- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2570 Risk Management courses delivered Online

Embark on a transformative journey with the 'Level 4 Financial Advisor Certification' course, a comprehensive pathway designed to shape future financial wizards. The curriculum, intricately structured, unfolds across eight modules, each delving into critical aspects of financial advising. Beginning with the fundamentals of finance, the course swiftly transitions into developing essential skills required in the realm of financial advising. As learners progress, they encounter nuanced topics like financial planning, wealth management, and crafting personal financial statements. The programme not only emphasises theoretical understanding but also instills practical wisdom in financial risk management and investment planning. Unique to this course is the inclusion of divorce planning and the application of Google Analytics in financial advisement, offering a cutting-edge perspective in the field. This blend of traditional knowledge with contemporary tools equips participants with a holistic skillset, priming them for success in the dynamic world of finance. Enrollees in this certification program will unearth a treasure trove of insights, preparing them to navigate the complexities of financial advisory with confidence and acumen. This journey transcends mere academic learning; it is a venture into the very heart of financial expertise, promising a transformative experience for aspiring financial advisors. Learning Outcomes Gain a foundational understanding of finance and its practical application. Develop specialised skills necessary for effective financial advising. Master the art of crafting and managing personal financial statements. Acquire proficiency in identifying and mitigating financial risks. Learn strategic investment planning and the nuances of divorce planning. Why choose this Level 4 Financial Advisor Certification? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Level 4 Financial Advisor Certification for? Individuals aspiring to become financial advisors. Finance professionals seeking to enhance their knowledge. Entrepreneurs needing insights into financial management. Career changers interested in the finance sector. Students aiming for a comprehensive understanding of financial advising. Career path Financial Advisor: £30,000 - £60,000 Wealth Manager: £40,000 - £70,000 Risk Management Analyst: £35,000 - £55,000 Investment Planner: £32,000 - £58,000 Personal Finance Consultant: £28,000 - £50,000 Analytics Specialist in Finance: £33,000 - £65,000 Prerequisites This Level 4 Financial Advisor Certification does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Finance Introduction to Finance 00:23:00 Module 02: Essential Skill for Financial Advisor Essential Skills for Financial Advisors 00:34:00 Module 03: Financial Planning Financial Planning 00:37:00 Module 04: Wealth Management and Guide to Make Personal Financial Statements Wealth Management and Guide to Make Personal Financial Statements 00:18:00 Module 05: Financial Risk Management and Assessment Financial Risk Management and Assessment 00:31:00 Module 06: Investment Planning Investment Planning 00:25:00 Module 07: Divorce Planning Divorce Planning 00:26:00 Module 08: Google Analytics for Financial Advisors Google Analytics for Financial Advisor 00:26:00 Assignment Assignment - Level 4 Financial Advisor Certification 00:00:00

Course Overview Whether you are an employee or an employer, it is important to learn how to create a safe workplace. Building a risk-free work environment will not only protect the people but also help in creating a productive workforce. However, to create a risk-free workplace, you must first learn how to assess the risks. That is where our Risk Assessment Skills Training comes in. This course is focused on helping you understand the fundamentals of risk assessment. The highly engaging and bit-sized modules will educate you on the five steps of the risk management process. Then you will learn the skills required for assessing the potential risks in the workplace. The course will also include detailed lessons on the risk assessment toolkit and show you how to utilise it properly. Enrol in the Risk Assessment Skills Training course and get a step closer to creating a safe and healthy workplace. Course Sneak Peek Learning Outcomes Learn the basic principles of risk assessment and its significance in ensuring workplace safety. Familiarise yourself with the five essential steps of the risk management process. Build your competence in identifying the sources of potential risks Gain a deeper understanding of the risk assessment toolkit Course Promo Why Should Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Engaging tutorial videos, materials from the industry-leading experts Opportunity to study in a user-friendly, advanced online learning platform Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email. What Skills Will You Learn from This Course? Risk Assessment Risk Management Who Should Take this Risk Assessment Skills Training? Whether you're an existing practitioner or an aspiring professional, this course will enhance your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Risk Assessment Skills Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing and passing the Risk Assessment Skills Training successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in Hard Copy at £39 or in PDF format at £24. Career Path This exclusive Risk Assessment Skills Training course will equip you with effective skills and abilities and help you explore career paths such as Risk Assessor Safety OfficerHR Manager Course Curriculum Module 01: What is Risk Assessment? What is Risk Assessment? 00:10:00 Module 02: How to Manage Risks How to Manage Risks 00:14:00 Module 03: Risk Assessment Toolkit Risk Assessment Toolkit 00:10:00 Certificate & Transcript Order Your Certificates and Transcripts 00:00:00

Our Aim Is Your Satisfaction! Offer Ends Soon; Hurry Up!! Are you looking to improve your current abilities or make a career move? Our unique Compliance Officer Training Level 3 course might help you get there! Expand your expertise with high-quality training - study the Compliance Officer Training Level 3 course and get an expertly designed, great-value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the Compliance Officer Training Level 3 online training course. The Compliance Officer Training Level 3 course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Compliance Officer Training Level 3 course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this course. This Compliance Officer Training Level 3 training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join us today and gear up for excellence! Why Prefer Us? Opportunity to earn a certificate accredited by CPDQS. Get a free student ID card!(£10 postal charge will be applicable for international delivery) Innovative and Engaging Content. Free Assessments 24/7 Tutor Support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Compliance Officer Training Level 3 course: Module 01 : Introduction to Compliance Module 02 : Compliance Management System Module 03 : Basic Elements of Effective Compliance Module 04 : Compliance Audit Module 05 : Compliance and Ethics Module 06 : Introduction to Risk and Basic Risk Types Module 07 : Further Risk Types Module 08 : Introduction to Risk Management Module 09 : Risk Management Process Module 10 : Risk Assessment and Risk Treatment Module 11 : Types of Risk Management Assessment Process Once you have completed all the modules in the Compliance Officer Training Level 3 course, you can assess your skills and knowledge with an optional assignment. Certificate of Completion The learners have to complete the assessment of this Compliance Officer Training Level 3 course to achieve the CPDQS accredited certificate. Digital Certificate: £10 Hard Copy Certificate: £29 (Inside UK) Hard Copy Certificate: £39 (for international students) CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Compliance Officer Training Level 3 course. This course is open to everybody. Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this course, you are to start your career or begin the next phase of your career.

Business Management Masterclass: Part 3

By iStudy UK

Course Description This Business Management Masterclass: Part 3 course is designed to help you extend your knowledge about various aspects of managing a business. Risk is an essential part of any business. In this course, you will be introduced to risk management. You will learn how you can prepare your business for quality control and monitoring quality assurance. In addition, the Business Management Masterclass: Part 3 course will help you improve your communication skills, both verbal and non-verbal. You will become familiar with different types of business environments and develop your organisational skills. Join the course right away to enhance your skills as a business manager. Learning outcome Get introduced to risk management Learn how you can prepare your business for quality control and monitoring quality assurance through quality management Enhance your verbal and non-verbal communication skills Familiarise yourself with different types of business environments Develop your organisational skills How Much Do Business Managers Earn? Senior - £70,000(Appx.) Average - £46,000(Appx.) Starting - £36,000(Appx.) Requirement Our Business Management Masterclass: Part 3 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Business Management Masterclass: Part 3 Module 01: Managing Risk and Recovery 00:26:00 Module 02: Quality Management 00:21:00 Module 03: Communication Skills 00:25:00 Module 04: Business Environment 00:16:00 Module 05: Organisational Skills 01:16:00 Assignment Assignment - Business Management Masterclass: Part 3 00:00:00

ISO 14001: Environmental Management Systems Masterclass Unlock unparalleled expertise in sustainable practices with our ISO 14001: Environmental Management Systems Masterclass. Gain proficiency in Environmental Management standards and protocols. Elevate your career with ISO 14001 in Environmental Management. Learning Outcomes: Interpret the core elements of ISO 14001 for Environmental Management. Apply ISO/IEC 20000 principles to Environmental Management. Integrate ISO 31000 risk management in Environmental Management practices. Assess the significance of environmental awareness through Environmental Management. Solve major environmental issues using Environmental Management guidelines. More Benefits: LIFETIME access Device Compatibility Free Workplace Management Toolkit Key Modules from ISO 14001: Environmental Management Systems Masterclass: Introduction to ISO 14001: Understand and apply the foundational principles of ISO 14001 in your Environmental Management practice. Fundamentals of ISO/IEC 20000: Incorporate ISO/IEC 20000 standards to enrich your Environmental Management systems. ISO 31000- Risk Management: Integrate ISO 31000 risk management frameworks into Environmental Management protocols. Importance of Environmental Awareness: Highlight the critical role of awareness in effective Environmental Management. Major Environmental Issues: Address and resolve significant environmental challenges through robust Environmental Management. Environmental Management and ISO 14001: Master the intricate relationship between ISO 14001 standards and best practices in Environmental Management.

The Essential Accounting Basics Course is a vital tool for anyone looking to thrive in today's fast-paced financial landscape. Understanding accounting is crucial not just for professional success but also for managing personal finances effectively. By learning accounting, you gain insights into financial statements, budgeting, and investment management, which are indispensable skills for making informed decisions. In the UK, accounting professionals are in high demand, with average salaries ranging from £25,000 to £45,000, depending on experience. This course will significantly enhance your employability, opening doors to numerous job opportunities in finance and accounting sectors. Moreover, the accounting sector is experiencing growth, with a projected increase of 6% over the next decade. Enrolling in this Essential Accounting Basics course means you're equipping yourself with a skill set that is not only essential for daily financial management but also crucial for a thriving career. Whether you're looking to advance in your current role or switch to a new profession, understanding accounting is a strategic move that offers both stability and growth potential in the ever-evolving job market. Key Features: CPD Certified Essential Accounting Basics Course Developed by Specialist Lifetime Access Course Curriculum Module 01: Introduction to Accounting Module 02: Who are Accountants? Module 03: The Accounting System Module 04: What are Financial Statements? Module 05: Introduction to Financial Statement Analysis Module 06: Budgeting and Its Importance Module 07: Financial Markets and Bonds Module 08: Dealing with Financial Risk Management Module 09: Investment Management and Analysis Module 10: Auditing and Risk of Frauds Learning Outcomes: Decode financial statements for insightful business analysis and decision-making. Master the principles of risk management and enhance financial resilience strategies. Cultivate advanced skills in investment analysis for strategic financial planning. Navigate the intricate landscape of financial markets and comprehend bond dynamics. Develop expertise in auditing, mitigating risks, and safeguarding against financial frauds. Gain a comprehensive understanding of budgeting's pivotal role in financial stability. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Essential Accounting Basics course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Essential Accounting Basics. Moreover, this course is ideal for: Aspiring financial analysts seeking advanced financial expertise. Business professionals aiming to enhance financial decision-making skills. Individuals interested in mastering risk management strategies for business resilience. Aspiring auditors and risk analysts pursuing a deeper understanding of financial landscapes. Those keen to explore the dynamics of financial markets and investments. Requirements There are no requirements needed to enrol into this Essential Accounting Basics course. We welcome individuals from all backgrounds and levels of experience to enrol into this Essential Accounting Basics course. Career path After finishing this Essential Accounting Basics course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Accounting are: Junior Accountant - £18K to £26K/year. Financial Analyst - £30K to £50K/year. Budget Analyst - £27K to £45K/year. Auditor - £28K to £48K/year. Investment Analyst - £32K to £55K/year. Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Use Steemit to Earn Steem - Cryptoception

By Compete High

ð Unlock the Power of Steemit and Earn Steem with 'Cryptoception' ð Are you ready to dive into the world of cryptocurrency and leverage the incredible potential of Steemit to earn Steem? Look no further! Introducing 'Cryptoception,' your gateway to mastering Steemit and maximizing your earnings in the ever-evolving crypto sphere. ð¥ What is 'Cryptoception' all about? ð¥ This comprehensive online course is your ultimate guide to harnessing the power of Steemit, the revolutionary social media platform built on blockchain technology. Led by industry experts and seasoned Steemit enthusiasts, 'Cryptoception' is designed to equip you with the knowledge and strategies needed to navigate Steemit effectively and earn Steem like a pro. ð What You'll Learn: Understanding Steemit: Dive deep into the mechanics of Steemit, comprehend its blockchain structure, and grasp the dynamics of earning through content creation, curation, and engagement. Optimizing Your Content: Learn insider tips and tricks to create engaging and rewarding content that attracts attention, gains followers, and ultimately boosts your earnings. Monetization Strategies: Explore various monetization techniques, including leveraging Steem Power, exploring communities, and utilizing smart strategies to maximize your rewards. Navigating the Steemit Ecosystem: Gain insights into the diverse opportunities within Steemit, including DApps, tokens, and the broader crypto ecosystem connected to Steem. Risk Management and Security: Understand the importance of security measures, risk management, and safeguarding your assets in the crypto world. ð¡ Why 'Cryptoception' Stands Out: Expert Guidance: Learn from industry experts who have navigated the intricacies of Steemit and earned significant rewards. Practical Insights: Gain actionable strategies and practical advice you can implement immediately to enhance your Steemit journey. Community Support: Join a vibrant community of like-minded individuals, exchange ideas, and grow together on your Steemit journey. ð Don't Miss Out on Your Chance to Earn with Steemit! Enroll in 'Cryptoception' Today! ð Join the ranks of successful Steemit users who have unlocked the potential of earning Steem while engaging with a thriving online community. Take charge of your crypto journey and turn your content into valuable rewards! Course Curriculum

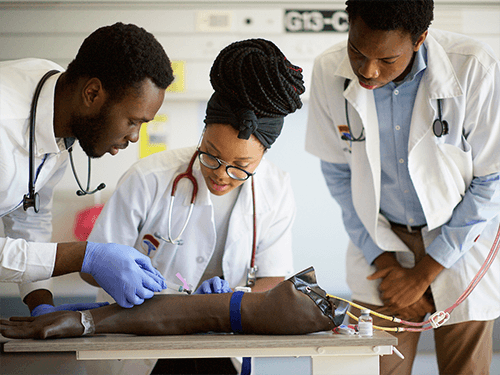

Phlebotomy Training

By iStudy UK

Phlebotomy Training Overview Have you ever wondered how magic happens when a tiny vial holds the key to unlocking a wealth of information about our health? Phlebotomy, the art and science of blood collection, plays a vital role in medical diagnosis, treatment, and research. Imagine yourself at the forefront of this fascinating field, expertly drawing blood with precision and care, contributing directly to patients' well-being. This Phlebotomy Training course equips you with the knowledge and skills to embark on this rewarding career path. Across nine comprehensive modules, you'll delve into the fascinating world of blood, mastering key concepts like its circulation, function, and composition. You'll become familiar with the tools of the trade, from needles and syringes to collection tubes and tourniquets. Hone your technique through practical venipuncture training, learning to navigate routine procedures and address potential complications. Discover alternative blood collection methods like dermal punctures, and gain insights into quality control and risk management practices. Finally, delve into the crucial aspects of infection control, ensuring patient safety and your own well-being. By the end of this 3-hour journey, you'll be equipped to excel in this dynamic healthcare field. You'll possess the practical skills, theoretical knowledge, and unwavering commitment to join the ranks of lifeblood heroes, making a vital contribution to patient care. Why You Should Choose Phlebotomy Training Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Phlebotomy Training is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Phlebotomy Training is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Phlebotomy Training Module 01: Introduction to Phlebotomy Introduction to Phlebotomy 00:17:00 Module 02: Blood Circulation, Function, and Composition Blood Circulation, Function, and Composition 00:27:00 Module 03: Phlebotomy Equipment Phlebotomy Equipment 00:16:00 Module 04: Routine Venipuncture Routine Venipuncture 00:24:00 Module 05: Venipuncture Complications and Pre-Examination Variable Venipuncture Complications and Pre-Examination Variables 00:26:00 Module 06: Dermal Puncture Dermal Puncture 00:14:00 Module 07: Quality Assessment and Management in Phlebotomy Quality Assessment and Management in Phlebotomy 00:19:00 Module 08: Special Blood Collection Procedure Special Blood Collection Procedure 00:15:00 Module 09: Infection Control and Risk Management Infection Control and Risk Management 00:19:00

Crisis Management at QLS Level 3 & 5

By Imperial Academy

Level 5 QLS Endorsed Course | Endorsed Certificate Included | Plus 5 Career Guided Courses | CPD Accredited

24 Hour Flash Deal **33-in-1 Team Leading and Supervision Mega Bundle** Team Leading and Supervision Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Team Leading and Supervision package online with Studyhub through our online learning platform. The Team Leading and Supervision bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Team Leading and Supervision course provides complete 360-degree training on Team Leading and Supervision. You'll get not one, not two, not three, but thirty-three Team Leading and Supervision courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Team Leading and Supervision courses are yours for as long as you want them once you enrol in this course This Team Leading and Supervision Bundle consists the following career oriented courses: Course 01: Leadership and Management Course 02: Strategic Management and Leadership Development Course 03: Team Building Masterclass Course 04: Effective Communication Skills Diploma Course 05: Performance Management Course 06: Conflict Resolution Course 07: Diversity Training Course 08: Motivational Mentorship: Inspiring Personal and Professional Growth Course 09: Talent Management & Employee Retention Techniques Course 10: Employee Training Responsibilities: Effective Training Management Course 11: Motivating, Performance Managing and Maintaining Team Culture in a Remote Team Course 12: Emotional Intelligence and Social Management Diploma Course 13: Negotiation Skills Course 14: Art of Negotiation and Conflict Resolution Course 15: Public Speaking: Presentations like a Boss Course 16: PR : Public Relation and Management Training Course 17: Delegation Skills Training Course 18: Operations and Time Management Course 19: Project Management Course 20: Lean Leadership, Culture and Management - Online Diploma Course 21: Change Management Course 22: Risk Management Course 23: Corporate Risk And Crisis Management Course 24: Agile Project Management Diploma Course 25: Lean Six Sigma White Belt course Course 26: Six Sigma Green Belt Diploma Course 27: Six Sigma Black Belt - Advance Diploma Course 28: Cross-Cultural Awareness Training Diploma Certificate Course 29: Governance and Risk Management: Navigating Corporate Strategies Course 30: Corporate Relationship Goals for Success Course 31: Strategic Planning and Implementation Course 32: Middle Manager Management Course 33: Time Management In this exclusive Team Leading and Supervision bundle, you really hit the jackpot. Here's what you get: Step by step Team Leading and Supervision lessons One to one assistance from Team Leading and Supervision professionals if you need it Innovative exams to test your knowledge after the Team Leading and Supervision course 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all thirty-three Team Leading and Supervision courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Team Leading and Supervision certificate and transcript on the next working day Easily learn the Team Leading and Supervision skills and knowledge you want from the comfort of your home The Team Leading and Supervision course has been prepared by focusing largely on Team Leading and Supervision career readiness. It has been designed by our Team Leading and Supervision specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Team Leading and Supervision Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Team Leading and Supervision bundle course has been created with thirty-three premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Team Leading and Supervision Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Team Leading and Supervision Elementary modules, allowing our students to grasp each lesson quickly. The Team Leading and Supervision course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. CPD 330 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Team Leading and Supervision training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Team Leading and Supervision This course is suitable for anyone interested to further progress there career in: Level 2 Certificate in Principles of Team Leading (RQF) Level 2 Certificate in Principles of Team Leading (VRQ) Level 2 Diploma in Team Leading (RQF) Level 3 Diploma in Team Leading and Supervision (RQF) City & Guilds Level 2 Certificate in Leadership and Team Skills Institute of Leadership & Management City & Guilds Level 3 Award in Leadership and Management City & Guilds Level 3 Certificate in Leadership and Management City & Guilds Level 5 Award in Leadership and Management CMI Level 5 Award in Professional Team Coaching cmi level 3 diploma in principles of managment and leadership level 3 award in management and leadership the institute of leadership & management city & guilds level 7 certificate in leadership and management Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Requirements To participate in this Team Leading and Supervision course, all you need is - A smart device A secure internet connection And a keen interest in Team Leading and Supervision Career path You will be able to kickstart your Team Leading and Supervision career because this course includes various courses as a bonus. This Team Leading and Supervision is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Team Leading and Supervision career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free