Should Attend? Managers or consultants seeking to master their skills to support an organization during the implementation of an organization-wide Risk Management framework and process based on the principles and recommendations of ISO 31000 Professionals responsible for the creation and protection of value in organizations through effective management of risks Expert advisors seeking to gain comprehensive knowledge of the key concepts, processes and strategies of Risk Management Risk Management team members Our Guarantee We are an approved IECB Training Partner. You can learn wherever and whenever you want with our robust classroom and interactive online training courses. Our courses are taught by qualified practitioners with commercial experience. We strive to give our delegates the hands-on experience. Our courses are all-inclusive with no hidden extras. The one-off cost covers the training, all course materials, and exam voucher. Our aim: To achieve a 100% first time pass rate on all our instructor-led courses. Our Promise: Pass first time or 'train' again for FREE. *FREE training and exam retake offered Accreditation Assessment The exam consists of a 12 question essay type format, to be completed within 150 minutes and a pass mark of 70% Exam results are provided within 24 hours. Provided by This course is Accredited by NACS and Administered by the IECB.

Professional Certificate Course in Project Procurement Risk Management in London 2024

4.9(261)By Metropolitan School of Business & Management UK

Our Professional Certificate Course in Project Procurement Risk Management offers in-depth knowledge and skills to effectively manage procurement risks in projects. The course covers the concept of procurement risk and its various types, including e-procurement risks and their causes and types. Participants will also gain practical knowledge on risk probability framework, risk scoring, and risk impact ranges, along with an understanding of the procurement risk cycle. By the end of the course, participants will be equipped with the necessary expertise to identify, assess, and mitigate procurement risks to ensure project success. Project procurement involves risks that can affect project success. Our Professional Certificate Course in Project Procurement Risk Management provides practical skills to identify, assess, and mitigate these risks.After the successful completion of the course, you will be able to learn about the following, The concept of procurement risk and its various types. The meaning of e-procurement risks, its causes and types. Risk probability framework, risk scoring, and risk impact ranges. You will also learn about the procurement risk cycle. Our Professional Certificate Course in Project Procurement Risk Management offers in-depth knowledge and skills to effectively manage procurement risks in projects. The course covers the concept of procurement risk and its various types, including e-procurement risks and their causes and types. Participants will also gain practical knowledge on risk probability framework, risk scoring, and risk impact ranges, along with an understanding of the procurement risk cycle. By the end of the course, participants will be equipped with the necessary expertise to identify, assess, and mitigate procurement risks to ensure project success. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Project Procurement Risk Management Self-paced pre-recorded learning content on this topic. Project Procurement Risk Management Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience, Project Managers Procurement Managers Risk Management Professionals Contract Administrators Supply Chain Managers Purchasing Managers Operations Managers Quality Assurance Managers Business Owners Anyone Involved in Project Procurement Processes. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

NextGen Project Risk Management

By IIL Europe Ltd

NextGen Project Risk Management Risk and uncertainty are inherent to projects. They influence every major project decision and eventual outcome. It is paramount to understand them to make the right decisions and achieve successful outcomes. Many organizations have recently adopted risk registers and qualitative methods to manage their project risks. While these methods are a first step, there is a strong need for more sophisticated next generation tools involving quantitative analysis. Such tools can provide us with more realistic cost and schedule estimates. They can also help us establish and manage contingencies more effectively. This and other IIL Learning in Minutes presentations qualify for PDUs. Some titles, such as Agile-related topics may qualify for other continuing education credits such as SEUs, or CEUs. Each professional development activity yields one PDU for one hour spent engaged in the activity. Some limitations apply and can be found in the Ways to Earn PDUs section that discusses PDU activities and associated policies. Fractions of PDUs may also be reported. The smallest increment of a PDU that can be reported is 0.25. This means that if you spent 15 minutes participating in a qualifying PDU activity, you may report 0.25 PDU. If you spend 30 minutes in a qualifying PDU activity, you may report 0.50 PDU.

LNG Markets, Pricing, Trading & Risk Management

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course The LNG market is developing from a fully based market on long-term contracts, to a more flexible market based on a portfolio of contracts of different durations. The increase of LNG demand, fuelled by South Korea, Japan and several other emerging economies, are creating a base for a more flexible market, where the LNG spot market will be playing a key role. Changes in the LNG market can be identified in the following areas: development of terminals and plant sizes, increased integration throughout the supply chain, diversification of supply sources, increased contractual flexibility and increased geographical distance. This is creating the foundation for the development of the LNG spot market right here in Asia today. This 3 full-day intensive intermediate level course will give you cutting-edge knowledge needed in today's complex LNG market. Increase your knowledge and understanding of the LNG market and spot trading aspects by attending this course. Training Objectives By the end of this course, participants will be able to: Leverage on the current and global drivers of the world Natural gas and LNG markets Understand regional LNG pricing effects and who the key buyers and new sellers are Appreciate the trading structures of LNG and how to structure its risk management Understand the workings and future outlook of the Asian LNG Spot market Discover and exploit the arbitrage trading opportunities between the different markets Learn what LNG derivatives are and how it will become available for hedging and proprietary trading purposes Target Audience This course will benefit: LNG market development executives are drawn from both technical and non-technical (commercial, finance and legal) backgrounds. Participants in an LNG market development team, perhaps with expertise in one area of gas development, will benefit from the course by obtaining a good grounding of all other areas. The course is pitched at an intermediate level, although those with a basic knowledge will be able to grasp most of the concepts covered. Course Level Intermediate Trainer Your course leader is a skilled and accomplished professional with over 25 years of extensive C-level experience in the energy markets worldwide. He has strong expertise in all the aspects of (energy) commodity markets, international sales, marketing of services, derivatives trading, staff training and risk management within dynamic and high-pressure environments. He received a Master's degree in Law from the University of Utrecht in 1987. He started his career at the NLKKAS, the Clearing House of the Commodity Futures Exchange in Amsterdam. After working for the NLKKAS for five years, he was appointed as Member of the Management Board of the Agricultural Futures Exchange (ATA) in Amsterdam at the age of 31. While working for the Clearing House and exchange, he became an expert in all the aspects of trading and risk management of commodities. In 1997, he founded his own specialist-consulting firm that provides strategic advice about (energy) commodity markets, trading and risk management. He has advised government agencies such as the European Commission, investment banks, major utilities, and commodity trading companies and various energy exchanges and market places in Europe, CEE countries, North America and Asia. Some of the issues he has advised on are the development and implementation of a Risk Management Framework, investment strategies, trading and hedging strategies, initiation of Power Exchanges (APX) and other trading platforms, the set-up of (OTC) Clearing facilities, and feasibility and market studies like for the Oil, LNG and the Carbon Market. The latest additions are (Corporate) PPAs and Artificial Intelligence for energy firms. He has given numerous seminars, workshops and (in-house) training sessions about both the physical and financial trading and risk management of commodity and carbon products. The courses have been given to companies all over the world, in countries like Japan, Singapore, Thailand, United Kingdom, Germany, Poland, Slovenia, Czech Republic, Malaysia, China, India, Belgium and the Netherlands. He has published several articles in specialist magazines such as Commodities Now and Energy Risk and he is the co-author of a book called A Guide to Emissions Trading: Risk Management and Business Implications published by Risk Books in 2004. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Do you want to prepare for your dream job but strive hard to find the right courses? Then, stop worrying, for our strategically modified Financial Engineering & Risk Management bundle will keep you up to date with the relevant knowledge and most recent matters of this emerging field. So, invest your money and effort in our 33 course mega bundle that will exceed your expectations within your budget. The Financial Engineering & Risk Management related fields are thriving across the UK, and recruiters are hiring the most knowledgeable and proficient candidates. It's a demanding field with magnitudes of lucrative choices. If you need more guidance to specialise in this area and need help knowing where to start, then StudyHub proposes a preparatory bundle. This comprehensive Financial Engineering & Risk Management bundle will help you build a solid foundation to become a proficient worker in the sector. This Financial Engineering & Risk Management Bundle consists of the following 30 CPD Accredited Premium courses - Course 1: Financial Analysis Course 2: Financial Management Course 3: Finance Principles Course 4: Develop Your Career in Finance: Blue Ocean Strategy Course 5: Improve your Financial Intelligence Course 6: Corporate Finance: Working Capital Management Course 7: Raising Money & Valuations Course 8: Corporate Finance: Profitability in a Financial Downturn Course 9: Financial Ratio Analysis for Business Decisions Course 10: Banking and Finance Accounting Statements Financial Analysis Course 11 : Fundamentals of Zero Based Budgeting Course 12: Dealing With Uncertainity: Make Budgets and Forecasts Course 13: Making Budget & Forecast Course 14: Financial Statements Fraud Detection Training Course 15: Presenting Financial Information Course 16: Anti-Money Laundering (AML) Training Course 17: Cost Control & Project Scheduling Course 18: Commercial Law Course 19: Day Trade Stocks with Price Action and Tape Reading Strategy Course 20: Stock Trading Analysis with Volume Trading Course 21: UK Tax Accounting Course 22: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 23: Accounting Basics Course 24: Know Your Customer (KYC) Course 25: Quickbooks Online Course 26: Sage 50 Accounts Course 27: Xero Accounting and Bookkeeping Online Course 28: Excel Pivot Tables for Data Reporting Course 29: Dynamic Excel Gantt Chart and Timelines Course 30: Excel Vlookup, Xlookup, Match and Index 3 Extraordinary Career Oriented courses that will assist you in reimagining your thriving techniques- Course 1:Career Development Plan Fundamentals Course 2:CV Writing and Job Searching Course 3:Interview Skills: Ace the Interview Learning Outcome This tailor-made Financial Engineering & Risk Management bundle will allow you to- Uncover your skills and aptitudes to break new ground in the related fields Deep dive into the fundamental knowledge Acquire some hard and soft skills in this area Gain some transferable skills to elevate your performance Maintain good report with your clients and staff Gain necessary office skills and be tech savvy utilising relevant software Keep records of your work and make a report Know the regulations around this area Reinforce your career with specific knowledge of this field Know your legal and ethical responsibility as a professional in the related field This Financial Engineering & Risk Management Bundle resources were created with the help of industry experts, and all subject-related information is kept updated on a regular basis to avoid learners from falling behind on the latest developments. Certification After studying the complete training you will be able to take the assessment. After successfully passing the assessment you will be able to claim all courses pdf certificates and 1 hardcopy certificate for the Title Course completely free. Other Hard Copy certificates need to be ordered at an additional cost of •8. CPD 330 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Ambitious learners who want to strengthen their CV for their desired job should take advantage of the Financial Engineering & Risk Management bundle! This bundle is also ideal for professionals looking for career advancement. Requirements To participate in this course, all you need is - A smart device A secure internet connection And a keen interest in Financial Engineering & Risk Management Career path Upon completing this essential Bundle, you will discover a new world of endless possibilities. These courses will help you to get a cut above the rest and allow you to be more efficient in the relevant fields.

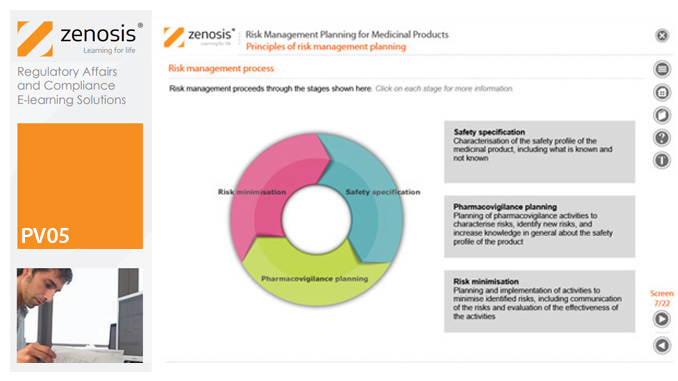

PV05: Risk Management Planning for Medicinal Products

By Zenosis

Proactive risk management is a major component of good pharmacovigilance practice. This module sets out the principles of risk management planning and outlines regulatory requirements for risk management plans in regions that are major markets for medicinal products.