- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

68 Portfolio Management courses in Cardiff delivered Live Online

Financial Engineering Courses - 8 Courses Bundle

By NextGen Learning

Course Overview The Financial Engineering Courses – 8 Courses Bundle is a comprehensive training package designed to equip learners with a robust understanding of the mathematical, statistical, and analytical foundations of modern finance. This bundle merges core financial theories with quantitative models to support strategic financial decision-making. Learners will explore concepts ranging from derivatives pricing and risk modelling to portfolio optimisation and stochastic processes, gaining a solid foundation in the methodologies used in financial institutions and investment firms. By the end of the course, participants will be able to interpret financial models, assess risk frameworks, and contribute effectively to quantitative analysis roles. This course is particularly valuable for those aiming to strengthen their understanding of finance through an analytical lens, aligning with roles in investment banking, financial consultancy, or quantitative research. Course Description This course bundle offers eight interconnected modules covering a wide array of financial engineering topics. Learners will be introduced to financial mathematics, stochastic calculus, fixed income securities, options pricing, quantitative risk management, and algorithmic trading strategies. The programme provides an in-depth look into the mechanics of financial markets and the computational tools that underpin asset valuation and portfolio structuring. Through clear instruction and structured content, learners will build confidence in applying quantitative techniques and economic theory to real-world financial challenges. Emphasis is placed on theoretical rigour, analytical accuracy, and strategic application. Ideal for learners with a background or interest in finance, mathematics, or economics, this course supports a deeper understanding of financial markets and prepares participants for roles that require data-driven financial modelling and risk assessment skills. Course Modules Module 01: Introduction to Financial Engineering Module 02: Financial Mathematics and Modelling Techniques Module 03: Fixed Income Securities and Yield Curves Module 04: Derivatives and Options Pricing Theory Module 05: Quantitative Risk Management Fundamentals Module 06: Stochastic Processes in Finance Module 07: Portfolio Theory and Investment Analysis Module 08: Algorithmic and Computational Finance (See full curriculum) Bundle Instructions Access all eight courses through a single enrolment. Courses are self-paced and available online 24/7. Learners receive a certificate for each completed module. Support is available throughout the learning journey. Who is this course for? Individuals seeking to build a strong foundation in quantitative finance. Professionals aiming to advance their knowledge in financial modelling and analysis. Beginners with an interest in finance, mathematics, or data-driven investment theory. Graduates or career changers targeting roles in banking, analytics, or asset management. Career Path Quantitative Analyst Financial Risk Manager Investment Banking Analyst Asset or Portfolio Manager Financial Modelling Consultant Data Analyst in Financial Services Derivatives Pricing Specialist Economic Research Associate

Technical Analysis Masterclass for Trading & Investing

By NextGen Learning

Course Overview: The "Technical Analysis Masterclass for Trading & Investing" is a comprehensive course designed to equip learners with the essential skills to make informed trading and investment decisions using technical analysis. Covering a wide range of topics, from candlestick patterns to advanced trading strategies, this course empowers learners to interpret market data and identify trends effectively. By the end of the course, participants will have a solid understanding of how to analyse price movements, recognise key patterns, and apply strategies to improve their decision-making. With an emphasis on real-world applicability, learners will be prepared to confidently navigate the markets and pursue trading and investment opportunities. Course Description: This in-depth course dives into the core concepts and techniques used in technical analysis, ideal for those looking to sharpen their trading and investment skills. Learners will explore topics such as candlestick patterns, chart patterns, and volume analysis to understand market behaviours. Key focus areas also include tape reading strategies and technical trading systems, which are critical for timing market entries and exits. The course provides a structured learning experience, guiding participants through different methods of interpreting market data and applying analytical strategies to both short- and long-term trading. By mastering these techniques, learners will develop the skills to assess market conditions, identify profitable trends, and execute informed investment decisions with confidence. Course Modules: Module 01: Introduction to Technical Analysis Overview of technical analysis and its importance in trading and investing Key concepts and tools used in technical analysis Market data types and interpretation Module 02: Candlestick Patterns and Analysis Introduction to candlestick charting Key candlestick patterns and their significance Identifying trends and reversals Module 03: Trade and Investment Chart Patterns Common chart patterns: head and shoulders, triangles, and more How to interpret chart patterns for trade signals Setting up price targets using chart patterns Module 04: Volume Analysis Understanding volume and its role in market analysis Volume indicators and their applications Volume-based trading strategies Module 05: Tape Reading Strategies Introduction to tape reading and its historical significance Techniques for interpreting market order flow Understanding supply and demand through tape reading Module 06: Technical Trading Strategies Popular technical analysis strategies for trading Risk management and strategy development Implementing strategies for both short and long positions Module 07: Trading Platform and Practice Overview of different trading platforms and their features Using charting tools and indicators in platforms Best practices for executing trades and managing portfolios (See full curriculum) Who is this course for? Individuals seeking to enhance their trading and investment knowledge. Professionals aiming to refine their analytical skills for better decision-making. Beginners with an interest in financial markets and technical analysis. Investors wanting to better understand charting techniques and market trends. Career Path: Stock Trader Investment Analyst Financial Consultant Portfolio Manager Market Research Analyst Risk Manager

Stock Trading Analysis with Volume Trading

By NextGen Learning

Course Overview "Stock Trading Analysis with Volume Trading" is designed to provide learners with a comprehensive understanding of how to leverage volume analysis in stock trading. This course covers essential volume indicators, strategies, and techniques, empowering learners to make informed trading decisions. The course aims to enhance trading skills by explaining how volume trends can influence stock price movements, offering learners practical insights into market behaviour. By the end of the course, learners will have the ability to interpret volume data, use it to spot market trends, and apply it within their trading strategies, enhancing their confidence and decision-making capabilities in stock trading. Course Description This course delves into the critical aspect of volume analysis in stock trading, providing a thorough exploration of how trading volume can provide valuable market insights. Learners will study various volume indicators and their applications, uncover trading strategies that incorporate volume as a key factor, and gain the skills necessary to identify profitable market movements. The course also includes practical examples and analysis to demonstrate how volume impacts stock trends, while familiarising learners with the tools used in volume trading. By completing this course, learners will develop the expertise to utilise volume trading strategies to enhance their trading performance and make more informed decisions in real-time market scenarios. Course Modules Module 01: Volume Analysis Module 02: Volume Studies and Indicators Module 03: Volume Trading Strategies and Techniques Module 04: Examples and Analysis Module 05: Trading Platform (See full curriculum) Who is this course for? Individuals seeking to enhance their stock trading skills Professionals aiming to develop expertise in volume trading strategies Beginners with an interest in stock market analysis Anyone looking to understand the role of volume in trading decisions Career Path Stock Trader Financial Analyst Investment Advisor Trading Platform Specialist Portfolio Manager

Portfolio Building for Property

By NextGen Learning

Portfolio Building for Property Course Overview: This course on "Portfolio Building for Property" offers a comprehensive guide to the key principles of property investment and management. Designed for individuals seeking to develop a successful property portfolio, the course covers various property types, investment strategies, and risk management techniques. Learners will gain an understanding of the financial aspects of property investment, from budgeting and financing to analysing property value and market trends. By the end of the course, participants will be equipped with the knowledge to build and manage a diverse property portfolio and make informed decisions that contribute to long-term financial success. Course Description: "Portfolio Building for Property" explores the essential elements of property investment, focusing on the strategies and tools needed to create a profitable and diversified property portfolio. Key topics include property selection, financing options, market analysis, risk management, and growth strategies. Throughout the course, learners will explore how to evaluate properties, understand market dynamics, and develop a sustainable portfolio. The course also introduces financial models and investment techniques that are critical in today’s property market. Learners will finish with the skills to assess opportunities, maximise returns, and make well-informed decisions within the property industry. Portfolio Building for Property Curriculum: Module 01: Module 02: Module 03: (See full curriculum) Who is this course for? Individuals seeking to enter the property investment market. Professionals aiming to enhance their property investment knowledge. Beginners with an interest in property management and investment. Investors looking to diversify their portfolio. Career Path Property Investor Real Estate Analyst Portfolio Manager Property Consultant Investment Advisor

Block Management

By NextGen Learning

Block Management Course Overview: This Block Management course provides an in-depth understanding of property management, offering a comprehensive approach to the key responsibilities and skills required for managing residential blocks effectively. Learners will explore the intricacies of managing apartment complexes, dealing with tenant relations, and ensuring regulatory compliance. The course covers essential aspects such as leasing, marketing properties, tenant retention, and property valuation. Upon completion, learners will be equipped to pursue a career in property management with a strong foundation in both theoretical knowledge and practical application. Course Description: The Block Management course is designed to equip learners with the essential knowledge and skills required to manage residential properties efficiently. This course covers a wide array of topics, including property listing and marketing, the letting process, tenant relations, and the management of communal areas. Learners will explore the regulatory framework surrounding property management, including laws and regulations related to tenancy agreements and building compliance. The course is structured to provide both theoretical understanding and practical insights, preparing learners for a successful career in property management. By the end of the course, learners will possess the tools to manage residential properties effectively, ensuring both operational success and tenant satisfaction. Block Management Course Curriculum : Module 01: Introduction to Property Management Module 02: The Role and Responsibilities of a Property Manager Module 03: Listing Properties and Marketing Module 04: The Letting Process and Tenancy Agreement Module 05: The Property Management Process Module 06: Valuation Process Module 07: Selling Property Finding the Buyers Module 08: Keeping Tenants Long Term Module 09: Regulations of Property Management Module 10: Changes in the UK Property Market An Opportunity (See full curriculum) Who is this course for? Individuals seeking to enter property management. Professionals aiming to enhance their property management skills. Beginners with an interest in real estate or property management. Anyone looking to understand the legalities and regulations of property management. Career Path: Property Manager Block Manager Property Administrator Real Estate Consultant Lettings Manager Property Portfolio Manager Facilities Manager

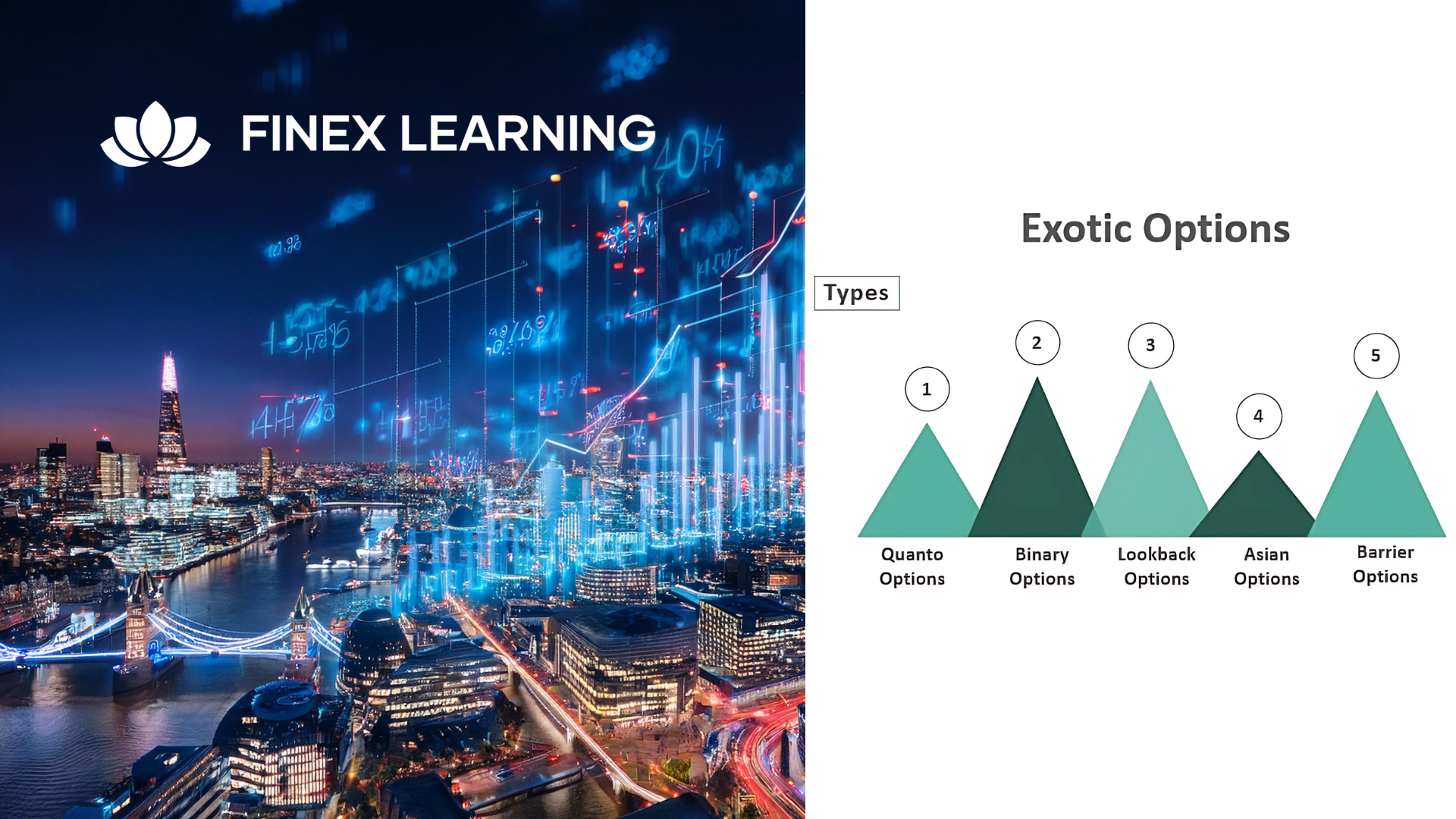

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please click here. To learn more about schedule, pricing & delivery options speak to a course specialist now

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

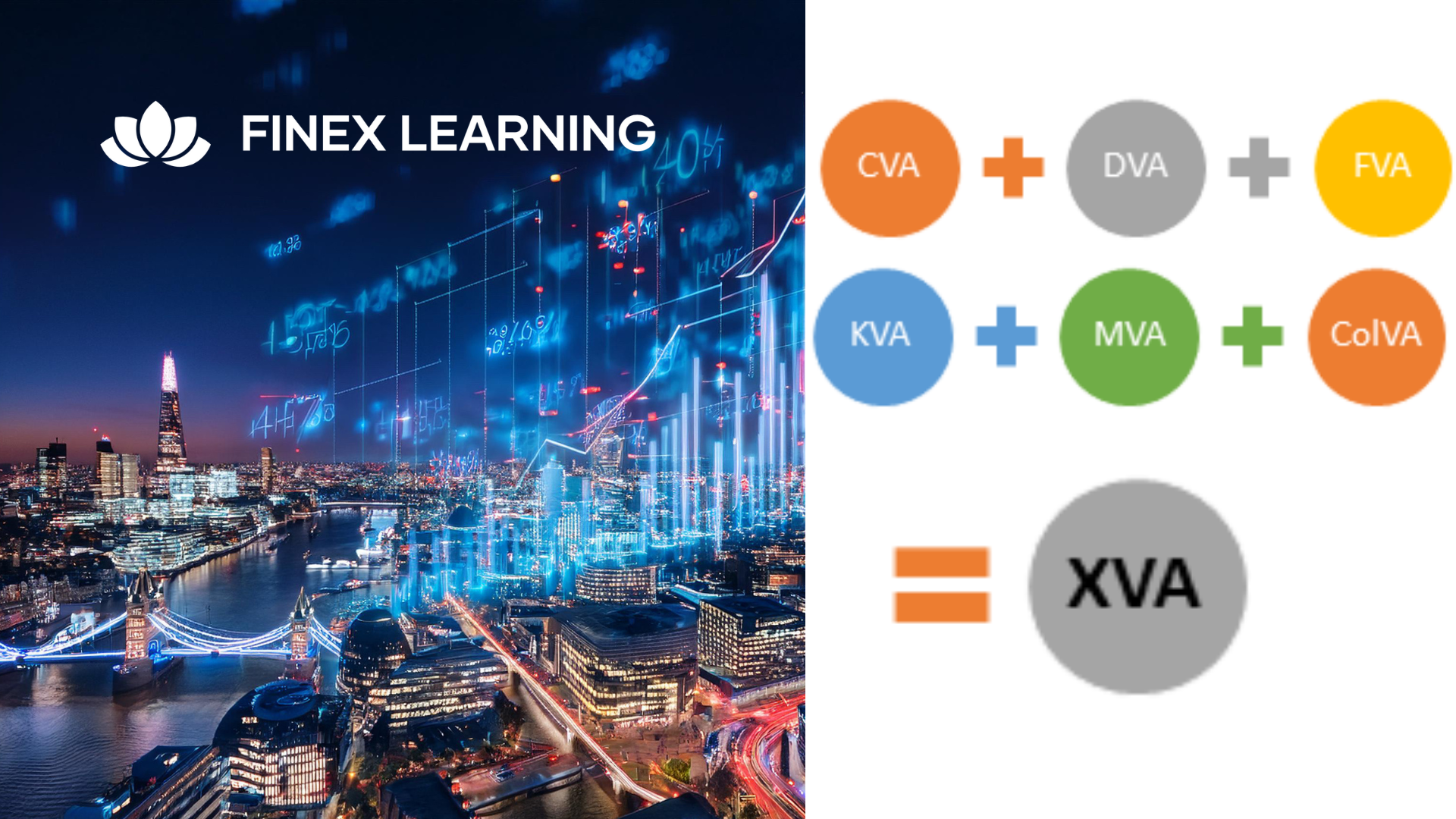

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now