- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

11747 Professional Development courses in Huntingdon delivered Online

Overview This course will define the scope of work, project goal, project plan, project phase, sequencing and phase relationship Project Planning & Budgeting will provide participants with a demonstrated set of methods, processes, tools and techniques to cultivate a systematic and dynamic project plan to certify progressive monitoring control and reporting of the project cost.

Overview Tendering is a process on which a lot of money relies. When a tender is issued and published, winning that contract is completely depended on how deeply you understand the tender, the key areas of the tender along with how much in-depth knowledge you have about the potential client's need and how you can provide your service to those needs.

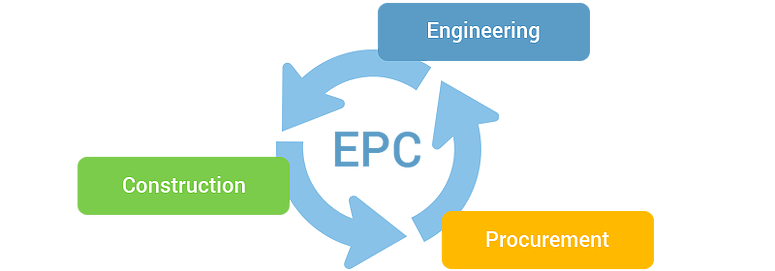

Overview EPC (Engineering, Procurement and Construction) is a very challenging area and is very competitive as well. Companies dealing with large and complex EPC projects are more often get involved in mitigation by complex contract laws and management that lead to huge financial losses. It is very important to Know-how EPC contract laws, and their commercial and financial aspects to gain skills and the ability to deal with complex contract laws and reduces the risk.

Overview The course focuses on topics such as the fundamental concepts of auditing and quality management, principles of internal and external audit, auditing processes and tools, principles and practice of root cause analysis, communication and people skills, and other related topics. Students who successfully complete this course will gain the essential knowledge and skills necessary to become successful auditors and work with confidence to improve the processes in their organizations.

Overview Strategic Financial Management and Effective Budget Execution also called Strategic Financial Management provide the important elements for attaining a comprehensive budget preparation and effective execution system. This course focuses on the risks and challenges likely to obstruct the operation of management and financial accounting processes and evaluates the techniques and tools needed to tackle them. It will highlight what constitutes strategic financial management and effective budget execution within the context of achieving their strategic and operational objectives.

Overview With the change in the density of enterprise risk, new risks have emerged, and managing it has become everyone's responsibility. The new Enterprise Risk Management course offers you the exclusive opportunity to learn the concepts and principles of the newly updated ERM framework and to integrate the framework into your organisation's strategy. The course is designed with all the modules to provide you with the knowledge necessary to understand and apply Enterprise Risk Management - Integrating with Strategy and Performance. The ERM framework assists management and boards of directors with their respective duties for managing risk.

Overview This course will help you manage project risk effectively by identifying, analyzing, and communicating inevitable changes to project scope and objectives. You will understand and practice the elements needed to measure and report on project scope, schedule, and cost performance. You will be equipped with the tools to manage change in the least disruptive way possible for your team and other project stakeholders.

Overview Competitor Analysis is a key area every professional does to understand their business presence. It gives your insight into your business standings and also knowledge of your competitors and their strength and weakness. Analysing your competitors helps you understand the market and your power to deal with the competitors. It is an essential marketing and strategic tool. It provides both an offensive and defensive strategic tool to analyse opportunities and threats.

Overview To understand the course thoroughly, you need to understand the practical application of the theory along with case studies as well as relevant examples. IT Project Management course will include those areas in managing the processes and activities related to guaranteeing the success of IT projects.

Overview Objective Understand the requirement of Information Security Concepts and Definitions of Information Security Management Systems Deeply Analysing the policies, Standards and procedures How to deliver a balanced ISMS and following its security procedures Analysing the Information risk management Evaluating the organisational responsibilities Understanding the Information security controls Scrutinising Legal framework Techniques of Cryptographic models