- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

New business and lead generation (In-House)

By The In House Training Company

Generating new leads and new business can be both time-consuming and frustrating. It's not easy - it takes skill, careful preparation and the creation of effective models and methods, even perhaps using formal approaches and scripts. Once generated, a new lead or enquiry must also be carefully managed to maximise the potential revenue it can generate. But it's crucial to get it right. If your company can afford not to worry about getting new business - congratulations! If your company is completely confident that it is performing at peak potential in generating new leads - again, congratulations! But if your company is working in the real world, couldn't your team do with some help, to become even just that little bit more effective, to make the process just that little less painful? This highly practical, intensive workshop gives sales teams the proven strategies and tactics they need to build a sustainable new business pipeline. This course will help participants: Develop a clear and consistent process for new business development and lead-generation Master the secret of effective new business development and lead-generation - 'only sell the appointment or next stage of the sales process, not your product or service' Set and achieve the right level of new business development and lead-generation activity to achieve your personal and organisational sales goals Apply the key principles of effective prospecting and pipeline management using a proven toolkit and approach Overcome the most common 'put-offs' when conducting telephone or face-to-face business-development and lead-generation activities Develop an engaging telephone voice and manner - and a 'networking personality' Qualify potential opportunities with more accuracy on a consistent basis Prioritise opportunities and manage their time when sourcing new business Discover online sources of leads, contacts and referrals Overcome psychological blocks to cold or warm calling - theirs and the client's Identify potential prospects - and decision-makers and influencers within target prospects - with greater accuracy Make outbound sales or appointment calls with improved confidence, control and results Improve the conversion of calls to appointments by using more effective questions and sales messages Get past gatekeepers and assistants more effectively Make the most of your CRM software and systems 1 Online marketing - what works! Workshop overview and learning objectives Choosing your social media channels LinkedIn for sales and marketing Designing and implementing an effective new business email campaign online Creating a lead-generation strategy online - with case studies Avoiding common mistakes in social media marketing Case study: 'Best practice in social media sales and marketing' Using blogs and video-based marketing (eg, YouTube) New trends and how to keep your finger on the 'social media' pulse Twenty essential websites and online marketing tools 2 Making appointments by telephone Planning the call, telephone techniques, integrating with email and online marketing Developing a clear and consistent process to appointment-making Setting and achieving the right level of telephone activity to achieve your appointment goals Applying the key principles of effective prospecting and pipeline management generation, using a proven toolkit and approach Overcoming the most common 'put-offs' to seeing or engaging with you Overcoming psychological blocks to cold or warm calling - yours and the client's Identifying potential prospects - and decision-makers and influencers within target prospects - with greater accuracy Making outbound sales or appointment calls with improved confidence, control and results Improving conversion of calls to appointments by using more effective questions and sales messages The five keys to developing an engaging telephone voice and approaching manner 3 Power networking Strategies for networking and B2B referral-based marketing The importance, and different types, of networking How to work a room - preparation and strategy Communication dynamics in networking - the power of the listening networker Assumptions when networking Business networking etiquette Making connections, asking for cards, contact details and referrals, gaining follow-up commitments Building relationships - follow-up and follow-through 4 Developing new leads Strategies for first-time sales calls Gaining rapport and opening first-time and new business sales calls effectively Advanced consultative selling - questioning techniques to quickly and efficiently uncover opportunities, need areas and preferences Presenting your solution to a new or first-time customer - creating an enthusiastic and compelling personalised and persuasive summary of your proposal Value message - differentiate your solutions clearly and accurately, with tailored value statements Presenting the right initial USPs, features and benefits and making them relevant and real to the customer Smart ways to position price, emphasise value and be a strong player without being the cheapest or leading on price Learn and use advanced techniques to determine customer needs, value and decision-making criteria in depth on a first-time call 5 Organised persistence - CRM and prospect-tracking Organised persistence - sales tracking, following up on 'sleeping' customers, gaining referrals, time and territory management Maintaining a good database for maximising new business ROI Developing a contact strategy with different types and levels of contact Analysing your contact base using state-of-the-art software and tools Making the most of your CRM systems and solutions Understanding that your attitude makes a difference when sourcing new business Setting SMART objectives for new business development and lead-generation Practical exercise - setting personal development and business goals Time management tips to improve daily productivity New business pipeline management strategies for peak sales performance 6 Workshop summary and close Practical exercise - developing your new business action plan Review and feedback

NPORS Crusher Training The aim of the NPORS Crusher Training is to provide theoretical and practical training for operators of Mobile Crushing equipment in the workplace. This Crusher training Course Or Test is carried out on your site using your own equipment. Please contact us for a competitive quote The Crusher Training Course is designed to provide candidates with the skills and knowledge required in order to operate a crusher safely and competently in the workplace. NPORS is an approved CSCS Partner Card Scheme, providing evidence that individuals working on construction sites have the appropriate Crusher training and qualifications for the Crusher Operation. Furthermore, training criteria is based on the approved standards of the Construction Leadership Council. Most major contractors should accept the NPORS Crusher card when presented on-site, which displays the silver CSCS logo. This NPORS crusher training meets the statutory requirements of the Health & Safety at Work Act 1974 and other relevant statutory provisions and Approved Codes of Practice. NPORS Crusher Test For Experienced Operators Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Crusher Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Crusher Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Crusher Test is for operators who have received some form of training in the past or alternatively has been operating Crusher for a number of years. If you are unsure if you qualify to go down the test route please contact us to discuss this in more detail. Discounts are available for multiple bookings There are two parts to the Crusher Test, a theory section comprised of 25 questions and a practical session operating the Crusher, revision notes are available when booking. Crusher Course Content Crushers are essential equipment in mining, quarrying, and construction industries, tasked with breaking down large rocks and materials into smaller, more manageable sizes. Operating mobile crushers requires specialised skills and knowledge to ensure safety, efficiency, and optimal performance. In this comprehensive course overview, we will explore the essential content covered in a crusher training course, designed to equip participants with the expertise needed to operate crushers safely and effectively in the workplace. 1. Introduction to Crushers: Overview of crusher types: jaw crushers, cone crushers, impact crushers, etc. Understanding the components and operating principles of crushers Different configurations and applications for specific tasks 2. Crusher Safety Procedures: Importance of safety in crusher operation Pre-operational checks and inspections Understanding crusher capacities and limitations Personal protective equipment (PPE) requirements Emergency procedures: shutdown, lockout/tagout, and evacuation protocols 3. Crusher Operation Basics: Starting, stopping, and controlling the crusher, including emergency stops Familiarisation with crusher controls: power source, conveyor belts, feeders, etc. Monitoring and adjusting crusher settings for optimal performance Understanding crusher dynamics: feed size, speed, and throughput 4. Material Handling and Crushing Techniques: Proper assessment of materials: hardness, size, and moisture content Loading and feeding materials into the crusher safely and efficiently Adjusting crusher settings for different material types and sizes Maximising crusher efficiency and product quality 5. Site Safety and Hazard Awareness: Identifying potential hazards in the crusher area Working safely around moving parts, conveyor belts, and rotating equipment Recognising environmental hazards: dust, noise, and vibration Understanding site-specific safety rules and regulations 6. Maintenance and Inspections: Importance of regular maintenance for crusher performance and reliability Daily, pre-shift, and post-shift inspection procedures Lubrication points and maintenance schedules Identifying and reporting mechanical issues and wear parts replacement 7. Practical Hands-On Crusher Training: Moving the crusher in reverse and forwards through obstructions Loading and feeding materials into the crusher using excavator and loading shovels Adjusting crusher settings and monitoring performance for efficiency Emergency response drills: simulated scenarios to test response and decision-making skills 8. Assessment and Certification: Written examination to assess theoretical knowledge Practical assessment of crusher operation skills Certification upon successful completion of the course Conclusion: A crusher training course equips participants with the essential knowledge, skills, and confidence to operate crushers safely and efficiently in various work environments. By covering topics such as safety procedures, operation techniques, material handling, site safety awareness, best maintenance practices, and practical hands-on training, participants can enhance their proficiency and contribute to a safer and more productive workplace. Whether you’re a novice operator or an experienced professional, investing in crusher training with Vally Plant Training is essential for ensuring compliance, reducing risks, and maximising productivity in crushing operations. Frequently Asked Questions About Crusher Training What is Crusher Training, and why is it necessary? Crusher Training provides individuals with the skills and knowledge required to safely and effectively operate crushers, heavy machinery used in mining, construction, and recycling industries. It’s essential for ensuring operator safety, maximising productivity, and preventing accidents on job sites. Who should undergo Crusher Training? Crusher Training is essential for anyone involved in operating or working around crushers, including quarry workers, machine operators, maintenance personnel, and site supervisors. Proper training ensures that individuals understand equipment operation procedures and safety protocols. What topics are covered in Crusher Training programs? Crusher Training programs cover a range of topics, as above, including equipment familiarisation, safety precautions, preventive maintenance, operational techniques, troubleshooting, and emergency procedures. Participants learn how to operate crushers efficiently while prioritising safety and minimising risks. How long does Crusher Training take? The duration of Crusher Training programs varies depending on factors such as the complexity of the equipment and the depth of the curriculum. Basic training courses may last a couple of days, while more comprehensive programs could extend over 1 week to cover advanced concepts and practical applications. Is Crusher Training mandatory in certain industries? While Crusher Training may not be legally mandated in all areas, many employers in the mining, construction, and recycling industries require operators to undergo training as part of their occupational health and safety policies. Compliance with training requirements helps prevent accidents and ensures regulatory compliance along with productivity. Where can I find reputable Crusher Training courses? Reputable Crusher Training courses are offered by various institutions, including industry associations, equipment manufacturers, and specialised training providers like Vally Plant Training. It’s important to choose a program that offers accredited certification and covers relevant industry standards and best practices. Crusher Courses Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable Crusher instructors, who have a wealth of knowledge of crushers and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment, however, Crusher Training can only be conducted on your sites Our Crusher course and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS Crusher Tester to your site nationwide, to reduce the amount of time away from work and complete the crusher test Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today.

NPORS Cat And Genny Training or Cable Avoidance Training Prioritising the safety of underground utilities in construction and excavation projects is essential, necessitating comprehensive Cat and Genny training. In these sessions, workers receive education on operating Cable Avoidance Tools (CAT) and Signal Generators (Genny), Cat and Genny. The Cat and Genny use electromagnetic signals to detect buried cables and pipes before digging commences. Through comprehensive Cat and Genny training, workers become proficient in using CAT and Genny equipment, enabling them to accurately map out the locations of underground infrastructure. This proactive approach not only enhances on-site safety but also contributes to efficient project management by minimising the risk of accidental damage and costly delays. The aim of the NPORS Cat & Genny Training is to Provide training in Cable Avoidance and Service Location (Cat and Genny).The Cat and Genny Course is designed for any person working on the roads, setting out before a build, surveying and any others who may be excavating an area where pipes or cables may be buried underground. Price Match Promise Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Price Match Promise. When you choose us for your Cat and Genny Course, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Cat And Genny Course, we’ll match it—ensuring you receive top-quality training at the best possible rate. Your skills, our commitment—always at the best price. CAT & GENNY Training is designed for construction professionals and workers involved in excavation who need to operate Cable Avoidance Tools and Signal Generators. This training is ideal for individuals who have prior experience in excavation but require formal instruction on the safe and effective use of these specific tools to prevent accidental damage to underground services. Participants should have a basic understanding of excavation work, and if unsure of their eligibility for this advanced training, are encouraged to contact our training coordinators for more information. The CAT & GENNY training program is divided into two main sections: a theoretical module and a practical application module. The theory part covers the principles of operation, safety procedures, and risk assessment associated with underground utility detection. The practical module provides hands-on experience with both the Cable Avoidance Tool and Signal Generator, emphasising field techniques and problem-solving. Upon completion of the Cat And Genny course, participants will receive comprehensive revision materials to reinforce key concepts covered during the training. Introduction to CAT and Genny Training CAT and Genny , also referred to as CAT & Genny or CAT and Genny Training, are essential tools used in the construction and utility sectors to help locate and avoid underground cables and pipes during excavation works. CAT, which stands for Cable Avoidance Tool, is designed to detect signals naturally emitted by metallic services like electrical cables. Meanwhile, the Genny, short for Signal Generator, is used alongside the CAT to apply a signal to underground utilities that do not naturally emit detectable signals, such as telecoms or fibre . Understanding how to operate these tools is crucial for anyone involved in excavation. Proper use of CAT and Genny can prevent costly and dangerous errors, such as accidentally cutting through power lines or water pipes. The training not only focuses on how to use these devices effectively but also covers the best practices for scanning different types of terrain and interpreting the signals received. This ensures that workers can conduct their tasks safely and efficiently, minimising the risk of disruption and damage to underground services. What Is CAT and Genny Training? CAT and Genny Training provides comprehensive instruction on using Cable Avoidance Tools (CAT) and Signal Generators (Genny) to locate underground utilities safely. This training is critical to reduce the risk of accidentally striking underground assets during excavation, which can lead to severe safety hazards and financial losses. What Does Our CAT and Genny Training Course Cover? Our CAT and Genny Training Course covers: Basics of operating CAT and Genny equipment: Understanding the device controls, functions, and proper handling. Detection techniques: Learning how to detect different types of services, including electric, gas, and water. Practical applications: Hands-on training with both simulated and live environments to practice safe scanning and detection. Safety protocols: Emphasising safety procedures to prevent injuries and accidents. Legal compliance: Overview of health and safety regulations related to excavation work. Who Needs CAT and Genny Training? CAT and Genny Training is essential for anyone involved in excavation and groundworks. This includes utility workers, construction workers, civil engineers, site managers, and anyone else who may need to locate underground utilities as part of their job. The Cat And Genny Course is crucial for preventing damage to underground infrastructure like gas, water, telecoms and electrical lines, which can result in costly repairs and dangerous accidents. Do You Need to Be Trained to Use a CAT Scanner? Yes, training is highly recommended to use a CAT scanner effectively and safely. While not legally mandatory, proper training ensures that operators can accurately interpret the scanner’s signals and avoid potential hazards when working near underground utilities. Specialised Genny Tool Training Course Overview: The Genny Course is designed specifically to train users on the effective operation of the Genny tool, a crucial component of the CAT and Genny system used for detecting underground utilities. Key Learning Outcomes: → Understanding Genny Signals: Participants will learn how different signals can be applied and traced using the Genny, improving their ability to detect non-metallic utilities such as plastic water pipes. → Optimising Signal Strength: Training includes adjusting the Genny’s signal strength to suit various soil conditions and utility types, ensuring clearer and more accurate detections. Practical Applications: → Hands-on Practice: Extensive field practice sessions are included to give participants real-world experience in using the Genny effectively. →Troubleshooting Common Issues: Learners will be taught how to troubleshoot common operational issues to minimise downtime and enhance field productivity. Advanced Techniques: → Using Genny with CAT4: Instructions on how to integrate Genny use with the CAT4 detector for enhanced detection capabilities. → Interpreting and Mapping: Skills in interpreting the Genny’s output and using integrated mapping tools for accurate utility mapping. Safety Protocols: → Safe Operation Practices: Emphasis on safety measures to prevent accidents during the use of high-frequency signals. → Maintenance and Daily Checks: Training on regular maintenance routines and daily checks to keep the Genny in optimal working condition. Certification: → Qualification and Certification: Upon completion of the course, participants receive a certification that validates their proficiency in using the Genny tool according to industry standards. Scanning Techniques with CAT and Genny General Scanning Techniques: → Sweeping Motion: Always use a slow, steady sweeping motion with the CAT device. Begin scanning at least a few meters away from the expected area of the utilities to avoid missing any signals. → Directional Scans: Perform scans in multiple directions — both parallel and perpendicular to the expected direction of the utility lines to ensure thorough coverage. → Depth Perception: Adjust the depth settings based on preliminary scans to get an accurate depth estimate of buried utilities. Specific Use of Genny: → Direct Connection: When available, use the direct connection method with the Genny to induce a precise signal into a specific utility line. This is particularly useful in crowded areas with multiple utility lines. → Induction Mode: Use the Genny’s induction mode when direct connections are not possible. Ensure the Genny is placed on the ground vertically for optimal signal transmission. How to Use the CAT and Genny to Find Hidden Wires and Pipes Getting Ready: Check the Tools: Make sure the CAT and Genny are ready to use and have full batteries. Set Up the Genny: Pick the right sound for the Genny to use so it can find wires or pipes under the ground. If you can, connect the Genny to the pipe or wire with a special wire. Using the Genny: Stand it on the Ground: Put the Genny on the ground where you think there might be something hidden. Turn it on to send a beep into the ground. Connect it for Better Finding: Sometimes, you connect the Genny to something like a pipe for a clearer beep. Using the CAT: Start with Power Mode: Turn on the CAT and use the power mode to find beeps from wires that are on. Try Radio Mode: Next, switch to radio mode to hear beeps from metal things like pipes. Finally, Use Genny Signal Mode: Use this mode to hear the special beeps from your Genny to find hidden stuff like plastic pipes. How to Look Properly: Move Slowly: Walk slowly with the CAT over the area. If you move too fast, you might miss some beeps. Check in a Cross Pattern: First walk in one direction and then the other direction to make sure you cover all the area. Understanding What You Hear: Listen to the Beeps: A loud beep means you are close to a wire or pipe. If the beep sounds the same as you move, it probably means you found a wire or pipe. Staying Safe: Look Before You Dig: Always check by looking in the hole to make sure what the CAT and Genny found before you start digging. Keep the Tools Working Well: Make sure your tools are working right by checking them often. 500 mm from utilities; Always use insulated digging tools when close to underground utilities Frequently Asked Questions On Cat & Genny Training What is CAT and Genny training? CAT and Genny training provides instruction on how to use Cable Avoidance Tools (CAT) and Signal Generators (Genny) effectively to detect underground utilities and avoid accidental strikes during excavation. The training covers operational techniques, safety procedures, and the correct interpretation of the equipment’s signals. Why is CAT and Genny training important for construction workers? This Cat And Genny Course is crucial for safety and efficiency on construction sites. It helps workers avoid costly damages to underground utilities such as water pipes, electricity cables, and communication lines, which can lead to severe consequences including service outages, legal liabilities, and endangerment of worker and public safety. 3. How Long Is the Certification Valid? The certification received after completing CAT and Genny Training is generally valid for three to five years. After this period, a refresher course is recommended to keep up with new technologies and changing safety regulations. 4. Is CAT and Genny training required by law in the UK? While not specifically mandated by law, CAT and Genny training is strongly recommended under the UK Health and Safety Executive guidelines (HSE) to meet the legal duties under the Health and Safety at Work Act. It is considered best practice for anyone involved in excavation works. Cat & Genny Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of cable avoidance and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment for the cat & genny course. Our Cable Avoidance training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS cat & genny Tester to your site nationwide, to reduce the amount of time away from work Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today.

Advanced sales skills (In-House)

By The In House Training Company

Do you hear yourself saying the same thing over and over again? Do you want to bring some new skills to your role? If you have been in a sales role for some time it is easy to fall into a comfortable pattern. This workshop will help you incorporate advanced techniques drawn from NLP, behavioural science and social psychology into your existing skills. This course will help you: Use the consultative sales process to achieve more cross-sales Employ advanced rapport-building skills Assess the buying preferences of a customer Articulate the link between customer goals and needs Identify your customer's needs and wants Use advanced questioning techniques to gather information Resist the temptation to tell when it would be better to ask Identify communication preferences Given various scenarios, present a product to the explicit need of a customer Appreciate the impact of the language used during this stage of the sale and decide what language is appropriate with a variety of customers Handle objections positively Close the sale or gain commitment to further action 1 Introduction Aims and objectives of the training Personal introductions and objectives Self-assessment of existing sales skills Overview of content 2 Understanding yourself and your customers Personal communication style and what this means in a sales situation Wants versus needs What motivates people to buy Using social media tools such as LinkedIn Managing your portfolio to maximise sales Preparing to sell 3 The sales process Overview of the consultative sales process Review personal strengths and weaknesses as a salesperson Habits of top-performing sales people Common pitfalls Articulate sales goals 4 Building rapport 11 decisions that customers make in the first 9 seconds Spotting buyer communication preferences Building rapport with a wide variety of customers Dealing with emotions Keeping control 5 Questioning and listening Assumptions and how they trip us up Structured questioning Looking for cross-sales Honing your listening skills Identifying buyers' motivation Using summaries to move the customer forward 6 Presenting products and services to customers Choosing the right time to present Using features, advantages and benefits Tailoring your presentation of products and services to match buyer preferences and motivations 7 Gaining commitment When to close Dealing with difficult customers 5 things to avoid when handling a customer objection 8 Managing your business The link between service and sales Using customer surveys Winning back lost business 9 Putting it all together Skills practice Personal learning summary and action plans

Telephone Sales - outbound (In-House)

By The In House Training Company

Telephone selling can be a challenge. It can be a pressured environment and sales professionals need to be able to maintain peak performance in order to meet - and preferably exceed - their targets. This programme will help make it easier for them. The expert trainer covers the whole process, to help participants see it from their customer's perspective. The focus is on how to use a practical understanding of sales psychology, and of the nature of the telephone sales conversation, to help make it easier for customers to buy. This programme will give your team the skills to: This course will help participants: Understand why people buy - and how that makes it easier to sell Manage the sales process better Steer their sales calls to a more positive outcome Recognise - and respond to - customer buying signals Meet and overcome objections Choose the most appropriate techniques for closing with confidence Enhance their resilience Improve their communication skills on the telephone 1 Introduction Aims and objectives Overview Self-appraisal of current skills and development areas 2 The sales approach What selling means Why selling is like nature 3 The telephone as an instrument of communication Qualities of the telephone How telephone communication differs from face-to-face Advantages and drawbacks of the telephone How to optimise selling over the telephone Communication techniques to help you stand out from the crowd 4 Creating a relationship Professional telephone etiquette Building a rapport Connecting with the customer so that they feel you are on the same wavelength 5 The structure of a sales call Opening the call - creating a positive first impression Effective questioning to gather information and establish need Identifying and presenting the features and benefits of the product or service Matching the benefits to customers' needs Recognising and responding to buying signals Anticipating, meeting and overcoming objections Closing the sale and asking for the order - different closing techniques The importance of testimonials - how to obtain them and when to use them 6 Listening skills The challenges of accurate listening How to enhance listening skills Ensuring the customer feels heard and understood through empathetic listening 7 Shaping and using a script Developing a script to increase levels of confidence Leaving the door open 8 Managing the campaign Organisation and call planning Identifying your target market group Planning who and when to call Logging constructive information 9 Personal management The importance of persistence Is there a time to back off? Stamina - optimising energy levels Bouncing back 10 Practising the new information Pulling the details together Practising in a supportive environment 11 Action planning Personal learning summary and action plan

Finance for project managers and engineers (In-House)

By The In House Training Company

What do engineers and project managers need to know of finance? 'Nothing - leave it to the accountants!' No, no, no! Engineers must be conversant with the terminology and statements that accountants use. Technical expertise in projects, service delivery, production or other areas can only really be harnessed if the managers understand the accounting and reporting that drives businesses. This course gives the necessary understanding to project, production and technical managers. It develops their skills in understanding financial and management accounting. Accountants may not always like it but a major part of their work is to be the 'servants of business' and to gather, compile and present your figures. So you must understand the figures - they belong to you, your processes or projects. There are many reasons for maintaining accurate accounts. This course focuses on the strategic issues (those over-used words) - what figures reveal about the drivers of business and what they reveal about the day-to-day issues that accountants bother you with. The course will enhance your understanding of finance and of the accounting issues which affect your projects, production and technical areas of business. This course will help you: Understand the business world in figures - make sense of what the accountants are telling you Appreciate what drives business - and how this affects your role in your part of the business Relate your activities to the success of the business - through figures Gain the skills to advance in management - financial awareness is a 'must have' if you are to progress in your career 1 What do accountants do? The finance function, types of accountant, financial v management accounting and the treasury function Understanding the role of the finance function and how the information you provide may be used 2 The basic financial statements Balance sheets and income statements (P&L accounts) What they are, what they contain and above all what they can reveal - how to read them The accounting process - from transactions to financial statements What underpins the statements - accounting systems and internal controls 3 Why be in business - from a financial perspective The driving forces behind financial information Performance measures - profitability, asset utilisation, sales and throughput, managing capital expenditure 4 Accounting rules - accounting standards Accounting concepts and the accounting rules: accruals, 'going concern' - substance over form and other 'desirable qualities' Accruals - why the timing of a transaction is so important to the finance function Depreciation and amortisation - the concepts and practice Accounting standards - the role of International Financial Reporting Standards 5 Cash The importance of cash flow - working capital management Cash flow statements - monitoring overall cash flows Raising cash - levels of borrowing, gearing Spending cash - an outline of capital expenditure appraisal 6 Budgeting Why budget? - good and bad practice Determining why budgets play a key role and should not be simply an annual ritual Justifying your budgets - the link between the strategic plan and day-to-day budgeting - alignment of company culture Budgets as motivators - the importance of the right culture Techniques to improve budgeting - whether day-to-day or capital budgeting 7 Costing The type and detail of costing very much depends on your business - eg, manufacturing piston rings is quite different from the construction of a power plant Issues with overhead allocation Accounting for R&D 8 Reading financial statements Annual financial statements - why they are produced, what's in them and what you should look for Learning what a set of accounts reveals about a company's current situation, profitability and future prospects 9 Performance measurement - analytical reviews and ratio analysis ROI/ROCE Profitability, margins and cost control Sales - asset turnover Efficiency (asset / stock turnover, debtor / creditor days) 'City' measures Investment (interest / dividend cover, earnings per share, dividend yield)

Forklift Truck Training The aim of the NPORS Forklift Truck Training is to provide both theoretical and practical training to ensure the safe usage of the FLT Counter Balance Forklifts. As a result of the forklift truck training you will receive the red trained operator card or the Traditional Card. Call to book your forklift course today Experienced operator – NPORS Forklift Truck Test Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Forklift Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Forklift Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Forklift Truck Test is for operators who have received some form of forklift training in the past or alternatively has been operating Forklift trucks for a period of time. If you are unsure if you qualify to go down the forklift truck test route please contact us to discuss this in more detail. There are two parts to the forklift truck course, a theory section comprised of 25 questions and a practical session. Forklift Truck Training Course: Navigating Safety and Efficiency Forklift trucks, also known as lift trucks or forklifts, are indispensable tools in various industries, facilitating the movement and handling of materials with precision and ease. However, operating a forklift requires specialised skills and knowledge to ensure safety, efficiency, and compliance with regulations. In this comprehensive course outline, we will delve into the essential content covered in a forklift truck training course, designed to equip participants with the expertise needed to operate forklifts safely and effectively in the work place. 1. Introduction to Forklift Trucks: Overview of forklift types: counterbalance, reach, pallet trucks, etc. Understanding the components and controls of a forklift Different configurations and attachments for specific tasks All health and safety regulations covered 2. Forklift Safety Procedures: Importance of safety in forklift operation Pre-operational checks and inspections Understanding load capacity and load centre Personal protective equipment (PPE) requirements Emergency procedures: evacuation, fire, and accident response 3. Forklift Operation Basics: Starting, stopping, and manoeuvring the forklift safely around obstacles Steering techniques: forward, reverse, and turning Operating on various surfaces: smooth floors, ramps, and inclines Lifting, lowering, side shifting and tilting loads using hydraulic controls 4. Load Handling Techniques: Proper load assessment: weight, size, and stability Positioning the forklift for efficient loading and unloading Securing loads with proper attachments: forks, clamps, and attachments Stacking and de-stacking loads safely and efficiently 5. Site Safety and Hazard Awareness: Identifying potential hazards in the workplace Working safely around pedestrians, other forklifts, and obstacles Recognising environmental hazards: narrow aisles, confined spaces, and overhead obstructions Understanding site-specific safety rules and regulations 6. Maintenance and Inspections: Importance of regular maintenance for forklift performance and longevity Daily, pre-shift, and post-shift inspection procedures Lubrication points and maintenance schedules Identifying and reporting mechanical issues and defects 7. Practical Hands-On Training: Practical exercises in forklift operation under supervision Manoeuvring through obstacle courses and tight spaces Load handling exercises: stacking, de-stacking, and transporting loads Emergency response drills: simulated scenarios to test response and decision-making skills 8. Assessment and Certification: Written examination to assess theoretical knowledge Practical assessment of forklift operation skills Certification upon successful completion of the course Conclusion: A forklift truck training course equips participants with the essential knowledge, skills, and confidence to operate forklifts safely and efficiently in various work environments. By covering topics such as safety procedures, operation techniques, load handling, site awareness, maintenance practices, and practical hands-on training, participants can enhance their proficiency and contribute to a safer and more productive workplace. Whether you’re a novice operator or an experienced professional, investing in forklift training is essential for ensuring compliance, reducing risks, and promoting excellence in material handling operations. Frequently Asked Questions 1. What types of forklifts are covered in the training? The training covers various forklift types, including counterbalance, reach trucks, and pallet trucks. 2. What are the course components? The course includes theoretical training, practical sessions, safety procedures, load handling techniques, site safety, maintenance, and inspections. 3. Who is the training suitable for? The training is suitable for both novice operators and experienced operators who need certification or recertification. 4. What certification will I receive? Participants will receive an NPORS card, either a red trained operator card or a traditional card, valid for 2-5 years depending on the type. 5. What are the prerequisites for the course? There are no prerequisites for novice operators, but experienced operators should have prior forklift operation experience. Forklift Truck Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of Forklifts and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment. However, this training can only be conducted on your sites Our forklift training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS forklift Tester to your site nationwide, to reduce the amount of time away from work Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today. For those looking for a “NPORS Forklift Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

Lorry Loader Training The aim of the Lorry Loader Training or Clamshell Bucket Courses is to provide the candidate with the basic knowledge and practical skills involved in operating a Lorry Loader ( HIAB ) or clamshell bucket courses, and on successful completion of the practical test, you will be issued with the NPORS Identity card with or without the CSCS logo. Discounts are available for multiple bookings NPORS/CSCS Lorry loader Experienced Worker Test or Training can only be delivered on our customer’s sites nationwide, Therefore reducing downtime and disruption of works to our clients. Experienced operator – NPORS Lorry Loader Test Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Lorry Loader Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Lorry Loader Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Lorry Loader Test is for operators who have received some form of training in the past or alternatively has been operating the Lorry Loader for several years. If you are unsure if you qualify to go down the test route please contact us to discuss this in more detail. Discounts are available for multiple bookings There are two parts to the lorry loader test, a theory section comprised of 25 questions and a practical session. Lorry Loader Training Course: Safely Operating Mobile Crane Vehicles 1. Introduction to Lorry Loaders Overview of lorry loader types and configurations Understanding the components and controls of a lorry loader Different applications and lifting capacities of lorry loaders 2. Lorry Loader Safety Procedures Importance of safety in lorry loader operation Pre-operational checks and inspections Understanding load charts and load capacities Personal protective equipment (PPE) requirements Emergency procedures: shutdown, lockout/tagout, and evacuation protocols 3. Lorry Loader Operation Basics Starting, stopping, and controlling the lorry loader, include emergency stops Familiarisation with lorry loader controls: boom, remote, and outriggers Manoeuvring the lorry loader on different terrain types: roads, construction sites, etc. Lifting and lowering loads safely and accurately 4. Load Handling Techniques Proper assessment of loads: weight, size, and stability Positioning the lorry loader for efficient loading and unloading Securing loads with proper rigging techniques: slings, chains, and hooks Stacking and de-stacking loads safely and efficiently Using other professionals to complete the work. Slinger signaller to direct the load 5. Site Safety and Hazard Awareness Identifying potential hazards in the workplace Working safely around pedestrians, other vehicles, and obstacles Recognising environmental hazards: overhead obstructions, power lines, etc. Understanding site-specific safety rules and regulations 6. Maintenance and Inspections Importance of regular maintenance for lorry loader performance and reliability Daily, pre-shift, and post-shift inspection procedures Lubrication points and maintenance schedules Identifying and reporting mechanical issues and wear parts replacement 7. Practical Hands-On Training Practical exercises in lorry loader operation under supervision Manoeuvring through obstacle courses and confined spaces Load handling exercises: lifting, positioning, and placing loads Emergency response drills: simulated scenarios to test response and decision-making skills 8. Assessment and Certification Written examination to assess theoretical knowledge Practical assessment of lorry loader operation skills Certification upon successful completion of the course A lorry loader training course, by Vally Plant Training provides participants with the essential knowledge, skills, and confidence to operate lorry loaders safely and efficiently in various work environments. By covering topics such as safety procedures, operation techniques, load handling, site awareness, maintenance practices, and practical hands-on training, participants can enhance their proficiency and contribute to a safer and more productive workplace. Whether you’re a novice operator or an experienced professional, investing in lorry loader training is essential for ensuring compliance, reducing risks, and maximising productivity in lifting operations. Lorry Loader Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of lorry loader and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built HIAB practical training area to simulate an actual working environment. Our Lorry Loader or clamshell bucket courses and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS LORRY LOADER Tester to your site nationwide, to reduce the amount of time away from work More courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today. Frequently Asked Questions 1. What is the aim of the Lorry Loader Training course? • The course aims to provide candidates with the basic knowledge and practical skills involved in operating a Lorry Loader (HIAB) or clamshell bucket. Successful completion of the practical test will result in receiving the NPORS Identity card with or without the CSCS logo. 2. What does the Lorry Loader training course cover? • The course covers various aspects, including: o Types and configurations of lorry loaders o Safety procedures and pre-operational checks o Operation basics, including controls and manoeuvring o Load handling techniques o Site safety and hazard awareness o Maintenance and inspection procedures o Practical hands-on training and assessments 3. What is the duration of the Lorry Loader Training course? • For experienced operators, the course is a 1-day test, accommodating up to 4 candidates. For novice operators, it is a 2-day training session, accommodating up to 3 candidates. 4. Where is the training conducted? • Training can be conducted at the client’s site nationwide, which helps reduce downtime and disruption to work. The training centre is located near the M5 junction 9 in Tewkesbury, with a purpose-built HIAB practical training area. 5. What are the certification options available? • There are two certification options: o NPORS traditional card (valid for 5 years) o NPORS card with CSCS logo (initial RED trained operator card valid for 2 years, upgradable to BLUE competent operator card upon completing relevant NVQ) For those looking for a “NPORS Lorry Loader Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

Tableau Desktop Training - Analyst

By Tableau Training Uk

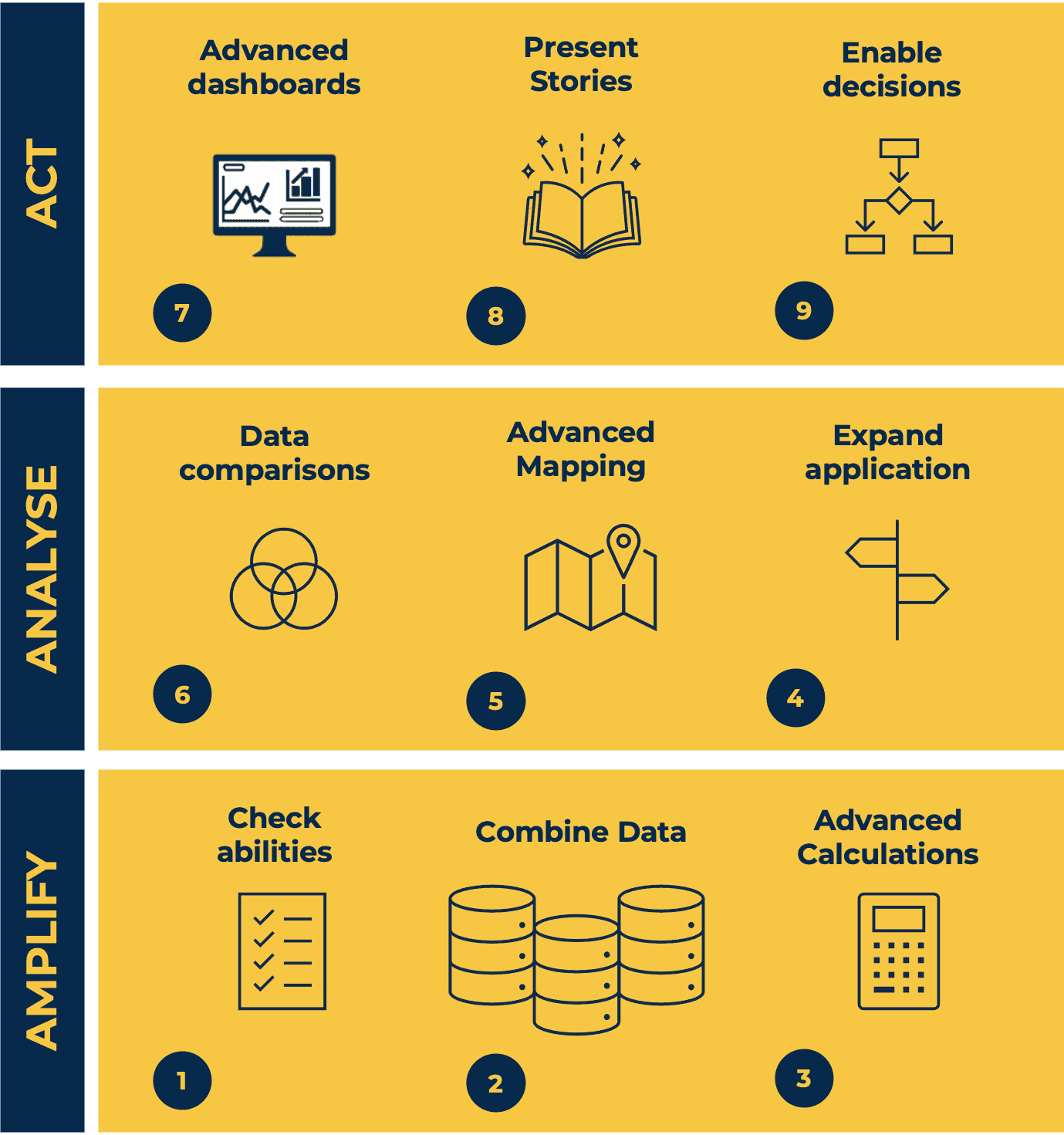

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: Overcome the barrier of the accountants' strange language Deal confidently with financial colleagues Improve their understanding of your organisation's finance function Radically improve their planning and budgeting skills Be much more aware of the impact of their decisions on the profitability of your organisation Enhance their role in the organisation Boost their confidence and career development 1 Review of the principal financial statements What each statement containsOutlineDetail Not just what the statements contain but what they mean Balance sheets and P&L accounts (income statements) Cash flow statements Detailed terminology and interpretation Types of fixed asset - tangible, etc. Working capital, equity, gearing 2 The 'rules' - Accounting Standards, concepts and conventions Fundamental or 'bedrock' accounting concepts Detailed accounting concepts and conventions What depreciation means The importance of stock, inventory and work in progress values Accounting policies that most affect reporting and results The importance of accounting standards and IFRS 3 Where the figures come from Accounting records Assets / liabilities, Income / expenditure General / nominal ledgers Need for internal controls 'Sarbox' and related issues 4 Managing the budget process Have clear objectives, remit, responsibilities and time schedule The business plan Links with corporate strategy The budget cycle Links with company culture Budgeting methods'New' budgetingZero-based budgets Reviewing budgets Responding to the figures The need for appropriate accounting and reporting systems 5 What are costs? How to account for them Cost definitions Full / absorption costing Overheads - overhead allocation or absorption Activity based costing Marginal costing / break-even - use in planning 6 Who does what? A review of what different types of accountant do Financial accounting Management accounting Treasury function Activities and terms 7 How the statements can be interpreted What published accounts contain Analytical review (ratio analysis) Return on capital employed, margins and profitability Making assets work - asset turnover Fixed assets, debtor, stock turnover Responding to figures EBIT, EBITEDIA, eps and other analysts' measure 8 Other key issues Creative accounting Accounting for groups Intangible assets - brand names Company valuations Fixed assets / leased assets / off-balance sheet finance

Search By Location

- OV Courses in London

- OV Courses in Birmingham

- OV Courses in Glasgow

- OV Courses in Liverpool

- OV Courses in Bristol

- OV Courses in Manchester

- OV Courses in Sheffield

- OV Courses in Leeds

- OV Courses in Edinburgh

- OV Courses in Leicester

- OV Courses in Coventry

- OV Courses in Bradford

- OV Courses in Cardiff

- OV Courses in Belfast

- OV Courses in Nottingham