- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

408 Organisation courses in Cobham

Interview Skills

By Mpi Learning - Professional Learning And Development Provider

Hiring the right staff is one of the most important management and HR skills and it is critical to get it right. This course is designed for managers and HR specialists who either want to improve their interviewing skills or who are just now starting a recruitment role in the organisation.

Writing Policies and Procedures

By SAVO CIC

This half day course is designed to help participants who need to write or revise policies and procedures for their organisations. It will help them to develop effective structures for the writing and design and ensure that they meet key legal and good practice requirements on some of the most important policies such as health and safety, equal opportunities and financial procedures. It will also look at the process of consultation and implementation so that the policies obtain “buy-in” and commitment from staff and volunteers.

SharePoint Training

By FourSquare Innovations Ltd

FourSquare Training specialise in private, corporate SharePoint courses delivered at your premises and tailored to your needs.

AAT Level 3 Certificate in Bookkeeping

By London School of Science and Technology

This qualification will develop complex skills and knowledge necessary to work in a bookkeeping role or to progress to higher level accountancy roles or study. Course Overview This qualification will develop complex skills and knowledge necessary to work in a bookkeeping role or to progress to higher level accountancy roles or study. Students completing this qualification will become competent in financial processes including accounting principles and concepts, advanced bookkeeping and preparing financial statements. They will also be introduced to business issues regarding payroll and value added tax (VAT). Learn enhanced skills and expertise in bookkeeping activities, critical for the smooth and efficient running of all finance departments. The jobs it can lead to: • Professional bookkeeper • Senior bookkeeper • Accounts manager • Ledger manager Entry requirements Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue & Customs. The unit provides students with the knowledge and skills needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principals of payroll. • Report information within the organisation.

ProQual NVQ Level 3 Diploma - Plant Maintenance

By Learning for Hire Limited

NVQ Level 3 Plant Maintenance - on-site assessment - we come to you

AAT Level 2 Certificate in Accounting

By London School of Science and Technology

This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Course Overview This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Students will also learn about accountancy related business and personal skills and be introduced to the four key themes embedded in the qualification: ethics, technology, communications and sustainability. The jobs it can lead to: • Account administrator • Accounts assistant • Accounts payable clerk • Purchase/sales ledger clerk • Trainee accounting technician • Trainee finance assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They’ll use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. Principles of Costing: This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting tasks. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. Learning outcomes: • Understand the cost recording system within an organisation. • Use cost recording techniques. • Provide information on actual and budgeted cost and income. • Use tools and techniques to support cost calculations. The Business Environment: This unit provides knowledge and understanding of key business concepts and their practical application in the external and internal environment in which students will work. Students will gain an understanding of the legal system and principles of contract law and an appreciation of the legal implications of setting up a business and the consequences this may have. This unit will also give an understanding of how organisations are structured and where the finance function fits. Learning outcomes: • Understand the principles of contract law. • Understand the external business environment. • Understand the key principles of corporate social responsibility (CSR), ethics and sustainability. • Understand the impact of setting up different types of business entity. • Understand the finance function within an organisation. • Produce work in appropriate formats and communicate effectively. • Understand the importance of information to business operations. DURATION 170-190 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Power BI Training

By FourSquare Innovations Ltd

FourSquare Training specialise in private, corporate Power BI courses delivered at your premises and tailored to your needs.

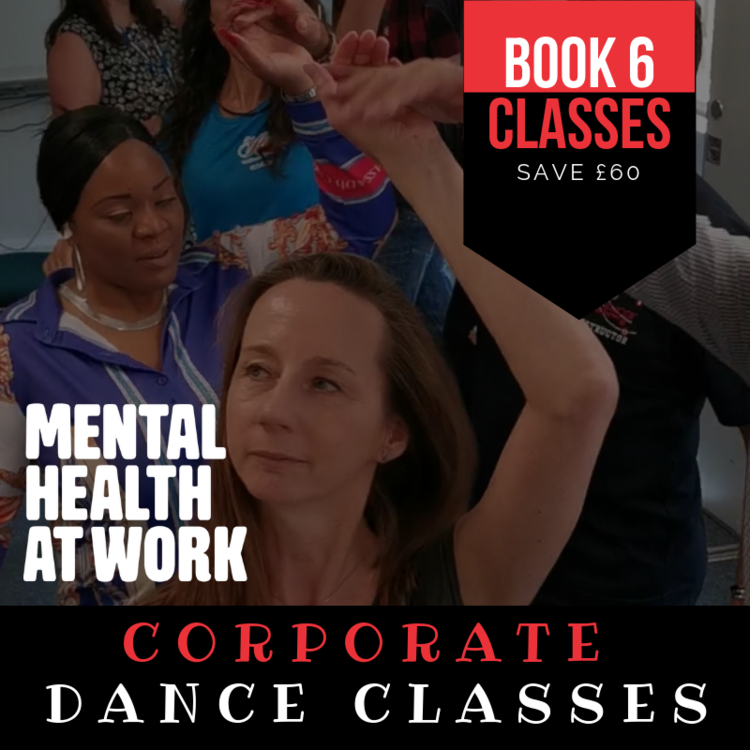

HOW DANCING CAN IMPROVE YOUR MENTAL AND PHYSICAL HEALTH Move your body to your favourite tunes – it’s the ultimate feel-good exercise and has some surprising effects on both the body and mind Music and dance have been fundamental parts of the human experience for thousands of years. No matter what your favourite tune may be, music can have a huge effect on your wellbeing – Charles Darwin even thought that our ability to make and understand rhythmic beats worked as an early form of communication. Whether or not we still share messages through music, we all know that it can change our mood and studies have shown that we share a natural sense of rhythm (no matter how much you might protest). Dance is therefore a natural outlet, and one which can do a lot to make us feel good. Club Azucar offers corporate dance packages for the workplace in order for your organisation (Companies, Institutions & Schools) not only function at its best, but to be happy and healthy in life. These are the expected benefits for the individual employee which have been also confirmed by the participants: Physical Health: Salsa/Zumba or any Latin Dance Classes improves mobility, coordination / motor skills and fitness level.while being a low-impact exercise which includes people of all ages, abilities and fitness levels Mental Health: Dancing requires full concentration so for one hour away from their desk ,participants will experience reduced stress levels, , feel refreshed and more alert and able to concentrate better following the lesson Music in combination with physical exercise has an uplifting effect through the release of endorphins and dopamine in the body & brain Learning a new skill is proven to train your brain, contribute to prevention of dementia and give the confidence to face new tasks and challenges in other areas of work and life The patience and encouragement of the teachers has furthered this new confidence and sense of achievement and contributed to participants’ belief in themselves and their ability to take themselves out of their “comfort zones” and take on new challenges Getting to know each other in a social rather than work context and learning a new skill together, dancing and laughing together, gives participants a sense of belonging and furthers team buildingDo you want more proof? Get involved and hire us!!! Booking Terms & Conditions 1. The above prices are only for Greater London 2. Fees are non refundable 3. Courses are subject to availability from both parties 4. Train, plane. petrol, or any sort of transport fares are to be refunded. 5. Cancellation must be before 24 hours every class

Level 2 NVQ Diploma in Groundworks Operations

By Dynamic Training and Assessments Ltd

Level 2 NVQ Diploma in Groundworks Operations

Level 3 Endorsed Award in Delivering Health and Social Care Training (Healthcare Train the Trainer)

By Guardian Angels Training

Gain expertise in healthcare training with our Level 3 Endorsed Award in Delivering Health and Social Care Training. Our comprehensive program equips you with the skills and knowledge to become a proficient trainer in the healthcare sector.

Search By Location

- Organisation Courses in London

- Organisation Courses in Birmingham

- Organisation Courses in Glasgow

- Organisation Courses in Liverpool

- Organisation Courses in Bristol

- Organisation Courses in Manchester

- Organisation Courses in Sheffield

- Organisation Courses in Leeds

- Organisation Courses in Edinburgh

- Organisation Courses in Leicester

- Organisation Courses in Coventry

- Organisation Courses in Bradford

- Organisation Courses in Cardiff

- Organisation Courses in Belfast

- Organisation Courses in Nottingham