- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

CMI Level 6 Certificate in Professional Management and Leadership practice

By School of Business and Technology London

Getting Started The CMI Level 6 Certificate in Professional Management and Leadership Practice is designed for individuals wishing to develop their professional and leadership skills and who will have the knowledge, skills and behaviours to drive business activities in a senior management and leadership role. The CMI Level 6 Certificate in Professional Management and Leadership Practice is a shorter course than the Diploma and ideal for you if you are a practising or aspiring manager in a role such as: Senior Manager Regional Manager Specialist Manager (with expertise in a specific business or technical function such as quality, finance, risk, marketing, sales IT, human resources etc.) Director You'll have a wide range of modules to choose from, and depending on your career goals, you can select the modules that will be most effective for your progression. Key Benefits For learners: Develop professional management and leadership practices Enhance the skills required for the level of responsibility at the senior management level For organisations: Carry out business activities in a senior management and leadership role Provide you with extensive knowledge of management skills focusing on the specific areas appropriate to you and your workplace Key Highlights Are you aspiring for the next Senior Management or Director position that opens up and has a growth mindset? The CMI Level 6 qualification in Professional Management and Leadership Practice offered by the School of Business and Technology London aims at individuals with the knowledge, skills and behaviours to drive business activities in a senior management and leadership role. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our CMI-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide you with comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The CMI Level 6 Professional Management and Leadership Practice can open many career pathways including, but not limited to: Senior Manager - With an estimated salary of £ 75,270 per annum Regional Manager - With an estimated salary of £ 52,379 per annum Specialist Manager With an estimated salary of £56,872 per annum Director - With an estimated salary of £78,867 per annum About Awarding Body Chartered Management Institute established over 60 years ago as the British Institute of Management back then; it has developed the UK's very first diploma in management studies. In the years that followed CMI has consistently been at the forefront of all aspects of management and leadership. Today CMI is the only chartered professional awarding body committed to offering the highest standards in management and leadership excellence. Presently over 100,000 managers use its unique services daily. CMI qualifications aim for managers and leaders at any level, and it remains the only Awarding Body which can award Chartered Manager status - the ultimate management accolade. Employers highly value the qualifications awarded by CMI, and boost your career prospects. What is included? Learn 100% online at your own pace Dedicated support from expert tutors Dedicated Support Desk Portal: You can raise queries, request tutor support and ask for a call back whenever you need guidance and assistance. Elevate Knowledge: Your tutors will provide formative assessment feedback for each module, helping you improve your achievements throughout the program Schedule online personal tutor meetings whenever you want, which will help you get the most out of your studies and provide guidance, support and encouragement 10 months support period 24-hour access to the online learning platform 'MyLearnDirect' Schedule live online classes for each module at your convenience. (Blended learning only) Quality learning resources and study guides developed by CMI-approved tutors. All assessment materials are conveniently accessible through the online learning platform 'MyLearnDirect' Induction: We offer online and flexible learning induction to help you settle in and prepare for your online studies Get Foundation Chartered Manager status upon course completion Access to CMI Management Direct. It has 100,000s of reliable and validated management and leadership resources, including company and industry reports, videos, checklists, E-books, and journals. You have access to CMI Membership and Support for the duration of your study. Assessment For each module you study, you will complete a written assignment of 3000 to 4,000 words and submit it online at your MyLearnDirect learning portal. The submitted assignments will be assessed by your CMI-approved tutor. Entry Requirements This course is designed for practising or aspiring senior managers. You don't need any formal qualifications to study the CMI Level 6 Certificate in Professional Management and Leadership Practice. However, to be eligible for this course, you must: Be 19 years of age and over Have some management experience in the junior, middle or senior level Possess the ability to complete the Level 6 course Our friendly admissions advisors will provide the best advice, considering your needs and goals. Progression Upon successful completion of their qualification, learners are able to progress to further learning within the suite of Level 6 Qualifications in Professional Management and Leadership Practice - i.e. completing an Award and topping-up to Certificate or Diploma. Why gain a CMI Qualification? The CMI Level 6 Certificate in Professional Management and Leadership Practice course is perfect if you are a practising or aspiring senior manager and want to improve your management and leadership skills through effective decision-making and strategic leadership. You will develop professional management and leadership practices and enhance the skills required for the level of responsibility at the senior management level. You may also wish to further your ongoing personal and professional development by accessing other CMI courses, such as the CMI Level 7 courses in Management and Leadership. Studying for a CMI qualification offers you more than just academic standing. When you enrol with us for the CMI Level 6 Certificate in Professional Management and Leadership Practice, you will have access to CMI Membership and Support for the duration of your study alongside your qualification. CMI graduates achieve remarkable things: 72% agree that their CMI qualification gave them a competitive edge in the job application process. 89% agree they use the skills learnt on their accredited qualification in their current role. 88% agree that the accredited qualification gave them good career prospects. Recent CMI graduates earn a median of 28k compared to just 21k for a typical business studies graduate. Employers highly value the qualifications awarded by CMI, and over 80% of managers agree that a CMI qualification is essential to becoming a professional manager. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Professional Management and Leadership Practice Reference No : CMI 601 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the influence of organisational context on management and leadership practice. 2. Understand the practice of professional management and leadership. UNIT2- Developing and Leading Strategy Reference No : CMI 606 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand approaches to developing organisational strategy. 2. Know how to develop and lead operational strategy to achieve a strategic aim. UNIT3- Procurement, Purchasing and Contracting Reference No : CMI 607 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the principles of procurement, purchasing and contracting within organisational contexts. 2. Know how to apply the principles of procurement, purchasing and contracting to achieve an operational requirement. UNIT4- Innovation and Change Reference No : CMI 605 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand innovation and change within an organisational context. 2. Know how to drive innovation and change. UNIT5- Developing, Managing and Leading Individuals and Teams Reference No : CMI 602 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the principles for developing, managing and leading individuals and teams. 2. Know how to develop, manage and lead individuals and teams to achieve results. UNIT6- Organisational Culture Reference No : CMI 603 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the role of culture within organisational contexts. 2. Understand approaches required to make and sustain cultural change. UNIT7- Strategic Programme and Project Management Reference No : CMI 604 Credit : 9 || TQT : 90 LEARNING OUTCOME 1. Understand programmes and project management in an organisational context. 2. Understand factors and approaches for delivering a strategy for a programme or project management. UNIT8- Strategic Corporate Social Responsibility and Sustainability Reference No : CMI 608 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand corporate social responsibility and sustainability in organisational contexts. 2. Know how corporate social responsibility and sustainability is applied in an organisational setting. UNIT9- Leading Quality Management Reference No : CMI 609 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the factors which influence organisational approaches to quality management. 2. Know how to lead quality management to achieve strategic objectives. UNIT10- Principles and Practices of Policy Development Reference No : CMI 610 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the context in which a policy is developed. 2. Know how to develop, implement and evaluate policy. UNIT11- Knowledge Management Reference No : CMI 611 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand knowledge management within organisational contexts. 2. Understand the human and cultural dimensions of knowledge management. 3. Know how to develop a strategy to drive knowledge management in an organisational context. UNIT12- Coaching Skills for Leaders Reference No : CMI 612 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the benefits, types and application of coaching used by leaders. 2. Know the skills, techniques and approaches required by leaders to coach. UNIT13- Leading Equality, Diversity and Inclusion Reference No : CMI 613 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the context for leading equality, diversity and inclusion. 2. Know how to lead equality, diversity and inclusion in an organisational context. UNIT14- Principles and Practices of Ethical Decision Making Reference No : CMI 614 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand ethical decision making within organisational contexts. 2. Know how to make an ethical decision. UNIT15- Managing Stakeholder Relationships Reference No : CMI 509 Credit : 4 || TQT : 40 LEARNING OUTCOME 1. Understand the different types and value of stakeholder relationships. 2. Understand the frameworks for stakeholder management. 3. Know how to manage stakeholder relationships. UNIT16- Managing Risk Reference No : CMI 518 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the scope of business risk management. 2. Understand the process for managing business risk. UNIT17- Managing the Customer Experience Reference No : CMI 522 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the principles of managing the customer experience. 2. Understand the customer journey in the context of an organisation. 3. Know how to manage the customer experience. UNIT18- Using Reflective Practice to Inform Personal and Professional Development Reference No : CMI 525 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the value of reflective practice to inform personal and professional development. 2. Know how to apply reflective practice to inform personal and professional development. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. Management Direct As part of the program, you will get access to CMI Management Direct, which provides a rich foundation of management and resource for students. The Management Direct is packed with content, including: E-Books Articles Leader videos Idea for leaders Models and so much more... How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

CMI Level 7 Certificate In Strategic Management and Leadership Practice

By School of Business and Technology London

Getting Started The CMI Level 7 Certificate in Strategic Management and Leadership Practice is an ideal course for individuals wishing to develop the necessary skills required for effective senior managers and leaders. This CMI Level 7 Certificate course is designed for those desiring to develop strategic management and leadership practices who will have the knowledge, skills and behaviours to drive business activities in a senior, regional, specialist, director or CEO management and leadership role. You will gain the expertise and significantly improve your potential to implement fundamental management and leadership models within an organisation's strategic framework. Depending on your career goals, you will learn various aspects of strategic management and leadership practices. The Level 7 Certificate in Strategic Management and Leadership Practice is a shorter course that will give you key skills and competencies to become a competent manager and deliver effective results for your organisation. You'll have a wide range of modules to choose from, and depending on your career goals, you can select the modules that will be most effective for your progression. Key Benefits Demonstrate to employers that you possess substantial senior management and leadership skills required to drive business activities and achieve organisational success. Develop the professionalism to deliver impact and behave ethically Demonstrate a commitment to continual learning and development Build strategic management and leadership skills to focus on the requirements of embedding the organisation's strategy Provide skills and behaviours to drive core business activities Key Highlights Do you want to develop strategic management and leadership skills and drive business activities in a senior, regional, director or CEO management and leadership role? The CMI Level 7 Strategic Management & Leadership Practice offered by the School of Business and Technology London is the ideal starting point for your career journey. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our CMI-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide you with comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The CMI Level 7 Strategic Management & Leadership Practice can open many career pathways including, but not limited to: Senior Manager - With an estimated average salary of £ 75,270 per annum Regional Manager - With an estimated average salary of £ 52,379 per annum Specialist Manager With an estimated average salary of £56,872 per annum Regional Director, with an estimated average salary of £110,000 per annum Director, with an estimated average salary of £135,397 per annum CEO, with an estimated average salary of £155,000 per annum About Awarding Body Chartered Management Institute established over 60 years ago as the British Institute of Management back then; it has developed the UK's very first diploma in management studies. In the years that followed CMI has consistently been at the forefront of all aspects of management and leadership. Today CMI is the only chartered professional awarding body committed to offering the highest standards in management and leadership excellence. Presently over 100,000 managers use its unique services daily. CMI qualifications aim for managers and leaders at any level, and it remains the only Awarding Body which can award Chartered Manager status - the ultimate management accolade. Employers highly value the qualifications awarded by CMI, and boost your career prospects. What is included? Learn 100% online at your own pace Dedicated support from expert tutors Dedicated Support Desk Portal: You can raise queries, request tutor support and ask for a call back whenever you need guidance and assistance. Elevate Knowledge: Your tutors will provide formative assessment feedback for each module, helping you improve your achievements throughout the program Schedule online personal tutor meetings whenever you want, which will help you get the most out of your studies and provide guidance, support and encouragement 10 months support period 24-hour access to the online learning platform 'MyLearnDirect' Schedule live online classes for each module at your convenience. (Blended learning only) Quality learning resources and study guides developed by CMI-approved tutors. All assessment materials are conveniently accessible through the online learning platform 'MyLearnDirect' Induction: We offer online and flexible learning induction to help you settle in and prepare for your online studies Get Foundation Chartered Manager status upon course completion Fast Track to Chartered Manager status. You will be eligible to apply for Chartered Manager status, the ultimate professional accolade for managers, after completing the course and with 3+ years of experience in a managerial role. Access to CMI Management Direct. It has 100,000s of reliable and validated management and leadership resources, including company and industry reports, videos, checklists, E-books, and journals. You have access to CMI Membership and Support for the duration of your study. Assessment For each module you study, you will complete a written assignment of 3500 to 4500 words and submit it online at your MyLearnDirect learning portal. The submitted assignments will be assessed by your CMI-approved tutor. Entry Requirements This course is designed for practising or aspiring senior managers, regional managers, specialist managers, or directors. You don't need any formal qualifications to study the CMI Level 7 Certificate in Strategic Management and Leadership Practice. However, to be eligible for this course, you must: Be 21 years of age and over Have some management experience in the junior, middle or senior level Possess the ability to complete the Level 7 course Our friendly admissions advisors will provide the best advice, considering your needs and goals. Progression Upon successful completion of their qualification, learners are able to progress to further learning within the suite of Level 7 Qualifications in Strategic Management and Leadership in Practice - i.e. completing the certificate and topping up to the Diploma. Why gain a CMI Qualification? Achieving the globally recognised CMI Level 7 qualification will demonstrate to employers that you possess substantial senior management and leadership skills required to drive business activities and achieve organisational success. The CMI Level 7 Certificate in Strategic Management and Leadership Practice is ideal for senior managers, regional managers, directors and CEOs who want to develop skills to drive business activities and deliver long-term outcomes. With this CMI Level 7 Certificate, you will develop skills and knowledge to manage people, projects, change, services, operations, and strategies for delivering organisational success. You will build your strategic management and leadership skills to focus on the requirements of embedding the organisation's strategy. Upon completing this course, you can progress to further learning within the suite of Level 7 courses in Management and Leadership - i.e. achieving a Certificate and topping up to a Diploma. Studying for a CMI qualification offers you more than just academic standing. When you enrol with us for the CMI Level 7 Certificate in Strategic Management and Leadership Practice, you will have access to CMI Membership and Support for the duration of your study alongside your qualification. You can fast-track to apply for Chartered Manager status, the ultimate professional accolade for managers, after completing the CMI Level 7 Certificate in Strategic Management and Leadership Practice course and with 3+ years of experience in a managerial role. CMI graduates achieve remarkable things: 72% agree that their CMI qualification gave them a competitive edge in the job application process. 89% agree they use the skills learnt on their accredited qualification in their current role. 88% agree that the accredited qualification gave them good career prospects. Recent CMI graduates earn a median of 28k compared to just 21k for a typical business studies graduate. Employers highly value the qualifications awarded by CMI, and over 80% of managers agree that a CMI qualification is essential to becoming a professional manager. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Strategic Risk Management Reference No : CMI 708 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand strategies for managing risk. 2. Know how to develop risk management strategies. UNIT2- Leading Strategic Change Reference No : CMI 705 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand the scope and context of strategic change. 2. Know how to propose a strategy for leading strategic change. UNIT3- Finance for Strategic Leaders Reference No : CMI 706 Credit : 9 || TQT : 90 LEARNING OUTCOME 1. Understand the scope of the Finance function within an organisational context. 2. Understand the role of Finance in strategic decision making. UNIT4- Organisational Design and Development Reference No : CMI 707 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand organisational design and development. 2. Understand how to apply the principles of organisational design and development. UNIT5- Developing Organizational Strategy Reference No : CMI 704 Credit : 9 || TQT : 90 LEARNING OUTCOME 1. Understand how to develop strategy. 2. Know how to develop strategy. UNIT6- Strategic Leadership Reference No : CMI 701 Credit : 11 || TQT : 110 LEARNING OUTCOME 1. Understand the role and context for strategic leadership. 2. Understand the behaviours and skills for strategic leadership. UNIT7- Leading and Developing People to Optimise Performance Reference No : CMI 702 Credit : 10 || TQT : 100 LEARNING OUTCOME 1. Understand the principles for leading and developing people. 2. Understand leadership and development strategy. UNIT8- Collaboration and Partnerships Reference No : CMI 703 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the role of collaboration and partnerships. 2. Know how collaboration and partnerships further organisational success. UNIT9- Strategic Management of Data and Information Reference No : CMI 709 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand the strategic management of data and information UNIT10- Marketing Strategy Reference No : CMI 710 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand the context in which a marketing strategy is developed. 2. Know how to develop a marketing strategy. UNIT11- Entrepreneurial Practice Reference No : CMI 711 Credit : 9 || TQT : 90 LEARNING OUTCOME 1. Understand entrepreneurship in strategic contexts. 2. Understand the principles of entrepreneurial practice. UNIT12- Strategic Management Project Reference No : CMI 712 Credit : 10 || TQT : 100 LEARNING OUTCOME 1. Know how to develop a strategic management project. 2. Know how to conduct a strategic management project. UNIT13- Applied Research for Strategic Leaders Reference No : CMI 713 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the research process 2. Know how to develop a research proposal of strategic benefit. UNIT14- Personal and Professional Development for Strategic Leaders Reference No : CMI 714 Credit : 9 || TQT : 90 LEARNING OUTCOME 1. Understand approaches for personal and professional development. 2. Know how to develop as a strategic leader through personal and professional development. UNIT15- Strategic Approaches to Equality, Diversity and Inclusion Reference No : CMI 715 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand equality, diversity and inclusion at a strategic level. 2. Know how to develop strategic priorities for equality, diversity and inclusion. UNIT16- Strategic Approaches to Mental Health and Wellbeing Reference No : CMI 716 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the impact of managing mental health and wellbeing on organisational performance. 2. Know how to develop a culture of mental health and wellbeing. UNIT17- Strategic Corporate Social Responsibility and Sustainability Reference No : CMI 608 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand corporate social responsibility and sustainability in organisational contexts. 2. Know how corporate social responsibility and sustainability is applied in an organisational setting. UNIT18- Leading Quality Management Reference No : CMI 609 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the factors which influence organisational approaches to quality management. 2. Know how to lead quality management to achieve strategic objectives. UNIT19- Principles and Practices of Policy Development Reference No : CMI 610 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the context in which a policy is developed. 2. Know how to develop, implement and evaluate policy. UNIT20- Coaching Skills for Leaders Reference No : CMI 612 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand the benefits, types and application of coaching used by leaders. 2. Know the skills, techniques and approaches required by leaders to coach. UNIT21- Principles and Practices of Ethical Decision Making Reference No : CMI 614 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand ethical decision making within organisational contexts. 2. Know how to make an ethical decision. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. Management Direct As part of the program, you will get access to CMI Management Direct, which provides a rich foundation of management and resource for students. The Management Direct is packed with content, including: E-Books Articles Leader videos Idea for leaders Models and so much more... How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

English Language IGCSE Distance Learning Course by Oxbridge

By Oxbridge

Unleash the power of English Language to inspire, motivate, and challenge your world view. Embark on our IGCSE English Language course, devised to boost your capability to read, engage with and critically analyse a spectrum of texts. Dive deep into the 20th and 21st-century textual influences and understand how writers impact their readers. Gain proficiency in crafting clear, concise and compelling narratives across diverse styles and text formats, including letters, reports, and interviews. Aiming for accessibility, our course offers a stimulating learning experience suitable for all learners. An English Language IGCSE qualification is a valuable asset across various career paths, given the essential role of written and verbal communication in human connections and comprehension. IGCSEs are a revered qualification in the UK and globally, serving as a significant educational stepping stone for school-leavers. This self-paced, online course adheres to the latest CAIE IGCSE English Language syllabus, allowing you to learn at your leisure and convenience. With unlimited tutor support, a clear induction, and meticulously structured assignments, you'll acquire the knowledge and skills required to excel in the exam. For those undertaking final exams in the UK, we guarantee access to one of our exam centres. Your enrolment includes: Dynamic content based on the latest course specification Fast track option for 2022 exams Access to our partnered exam centres (guaranteed exam venue) Unlimited tutor support, including study plan assistance Exam pass assurance (support until you pass) English Language is a vital skill for careers requiring comprehensive English proficiency and effective written and verbal communication. About the awarding body Awarding body: CAIE Our course code: X803 Qualification code: 0990 Cambridge Assessment International Education is the world's leading provider of international education programmes and assessments, reaching over 8 million learners in more than 170 countries. ⏱ Study Hours Anticipate between 120 and 150 hours of study time, plus additional time for assignment completion. 👩🏫 Study Method Our interactive online learning platform offers diverse media resources, including videos, quizzes, and activities. Materials can be printed for those who prefer physical copies. 📆 Course Duration Enrolment is open, with the course commencing on 01/09/21. You'll receive logins to MyOxbridge before the start date, with access to learning materials and two years of unlimited tutor support from the official start. 📋 Assessment Enrolment for Summer 2022 examinations is now open. Two GCSE standard written exams are required: Paper 1: Reading: 2 hours, 80 marks, 50% of IGCSE. This exam includes structured and extended writing questions based on three reading texts. Paper 2: Writing: 2 hours, 80 marks, 50% of IGCSE. This exam involves extended writing questions and a composition task. Guaranteed exam space in one of our UK exam centres is provided. Assignments throughout the course aid your progress, with tutor feedback provided, though these do not contribute towards your final grade. There is no coursework required. 👩🎓 Course Outcomes Successful completion results in a GCSE in English Language, issued by CAIE. We've selected syllabus (0990) as it is best suited to distance learning. ℹ️ Additional Information Difficulty - Level 2 Entry requirements - A strong command of both spoken and written English is assumed. The course includes reading and analysing texts from the 19th, 20th and 21st centuries. Therefore, this course may not be suitable for non-native English speakers. If in doubt, reach out for guidance. Course Content Explore persuasive and descriptive texts, delve into discursive and narrative texts, and unravel argumentative texts. Strengthen your comprehension and summary skills while examining classic works, such as Mary Shelley's 'Frankenstein', Leo Tolstoy's 'Anna Karenina' and George Orwell's '1984'. Develop your critical reading, evidence-based answering, note-taking, and paraphrasing skills. Deconstruct news articles, identify author bias, recognise linguistic devices, and express your thoughts and ideas fluently.

Spanish GCSE Distance Learning Course by Oxbridge

By Oxbridge

Broaden your horizons with Spanish, the language of over 400 million native speakers worldwide! With a GCSE in Spanish under your belt, you're setting the stage for further education and a range of career options, including journalism, education, marketing, law enforcement, and more! Our comprehensive GCSE Spanish course provides you with the skills to confidently comprehend and communicate in Spanish, covering diverse topics from self-identity and interpersonal relationships to the significance of locale, culture, and societal issues. With unlimited access to your tutor, you'll master grammatically correct writing, effective listening skills, and the creative articulation of your thoughts, ideas, and opinions. Bilingualism is a notable achievement well-regarded by educational institutions and employers alike. Our digital Edexcel GCSE Spanish course is designed for convenience, allowing you to learn at your pace and in your comfort. Your tutor will assist and guide you, as well as provide feedback on your tasks. The course is systematically structured, ensuring you gain the requisite skills and knowledge to ace your exams. By enrolling in this GCSE Spanish course, you will enjoy: Freshly-curated course content, aligned with the latest specifications Fast track option available (for 2022 exams) Complimentary e-textbook to facilitate learning Access to our consortium of exam centres (guaranteed exam venue) Unlimited tutor support – Your tutor will aid in formulating a study plan and provide constant support Exam pass guarantee (We'll support you until you pass). Understanding Spanish opens doors to both professional and social opportunities globally. About the awarding body Awarding body: Edexcel Our course code: X810 Qualification code: 1SP0 Official Qualification Title: GCSE Spanish Edexcel, the largest awarding body in the UK, offers academic and vocational qualifications across the globe. They have been facilitating success through learning for nearly two decades, providing a reliable educational foundation. ⏱ Study Hours Allocate between 120 and 150 hours for study, along with additional time for assignments. 👩🏫 Study Method Our interactive online platform enhances your learning experience with diverse media resources like videos, quizzes, and interactive activities. If you wish, you can print the learning materials yourself. 📆 Course Duration Upon enrolment, you have up to two years to complete your studies and exams, with continued tutor support throughout. 📋 Assessment Examinations are available from Summer 2022 onwards. You will be required to complete three standard GCSE written exams and one speaking assessment. Exams: Paper 1: Listening and understanding – 45 minutes, 25% of GCSE, 50 marks. Paper 2: Speaking – 10-12 minutes, 25% of GCSE, 70 marks. Paper 3: Reading and understanding – 1 hour, 25% of GCSE, 50 marks. Paper 4: Writing – 1 hour 20 minutes, 25% of GCSE, 60 marks. We arrange an assured exam space for you in one of our UK-wide exam centres. Assignments: Throughout the course, you'll complete various assignments. While not contributing towards your final grade, they provide opportunities for feedback and self-assessment. 👩🎓 Course Outcomes Upon successful completion, you'll receive a GCSE in Spanish, issued by Edexcel. We've chosen this syllabus (1SP0) specifically for its suitability to distance learning. ℹ️ Additional Information Official Qualification Title - GCSE Spanish Difficulty - Level 2 Entry requirements - We recommend a basic knowledge of Spanish before starting this course. Course Content From understanding yourself and everyday transactions to discussing significant societal issues and preparing for your exams, this course provides you with a robust foundation in Spanish. The structured course content encompasses self-expression, shopping, daily routines, travel experiences, environmental issues, media, and traditions. In each unit, you'll focus on essential grammatical elements and vocabulary to enhance your language proficiency and cultural understanding. Through this course, you'll emerge well-prepared to excel in your GCSE exams.

French IGCSE Distance Learning Course by Oxbridge

By Oxbridge

Fuel your linguistic ambitions and elevate your fluency in French with our online Edexcel French IGCSE course. Whether you're preparing for A-Level study, planning to navigate foreign territories, or aspiring to make a splash in global business, this course equips you with the skills to communicate effectively and comprehend French with finesse. Enjoy the freedom to explore various topics like lifestyle, holidays, and environmental issues, with the personal attention and limitless assistance of your dedicated tutor. This course empowers you to articulate your thoughts spontaneously, listen to French dialogue, and write with confidence, all in a coherent and fluent manner. Recognise the prestige of being multilingual, a skill cherished by universities, employers, and a multitude of professions such as journalism, marketing, teaching, law enforcement, and many more! Our uniquely designed Edexcel IGCSE course allows you to study online at your own pace, with well-structured topics for efficient learning. Your tutor will offer valuable feedback on assignments and guidance throughout your studies to ensure your exam success. With this IGCSE French course, you will enjoy the following benefits: Course material aligned with the latest specifications, offering engaging and dynamic content. Option for fast track study for 2022 exams. Access to our partnered network of exam centres (exam venue guaranteed). Unending tutor support to help devise your study plan and throughout your studies. Exam pass guarantee (Should you fail the first time, our support continues till you pass). French, the UK's most chosen second language, can be mastered right from the comfort of your home through this IGCSE course, which focuses on both spoken and written aspects. About the awarding body Awarding body: Edexcel Our course code: X811 Qualification code: 4FR1 Official Qualification Title: IGCSE French Edexcel, the UK's largest awarding organisation, has been steering individuals towards success through education for nearly two decades, both in the UK and overseas. It is a globally recognised education and examination body. ⏱ Study Hours Allocate between 120 and 150 hours for studying, plus additional time for completing assignments. 👩🏫 Study Method Our interactive online learning platform delivers the course, offering diverse resources such as videos, quizzes, and interactive activities. Should you prefer, the learning materials can be printed. 📆 Course Duration Upon enrolment, you are given up to two years to complete your studies and exams, with continuous tutor support. 📋 Assessment Enrolment for examinations is open from Summer 2022. You’ll need to complete two standard IGCSE written exams and one speaking assessment. Exams Paper 1: Listening – 30-minute written exam, contributing 25% towards IGCSE, 40 marks Paper 2: Reading and writing – One hour 45-minute written exam, contributing 50% towards IGCSE, 80 marks Paper 3: Speaking – 8-10 minute spoken exam, contributing 25% towards IGCSE, 40 marks Questions in the exam will be multiple-choice, structured, closed short answer, and open response. Your exam centre will be arranged at one of our partnered locations across the UK. Assignments Throughout the course, various assignments will be required. These assignments will not contribute towards your final grade but will allow your tutor to provide feedback and track your progress. These assignments will also be used to provide predicted grades if needed. 👩🎓 Course Outcomes Upon successful completion, you will be awarded an IGC SE in French by Edexcel. This syllabus (4FR1) is specially chosen due to its suitability for distance learning. ℹ️ Additional Information Official Qualification Title - IGCSE French Difficulty - Level 2 Entry requirements - It is highly recommended that you possess a fundamental understanding of French before embarking on this course. Course Content The course content spans across various topics such as home life, school environment, food and health, the media, family, friends, holidays, special occasions, daily life, environmental issues, traditions, education, and future plans. You will also be guided on how to prepare for your speaking, listening, reading, and writing assessments.

Hypnobirthing Journey Of Your Birth (JOY) Hypnobirthing Programme

5.0(26)By The Northern College Of Clinical Hypnotherapy

During pregnancy, hypnotherapy fosters a calm mindset, eases discomfort, and aids in preparing for childbirth (hypnobirthing). By harnessing the power of the mind-body connection, hypnotherapy proves advantageous in alleviating challenges when birthing fostering overall women's health and empowerment.

Module 8 Part 3 Journey Of Your Birth (JOY) Hypnobirthing workshop.

5.0(26)By The Northern College Of Clinical Hypnotherapy

During pregnancy, hypnotherapy fosters a calm mindset, eases discomfort, and aids in preparing for childbirth (hypnobirthing). By harnessing the power of the mind-body connection, hypnotherapy proves advantageous in alleviating challenges when birthing fostering overall women's health and empowerment.

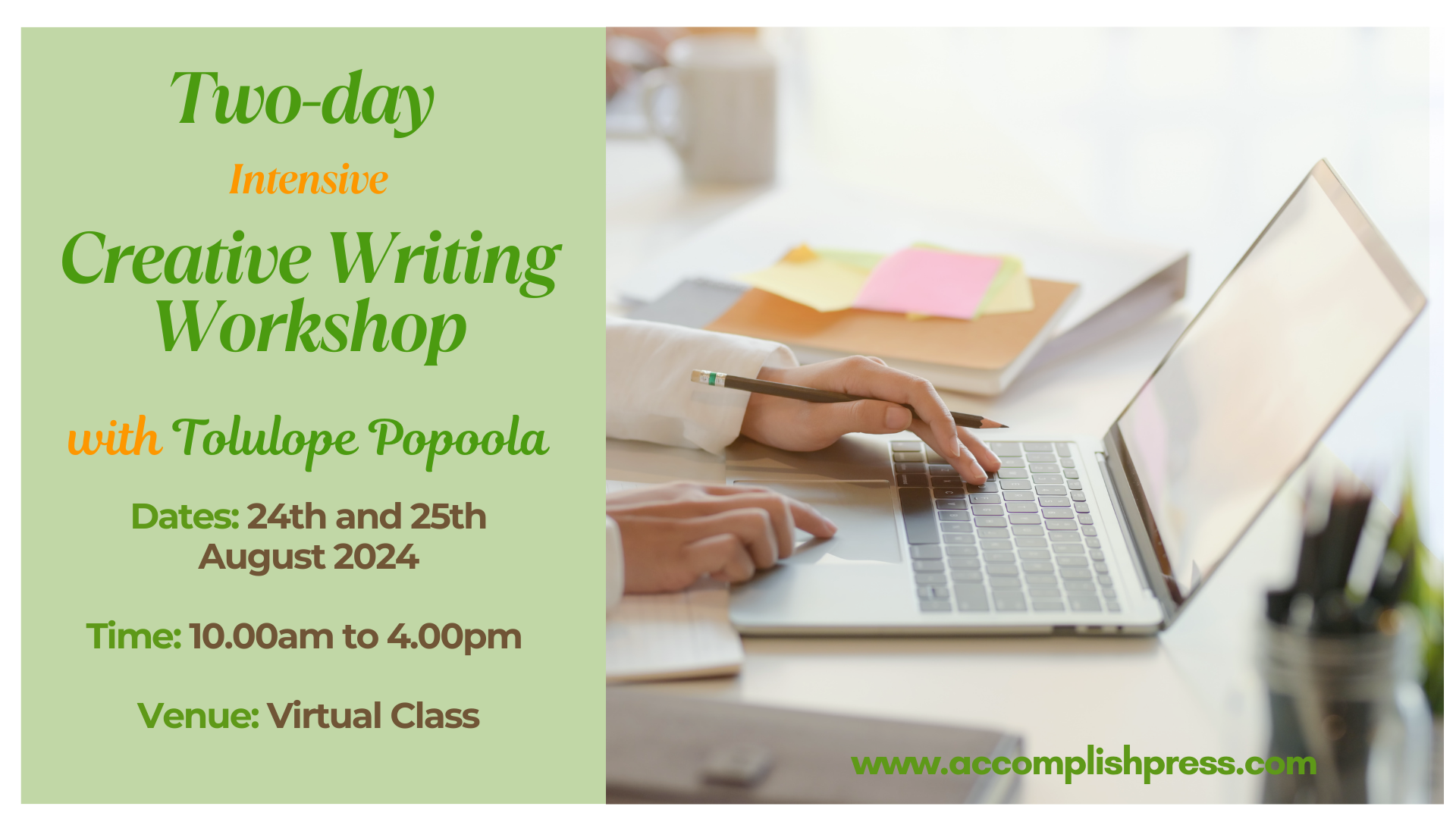

Aspiring author? We know how frustrating it can be to have a brilliant story idea but feel stuck on where to start. The blank page can be intimidating, and finding the time and confidence to write can seem impossible. This Two-Day Creative Writing Workshop is designed specifically for beginners like you, ready to turn your novel dreams into reality! 🚀✍️

Module 5 part 3 PTSD, Trauma & Vagus Nerve stimulation.

5.0(26)By The Northern College Of Clinical Hypnotherapy

In our exploration of hypnotherapy's effectiveness in addressing trauma and PTSD symptoms, we delve into the intricate relationship between traumatic experiences and physiological responses, such as the function of the vagus nerve. Traumatic events can contribute to an overactive vagus nerve, which manifests in symptoms as anxiety, mood changes, nausea, and pain.

Excel Working with Macros

By Underscore Group

Learn how to use Macros in Excel to automate your work and start to see the power these can give you. Course overview Duration: 1 day (6.5 hours) Our Excel – Working with Macros course aims to show how macros can be used to automate commonly used commands and processes. This course is designed for existing experienced users of Excel. You should be confident creating and manipulating Excel spreadsheets and creating formulas before attending this course. Objectives By the end of the course you will be able to: Record and run macros Navigate within the Visual Basic Environment Edit pre-recorded macros Create your own functions Content Recording macros Accessing the Developer Tab Naming conventions and storage locations Recording macros Absolute and relative cell addressing Running macros Assigning macros to the Quick Access Toolbar Assigning macros to objects Creating new tabs Workbook macros Recording macros in a specific workbook Saving the workbook as an Excel Macro-Enabled Workbook Creating quick access items specific to workbooks Importing and manipulating data Importing Delimited Text Files Importing Fixed Width Text Files The Visual Basic environment Project explorer Code window Properties window Renaming modules Deleting modules Working with code Code structure Adding comments Navigating within your code Editing macro code Getting help with syntax Debugging Errors Using debug Function procedures Creating function macros