- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

33 Options Trading courses

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

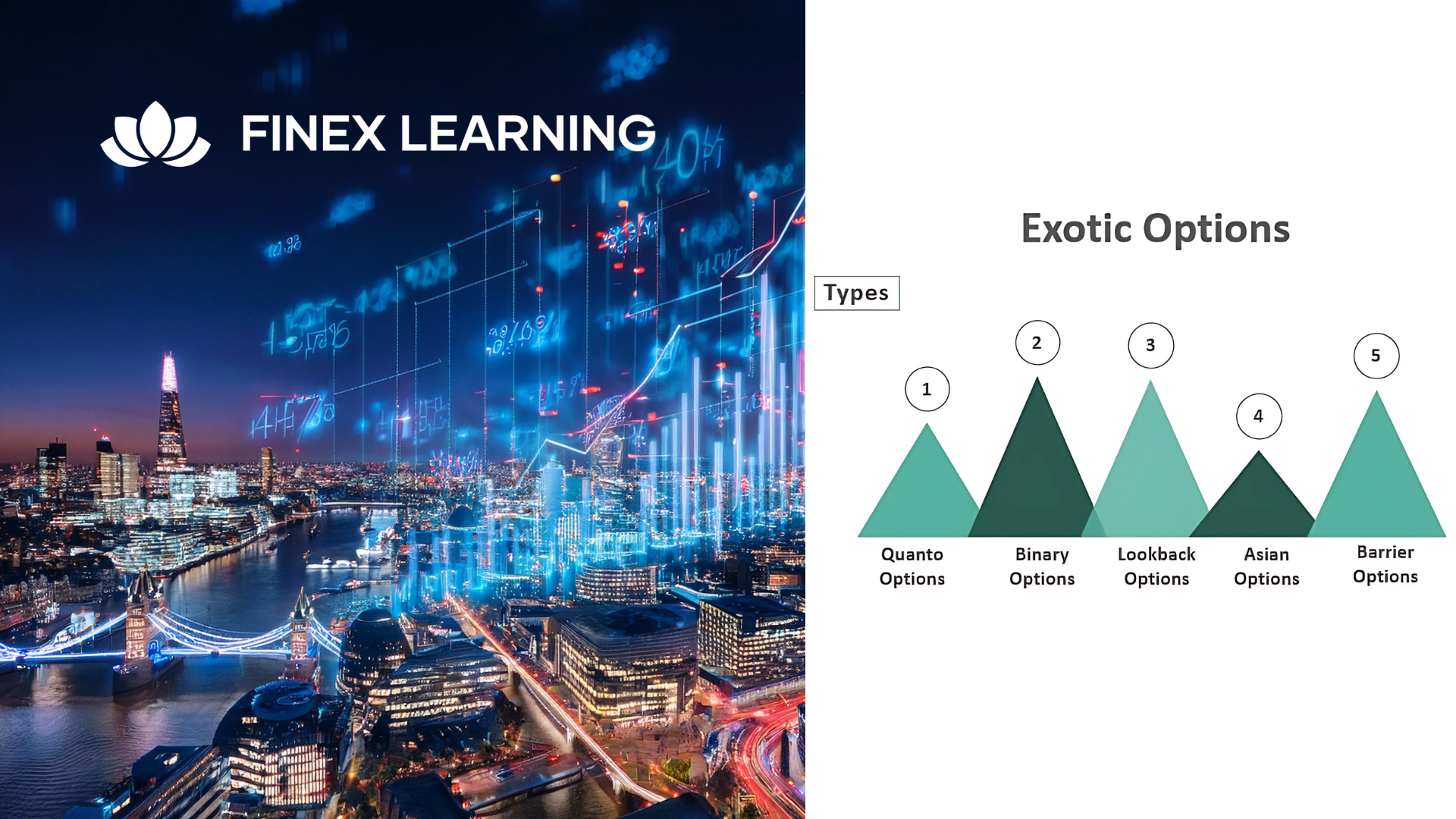

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Course overview Trading becomes more manageable and profitable when market prices are predicted. Technical analysis helps traders identify market trends. It provides valuable evidence that traders can use to determine their organization's strengths and shortcomings and make informed decisions to improve business performance. In this Trading & Investing With Technical Analysis Masterclass course, you will learn the fundamentals of technical analysis for successful investing and trading. The course covers essential information on approaching technical analysis using charts, candlesticks, volumes and other indicators. In addition, you will learn how to read price actions for trading and explore the trading strategies for reducing investment risk and increasing returns. Successful Traders prepare ahead of time and don't lose money. Enroll right now! Learning outcomes Deepen your understanding of technical analysis Learn about candlestick patterns and analysis Strengthen your knowledge of technical analysis chart patterns Be able to read a trading chart Learn about price action trading Have a thorough grasp of the technical trading strategies Who Is This Course For? Anyone interested in gaining the relevant skills in technical analysis for successful investing and trading can take this Trading & Investing With Technical Analysis Masterclass course. Entry Requirement This course is available to all learners of all academic backgrounds. Learners should be aged 16 or over. Good understanding of English language, numeracy and ICT skills are required to take this course. Certification After you have successfully completed the course, you will obtain an Accredited Certificate of Achievement. And, you will also receive a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy for £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why Choose Us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos and materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; United Kingdom & internationally recognized accredited qualification; Access to course content on mobile, tablet and desktop from anywhere, anytime; Substantial career advancement opportunities; 24/7 student support via email. Career Path The Trading & Investing With Technical Analysis Masterclass course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Trading Executive Trading Assistant Trading Operations Analyst Investment Analyst Technical Analysis Masterclass for Trading & Investing Introduction Introduction 00:02:00 Unit 01: Introduction to Technical Analysis 1.1 Technical Analysis 00:01:00 Unit 02: Candlestick Patterns and Analysis 2.1 Candlestick Charts 00:05:00 2.2 Anatomy of Candlesticks 00:04:00 2.3 Demand and Supply in Candlestick Pattern 00:08:00 2.4 Support and Resistance 00:12:00 2.5 Standard Doji 00:05:00 2.6 Dragonfly Doji 00:03:00 2.7 Gravestone Doji 00:06:00 2.8 Engulfing Candles 00:08:00 2.9 Morning & Evening Stars 00:09:00 2.10 Hammer & Hanging Man Candles 00:07:00 2.11 Mat Hold Pattern 00:05:00 2.12 3-Methods Pattern 00:06:00 2.13 Gaps Between Candlesticks 00:03:00 2.14 Gap Close Reversal Strategy 00:05:00 Unit 03: Trade and Investment Chart Patterns 3.1 Trendlines 00:04:00 3.2 Head and Shoulders Pattern: H&S 00:06:00 3.3 Inverse Head & Shoulders Pattern: IH&S 00:02:00 3.4 Bull Flag 00:03:00 3.5 Bear Flag 00:03:00 3.6 ABCD Pattern 00:05:00 3.7 Pattern Practice 00:04:00 Unit 04: Volume Analysis 4.1 Volume 00:07:00 4.2 Adding Volume Indicators On Charts 00:07:00 4.3 Using VWAP: Volume Weighted Average Price 00:11:00 4.4 Using OBV: On-Balance Volume 00:06:00 4.5 Volume Profile 00:08:00 4.6 Supply & Demand In Volume 00:09:00 4.7 Stock Breakouts & Volume 00:05:00 4.8 Volume Exhaustion 00:07:00 4.9 Analysis and Example 00:08:00 Unit 05: Tape Reading Strategies 5.1 Level1 vs. Level2 00:03:00 5.2 Supply & Demand In The Tape 00:06:00 5.3 Time & Sales 00:03:00 5.4 Tape Reading 00:02:00 5.5 The Importance Of Tape Reading 00:03:00 5.6 Hidden Buyers 00:11:00 5.7 Hidden Sellers 00:09:00 5.8 Fakeouts & Manipulation Tactics 00:05:00 5.9 Identifying Reversals With The Tape 00:08:00 Unit 06: Technical Trading Strategies 6.1 Managing Risk 00:05:00 6.2 Breakout Trading Strategy 00:09:00 6.3 Momentum Trading Strategy 00:08:00 Unit 07: Trading Platform and Practice 7.1 Setting Up Trading Platform 00:30:00 7.2 Risk Free Trading Strategies 00:07:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on single name CDS, index CDS and index CDS options and how to use them to express views and hedge risks in credit markets Who the course is for Consultants Analysts Managers C-Level executives People in need of knowledge to develop a blockchain strategy People working with blockchain projects Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales Product control Research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Stock Trading: Forex Trading Technical Analysis and Strategies

By Training Tale

Stock Trading: Stock Trading Course Revolutionize your financial landscape with Stock Trading! Stock Trading opens doors to unparalleled wealth-building opportunities. Dive into the dynamic world of Stock Trading and witness your investments thrive. Maximize returns, embrace market fluctuations, and empower your portfolio. Elevate your financial game - Stock Trading is your key to a prosperous tomorrow! Special Offers of this Stock Trading: Stock Trading Course This Stock Trading: Stock Trading Course includes a FREE PDF Certificate. Lifetime access to this Stock Trading: Stock Trading Course Instant access to this Stock Trading: Stock Trading Course Get FREE Tutor Support from Monday to Friday in this Stock Trading: Stock Trading Course Main Course: Diploma in Stock Trading Other 2 courses that are included with our Stock Trading: Stock Trading Course Course 01: Level 5 Diploma in Business Analysis Course 02: Level 7 Business Management Course Other Benefits of Stock Trading: Stock Trading Course Free 03 PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [Note: A free PDF certificate will be provided as soon as the Stock Trading: Stock Trading Course is completed] Stock Trading: Stock Trading Industry Experts Designed this Stock Trading: Stock Trading Course into 09 detailed modules. Main Course Detailed Curriculum of Diploma in Stock Trading Module 01: An Overview of Forex Trading Module 02: Major Currencies and Market Structure Module 03: Different Types of Foreign Exchange Market Module 04: Managing Money Module 05: Fundamental Analysis Module 06: Technical Analysis Module 07: Drawbacks and Risks Module 08: Risk Management Module 09: Trading Mindset Assessment Method of Stock Trading After completing each module of the Stock Trading: Stock Trading course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of Stock Trading After completing the MCQ/Assignment assessment for this Stock Trading: Stock Trading course, you will be entitled to a Certificate of Completion from Training Tale which is completely free to download. Who is this course for? Stock Trading: Stock Trading This Stock Trading: Stock Trading course will benefit anyone interested in learning how to trade the FOREX market. Requirements Stock Trading: Stock Trading Students who intend to enroll in this Stock Trading: Stock Trading course must meet the following requirements: Stock Trading: Good command of the English language Stock Trading: Must be vivacious and self-driven. Stock Trading: Basic computer knowledge Stock Trading: A minimum of 16 years of age is required. Career path Stock Trading: Stock Trading This Stock Trading: Stock Trading course was designed to be educational and may be useful for the following professions: - Forex Trader, Stock Market Investor, and Financial Advisor. Certificates Certificate of completion Digital certificate - Included

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Our Aim Is Your Satisfaction! Offer Ends Soon; Hurry Up!! Are you looking to improve your current abilities or make a career move? Our unique Trading course might help you get there! Expand your expertise with high-quality training - study the Trading course and get an expertly designed, great-value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the Trading online training course. The Trading course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Trading course, an instant e-certificate will be exhibited in your profile that you can order as proof of your skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling in this Trading course. This Trading training can help you to accomplish your ambitions and prepare you for a meaningful career. So, enrol on this Trading course today and gear up for excellence! Why Prefer This Trading Course? Opportunity to earn a certificate accredited by CPDQS. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and Engaging Content. Free Assessments 24/7 Tutor Support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Trading course: Module 01: Welcome & Introduction Module 02: Opening Your Trading / Broker Account Module 03: Getting Familiar with Economic News Module 04: Trading the News Module 05: Setting yourself up like a Pro-Trader Module 06: Placing The Trade Module 07: Risk Managing Your Trades Module 08: Your On-going Support Module 09: Conclusion BONUS VIDEOS! How to predict the largest movements from news Understanding & trading market turmoil successfully! Student Interviews! Student Interview #1 - Paul, UK Student Interview #2 - Jean, South Africa Student Interview #3 - Gavin, UK Student Interview #4 - Connor, Australia Student Interview #5 - Lourens, South Africa Trade Examples BONUS TRAINING - USING CORRELATIONS TO YOUR ADVANTAGE!_2 Assessment Process Once you have completed all the modules in the Trading course, you can assess your skills and knowledge with an optional assignment. CPD 15 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Trading course. This course is open to everybody. Certificates CPD Accredited Certificate Digital certificate - £10 CPD Accredited Certificate Hard copy certificate - £29 If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Overview A review of the most enduringly popular structured equity-linked products. This 1 day hands-on programme will help you gain familiarity with 1st generation & 2nd generation structured products convexity – and their applications. Discover techniques for maximising the participation rate to enhance returns for investors. Explore the trade-offs between coupon payments and gearing, and how they affect the risk-return profile of the notes. Explore ladder structures, their relationship to lookbacks, and the benefits they offer to investors. Learn about accumulators, their structuring, and the reasons behind their controversy in the market. Who the course is for Structured Products Desks, Financial Engineers, Product Controllers Traders, Dealing Room Staff and Sales People Risk Managers, Quantitative Analysts and Middle Office Managers Fund Managers, Investors, Senior Managers Researchers and Systems Developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Options Trading Courses in London

- Options Trading Courses in Birmingham

- Options Trading Courses in Glasgow

- Options Trading Courses in Liverpool

- Options Trading Courses in Bristol

- Options Trading Courses in Manchester

- Options Trading Courses in Sheffield

- Options Trading Courses in Leeds

- Options Trading Courses in Edinburgh

- Options Trading Courses in Leicester

- Options Trading Courses in Coventry

- Options Trading Courses in Bradford

- Options Trading Courses in Cardiff

- Options Trading Courses in Belfast

- Options Trading Courses in Nottingham