- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

This foundational course will help all managers better understand what a procurement function does, including the processes, tools and techniques it employs to reach its goals and how it measures its business performance. PARTICIPANTS WILL LEARN HOW TO: Explain the contribution of procurement to the overall business objectives. Explain the added value that can be obtained by a business when it manages its procurement activities efficiently and effectively. Understand the complex activity of procurement and the challenges it presents for risk management. Develop good quality procurement practices that will manage the expectations of all stakeholders Identify methods by which a procurement function can be measured and performance monitored. Perform contract management activities. Understand ways in which improvements might be identified and implemented. COURSE TOPICS INCLUDE: Procurement and business objectives Stakeholder Management Commercial Specifications Whole Life Costing Targeted procurement Procurement planning Supplier Appraisal and selection RFQ & ITT & Evaluation Contract Management

Tableau Desktop Training - Foundation

By Tableau Training Uk

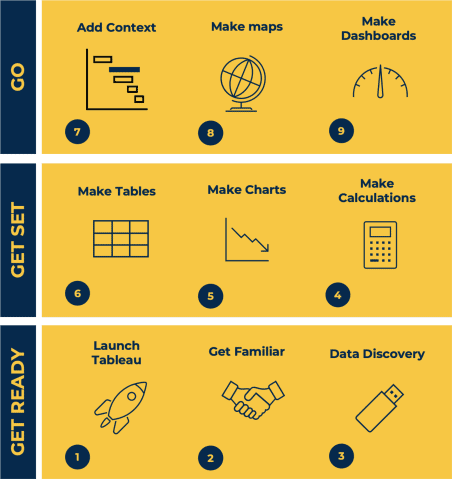

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Manual Handling (In-House)

By The In House Training Company

Some 60% of injuries at work are caused by lifting heavy objects. This powerful, practical programme is designed to help stop any of your staff from becoming the next statistic. 1 Introduction and objectives 2 Overview of Health and Safety Legislation and HSE Injury Statistics Health and Safety at Work Act 1974 Management of Health and Safety at Work Regulations (MHSWR) 1992 MHSWR 1999 specific duties to risk assess Manual Handling Operations Regulations (MHOR) 1992 Breakdown of injury statistics and costs of poor manual handling 3 The musculoskeletal system explained Prevention and ill-health Ergonomics RSI The spine in detail 4 Risk assessment General principles The TILE method Employees' duties Workplace scenarios

Control of Substances Hazardous to Health (COSHH) (In-House)

By The In House Training Company

This short course introduces staff to a range of hazardous substances, the risks and controls available, and what to expect from a control of substances hazardous to health (COSHH) assessment. It prepares them to contribute to the safer use of hazardous substances in their workplaces. 1 Definition and types Defining what constitutes a substance hazardous to health in the workplace Outlining the various types of hazardous substances 2 Health effects Exploring the health effects caused by exposure to hazardous substances Routes of entry - exploring how substances can enter the body and methods of prevention 3 Data COSSH register Data sheets Risk assessments Control options 4 Responsibilities An overview of the responsibilities imposed by the Control of Substances Hazardous to Health Regulations 2002

Introduction to supply chain management (In-House)

By The In House Training Company

This comprehensive one-day programme has been designed to provide participants with an overview of basic supply chain principles and concepts and to identify potential opportunities for reducing costs, minimising risks and adding value across the supply chain. This could include reducing inventory, procurement, transport and storage costs. Fundamentally, the object of the programme is to empower participants to be able to collaborate with all key stakeholders across the supply chain. This course will help participants: Appreciate the importance of the supply chain as a source of competitive advantage Understand the tools and techniques available to improve supply chain performance Analyse and mitigate risks across the supply chain Identify opportunities for improvements in their respective supply chains Demonstrate competence in the pro-active management of the supply chain

Health and Safety Representatives - Roles and Responsibilities (In-House)

By The In House Training Company

This practical course gives participants a brief overview of a range of legal aspects and also incorporates a topical perspective of health and safety matters in the workplace today. The programme will help elected staff safety representatives to grasp in more detail how to comply with the law in practice. 1 The legal framework Management of Health and Safety at Work Regulations (MHSWR) Safety Representatives and Safety Committees Regulations Representatives' functions H&S Consultation with Employees Regulation HSG 263 2 'The six pack' Management of Health and Safety at Work Regulations (MHSWR) Display Screen Equipment Regulation (DSE) Manual Handling Health, Safety and Welfare Provision and Use of Work Equipment Regulation Personal Protective Equipment Regulation 3 Accident reporting and procedures Reporting Injuries, Diseases and Dangerous Occurrences Regulation (RIDDOR) Accident investigation guidance

Mindfulness - an introduction (In-House)

By The In House Training Company

Mindfulness is a practical technique for developing a greater sense of awareness and focus on the present moment. It is the opposite of mindlessness, meaning that actions and reactions become conscious and deliberate. It is an extremely useful tool for any busy work environment. Currently being used by the likes of Google and Pepsi, mindfulness can be adopted within the workplace to reduce stress and anxiety, provide greater focus and clarity, improve leadership capabilities and enhance the general wellbeing of staff at all levels. This workshop has been developed for forward-thinking organisations wanting to make a real and sustainable commitment to improving workplace wellbeing and productivity. This workshop will help you to understand the basic principles and benefits of mindfulness, and how it can be used in the workplace setting. It will also enable you to develop techniques to alleviate overwhelming feelings of stress or anxiety, prepare for important or challenging meetings, and generally achieve a greater sense of focus, clarity and calm whilst dealing with a hectic schedule.

Eat - Sleep - Work - Repeat (In-House)

By The In House Training Company

Are you struggling with the 'creeping kilograms?' Many of us find that not only has our weight increased over the last few years but the diets either no longer work or become harder and harder to commit to. This session will help you re-evaluate your approach to losing weight and give you the foundations for creating a plan that makes it easy for you to reach and maintain a weight that feels right for you. Take away a tool that will enable you to assess your eating type, whether you are a protein or carbohydrate based eater, and eating style, whether you prefer to be a grazer or three meals a day, and develop an eating plan that works for you. You will have the opportunity to: Explore the myths and reality of losing weight Examine self-defeating eating habits and how to replace them with energy enhancing food Learn about one change you can make today that will not only help you lose weight but improve your ability to think and manage your emotions more constructively

Report writing (In-House)

By The In House Training Company

This very practical session is designed to enable participants to improve the impact, clarity and accuracy of their reports. It focuses equally on the two key areas - structure and writing technique. This course will help participants: Scope reports based on objective and intended readership Write a structured report Use the Fog Index to ensure readability Write grammatically correct and well-punctuated text Review and edit their work. 1 Introduction Objectives and overview Introductions and personal aims 2 What makes a good report? Practical activity and feedback 3 Before you start The planning process and scoping a report Organising information Key report headings What goes where? Writing practice and review 4 Writing tips and techniques Clear English and use of language Grammar and sentence structure Refresher in punctuation Writing in the third person The Fog Index - and how to measure readability 5 Pulling it all together Reviewing and proofing 6 Review Summary of key learning points Action planning

Search By Location

- OV Courses in London

- OV Courses in Birmingham

- OV Courses in Glasgow

- OV Courses in Liverpool

- OV Courses in Bristol

- OV Courses in Manchester

- OV Courses in Sheffield

- OV Courses in Leeds

- OV Courses in Edinburgh

- OV Courses in Leicester

- OV Courses in Coventry

- OV Courses in Bradford

- OV Courses in Cardiff

- OV Courses in Belfast

- OV Courses in Nottingham