- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2621 Risk Management courses in Stone delivered Online

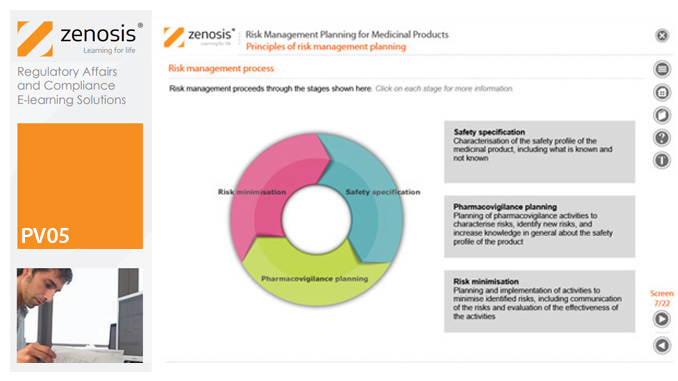

PV05: Risk Management Planning for Medicinal Products

By Zenosis

Proactive risk management is a major component of good pharmacovigilance practice. This module sets out the principles of risk management planning and outlines regulatory requirements for risk management plans in regions that are major markets for medicinal products.

PMI-RMP Exam Prep: In-House Training

By IIL Europe Ltd

PMI-RMP® Exam Prep: In-House Training This course is aimed at preparing the participant to pass the PMI-RMP® (Risk Management Professional) exam. The course will also provide practical tips and tools that can be used in any organization's project management risk practices. In this expanded session, you will also have time to practice your exam taking skills with coaching from a credentialed instructor. The course includes the tool RMP-IQ, with sample exam questions to practice for the exam and allow participants to see their knowledge level in the various domains. What You Will Learn At the end of this course, participants will be able to: Explain the value and benefits of the PMI-RMP® credential Perform a self-assessment of your knowledge and skills Prepare a study plan that will allow you to pass the exam Foundation Concepts The Risk Management Professional (PMI-RMP®) Exam PMI's Standard for Risk Management Portfolios, Programs and Projects Key risk definitions Risk management life cycle Levels of Risk Management Enterprise Risk Management Portfolio Risk Management Program Risk Management Project Risk Management Risk Strategy and Planning: Part 1 Task 1: Perform a preliminary document analysis Task 2: Assess project environment for threats and opportunities Task 3: Confirm risk thresholds based on risk appetites Risk Strategy and Planning: Part 2 Task 4: Establish risk management strategy Task 5: Document the risk management plan Task 6: Plan and lead risk management activities with stakeholders Agile, programs, and portfolio aspects of risk strategy and planning Risk Identification: Part 1 Objectivity and bias Task 1: Conduct risk identification exercises Risk Identification: Part 2 Task 2: Examine assumption and constraint analysis Task 3: Document risk triggers and thresholds based on context / environment Task 4: Develop risk register Agile, programs, and portfolio aspects of risk identification Risk Analysis: Part 1 Task 1: Perform qualitative analysis Risk analysis in an agile environment Risk Analysis: Part 2 Task 2: Perform quantitative analysis Task 3: Identify threats and opportunities Program and portfolio aspects of risk analysis Risk Response Task 1: Plan risk responses Agile, programs, and portfolio aspects of risk response planning Task 2: Implement risk responses Monitor and Close Risks: Part 1 Task 1: Gather and analyze performance data Monitor and Close Risks: Part 2 Task 2: Monitor residual and secondary risks Task 4: Monitor project risk levels Task 3: Provide information required to update relevant project documents Agile, programs, and portfolio aspects of monitoring and closing risks

PMI-RMP Exam Prep: Virtual In-House Training

By IIL Europe Ltd

PMI-RMP® Exam Prep: Virtual In-House Training This course is aimed at preparing the participant to pass the PMI-RMP® (Risk Management Professional) exam. The course will also provide practical tips and tools that can be used in any organization's project management risk practices. In this expanded session, you will also have time to practice your exam taking skills with coaching from a credentialed instructor. The course includes the tool RMP-IQ, with sample exam questions to practice for the exam and allow participants to see their knowledge level in the various domains. What You Will Learn At the end of this course, participants will be able to: Explain the value and benefits of the PMI-RMP® credential Perform a self-assessment of your knowledge and skills Prepare a study plan that will allow you to pass the exam Foundation Concepts The Risk Management Professional (PMI-RMP®) Exam PMI's Standard for Risk Management Portfolios, Programs and Projects Key risk definitions Risk management life cycle Levels of Risk Management Enterprise Risk Management Portfolio Risk Management Program Risk Management Project Risk Management Risk Strategy and Planning: Part 1 Task 1: Perform a preliminary document analysis Task 2: Assess project environment for threats and opportunities Task 3: Confirm risk thresholds based on risk appetites Risk Strategy and Planning: Part 2 Task 4: Establish risk management strategy Task 5: Document the risk management plan Task 6: Plan and lead risk management activities with stakeholders Agile, programs, and portfolio aspects of risk strategy and planning Risk Identification: Part 1 Objectivity and bias Task 1: Conduct risk identification exercises Risk Identification: Part 2 Task 2: Examine assumption and constraint analysis Task 3: Document risk triggers and thresholds based on context / environment Task 4: Develop risk register Agile, programs, and portfolio aspects of risk identification Risk Analysis: Part 1 Task 1: Perform qualitative analysis Risk analysis in an agile environment Risk Analysis: Part 2 Task 2: Perform quantitative analysis Task 3: Identify threats and opportunities Program and portfolio aspects of risk analysis Risk Response Task 1: Plan risk responses Agile, programs, and portfolio aspects of risk response planning Task 2: Implement risk responses Monitor and Close Risks: Part 1 Task 1: Gather and analyze performance data Monitor and Close Risks: Part 2 Task 2: Monitor residual and secondary risks Task 4: Monitor project risk levels Task 3: Provide information required to update relevant project documents Agile, programs, and portfolio aspects of monitoring and closing risks

Risk Management: Risk Management Course Online The Risk Management: Risk Management Course is ideal for any organisation that needs to manage uncertainty while achieving goals. Why is risk management important, and how does it affect an organisation's ability to achieve its goals? How do you integrate risk management with organisational objectives? These are some important business questions that will be discussed in the course. Throughout this Risk Management: Risk Management Course, you will learn how to identify risks, analyse these risks, determine correct action, rate risk depending on the likelihood of occurrence, and reduce and control risks. Risk Management: Risk Management Course is a part of an organisation. However, no matter how carefully plans are developed, or strategies are implemented, there is always a risk. There is always an element of uncertainty in the outcome, which makes it difficult to predict. The comprehensive Risk Management: Risk Management Course focuses on financial and economic risks. Learn how to identify financial and non-financial risks and the risk management framework, and the overall risk management essentials. Main Course: Level 5 Diploma in Risk Management Free Courses included with Risk Management: Risk Management Course Course 01: Manual Handling Course 02: Control of Substances Hazardous to Health (COSHH) Training Course 03: RIDDOR Training [ Note: Free PDF certificate as soon as completing the Risk Management: Risk Management Course] Risk Management: Risk Management Course Online This Risk Management: Risk Management Course consists of 17 modules. Course Curriculum of Risk Management: Risk Management Course Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Risk Management Process Module 07: Risk Assessment Module 08: Risk analysis Module 09: Managing Financial Risks Module 10: The Fundamentals of Operational Risk Management Module 11: Managing Technology Risks Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social Risk and Market Risk Module 15: Risk Assessment at Workplaces Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan Assessment Method of Risk Management: Risk Management Course After completing Risk Management: Risk Management Course, you will get quizzes to assess your learning. You will do the later modules upon getting 60% marks on the quiz test. Certification of Risk Management: Risk Management Course After completing the Risk Management: Risk Management Course, you can instantly download your certificate for FREE. Who is this course for? Risk Management: Risk Management Course Online This Risk Management: Risk Management Course is suitable for anyone. Requirements Risk Management: Risk Management Course Online To enrol in this Risk Management: Risk Management Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Risk Management: Risk Management Course. Be energetic and self-motivated to complete our Risk Management: Risk Management Course. Basic computer Skill is required to complete our Risk Management: Risk Management Course. If you want to enrol in our Risk Management: Risk Management Course, you must be at least 15 years old. Career path Risk Management: Risk Management Course Online Upon successful completion of our Risk Management: Risk Management Course, candidates may choose to pursue an extensive range of careers.

The Risk Management Course for Forex Traders is a wonderful learning opportunity for anyone who has a passion for this topic and is interested in enjoying a long career in the relevant industry. It's also for anyone who is already working in this field and looking to brush up their knowledge and boost their career with a recognised certification. This Risk Management Course for Forex Traders consists of several modules that take around 1 hour to complete. The course is accompanied by instructional videos, helpful illustrations, how-to instructions and advice. The course is offered online at a very affordable price. That gives you the ability to study at your own pace in the comfort of your home. You can access the modules from anywhere and from any device. Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Course Content Introduction to Forex Trading Introduction to Forex Trading 00:11:00 Pitfalls and Risks Pitfalls and Risks 00:11:00 Managing Risk Managing Risk 00:16:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Compliance & Risk Management

By Compliance Central

Are you looking to enhance your Compliance & Risk Management skills? If yes, then you have come to the right place. Our comprehensive course on Compliance & Risk Management will assist you in producing the best possible outcome by mastering the Compliance & Risk Management skills. The Compliance & Risk Management course is for those who want to be successful. In the course, you will learn the essential knowledge needed to become well versed in Compliance & Risk Management. Our Compliance & Risk Management course starts with the basics of Compliance & Risk Management and gradually progresses towards advanced topics. Therefore, each lesson of this course is intuitive and easy to understand Exclusive Bonus Courses: Diploma in Compliance and Risk Management 5 Bonus Courses with 5 Free PDF Certificates Course 01: UK - GDPR Course Course 02: Employment Law Course Course 03: Human Rights Consultant Course Course 04: AML Compliance Manager Course Course 05: (HR) Human Resources Management Course Along with the Compliance & Risk Management courses, you also get: Lifetime Access. Unlimited Retake Exam & Tutor Support. Easy Accessibility to the Course Materials- Anytime, Anywhere - From Any Smart Device (Laptop, Tablet, Smartphone Etc.) 100% Learning Satisfaction Guarantee. Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Curriculum Breakdown of the Course:- Module 1: Introduction to Compliance Module 2: Five Basic Elements of Compliance Module 3: Compliance Management System (CMS) Module 4: Compliance Audit Module 5: Compliance and Ethics Module 6: Risk and Types of Risk Module 7: Introduction Module 8: Process CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this bundle. Requirements To enrol in this course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs. Certificates Certificate of completion Digital certificate - Included Free 6 CPD Accredited PDF Certificate. Certificate of completion Hard copy certificate - £9.99 Get 5 CPD accredited Hardcopy certificate for £9.99 each. The delivery charge for the hardcopy certificate inside the UK is £3.99 each and international students need to pay £9.99 each to get their hardcopy certificate.

Risk Management Level 7 - QLS Endorsed

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

***24 Hour Limited Time Flash Sale*** Financial Engineering & Risk Management Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Do you know that the UK finance sector contributes over 12% to the national GDP? But with such a significant role come inherent risks and complexities. Are you equipped to navigate this dynamic landscape? This Financial Engineering & Risk Management bundle delivers the analytical abilities and financial intelligence today's businesses need. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Financial Engineering & Risk Management bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Financial Engineering & Risk Management Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Financial Engineering & Risk Management Career Bundle: Course 01: Diploma in Financial Analysis at QLS Level 5 Course 02: Financial Management Course 03: Risk Management Course 04: Financial Ratio Analysis for Business Decisions Course 05: Accounting Basics Course 06: Fundamentals of Zero-Based Budgeting Course 07: Quickbooks Online Course 08: Cost Control & Project Scheduling Course 09: Dealing With Uncertainty: Make Budgets and Forecasts Course 10: Sage 50 Accounts Course 11: Presenting Financial Information Course 12: Commercial Law Course 13: Improve Your Financial Intelligence Course 14: Excel Vlookup, Xlookup, Match, and Index Course 15: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 16: Excel Pivot Tables for Data Reporting Course 17: Dynamic Excel Gantt Chart and Timelines Course 18: Raising Money & Valuations Course 19: Stock Trading Analysis with Volume Trading Course 20: Banking and Finance Accounting Statements Financial Analysis Course 21: Financial Statements Fraud Detection Training Course 22: Corporate Finance: Working Capital Management Course 23: Anti-Money Laundering (AML) Training Course 24: Know Your Customer (KYC) Course 25: Day Trade Stocks with Price Action and Tape Reading Strategy Course 26: UK Tax Accounting Course 27: Making Budget & Forecast Course 28: Develop Your Career in Finance: Blue Ocean Strategy Course 29: Xero Accounting and Bookkeeping Online Course 30: Corporate Finance: Profitability in a Financial Downturn With Financial Engineering & Risk Management, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world at your own pace. Learning Outcomes of Financial Engineering & Risk Management Analyse financial statements for informed decision making. Implement effective risk management strategies. Master budgeting, forecasting, and cost control techniques. Utilize accounting software like QuickBooks and Sage 50. Gain insights into the latest accounting trends and regulations. Develop strong financial literacy and critical thinking skills. Enrol in Financial Engineering & Risk Management today and take the first step towards achieving your goals and dreams. Why buy this Financial Engineering & Risk Management? Free CPD Accredited Certificate upon completion of Financial Engineering & Risk Management Get a free student ID card with Financial Engineering & Risk Management Lifetime access to the Financial Engineering & Risk Management course materials Get instant access to this Financial Engineering & Risk Management course Learn Financial Engineering & Risk Management from anywhere in the world 24/7 tutor support with the Financial Engineering & Risk Management course. Start your learning journey straightaway with our Financial Engineering & Risk Management Training! The Financial Engineering & Risk Management premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Financial Engineering & Risk Management is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Financial Engineering & Risk Management course. After passing the Financial Engineering & Risk Management exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 450 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Requirements This Financial Engineering & Risk Management doesn't require prior experience and is suitable for diverse learners. Career path This Financial Engineering & Risk Management bundle will allow you to kickstart or take your career in the related sector to the next stage. Financial analyst Budget analyst FP&A manager Accounting manager Financial consultant Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge. Diploma in Financial Analysis at QLS Level 5 Hard copy certificate - Included

NEBOSH IIRSM Certificate in Managing Risk ~ Via eLearning

5.0(18)By Woodward Safety Health And Environment Ltd

This qualification provides a comprehensive overview of risk and risk management. It is a great way for health and safety professionals to expand their knowledge of risk beyond health and safety.