- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

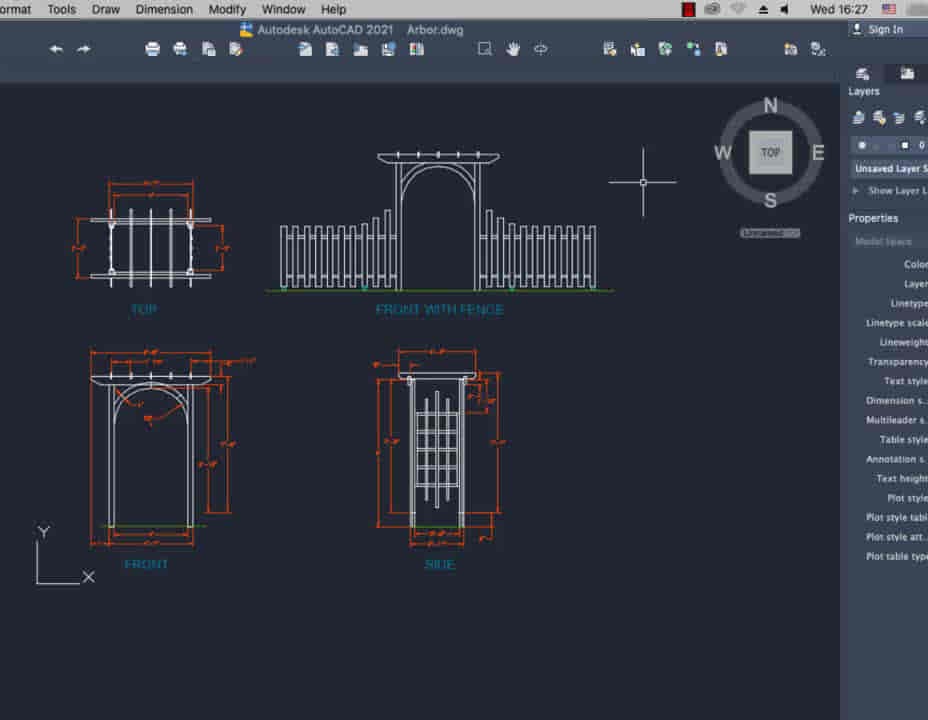

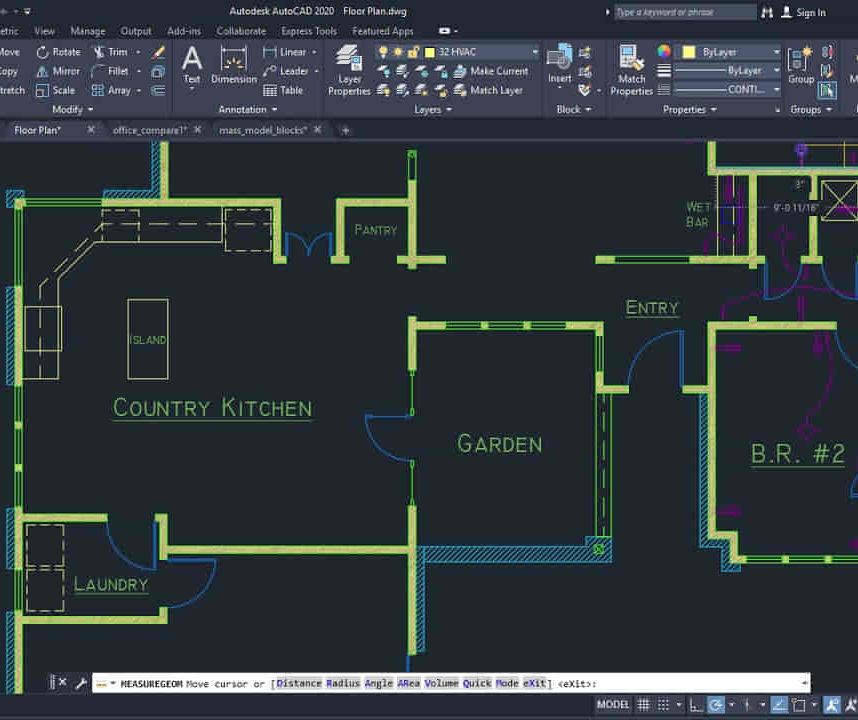

Bespoke AutoCAD Mac Basic-Intermediate Course

By ATL Autocad Training London

Why Learn Bespoke AutoCAD Mac Basic-Intermediate Course? Learn AutoCAD using your projects and learn how to use powerful tools and techniques for drawing, dimensioning, and printing 2D drawings with our Intermediate AutoCAD course. Check our Website How long is the training? 10 hours, Choose and split 10 hrs Mon to Sat 9 am to 7 pm. Book online or call 02077202581 or 07970325184. Method? 1-on-1, available in both in-person and Live Online. Course Topics Include: Building Fundamental Shapes Working with Lines, Arcs, and Polylines Utilizing Grip Tools Precision Object Alignment Data Management and Backups Exploring File Formats Ensuring Disaster Recovery Mastering Object Creation Handling Measurement Units Dynamic Input Techniques Inquiring Commands and Measurement Tools Effective Object Viewing Navigating Zoom and Pan Object Manipulation Strategies Object Selection Methods Swift Object Management Object Transformation Techniques Scaling and Altering Objects Trim, Extend, and Offset Functions Creating Geometric Variations Object Joining and Editing Corner Filleting and Chamfering Stretching Objects Organizing Your Drawings Layer Management Customizing Object Properties Applying Linetypes Layout Design and Setup Efficient Page Configurations Scaling Drawing Views Adding Annotations Multiline and Single-Line Text Creation Text Styling and Editing Dimensioning Concepts Customizing Dimension Styles Dimension Editing Implementing Multileaders Object Hatching Hatching Editing Reusable Content Management Blocks and Symbols Tool Palette Usage Working with Groups Model Space and Paper Space Understanding Layout Creation and Viewports Viewport Scaling Plotting and PDF Output Managing Multiple Sheet Drawings Utilizing Plotstyles Crafting Custom Drawing Templates Download AutoCAD Mac https://www.autodesk.co.uk After completing the AutoCAD for Mac course, learners can expect the following learning outcomes: Proficiency in AutoCAD: Participants will acquire the skills and knowledge needed to confidently use AutoCAD for Mac, including creating and editing drawings, managing objects, and applying precision techniques. Effective Design Skills: They will gain the ability to produce accurate 2D drawings, making them valuable assets in design-related professions. Jobs that individuals can pursue after completing this course include: Draftsperson: Working in architectural, engineering, or construction firms to create technical drawings and plans. CAD Technician: Assisting in the development of designs for various projects, such as product design or urban planning. Interior Designer: Using AutoCAD for space planning and layout design in the interior design industry. Architectural Designer: Collaborating on architectural projects, including creating floor plans and elevations. Mechanical Designer: Participating in the design and development of mechanical components and systems. Civil Engineering Technician: Supporting civil engineers in designing infrastructure projects, such as roads and bridges. Electrical or Electronics Designer: Assisting in the creation of electrical schematics and electronic circuit diagrams. Landscape Designer: Planning and visualizing outdoor spaces, gardens, and landscapes. Completing this AutoCAD course opens doors to various industries where precise and detailed 2D drawing skills are highly valued. The AutoCAD Mac Bespoke 1 on 1 Basics to Intermediate Level Training Course provides participants with a comprehensive skill set, enabling them to attain proficiency in using AutoCAD Mac. This course covers a wide range of functionalities and caters to individuals at all skill levels, whether they are beginners or experienced users. Participants will begin by learning fundamental features such as drawing, editing, annotations, and dimensioning. As they progress, they will delve into more advanced topics like object manipulation, customizing workspaces, and streamlining workflows. Key Benefits of the Course: Mastery of Mac-AutoCAD: Acquire expertise in both essential and advanced techniques for creating precise 2D drawings. Enhanced Productivity: Increase efficiency by implementing time-saving tips and optimizing your work processes. Versatile Design Abilities: Develop the skills to undertake diverse projects in fields such as architecture, engineering, and more. Industry-Relevant Competencies: Elevate your career prospects across various industries by gaining in-demand AutoCAD skills. Access to Recorded Lessons: Review and reinforce your learning at your convenience with access to recorded lesson sessions. Ongoing Email Support: Receive continuous assistance and guidance via email even after completing the course. Enroll today to benefit from interactive learning experiences guided by experienced instructors. Choose between flexible in-person or online sessions, gain access to lesson recordings, and enjoy a lifetime of email support. Tailored Guidance: Get personalized coaching and instruction tailored to your unique learning needs and objectives. Convenient Scheduling: Choose from flexible training slots available Monday to Saturday from 9 am to 7 pm, accommodating your busy schedule. Versatile Learning Options: Select between in-person training at our location, conveniently situated just 5 minutes away from Oval Tube Station, or participate in live online sessions from anywhere. Engaging Interactions: Participate in interactive sessions designed for questions, discussions, and problem-solving, creating an immersive learning experience. Effective Progression: Accelerate your learning with focused guidance, allowing you to advance at your own pace while mastering the material. Tailored Curriculum: Customize the course content to align with your prior knowledge and specific areas of interest, ensuring a relevant and engaging learning experience. Real-Time Guidance: Receive immediate feedback from the instructor, enhancing your comprehension and skill development. Comprehensive Support: Enjoy ongoing assistance and clarification opportunities through email or additional sessions beyond the course for an in-depth learning experience.

Adobe Illustrator and Photoshop Masterclass Training

By ATL Autocad Training London

Adobe Illustrator and Photoshop Masterclass Training, your gateway to Photoshop and Illustrator. Learn with the best software for publishing and marketing materials. This comprehensive training covers Photoshop, Illustrator, and InDesign, offering step-by-step tutorials tailored for creative professionals. Click here for more info: Website Duration: 10 hours Approach: Individualized, Tailored Content, Flexible Pace, Personal Support Scheduling Flexibility: 1-on-1 sessions from Mon to Sat, 9 am to 7 pm, based on your availability. Course Title: Adobe Photoshop and Illustrator Mastery Workshop Duration: 10 Hours (Divided into 10 Modules) Module 1: Introduction to Adobe Photoshop (1 hour) Familiarization with Photoshop interface and tools Understanding bitmap graphics and resolution Basic image editing techniques (cropping, resizing, color adjustments) Significance of layers in design Module 2: Essential Photoshop Tools (1 hour) Mastery of selection tools (Marquee, Lasso, Magic Wand) Understanding brushes and their settings Introduction to the Pen tool for precise selections Working adeptly with layers and layer styles Module 3: Advanced Image Editing (1 hour) Proficiency in advanced color adjustments (Curves, Levels, Hue/Saturation) Techniques for photo retouching and manipulation Creating composite images using blending modes Application of filters and special effects for creative designs Module 4: Introduction to Adobe Illustrator (1 hour) Exploration of Illustrator interface and tools Working with vector graphics and paths Basic shapes and drawing tools Understanding anchor points and handles Module 5: Creating Vector Artwork (1 hour) Expert use of the Pen tool for precise vector illustration Creating and editing shapes and objects Mastery in handling gradients and patterns Understanding the Appearance panel Module 6: Illustrator Typography (1 hour) Text tools and advanced formatting options Crafting text effects and artistic typography Integration of text with shapes and images Working adeptly with text on a path Module 7: Combining Photoshop and Illustrator (1 hour) Importing Illustrator files into Photoshop and vice versa Efficient use of smart objects and vector shapes in Photoshop Creation of custom brushes and patterns in Illustrator for seamless use in Photoshop Designing posters and flyers by combining elements from both software Module 8: Integration with InDesign (1 hour) Exporting assets from Photoshop and Illustrator for InDesign Crafting layouts in InDesign using assets from both programs Understanding print and digital design nuances Preparing files for printing and online use Module 9: Advanced Techniques and Tips (1 hour) Creating custom actions and automation in Photoshop Mastery in advanced selection techniques Utilizing Illustrator's advanced tools (Pathfinder, Shape Builder, etc.) Exploration of creative design styles and trends Module 10: Final Projects and Portfolio (1 hour) Individual or group projects incorporating Photoshop and Illustrator skills Detailed review and feedback on the projects Preparation of a portfolio showcasing the work Upon completion of the Adobe Photoshop and Illustrator Mastery Workshop, participants will: Master Advanced Design Techniques: Acquire expert skills in both Adobe Photoshop and Illustrator, delving into advanced tools, filters, and effects for intricate design work. Seamlessly Integrate Software: Learn to seamlessly integrate Photoshop and Illustrator, enabling the creation of dynamic and visually appealing designs by leveraging the unique strengths of both programs. Develop Creative Problem-Solving: Cultivate creative problem-solving abilities by exploring diverse design styles and industry-relevant trends, empowering the creation of innovative and captivating visuals. Construct Professional Portfolios: Gain the expertise to construct professional portfolios, showcasing a diverse range of projects incorporating advanced Photoshop and Illustrator techniques. Collaborate on Real-World Projects: Collaborate effectively on real-world design projects, combining Photoshop and Illustrator skills to produce high-quality marketing materials, promotional content, and digital artwork. Career Opportunities: Upon mastering Photoshop and Illustrator, participants can pursue a range of creative careers, including: Graphic Designer: Craft visually appealing designs for print and digital media, ranging from marketing materials to social media graphics. Digital Illustrator: Create intricate digital illustrations and artworks for various applications, including book covers, digital publications, and games. Web Designer: Develop engaging and user-friendly website layouts and elements, optimizing user experience through appealing visuals. Advertising Artist: Design compelling advertisements for print and online platforms, captivating audiences and promoting brands effectively. Freelance Designer: Work as a freelance designer, taking on diverse projects from clients and agencies, showcasing versatility in both Photoshop and Illustrator skills. By mastering these Adobe tools, participants open doors to a multitude of creative opportunities in the ever-expanding digital design industry. Skills Acquired: Participants in the Adobe Illustrator and Photoshop Masterclass Training will develop advanced skills in vector graphics, digital illustration, and photo manipulation using Adobe Illustrator and Photoshop. Key skills include: Precision Vector Graphic Design in Illustrator Creative Digital Illustration Techniques Advanced Photo Editing and Manipulation in Photoshop Job Opportunities: Upon completion, individuals can pursue roles such as: Graphic Designer Digital Illustrator Advertising Creative Branding Specialist Elevate Your Design Skills: Master Adobe Illustrator and Photoshop, crafting stunning graphics, logos, and digital illustrations. Understand design principles, tools, and workflows. Receive a recognized Certificate of Completion and access recorded lessons for future reference. Expert Guidance, Your Schedule: Learn from certified experts, tailored to your timetable-flexible online or in-person sessions, Monday to Sunday, 9 am to 8 pm. Enjoy lifetime email support for seamless learning. Unleash Your Creativity Today: Enroll now to ignite your creative potential in Adobe Illustrator and Photoshop. Elevate your designs effortlessly.

Rhino Introduction to Intermediate Training Course

By ATL Autocad Training London

Why Choose Rhino Introduction to Intermediate Training Course? Learn: 3D NURBS models. Master: Surfacing modeling. Interface: Rhino's navigation. Rendering Skills: Enhance presentations with Rhino renderings. Check our Website Flexible Scheduling: 1-on-1 training sessions according to your convenience. Choose any hour between 9 a.m. and 7 p.m., Mon to Sat. You can call us at 02077202581 to book over the phone. Duration: 10 hours. Methods: Personalized training either in-person, or live online. Introduction and Navigation Become acquainted with Rhino's interface, menus, and screen layout. Efficiently traverse through Rhino models, ensuring precision in 2D lines, polylines, and NURBS curves. Utilize modeling setup features, incorporating constraints like snap, ortho, and planar for accuracy. Leverage object snaps and Smart Track functionality to enhance precision. Solid and Surface Modeling Develop rapid 3D solids and surfaces, employing Rhino's organized layering system. Utilize coordinates and constraints for meticulous modeling, exploring 3D space and elevations. Create diverse shapes, such as rectangles, circles, arcs, ellipses, and polygon curves. Elevate models with Rhino render and render color, incorporating free-form curves, helix, and spiral curves. Efficiently handle model views with pan, zoom, and view management tools. Implement various editing commands for curve manipulation and transform curves into surfaces and solids. Utilize history tracking for advanced editing and execute general editing actions: move, copy, rotate, mirror, and scale. Create arrays with both polar and rectangular arrangements and employ boolean operations like union, difference, and intersection. Offset curves and surfaces effectively, ensuring meticulous detailing. Intermediate Edit and Surfacing Introduce key NURBS modeling concepts and terminologies. Edit curves and surfaces via control point manipulation and rebuild them for optimal refinement. Employ the nudge modeling aid for precise adjustments and generate deformable shapes. Create curves through projection techniques and split surfaces using curves and surfaces. Blend surfaces seamlessly, utilizing symmetry tools, lighting, and rendering effects. Convert intricate 3D objects into detailed 2D drawings, expertly crafting page layouts. Advanced Surfacing and Solid Modeling Construct model primitives and solid text, employing techniques such as pipe and extrusion. Modify solids efficiently using Boolean tools, expanding your surface modeling capabilities. Employ techniques like extrusion, lofting, and revolving for intricate surfaces. Create sweeps using 1 and 2 rail curves, mastering surface network techniques for complex shapes. Upon completion, you will: Master Rhino Tools: Navigate interfaces, utilize advanced tools for precise modeling, and employ features like object snaps and Smart Track. Expert Solid and Surface Modeling: Develop intricate 3D solids and surfaces, create diverse shapes, and use Rhino render effectively. Advanced Editing Skills: Apply intermediate and advanced editing techniques, including symmetry tools and realistic rendering. Precision Modeling: Utilize coordinates, constraints, and advanced aids for accurate detailing and problem-solving. Professional Project Execution: Create high-quality renderings, 2D drawings, and polished 3D models for real-world design scenarios. Upon completion, you'll be adept at 3D modeling, product design, and architecture, positioning you as a valuable asset in the design industry. Why Choose Our Rhino Courses? Rhino, also known as Rhinoceros, stands as a robust 3D computer graphics and computer-aided design software, utilized extensively in domains like architecture, industrial design, and multimedia. Our Rhino courses are meticulously crafted to empower you in mastering this software. Led by seasoned instructors, our courses provide a comprehensive understanding of Rhino, enabling you to create exceptional designs. Rhino 3D Training: Our Rhino 3D training caters to beginners and those seeking advanced techniques. Course Highlights: Precise 3D Modeling: Master free-form 3D NURBS models with precision. Advanced Functionality: Explore Rhino's features, including advanced surfacing commands. User Interface Mastery: Navigate Rhino's interface and hone skills in curves, surfaces, and solids. Expert Guidance: Acquire expertise in Rhino's modeling environment under expert guidance. Modeling Techniques: Learn free-form and precision modeling techniques. Modeling Aids: Utilize tools for accurate modeling and create basic Rhino renderings. Benefits of our Courses: Expert Guidance: Receive instruction from experienced architects and designers, providing practical, real-world insights for comprehensive learning. Comprehensive Resources: Access bespoke video tutorials for additional learning and reference, enhancing your understanding of the course materials. Digital Reference Material: Receive a digital reference book to support your revision efforts, providing a comprehensive resource for your studies. Ongoing Support: Enjoy free after-support through phone or email even after course completion, ensuring continuous assistance and guidance. Tailored Learning Experience: Customize your learning journey by adapting the syllabus and projects to align with your specific needs and interests, fostering a personalized educational experience. Certificate: Upon completion, earn a certificate from us, validating your achievement and recognizing your expertise in the field.

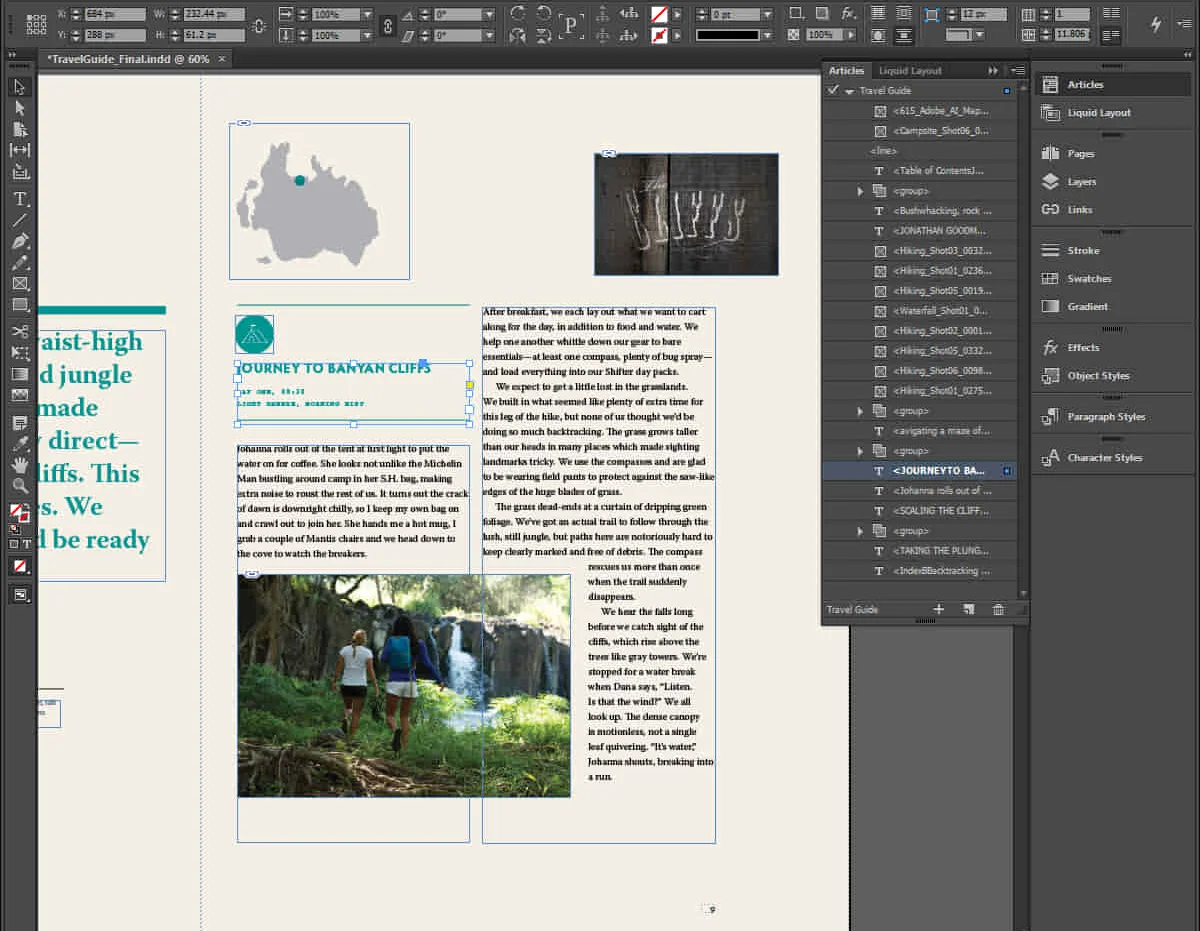

InDesign Evening Classes

By ATL Autocad Training London

Who is this for? InDesign Evening Classes. Refine your Adobe InDesign skills with expert tutors. Master layout creation, typography, and image manipulation. Design captivating brochures, magazines, and more. Choose between in-person or live online sessions. Earn a Certificate of Completion and enjoy lifetime email support. Explore our complimentary trial session. Check our Website Duration: 10 hours Approach: 1-on-1 sessions with tailored content. Schedule: 1-on-1 sessions, available Mon to Sat from 9 am to 7 pm. Course Title: Mastering Adobe InDesign Course Duration: 10 Hours Session 1: Introduction to Adobe InDesign (1 hour) Overview of Adobe InDesign interface Understanding tools and panels Setting up new documents and document properties Basic navigation and shortcuts Session 2: Mastering Page Layouts (1.5 hours) Working with master pages Creating and managing text frames and image placeholders Managing multiple pages and spreads Using grids and guides for precise layouts Session 3: Typography and Text Formatting (1.5 hours) Working with fonts, styles, and text formatting options Understanding text threading and linking Advanced text composition techniques Utilizing paragraph and character styles for consistency Session 4: Advanced Image Manipulation (1.5 hours) Importing and manipulating images and graphics Understanding image resolution and color modes Working with clipping paths and transparency Applying image effects and filters Session 5: Interactive Documents and Digital Publishing (2 hours) Creating hyperlinks and interactive buttons Embedding multimedia elements (audio, video) in documents Exporting documents for digital platforms (eBooks, PDF forms) Introduction to responsive design for various devices Session 6: Advanced Techniques and Special Effects (1 hour) Utilizing advanced drawing tools and shapes Applying special effects like drop shadows, transparency, and blending modes Working with tables and charts Introduction to data merge for personalized content Session 7: Printing and Prepress (1 hour) Understanding print terminology and specifications Preflighting documents for print readiness Color management and preparing files for different printing processes Exporting files for professional printing Session 8: Project Work and Review (0.5 hour) Participants work on a practical project applying learned skills Instructor-guided project review and feedback Session 9: Tips, Tricks, and Best Practices (0.5 hour) Time-saving shortcuts and productivity hacks Best practices for efficient workflow and file management Troubleshooting common issues and errors Session 10: Q&A and Certification (0.5 hour) Addressing participant queries and concerns Certificate distribution and course completion celebration This comprehensive 10-hour course aims to equip participants with advanced skills in Adobe InDesign, covering essential aspects of design, typography, interactivity, and print preparation. Participants will engage in hands-on activities, projects, and discussions to reinforce their learning throughout the course. By the end of this 10-hour advanced InDesign course, you will: Gain a comprehensive understanding of InDesign's most powerful features and advanced techniques. Create sophisticated page layouts with eye-catching special effects for professional-level designs. Efficiently manage fonts, colors, and shapes to enhance the visual appeal of your documents. Develop interactive PDFs with navigation, page transitions, and embedded video for engaging presentations. Master the use of character styles, paragraph styles, and word styles to streamline text formatting. Utilize advanced object styles and anchored objects for efficient layout design. Work effectively with Adobe Stock, Photoshop, Illustrator, and other Creative Cloud applications for seamless integration. Create PDF forms and implement interactive button-triggered animations for interactive documents. Optimize workflow with keyboard shortcuts, scripts, and advanced preferences for a smoother design process. Learn valuable tips and best practices from industry experts to boost your productivity and efficiency. Enhance your mastery of InDesign through our advanced program, meticulously designed to hone your skills. Explore intricate page layouts and seamlessly integrate captivating special effects into your projects. Our seasoned Adobe trainers, renowned for their approachable teaching style, will guide you through InDesign's powerful features, sharing invaluable insights derived from years of practical experience. This interactive course provides ample opportunities for hands-on practice, ensuring your confidence in harnessing InDesign's diverse technical capabilities. Key Course Highlights: In-depth exploration of InDesign's advanced functionalities. Individualized attention, fostering open discussions and encouraging questions. Expert trainers, small class sizes, and a supportive and collaborative learning environment. Comprehensive learning materials and resources, all inclusive. Continuous support for any post-course inquiries or concerns, ensuring your ongoing success. Enhance your InDesign proficiency, crafting polished designs effortlessly. Elevate your skills with our advanced course, ensuring: Thorough coverage of InDesign's technical capabilities. Personalized attention and ample opportunity for questions. Supportive, knowledgeable trainers in a comfortable learning environment. Comprehensive materials and resources for your learning journey. Continued assistance for post-course queries and concerns. Download InDesign

Advanced Adobe InDesign Training Program

By ATL Autocad Training London

Advanced Adobe InDesign Training Program Learn InDesign with a course at Real Animation Works. Choose from Weekend, Weekday or Evening Courses and learn from expert tutors. Benefit from professional InDesign training conducted by Adobe Certified Instructors with extensive graphic design expertise. Check our Website Duration: 10 hours. Approach: 1-on-1 and personalized attention. Schedule: 1-on-1 sessions, available Monday to Saturday from 9 am to 7 pm. Course Title: Comprehensive Adobe InDesign Training Duration: 10 Hours Session 1: Introduction to Adobe InDesign (1 hour) Overview of InDesign interface and tools Document setup: page size, margins, and columns Basic text formatting and paragraph styles Introduction to working with images and graphics Session 2: Advanced Text Formatting and Styles (1 hour) In-depth exploration of character and paragraph styles Advanced text composition techniques Managing text flow with threaded frames Incorporating special characters for typographic control Session 3: Mastering Images and Graphics (1 hour) Advanced image manipulation: resizing, cropping, and effects Text wrap options and integrating text with images Creating image frames and working with transparency Interactive elements: buttons and hyperlinks Session 4: Layout Design Techniques (1.5 hours) Grids and guides: precise alignment and spacing Working with layers for efficient design management Advanced object arrangement and distribution Utilizing master pages for consistent layout elements Session 5: Advanced Document Features (1.5 hours) Tables and data merge: organizing and automating data Interactive PDFs: forms, multimedia, and navigation Advanced print preparation: color management and preflighting Exporting for various digital and print outputs Session 6: Advanced Special Effects (1 hour) Creating drop shadows, gradients, and blending modes Working with typography on a path Advanced text and image effects Integrating Adobe Illustrator and Photoshop files Session 7: Project-Based Learning (1 hour) Participants work on a comprehensive project applying learned skills Instructor-guided project review and feedback Session 8: Tips, Tricks, and Time-Saving Techniques (1 hour) Productivity hacks and shortcuts Troubleshooting common issues and errors Best practices for efficient workflow and collaboration Session 9: Portfolio Building and Career Guidance (0.5 hour) Creating a professional portfolio showcasing InDesign projects Career advice and industry insights from the instructor Session 10: Q&A, Certification, and Course Completion (0.5 hour) Addressing participant questions and concerns Certificate of Completion distribution and course review Celebrating the completion of the Adobe InDesign training journey Upon completion of the Comprehensive Adobe InDesign Training course, participants will: Master Core Skills: Develop proficiency in essential InDesign tools, functions, and techniques for effective layout design. Advanced Text and Typography: Understand advanced text formatting, paragraph styles, and typographic controls for professional typography. Image Manipulation Expertise: Acquire skills in advanced image manipulation, text wrapping, transparency, and integration of multimedia elements. Advanced Layout Design: Learn precise layout techniques using grids, guides, layers, and master pages for consistency and visual appeal. Interactive Document Creation: Create interactive PDFs, forms, multimedia-rich content, and navigation elements for digital publications. Data Management and Automation: Master tables, data merge, and automation features for organized data presentation and streamlined workflow. Print and Export Proficiency: Understand color management, preflighting, and export settings for high-quality print and digital output. Special Effects and Integration: Apply advanced effects, gradients, blending modes, and integrate InDesign with Illustrator and Photoshop files seamlessly. Project-Based Expertise: Develop a comprehensive portfolio-worthy project, showcasing a range of InDesign skills and creativity. Efficient Workflow and Troubleshooting: Implement time-saving techniques, shortcuts, and troubleshoot common design challenges effectively. Career Readiness: Gain valuable insights into industry practices, portfolio building, and career guidance for pursuing opportunities in graphic design and desktop publishing. Versatile Learning Choices: Opt for either in-person sessions at our London center or engage in interactive online learning. Both options offer hands-on experience, detailed demonstrations, and ample chances for inquiries. Compatibility and Assistance: InDesign operates smoothly on Windows and Mac systems. Participants receive a comprehensive InDesign training manual for reference and an electronic certificate upon course completion. Additionally, enjoy lifelong email assistance from your InDesign instructor. Entry Requirements: No prior InDesign expertise is necessary. The training concentrates on InDesign 2023, relevant to recent software updates. Guarantees: We ensure exceptional value for your investment, guaranteeing your acquisition of essential skills and concepts during the training. Course Highlights: Master advanced typography techniques, including paragraph styles, character styles, and nested styles. Explore multi-page layout design, long document management, and advanced table formatting. Acquire skills to create and manipulate complex shapes, vector graphics, and custom illustrations. Learn efficient workflows for data merging, interactive documents, and digital/print output. Collaborate seamlessly with other Adobe Creative Cloud applications. Upon completion, receive a Certificate of Completion and access recorded lessons for self-paced learning. Expert Instruction: Learn from certified tutors and industry experts, gaining valuable insights, tips, and best practices for professional-level designs. Flexible Learning Options: Choose between in-person or live online sessions based on your schedule. Sessions are available Monday to Sunday, from 9 am to 8 pm, accommodating your convenience. Lifetime Support: Benefit from lifetime email support for continuous assistance. Our dedicated team is available to address your queries and challenges. Explore Adobe InDesign - Free Trial: https://www.adobe.com/uk/products/indesign/free-trial-download.html

AutoCAD 2D Introduction to Intermediate Course

By ATL Autocad Training London

Why Learn AutoCAD 2D Introduction to Intermediate Course? Click here for more info: Website Whether you're starting a career, enhancing skills, or exploring creativity, this course is tailored for you. Learn on Windows or Mac, transform into a confident AutoCAD user. Transition to our Intermediate to Advanced Course post-completion. Duration: 10 hrs. Personalized 1-on-1 training. Perfect for beginners, this course offers flexible scheduling (Mon-Sat, 9 am-7 pm) and covers 2D plan and elevation creation in AutoCAD. AutoCAD 2D Course Outline Workspace Exploring the working environment Managing files Displaying objects Constructing fundamental drawings Inputting data Constructing basic objects Utilizing object snaps Utilizing Polar Tracking and PolarSnap Implementing object snap tracking Handling units Manipulating objects Selecting objects in the drawing Adjusting an object's position Generating new objects based on existing ones Modifying an object's orientation Creating mirrored versions of existing objects Designing object patterns Altering an object's dimensions Organizing and querying drawings Utilizing layers Modifying object attributes Matching object attributes Utilizing the properties palette Applying linetypes Using inquiry commands Modifying objects Trimming and extending objects to specified boundaries Generating parallel and offset geometries Merging objects Dividing an object into two separate entities Applying rounded corners to objects Producing angled corners between objects Modifying an object's shape Layouts and viewports Harnessing layouts Creating layout configurations Modifying layouts and employing page setups Working with viewports Creating layout viewports Managing layout viewports Controlling object visibility within layout viewports Annotating a drawing Generating multiline text Creating single-line text Implementing text styles Editing text Dimensioning Creating dimensions Utilizing dimension styles Adjusting dimensions Implementing multileaders Hatching objects Hatching elements Editing hatch patterns Managing reusable content Working with blocks Exploring DesignCenter Utilizing tool palettes Designing additional drawing elements Managing polylines Generating splines Crafting ellipses Working with tables Producing plotted drawings Employing page setups Utilizing plotter configuration files Creating and applying plot styles Plotting drawings Plot style tables Publishing drawings Generating drawing templates Leveraging drawing templates Download AutoCAD AutoCAD Trial https://www.autodesk.co.uk After completing the AutoCAD 2D Introduction to Intermediate Course, you will: Master Fundamentals: Understand AutoCAD basics, including navigation and terminology. Create Precise Drawings: Develop the skills to create accurate 2D drawings like plans and elevations. Manipulate Objects: Learn object selection, modification, and pattern creation. Dimension Proficiency: Create and edit dimensions and use text styles effectively. Layer Control: Organize drawings with layer management. Annotation Skills: Handle text and annotations with ease. Layouts and Viewports: Work with layouts and viewports for presentation. Plotting Expertise: Plot and publish drawings confidently. Customization Options: Explore advanced features for efficiency. Intermediate-Level Competency: Transition from beginner to an intermediate level of AutoCAD proficiency. This course equips you with essential skills for various industries, including architecture and engineering. This one-on-one CAD course is perfect for students who are either entirely new to the software or possess limited self-taught knowledge. Regardless of your starting point, our goal is to get you drawing plans within the very first hour of your class. We'll begin by building a strong foundation in AutoCAD, ensuring that you understand its core principles before delving into more advanced topics. If you have specific preferences, we can customize your AutoCAD learning experience to align with your goals. On the initial day of the course, we'll cover fundamental aspects such as user interface and terminology. Subsequently, you'll engage in a diverse range of lessons designed to deepen your understanding of AutoCAD and its creative processes. Topics covered will include introductory drawing techniques, editing functions, drawing aids, working with layers, managing text, and handling dimensions. Throughout the course, you'll practice through various drawing exercises and explore the intricacies of plotting. By the course's conclusion, you'll possess the skills needed to create your own simple drawings, suitable for applications in architectural, interior, engineering, events, furniture, or product design. Included in the course price are the following: Lifetime Email Support: Enjoy unlimited access to our support via email throughout your learning journey. Expert Instruction: Benefit from expert teaching provided by practicing architects, designers, and software professionals. Hands-On Learning: Engage in practical, hands-on lessons that can be customized to match your project requirements. Comprehensive Resources: Access video recordings and a digital reference PDF book for revision and continuous development. Certification: Receive a certificate of completion from us to enhance your CV and LinkedIn profile. Career Guidance: Gain valuable insights into pursuing design roles or establishing a creative business. Our experienced tutors will help you acquire the technical skills needed to make your CV and portfolio stand out. Our instructors, who are accomplished interior designers, animators, architects, and software experts, will not only impart technical expertise but also provide guidance on achieving success in the design industry or entrepreneurial endeavors.

Writing Clear Business Communication: On-Demand

By IIL Europe Ltd

Writing Clear Business Communication: On-Demand This program is about learning about the writing process and covers the full spectrum of documents used when corresponding in the workplace. The ability to write effectively comes naturally to some people, but for the vast majority, it is a task often approached with a mixture of trepidation and dread. Effective writing seldom, if ever, 'magically materializes' on the spot. In reality, it is most often the product of planning, writing, and rewriting. This is why writing is called a process; it must go through a series of steps before it is clear and complete. This program is about learning about the writing process and covers the full spectrum of documents used when corresponding in the workplace. The ability to write effectively comes naturally to some people, but for the vast majority, it is a task often approached with a mixture of trepidation and dread. However, the ability to communicate in the written word, for whatever purpose, is an important part of our working and personal lives and can have a direct impact on our ability to persuade, gain commitment or agreement and enhance understanding. Good writing sounds like talking on paper, which is why this program is focused on getting the message across and achieving the desired results using the 'keep it simple and direct' approach. What you Will Learn At the end of this program, you will be able to: Write effective e-mails, letters, memos, and reports Clearly articulate the message Achieve desired results from correspondence Organize content for maximum impact Format for enhanced understanding Choose the appropriate communication medium for each document Revise documents to increase clarity and impact Foundations Concepts Business writing as a form of professional communication How business writing compares to other forms of writing Characteristics of good business writing Challenges with business writing The Project Environment Business writing in the project environment The concept of art, science, and optics of business writing Art Economy Precision Action Music Personality Science Purpose, simple, compound, and complex sentence structures Techniques to engage the reader Point of view: tone, attitude, and humor Organization: opening, body, and closing Support and coherence Optics Visual optics Sound optics Feel optics Effective optics Efficient optics Email Formal vs. informal emails Suggestions for improving email communication Instant and text messaging Reports Common types of reports created Formatting of reports Guidelines for meeting minutes Contracts Types of contracts Common agreements Procurement documents Templates, Forms, and Checklists Templates Forms Checklists Other Formatting Good Documentation Practices Good documentation practices Data integrity in business communication

ITIL4® Foundation

By Career Smarter

Explore ITIL4 Foundation, a comprehensive course delving into modern IT service management practices. Learn key concepts, principles, and processes to enhance organisational efficiency and align IT services with business goals. About this course £519.00 153 lessons Accredited training Certificate of completion included Exam included Course curriculum Module 1 - Introduction1.1 Tutor Introduction1.2 Certifications1.3 Course Features1.4 Why ITIL? Module 2 - Key Concepts2.1 What is a Service?2.2 What is Utility?2.3 What is Warranty?2.4 What are Customers, Users and Sponsors?2.5 What is Service Management?2.6 Creating value with Services2.7 Value & Value Co-creation2.8 What is Value?2.9 Organisations and Stakeholders2.10 Service Providers2.11 Other Stakeholders2.12 Value: Outcome, Cost and Risk2.13 Figure, Balance, Outcomes, Costs, Risks2.14 Outputs and Outcomes2.15 Cost2.16 Risk - Part 12.17 Risk - Part 22.18 Utility & Warranty - Part 12.19 Utility & Warranty - Part 22.20 Services Offerings2.21 Services Relationship2.22 Service Provisions2.23 Services Relationship Model2.24 Goods, Resources & Actions2.25 Products & ServicesTest Your Knowledge Quiz Module 3 - Guiding Principals3.1 Guiding Principles - Introduction Part 13.2 Guiding Principles - Introduction Part 23.3 Guiding Principles - The Key Message is Discussed!3.4 Guiding Principles - Nature, Use & Interaction of the Guiding Principles3.5 Focus on Value - The Key Message Discussed!3.6 Focus on Value - The Service Consumer & What is their Perspective of Value3.7 Focus on Value - The Customer Experience3.8 Focus on Value - How to Apply the Principle!3.9 Start Where You Are - Key Message Discussed!3.10 Start Where Your Are - Assess Where You Are3.11 Start Where You Are - The Role of Measurement3.12 Start Where You Are - How to Apply the Principle!3.13 Progress Iteratively with Feedback - Key Message Discussed!3.14 Progress Iteratively with Feedback - The Role of Feedback3.15 Progress Iteratively with Feedback - Iteration & Feedback Together3.16 Progress Iteratively with Feedback - How to Apply the Principle3.17 Collaborate & Promote Visibility - Key Message Discussed! (Part 1)3.18 Collaborate & Promote Visibility - Key Message Discussed! (Part 2)3.19 Collaborate & Promote Visibility - Key Message Discussed! (Part 3)3.20 Collaborate & Promote Visibility - Whom to Collaborate with (Part 1)3.21 Collaborate & Promote Visibility - Whom to Collaborate with (Part 2)3.22 Collaborate & Promote Visibility - Communication for Improvement3.23 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 1)3.24 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 2)3.25 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 3)3.26 Collaborate & Promote Visibility - How to Apply3.27 Think & Work Holistically - Key Message Discussed! (Part 1)3.28 Think & Work Holistically - Key Message Discussed! (Part 2)3.29 Think & Work Holistically - Key Message Discussed! (Part 3)3.30 Think & Work Holistically - How to Apply the Principle3.31 Optimise & Automate - Key Message Discussed! (Part 1)3.32 Optimise & Automate - The Key Message Discussed! (Part 2)3.33 Optimise & Automate - The Road to Optimisation (Part 1)3.34 Optimise & Automate - The Road to Optimisation (Part 2)3.35 Optimise & Automate - How to Apply the Principle3.36 Keep it Simple and Practical - Key Message Discussed!3.37 Keep it Simple & Practical - How to Apply the Principle3.38 Principle InteractionTest Your Knowledge Quiz Module 4 - 4 Dimensions of Service Management4.1 Introduction4.2 The 4 Dimensions of Service Management4.3 Organisation & People (Part 1)4.4 Organisations & People (Part 2)4.5 Organisation & People (Part 3)4.6 Information & Technology (Part 1)4.7 Information & Technology (Part 2)4.8 Information & Technology (Part 3)4.9 Information & Technology (Part 4)4.10 Partners & Suppliers (Part 1)4.11 Partners & Suppliers (Part 2)4.12 Partners & Suppliers (Part 3)4.13 Partners & Suppliers (Part 4)4.14 Partners & Suppliers (Part 5)4.15 Partners & Suppliers (Part 6)4.16 Value Streams & Processes (Part 1)4.17 Value Streams & Processes (Part 2)4.18 Value Streams & Processes (Part 3)4.19 Value Streams & Processes (Part 4)Test Your Knowledge Quiz Module 5 - The Service Value System5.1 Introduction5.2 Describe the ITIL Service Value System (Part 1)5.3 Describe the ITIL Service Value System (Part 2)5.4 Describe the ITIL Service Value System (Part 3)5.5 Describe the ITIL Service Value System (Part 4)Test Your Knowledge Quiz Module 6 - Service Value Chain and the Service Value Stream 6.1 Learning Objectives 6.2 Service Value Chain Model 6.3 The Interconnected Service Value Chain "elements" 6.4 The Interconnected Service Value Chain "more" 6.5 The Interconnected Service Value Chain "Value Streams" 6.6 The Interconnected Service Value Chain "Steps" 6.7 Plan 6.8 Improve 6.9 Engage 6.10 Design & Transition 6.11 Obtain/Build 6.12 Deliver & Support Test Your Knowledge Quiz ITIL® is a registered trademark of AXELOS Limited, used under permission of AXELOS Limited. The swirl logo ™ is a trade mark of AXELOS Limited, used under permission of AXELOS Limited. All rights reserved.

Microsoft Office 365 Online (with Teams for the Desktop)

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for This course is intended for business users and knowledge workers in a variety of roles and fields who have competence in a desktop-based installation of the Microsoft Office 2010, 2013, or 2016 edition of the Microsoft Office productivity suite, and who are now extending Microsoft Office to a collaborative cloud-based Office 365 environment. Overview In this course, you will build upon your knowledge of the Microsoft Office desktop application suite to work productively in the cloud-based Microsoft Office 365 environment. You will: Sign in, navigate, and identify components of the Office 365 environment. Create, edit, and share documents with team members using the Office Online apps, SharePoint, OneDrive© for Business, and Delve. Collaborate and work with colleagues using the Yammer and Planner apps. Use email and manage contacts with Outlook on the web. Collaborate using Teams. Configure Teams. This course introduces working with shared documents in the familiar Office 365 online apps?Word, PowerPoint©, and Excel©?as an alternative to installing the Microsoft© Office desktop applications. This course also introduces several productivity apps including Yammer?, Planner, and Delve© that can be used in combination by teams for communication and collaboration. Prerequisites Outlook - Part 1 PowerPoint - Part 1 Word 2016 - Part 1 Using Microsoft Windows 10 1 - GETTING STARTED WITH OFFICE 365 Topic A: Sign In to Office 365 Topic B: Navigate the Office 365 Environment 2 - COLLABORATING WITH SHARED FILES Topic A: Work with Shared Documents in SharePoint Topic B: Edit Documents in Office Online Topic C: Collaborate on the SharePoint Site Topic D: Work with OneDrive for Business and Delve 3 - USING PRODUCTIVITY APPS Topic A: Work with Productivity Apps in Combination Topic B: Broadcast Messages with Yammer Topic C: Manage Tasks with the Planner App 4 - USING OUTLOOK ON THE WEB Topic A: Send and Receive Email Topic B: Manage Contacts Topic C: Schedule Appointments Topic D: Personalize Outlook on the Web 5 - COLLABORATING WITH TEAMS Topic A: Overview of Microsoft Teams Topic B: Converse and Share in Teams Topic C: Call and Meet in Teams Topic D: Collaborate with Office 365 Apps and Teams 6 - CONFIGURING TEAMS Topic A: Configure Teams Topic B: Configure Channels Topic C: Configure Tabs

ISO 9001, ISO 14001, ISO 45001 (QHSE Management System) Lead Auditor Training Course

By TUVSW Academy

ISO 9001, ISO 14001, ISO 45001 are international standards of Quality, Environmental and Occupational Health & Safety Management System respectively, the existence of it requires competent personal to interpret its requirements, address those to integrate QHSE MS in an organization and audit organization to assess the implementation and effectiveness of overall implementation. This course is designed for professionals who are responsible of any aspect of QHSE Management System as well as for those, specifically, who are pursuing their career in the field of auditing and certification. This course enhance the knowledge and skills of delegates to understand the standard and audit it effectively. Course is consisting of study material in form of written and videos, exercises and role plays. Attendees of this course will be, on completion, competent to implement QHSE MS, Plan, Conduct & Report 1st, 2nd & 3rd party audits. Features of Couse ✔ 100% Online Self-paced: Considering the busy lives, we have designed this course to be attended online without bounding with the schedules. To make it interactive, we have created different communication groups where candidate can discuss the points with other fellows as well as the trainers of course. Also, they can interact with trainer on monthly demonstration classes. ✔ Testing the Learning: Each section of course is covered with exercise to check your knowledge in real-time, and overall result is affected by exercises you complete. ✔ Self-Scheduling: This 40 Hours full fledge course is designed to match you schedule. You will get a life time access to this course and complete it on your ease. ✔ Superlative Material: The training is designed, developed and reviewed by competent auditors having an extensive experience of auditing in different regions of world. ✔ Approved Course: The course is approved by one of the well-known personal certifying body “Exemplar Global”. With the approved course, you will get many benefits from Exemplar global which includes but not limited to; Exemplar Global graduate certificate with being listed on their website as auditor as well as badge of auditor from Exemplar Global. Extended learning content from Exemplar Global Complimentary access to online events, online magazine, newsletters, and low-cost professional Access to an exclusive LinkedIn Community Opportunity to explore career enhancement and employment opportunities Who should attend this? This course is recommended to be attended by those who are involved in implementation and/ or auditing of Quality, Environmental and Occupational Health & Safety Management System, specifically QHSE Managers, Auditors and others willing to add credibility with a widely accepted qualification for auditing. Also, recommended to satisfy the applicable requirement of training and competence, if any. This course can add values to your profile if you are Intending to perform audits of Quality, Environmental and Occupational Health & Safety Management System. A QHSE Executive/ Management Representative An Existing Internal Auditor A QHSE MS Consultant Responsible for implementing the ISO standards. Responsibility to evaluate the outcome of internal QHSE MS audits and have responsibility/ authority to improve the effectiveness of the QHSE MS. Pursuing to make career in QHSE MS auditing. Course Duration: 56 Learning Hours and extended time of exercise & Exam. Certificate: Those who pass all exercises with 50% at least in each exercise and 100% overall exercises completion will be awarded with successfully completion certificate with approval of Exemplar Global and a Lifetime validity. Note: Each exercise have 2 retakes, if a candidate fails in all 3 terms, the course will be blocked there and the candidate will have to purchase it again by paying 20% of the original price. Language of Course: English Pre-Requisites: ISO 9001, ISO 14001, ISO 45001 awareness training course.