- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Course Details Any persons carrying out non-licensed works with asbestos containing materials, as laid down in CAR 2012, Reg 3(2). This would normally include, but is not limited to, trade operatives such as demolition workers, construction workers, general maintenance staff, electricians, plumbers, gas fitters, painters and decorators, joiners, shop fitters, plasterers, roofers, heating and ventilation engineers, telecommunication engineers, computer installers, fire and burglar alarm installers, architects, building surveyors and other such professionals or any other persons likely to disturb and carry out work on asbestos containing materials as defined in CAR 2012.

The “ISO 14298:2021 Lead Implementer Course” is designed to provide participants with the knowledge and skills necessary to lead the implementation of a Security Printing Management System based on ISO 14298:2021. This comprehensive course covers the key principles, requirements, and best practices for establishing and maintaining an effective security printing management system. Participants will learn how to develop, implement, and manage processes that comply with the ISO 14298 standard.

AAT Level 4 Professional Diploma in Accounting

By Osborne Training

AAT Level 4 Professional Diploma in Accounting AAT Level 4 is the highest level or final stage of the AAT Accounting qualification. This qualification provides the skills necessary for a 'Finance Officer' role including the complex management accounting tasks, general management skills, drafting financial statements and specialist learning areas. This provides you with an opportunity to become a professional member of AAT and use MAAT after your name. You are also entitled to exemptions in the UK's chartered and certified accounting qualifications. Besides, if you want to pursue your career further in University, you are entitled to exemptions for up to two years in various universities in the UK. You will be awarded âAAT Level 4 Professional Diploma in Accounting certificateâ from the Association of Accounting Technicians (AAT), once you have passed all the professional-level qualification exams and skill tests. Once you finish Level 4 you become a professional member of AAT and you may use MAAT after your name to stand out from the crowd as an officially Accredited Accountant. What you will gain? Here you'll learn how to draft financial statements for limited companies, perform complex management accounting tasks and develop your own management skills, perform tax calculation for business & individuals and other specialist learning areas. The Level 4 Professional Diploma in Accounting covers the following areas: Management Accounting: Budgeting Management Accounting: Decision and Control Financial Statements of Limited Companies Accounting Systems and Controls Business Tax Personal Tax

Working with Elected Members (In-House)

By The In House Training Company

It is important for Officers to understand the roles and responsibilities, processes and procedures involved when working with Elected Members. They also need to appreciate the significance of Elected Members as the decision-makers in local government. Officers have a responsibility to work and communicate with Elected Members effectively. This very successful course is designed to help Officers with this. Note: this is very much an indicative outline. The programme is tailored to the needs of each particular organisation. To provide managers with the knowledge and understanding they need to have productive working relationships with Elected Members and provide appropriate support. By the end of the course participants will: Understand the roles, responsibilities, processes and procedures in place for working with Elected Members Be able to identify the best way to approach potentially sensitive issues Understand the skills and behaviours required for working effectively with Members Be able to deploy their influencing skills more successfully Review their learning and have an action plan to take back and implement at work Note: this is very much an indicative outline. The programme is tailored to the needs of each particular organisation. 1 Introduction Welcome and introductions Objectives and programme overview 2 Working in a political environment What is political awareness? Contact and experience with Members Importance of the role of Members 3 Why be an Elected Member? Perceptions of what Elected Members are and do Values of Members and their motivations for doing what they do 4 Political decision-making in local government Current challenges and drivers affecting the organisation / the council Roles and responsibilities of Officers and Members Centrality of Members' strategic role 5 (Option) A day in the life of an Elected Member An Elected Member gives a talk about what they do 6 Having a beneficial relationship between Officers and Members 7 Member / Officer communication Discussion of the formal processes, service procedures, etc (whether enshrined in a protocol, Memorandum of Understanding, etc) Response times and requirements Procedures required by Heads of Service [if appropriate] 8 Influencing styles and strategies Different forms of power and how they impact Developing an appropriate 'influencing style' Exploring strategies for improving communication and influencing at work 9 Review and evaluation Review and evaluation of learning Personal action plans

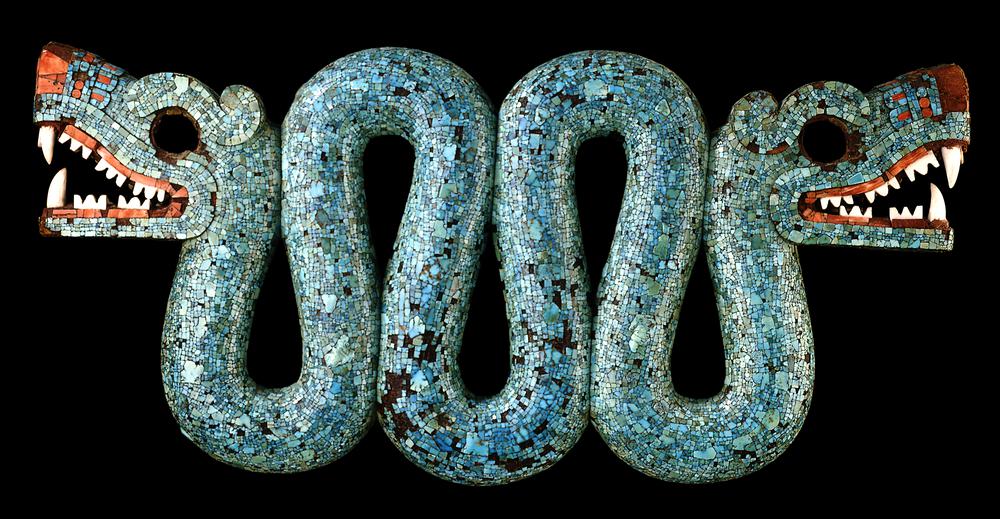

DATE: Friday 2nd February TIME: 4pm (meeting at school reception) BOOKING DEADLINE: Noon on 19th January On Friday 2nd February, we will have a school visit to the British Museum, the first of several extra-curricular trips we are looking to arrange in the coming terms. Whilst some of these trips will have a focus on Film & Television, others will be about other general interests, giving you a chance to get to know London and its rich cultural offerings. This trip to the British Museum will include a tour of various significant relics from across the world and human history, organised and led by Conrad, our Student Services Officer. Ideal for both first-timers and those that have been before and want to learn a bit more. We will meet in the School Reception at 3:50pm that day and then head over together at 4 o'clock. It is direct on the Northern Line and then a short walk to the museum. Once inside you are free to take the tour we have organised or explore on your own should you wish. Once the tour is complete people are welcome to stick around and explore more, have relaxed drinks in a nearby pub or head home, whatever you prefer. ONE TICKET PER PERSON, PLEASE DO NOT BOOK MORE THAN ONCE ONTO THIS EVENT. ONLY BOOK IF YOU ARE PLANNING ON ATTENDING. IF YOU ARE UNABLE TO MAKE IT, PLEASE LET US KNOW. This is a FREE TRIP that you will not need to pay for but must be booked in advance. There is a limit of 15 tickets in total for the tour and it will be first come, first served. You will not be able to join the tour if you do not have a pre-booked ticket. The deadline to book onto this tour is midday on the 19th January.

Accounting Courses | Total Accounting | CPD Training

By Osborne Training

Total Accounting Courses It is a comprehensive practical accountancy training programme designed to build the bridge between knowledge and practical aspects of accounting and tax. With this programme various modules of tax and accounting are covered as well as Computerised based Accounting & Payroll. After completion of the modules you will have the chance to get hands on practical work experience which will open the door for lucrative Accounting, Tax & Payroll sector. Duration Accountancy Training: 10-12 Weeks (Weekdays/weekend/Evening) Accounting Work Experience 3 Months after the training You can start anytime of the year. The training takes place once each week. Once you finish your training modules then you can start job placement. What accounting jobs will I qualify for? Tax advisor Tax consultant Payroll Consultant Finance Officer Financial Accountant In these roles, you could earn up to £42,000 per annum (source: reed Salary Checker, UK Only). Benefits for Trainees Completion of this training will open new doors to exciting careers, as well as extending current skills if you are currently employed Free Job Placement(optional) Start your own accountancy Practice Work in a wide range of businesses Update your knowledge on tax and accountancy Improve your employability prospects A career path into tax and accountancy Ideal Continuing Professional Development course Gain a qualification to boost your CV Start your training soon without having to wait long for the new term to begin Free Tablet PC when paying in full upfront Gain Verifiable CPD Units Accounting Courses Contents Advanced Excel Bookkeeping VAT Training - Preparation and Submission Personal Tax Return Training Company Accounting and Tax Training Sage 50 Accounting Training Sage Payroll Training Accounting work experience (optional)

Wound Management for HCAs

By M&K Update Ltd

An opportunity to develop knowledge and skills for wound management, infection control and removing skin closure devices.

Dermatology for HCAs

By M&K Update Ltd

A course for Healthcare Assistants, designed to give a broader understanding of anatomy and physiology of the skin and giving ability in recognising lesions, lumps and bumps.

Assisting with Medical Procedures for HCAs

By M&K Update Ltd

Includes assisting in minor surgery and chaperone training for invasive medical procedures. This course explores the role of Healthcare Support Workers assisting registered medical practitioners in caring for people undergoing minor medical procedures.

Ear Care Workshop for HCAs

By M&K Update Ltd

A practical ear care course for Healthcare Support Workers. Develop safe practice in ear irrigation (syringing) which attracts a high level of litigation.

Search By Location

- Officer Courses in London

- Officer Courses in Birmingham

- Officer Courses in Glasgow

- Officer Courses in Liverpool

- Officer Courses in Bristol

- Officer Courses in Manchester

- Officer Courses in Sheffield

- Officer Courses in Leeds

- Officer Courses in Edinburgh

- Officer Courses in Leicester

- Officer Courses in Coventry

- Officer Courses in Bradford

- Officer Courses in Cardiff

- Officer Courses in Belfast

- Officer Courses in Nottingham