- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

STAINED GLASS SUMMER CLASS - August 7th – 11th, 2023

By Rainbow Glass Studios

the stained glass summer class at rainbow glass studios August 7th - 11th 2023 is designed to teach all the traditional techniques needed to make a large stained glass panel. This class is for all abilities and is carried out in a well equipt studio in London.

Dare We Laugh

By The London Art Therapy Centre

Applied comedy; humour in therapy; reverse psychology; laughter and health; dramatherapy; improvisation; healthcare;

An emergency can happen anywhere, so it's better to be prepared at all instances, specially at the workplace. Come to Knight Training and ensure your employees are safe with our Emergency First Aid At Work Course now!

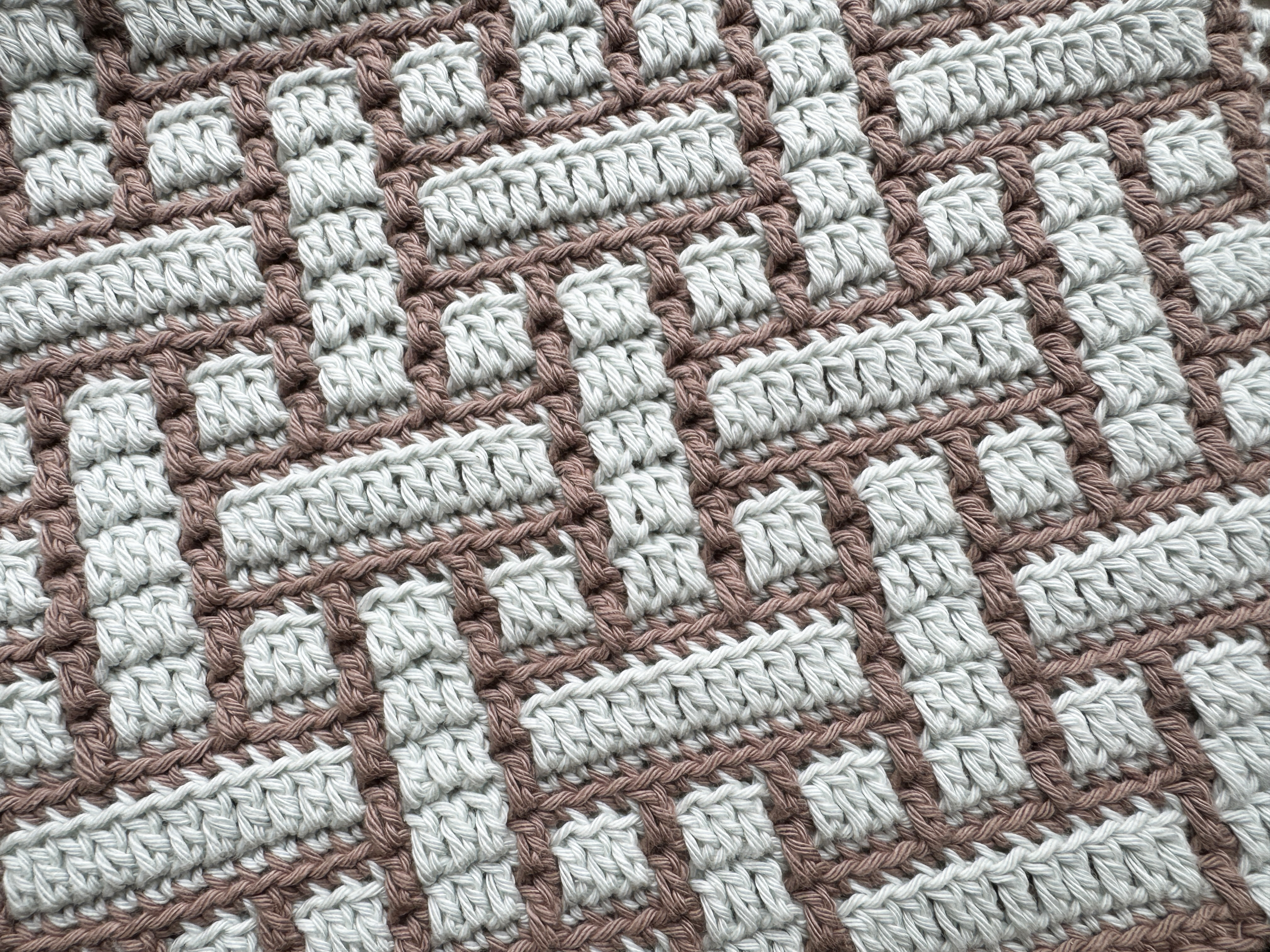

Learn Mosaic Crochet - 4 x2 hour sessions - Monday Evenings - Walton-on-Thames

By Merrian Holland

Learn mosaic crochet in Surrey - this is an immersive 4 x 2 hour course running on Tuesday evenings in Walton-on-Thames.

This course is designed for those people with little or no prior knowledge of Aviation English language, who are intending to seek employment within the Aviation Industry. One day Airline Cabin Crew Recruitment and Selection Day Airline Cabin Crew also known as: Air Hostess, Flight Attendant and Stewardess Achieving your dream to become cabin crew can sometimes feel really unclear. We know that competition is tough, but why do some people get it easily while others have to try time and time again? London Waterloo Academy students flying for over sixteen different airlines around the world, so we know what we are talking about when it comes to cabin crew recruitment and training. Major airlines are now accepting the fact that when individuals applying for cabin crew jobs, they have little or no idea what they are going to experience and what the cabin crew role is all about. Unfortunately, unprepared candidates failing their application and sometimes they have to wait 6 months before submitting new application. If you’ve ever been rejected, the best you can do is to review your performance and try to improve for your next application. London Waterloo Academy offers one day course, when you can revise, improve or to get an idea what to expect and become successful candidate. This course is a unique chance to get to know what really happens during interview. Interview Techniques Mock Job Interview Assessment Airline Cabin Crew Recruitment Day includes: ice breakers introductions individual assessments group exercises role play one to one interview At the end of the day, candidates will have a feedback session to identify areas for improvement. Dates for 2024 (please choose one for your course): 15 May, 18 September, 14 November 2024 Course duration – 1 Day Time – 10am to 5pm Fee – £52 Location – The Foundry, 156 Blackfriars Rd, London SE1 8EN (Southwark Station (2-3 min walk) and Waterloo/Blackfriars Station (10 min walk))

Belly dance course for beginners and improvers

By Jessica Gamil Bellydance

Learn the core moves of Egyptian Bellydance, and put it together with a fun choreography to Egyptian pop. We will learn: Correct posture and alignment. Hip movements (figures of eight/mayas (vertical and horizontal), circles and omis, different types of shimmies, drops and accents, locks, twists etc) Undulations and belly accents. Arm and hand positions, paths and movements. Common turns and stepping patterns used in bellydance e.g. pas de bourre. No belly dance experience required, if you are an improver you can refine and "troubleshoot" your base technique here to improve your movement quality. Variations will be offered in class depending on your level. There is also the opportunity to perform the choreography in the group at an end-of-term show (£10 ticket fee)! All classes are streamed and recorded on zoom so you can catch up if you miss a class. Homework with 1-2-1 feedback on WhatsApp included (optional) About your teacher: Jessica Gamil is an international performer, teacher and judge with over 16 years’ of Bellydance experience. Jessica has won Bellydance competitions in Italy and Switzerland, and travels to Cairo and festivals across the world to continue her dance training. Jessica is known for her easy to follow explanations of bellydance technique, so you’ll pick up new movements in no time!

Art Craft Pottery Wheel Taster Class

By Art Craft Studios

If you've always wanted to make handmade pottery but have no idea where to begin, this beginner-friendly wheel throwing class could be just the pottery workshop for you & your friends!

Level 3 Award in Administering Emergency Oxygen (RQF)

By BAB Business Group

The QA Level 3 Award in Administering Emergency Oxygen (RQF) qualification has been designed for those who are responsible for providing care to casualties where the administration of emergency oxygen may be required. Over a half day period, candidates will learn about the clinical need for emergency oxygen and the safety considerations of this, as well as how to administer emergency oxygen when dealing with a range of conditions. Successful candidates will leave the course with the knowledge and skills needed to administer emergency oxygen both safely and effectively. Achievement of this qualification confirms candidates have met both the theoretical and practical requirements, however, it does not imply a ‘license to practice’ – the scope of practice is determined by the organisation responsible for oxygen provision. This qualification does not allow candidates to obtain, store or administer oxygen without clinical governance.

Introduction to Blackwork Embroidery in Cumbria

By Maire Curtis Lakeland Studio

A relaxed and informal Blackwork Embroidery course in the lovely setting of a converted 18th Century cotton mill in Warwick Bridge, Carlisle. This course has been designed to guide the complete beginner or act as a refresher for those who may have dabbled in Blackwork embroidery in the past. We will cover the history, styles of Blackwork embroidery, threads and techniques.

Search By Location

- OV Courses in London

- OV Courses in Birmingham

- OV Courses in Glasgow

- OV Courses in Liverpool

- OV Courses in Bristol

- OV Courses in Manchester

- OV Courses in Sheffield

- OV Courses in Leeds

- OV Courses in Edinburgh

- OV Courses in Leicester

- OV Courses in Coventry

- OV Courses in Bradford

- OV Courses in Cardiff

- OV Courses in Belfast

- OV Courses in Nottingham