- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4528 National courses

The Powerboat Instructor course aims to provide candidates with the necessary skills and knowledge required to instruct the RYA National Powerboat Scheme in a safe and effective way. The course duration is 3 days and comprises both practical and theoretical training scenarios where candidates are expected to deliver short training sessions. These sessions aim to develop the candidates personal skills and teaching ability in the safety of the training environment. The course does focus on teaching you how to instruct. You will learn effective methods of instructing and coaching, how to debrief, and how to structure the courses. We do revise the skills you will need to teach, but you will need to be proficient on a power boat to do this course. All potential Powerboat Instructors are required to complete a 1 day pre-assessment course to assess your personal boat handling skills. This assessment must be completed within the 3 months prior to the commencement of your Powerboat Instructor course. Course Pre-Requisites To do this course you will need to have completed Pre-Assessment. You will also need the following certificates: Valid First Aid Certificate, RYA Powerboat Level 2, RYA VHF Short Range Certificate. You will need to have 5 years powerboating experiencing (or one season full time). The minimum age of this course is 16 years old. Ideally you will have a familiarity with a range of craft giving you a wide range of knowledge of powerboats. Your theory knowledge should be at RYA Day Skipper Theory level, and we would recommend holding the certificate. RYA Instructor Training At Torbay Sea School we have trained many RYA Instructors who have gone on to instruct with us, other RYA training centres or as freelance instructors. During the course of your general RYA training you will have gained all the skills necessary to sail, motor or power boat with confidence to a high standard. The following courses consolidate all those skills and give you the tools required to instruct others to gain their RYA qualifications. You will be able to utilise our Instructors experience and our boats/equipment to feel at ease with instructing others.

Give a compliment to your career and take it to the next level. This Wages & Benefits: Understanding Payroll Management will provide you with the essential knowledge and skills required to shine in your professional career. Whether you want to develop skills for your next job or want to elevate skills for your next promotion, this Wages & Benefits: Understanding Payroll Management will help you keep ahead of the pack. The Wages & Benefits: Understanding Payroll Management incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can reinforce your professional skills and essential knowledge, reaching out to the level of expertise required for your position. Further, this Wages & Benefits: Understanding Payroll Management will add extra value to your resume to stand out to potential employers. Throughout the programme, it stresses how to improve your competency as a person in your profession while at the same time it outlines essential career insights in this job sector. Consequently, you'll strengthen your knowledge and skills; on the other hand, see a clearer picture of your career growth in future. By the end of the Wages & Benefits: Understanding Payroll Management, you can equip yourself with the essentials to keep you afloat into the competition. Along with this Wages & Benefits: Understanding Payroll Management course, you will get 10 other premium courses. Also, you will get an original Hardcopy and PDF certificate for the title course and a student ID card absolutely free. This Wages & Benefits: Understanding Payroll Management Bundle Consists of the following Premium courses: Course 01: Wages & Benefits Course 02: Pension UK Course 03: Law and Contracts - Level 2 Course 04: Level 3 Tax Accounting Course 05: Payroll Management - Diploma Course 06: Employment Laws & Recruitment Process 2020 - Level 3 Course 07: Sage 50 Training Course 08: Xero Course 09: Virtual Interviewing for HR Course 10: Microsoft Excel Level 3 Course 11: Time Management As one of the top course providers in the UK, we're committed to providing you with the best educational experience possible. Our industry experts have designed the Wages & Benefits: Understanding Payroll Management to empower you to learn all at once with accuracy. You can take the course at your own pace - anytime, from anywhere. So, enrol now to advance your career! Benefits you'll get choosing Apex Learning for this Wages & Benefits: Understanding Payroll Management: One payment, but lifetime access to 11 CPD courses Certificate, student ID for the title course included in a one-time fee Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative modules taught by expert instructors Learn at your ease - anytime, from anywhere Study the course from your computer, tablet or mobile device CPD accredited course - improve the chance of gaining professional skills How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) If you want to get hardcopy certificates for other courses, generally you have to pay £20 for each. But this Fall, Apex Learning is offering a Flat 50% discount on hard copy certificates, and you can get each for just £10! P.S. The delivery charge inside the U.K. is £3.99 and the international students have to pay £9.99. Curriculum of Wages & Benefits: Understanding Payroll Management Bundle Course 01: Wages & Benefits Basics of Employment Law National Minimum Wage & National Living Wage Parental Rights, Sick Pay, & Pension Scheme Health & Safety at Work Course 02: Pension UK Module 01: Overview of the UK Pension system Module 02: Type of Pension Schemes Module 03: Pension Regulation Module 04: Pension Fund Governance Module 05: Law and Regulation of Pensions in the UK Module 06: Key Challenges in UK Pension System Course 03: Law and Contracts - Level 2 Module 01: Introduction to UK Laws Module 02: Ministry of Justice Module 03: Agreements and Contractual Intention Module 04: Considerations and Capacities of Contact Laws Module 05: Terms within a Contract Module 06: Misinterpretations and Mistakes Module 07: Consumer Protection Module 08: Privity of Contract Module 09: Insurance Contract Laws Module 10: Contracts for Employees Module 11: Considerations in International Trade Contracts Module 12: Laws and Regulations for International Trade Module 13: Remedies for Any Contract Breach Course 04: Level 3 Tax Accounting Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 10: Management Accounting and Financial Analysis Module 11: Career as a Tax Accountant in the UK Course 05: Payroll Management - Diploma Sage 50 Payroll for Beginners Payroll Basics Company Settings Legislation Settings Pension Scheme Basics Pay Elements The Processing Date Adding Existing Employees Adding New Employees Payroll Processing Basics And Many More... Sage 50 Payroll Intermediate Level The Outline View and Criteria Global Changes Timesheets Departments and Analysis Holiday Schemes Recording Holidays Absence Reasons Statutory Sick Pay And Many More... Course 06: Employment Laws & Recruitment Process 2020 - Level 3 Module 01: Basic of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Employee Handbook Module 05: Disciplinary Procedure Module 06: National Minimum Wage & National Living Wage Module 07: Parental Right, Sick Pay & Pension Scheme Module 08: Discrimination in the Workplace Module 09: Health & Safety at Work Module 10: Dismissal, Grievances and Employment Tribunals Module 11: Workplace Monitoring & Data Protection Course 07: Sage 50 Training Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Advanced Diploma Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 08: Xero Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 09: Virtual Interviewing for HR Module 1: An Introduction to Virtual Interviewing Module 2: Interviewer's Perspective Module 3: Interview Preparation Module 4: Picking a Tech to Use Module 5: Attract and Hire the Best Talents Module 6: Final Thoughts and Onboarding Course 10: Microsoft Excel Level 3 Microsoft Excel 2019 New Features Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks Using Lookup Functions and Formula Auditing Sharing and Protecting Workbooks Automating Workbook Functionality Creating Sparklines and Mapping Data Forecasting Data Excel Templates Course 11: Time Management Identifying Goals Effective Energy Distribution Working with Your Personal Style Building Your Toolbox Establishing Your Action Plan CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Wages & Benefits: Understanding Payroll Management bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future. Requirements Our Wages & Benefits: Understanding Payroll Management is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various expertise will increase the value in your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

Employment Law - Mega Bundle

By Imperial Academy

Level 5 Diploma(FREE QLS Endorsed Certificate)| 11 CPD Courses+11 PDF Certificates| 250 CPD Points|CPD & CiQ Accredited

Level 2 NVQ Diploma in Removal of Hazardous Waste - Licensed Asbestos

By Dynamic Training and Assessments Ltd

Level 2 NVQ Diploma in Removal of Hazardous Waste - Hazardous Waste

Gas Lift Design & Optimization using NODAL Analysis

By EnergyEdge - Training for a Sustainable Energy Future

About this training course Gas-lift is one of the predominant forms of artificial lift used for lifting liquids from conventional, unconventional, onshore and offshore assets. Gas-lift and its various forms (intermittent lift, gas-assisted plunger lift) allows life of well lift-possibilities when selected and applied properly. This 5-day training course is designed to give participants a thorough understanding of gas-lift technology and related application concepts. This training course covers main components such as application envelope, relative strengths and weaknesses of gas-lift and its different forms like intermittent lift, gas-assisted plunger lift. Participants solve examples and class problems throughout the course. Animations and videos reinforce the concepts under discussion. Unique Features: Hands-on usage of SNAP Software to solve gas-lift exercises Discussion on digital oil field Machine learning applications in gas-lift optimization Training Objectives After the completion of this training course, participants will be able to: Understand the fundamental theories and procedures related to Gas-Lift operations Easily recognize the different components of the gas-lift system and their basic structural and operational features Be able to design a gas-lift installation Comprehend how digital oilfield tools help address ESP challenges Examine recent advances in real-time approaches to the production monitoring and lift management Target Audience This training course is suitable and will greatly benefit the following specific groups: Production, reservoir, completion, drilling and facilities engineers, analysts, and operators Anyone interested in learning about implications of gas-lift systems for their fields and reservoirs Course Level Intermediate Advanced Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 5 days in total (35 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 20. This course is also available through our Virtual Instructor Led Training (VILT) format. Prerequisites: Understanding of petroleum production concepts. Each participant needs a laptop/PC for solving class examples using software to be provided during class. Laptop/PC needs to have a current Windows operating system and at least 500 MB free disk space. Participants should have administrator rights to install software. Trainer Your expert course leader has over 35 years' work-experience in multiphase flow, artificial lift, real-time production optimization and software development/management. His current work is focused on a variety of use cases like failure prediction, virtual flow rate determination, wellhead integrity surveillance, corrosion, equipment maintenance, DTS/DAS interpretation. He has worked for national oil companies, majors, independents, and service providers globally. He has multiple patents and has delivered a multitude of industry presentations. Twice selected as an SPE distinguished lecturer, he also volunteers on SPE committees. He holds a Bachelor's and Master's in chemical engineering from the Gujarat University and IIT-Kanpur, India; and a Ph.D. in Petroleum Engineering from the University of Tulsa, USA. Highlighted Work Experience: At Weatherford, consulted with clients as well as directed teams on digital oilfield solutions including LOWIS - a solution that was underneath the production operations of Chevron and Occidental Petroleum across the globe. Worked with and consulted on equipment's like field controllers, VSDs, downhole permanent gauges, multiphase flow meters, fibre optics-based measurements. Shepherded an enterprise-class solution that is being deployed at a major oil and gas producer for production management including artificial lift optimization using real time data and deep-learning data analytics. Developed a workshop on digital oilfield approaches for production engineers. Patents: Principal inventor: 'Smarter Slug Flow Conditioning and Control' Co-inventor: 'Technique for Production Enhancement with Downhole Monitoring of Artificially Lifted Wells' Co-inventor: 'Wellbore real-time monitoring and analysis of fracture contribution' Worldwide Experience in Training / Seminar / Workshop Deliveries: Besides delivering several SPE webinars, ALRDC and SPE trainings globally, he has taught artificial lift at Texas Tech, Missouri S&T, Louisiana State, U of Southern California, and U of Houston. He has conducted seminars, bespoke trainings / workshops globally for practicing professionals: Companies: Basra Oil Company, ConocoPhillips, Chevron, EcoPetrol, Equinor, KOC, ONGC, LukOil, PDO, PDVSA, PEMEX, Petronas, Repsol, , Saudi Aramco, Shell, Sonatrech, QP, Tatneft, YPF, and others. Countries: USA, Algeria, Argentina, Bahrain, Brazil, Canada, China, Croatia, Congo, Ghana, India, Indonesia, Iraq, Kazakhstan, Kenya, Kuwait, Libya, Malaysia, Oman, Mexico, Norway, Qatar, Romania, Russia, Serbia, Saudi Arabia, S Korea, Tanzania, Thailand, Tunisia, Turkmenistan, UAE, Ukraine, Uzbekistan, Venezuela. Virtual training provided for PetroEdge, ALRDC, School of Mines, Repsol, UEP-Pakistan, and others since pandemic. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Medical Secretary Diploma

By Training Tale

A medical secretary is responsible for ensuring that a doctor's office runs smoothly so that patients receive the best possible care. A medical secretary must understand office organisation and standard procedures to provide this secretarial support. They should also be able to use medical terminologies fluently. This Medical Secretary Diploma will teach you about the medical secretarial profession and the skills needed to do the job successfully. This coursewill teach you about the roles and responsibilities of a medical secretary. You will also learn various medical secretary skills, including an effective filing system, medical transcription, medical writing, maintaining medical records, an appointment system, and more. Furthermore, this comprehensive Medical Secretary Diploma will teach you the critical concepts of patient confidentiality and other legal aspects of the healthcare industry. Learning Outcomes After completing this course, learner will be able to: Understand the fundamentals of the National Health Service. Understand the roles and responsibilities of a medical secretary. Know how to organise schedules and manage appointment systems. Gain a clear understanding of the Law, Ethics and Medicine. Gain a thorough understanding of the effective filing system in medical offices. Familiarise yourself with the concept of patient confidentiality and its dos and don'ts. Become skilled at controlling and ordering stocks and supplies. Gain in-depth knowledge of Medical Terminology and Clinical Aspects. Know the importance of health and safety in the healthcare sector. Have a solid understanding of Complementary Medicine Why Choose Diploma in Medical Receptionist and Secretary from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. This Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing this Course. **Courses are included in this Medical Secretary Diploma Bundle Course Course 01: Medical Secretary Diploma Course 02: Dealing With Difficult People Course 03: Communication Skills Course Course 04: Level 4 Time Management Course Course 05: Level 5 Negotiation Skills Course Course 06: Level 5 Report Writing Course Course 07: Level 5 Proofreading & Copy Editing Course 08: Level 2 Customer Service Course 09: Mental Health Support Worker Course 10: Workplace Stress Management Course 11: Anger Management ***Others Included of Medical Secretary Diploma Bundle Course Free 11 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Medical Secretary Diploma: Module 1: The National Health Service History Structure of the NHS The NHS Plan Resource Allocation Delivering Care Mental Health Services Public Health The NHS, the Regions and Devolution Module 2: Patient (Customer) Care The Medical Receptionist Putting Patient First Complaints Within the Health Service The Complaints Procedure Patient and Public Involvement Patient's Rights Access to Health Care Total Quality in Medical Practice Customer Care: Involving Patients and the Public Module 3: Communication Report Writing Electronic Mail & Mobile Phones: Text Messages Telephone Skills People Skills - Face to Face Meeting Performance Review & Counselling The Practice Leaflet & Hospital Information Leaflets Networking Module 4: Law, Ethics and Medicine Medical Ethics and Etiquette Doctor's Duties Patient's Right The Regulatory Bodies and Their Role Legal Aspects Certification Health and Safety at Work Module 5: Health & Safety in a Clinical Environment First Aid at Work Hazardous Substances The NHS National Patient Safety Agency (NPSA) Hepatitis & AIDS Fire Precautions Clinical Risk Management Coping With Aggression & Violence Module 6: Practical Reception Skills in General Practice Record Keeping and General Administration Information Technology Module 7: The Hospital Service The Patient's Route Through the Hospital Outpatient Appointments Admissions from the Waiting List Accident and Emergency Admissions Home From Hospital Support Day Cases and Ward Attendees Hospital Team Clinical Audit Star Ratings What is a Medical Record? Cases Notes Master Index Filing Room or Records Library Medical Records Procedure for Departments Retention of Records Destruction of Medical Records The Role of the Secretary in the Hospital Module 8: Private Medicine Private Clinic or Hospital The Secretary In Private Practice Module 9: Forms, Fees and Finances in General Practises Contracting Finance Practice Income Scotland Wales Northern Ireland Module 10: Using Information Technology Computers in General Practice Electronic Medicine Computers in Hospitals Maintaining Security Module 11: Medical Terminology and Clinical Aspects Pathology and X-ray Examinations Prescribing and Drugs Nurse Prescribing New Developments in Pharmacy Module 12: Audit, Health Economics and Ensuring Quality for the Medical Receptionist and Secretary Audit Health Economics and Cost-effective Medicine Private Finance Initiative Clinical Governance National Institute for Clinical Excellence (NICE) National Clinical Assessment Service (NCAS) National Service Framework (NSF) Patient Surveys Module 13: Complementary Medicine Acupuncture Alexander Technique Aromatherapy Chiropractic Homoeopathy Hydrotherapy Hypnotherapy Osteopathy Reflexology ------------------- ***Communication Skills Course*** Module 01: Introduction to Communication Module 02: The Communication Skills Module 03: Different Types of Communication Module 04: Different Methods of Communication Module 05: Styles of Communication Module 06: Barriers to Communication Module 07: Assessing Communication Competence: Relevant Criteria Module 08: Seven Actions for Effective Communication Module 09: Do's and Don'ts of Effective Communication ------------------- ***Level 4 Time Management Course*** Module 1: Basics of Time Management Module 2: Prioritise Your Time Module 3: Organise Your Time Module 4: Using Your Time Efficiently Module 5: Time Management in the Workplace Module 6: Time Management For Students Module 7: Time Management Software Module 8: Create a Value-Based Time Management Plan ------------------- ***Level 5 Proofreading & Copy Editing*** Module 01: An Overview of Proofreading Module 02: Use of the Style Guide Module 03: Spelling and Grammar Module 04: Paper-based Proofreading Module 05: On the Screen Proofreading Module 06: Basics of Copy Editing Module 07: Copy Editing - the Use of Language Module 08: Copy Editing - Checking Accuracy and Facts Module 09: Copy Editing - Legal Checks Module 10: Career Development ------------------- ***Dealing With Difficult People*** Module 01: Difficult People and Their Difficult Behaviour Module 02: Communicating With Difficult People Module 03: Standing Up to Difficult People Module 04: A Quick Guide to the Seven Classically Difficult Types Module 05: Dealing with Bosses Who Drive You Barmy Module 06: Colleagues to Throttle Module 07: Dealing With Impossible People Module 08: The Temper Tantrum Type ------------------- ***Level 5 Negotiation Skills Course*** Module 01: An Overview of Negotiation Module 02: How to Prepare For Negotiations Module 03: The Process of Negotiation Module 04: Ways of Developing Persuasion & Influencing Skills Module 05: Ways of Developing Communication Skills Module 06: How to Develop Active Listening Skills Module 07: Comprehending Body Language Module 08: Assertiveness and Self Confidence Module 09: Managing Anger Module 10: Managing Stress Module 11: Negotiation Tactics to Closing a Better Deal Module 12: Ways of Overcoming Sales Objections ------------------- ***Level 5 Report Writing Course*** Module 01: Introduction to Report Writing Module 02: The Basics of Business Report Writing Module 03: The Practical Side of Report Writing (Part-1): Preparation & Planning Module 04: The Practical Side of Report Writing (Part-2): Collecting and Handling Information Module 05: The Practical Side of Report Writing (Part-3): Writing and Revising Report Module 06: The Creative Side of Report Writing (Part -1): A Style Guide to Good Report Writing Module 07: The Creative Side of Report Writing (Part -2): Improving the Presentation of Your Report Module 08: Developing Research Skills Module 09: Developing Creativity & Innovation Module 10: Develop Critical Thinking Skills Module 11: Interpersonal Skill Development ------------------- ***Level 2 Customer Service*** Module 1: Introduction to Customer Service Module 2: Understanding the Organisation Module 3: Prepare to Deliver Excellent Customer Service Module 4: Communication in the Customer Service Role Module 5: Understand Customers ------------------- ***Mental Health Support Worker*** ------------------- ***Workplace Stress Management*** ------------------- ***Anger Management*** ------------------- Assessment Method After completing each module of the Medical Secretary Diploma, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Medical Secretary Diploma, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Medical Secretary Diploma is ideal for Health Care Professionals who work and will be working in healthcare settings such as hospitals, clinics, and healthcare facilities. Requirements Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path After completing this Medical Secretary Diploma, you will have developed a set of skills necessary for career advancement and will be able to pursue a variety of job opportunities, including - Medical Receptionist Medical Secretary Healthcare Administrator GP Receptionist Patient Coordinator Certificates Certificate of completion Digital certificate - Included

Anti-Bribery and Corruption -CPD & Institute of Hospitality Approved

By BAB Business Group

Acts of bribery and corrupt business practices are still an all to common part of business to business activity in the UK and Worldwide. Inducements can range from small 'facilitation payments' to gifts worth millions of pounds. They can come in many different forms and can sometimes be hard to track down. This course examines some of the reasons why bribery and corruption occur as well as providing an overview of how common these practices are believed to be, before discussing how normal business activities, such as gifts, hospitality, sponsorship and donations, can be manipulated to become bribes. It goes on to cover the legislation that is in place both in the UK and internationally and the severe penalties that can be brought against someone found to be acting a corrupt way. It also looks at the effects of bribery at a national level, including corruption in state-owned enterprises and governments, worldwide. Finally, on a more practical level, it will show you some of the ways management and employees can reduce the risk of bribery and corruption in their organisations, particularly through anti-bribery and anti-corruption policies.

Nursing Assistant Complete Bundle - QLS Endorsed

By Imperial Academy

10 QLS Endorsed Courses for Nursing Assistant | 10 Endorsed Certificates Included | Lifetime Access

Early Years SEN Teaching + 3 Premium ChildCare Courses Bundle

By Study Plex

Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum SEN Teaching Course Child Counselling Child Psychology Child Psychology Advanced Diploma Obtain Your Certificate Order Your Certificate of Achievement 00:00:00

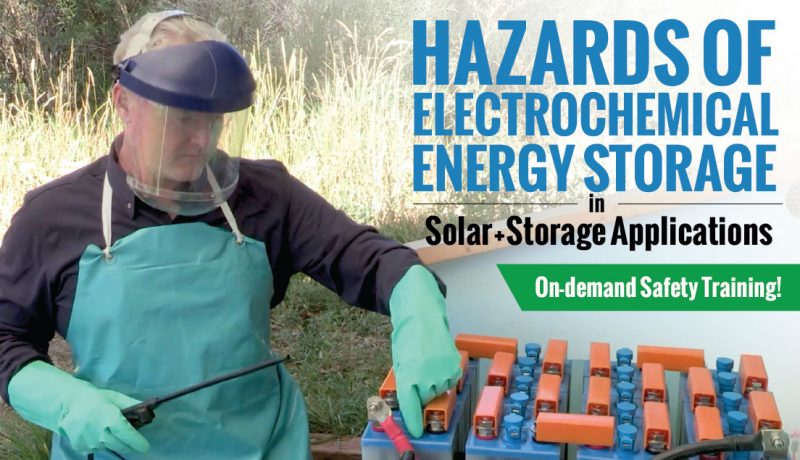

CE529: Hazards of Electrochemical Energy Storage in Solar + Storage Applications

By Solar Energy International (SEI)

Common chemistries, including lead acid, lithium ion, and nickel iron, each have different installation, maintenance, storage, and transportation requirements that can lead to fatal consequences if not conducted properly. This 8-hr online course, produced under an OSHA Susan Harwood Training Grant, provides training on the hazards associated with each energy storage technology and the control measures to eliminate or mitigate those hazards. This training includes five lessons for a total of 4 contact training hours. Lessons includes presentations, field videos, interactive exercises, and quizzes. Lesson content includes Lesson 1: Introduction to the Course and OSHA requirements Lesson 2: Energy Storage Technologies- Energy storage basics, lead-acid energy storage systems, lithium-ion energy storage, other types of electrochemical energy storage systems Lesson 3: Energy Storage Safety Regulations- OSHA safety regulations, NFPA 70 (the National Electrical Code) and NFPA 70E (Standard for Electrical Safety in the Workplace) NFPA 855 (Installation of Stationary Energy Storage Systems), the International Residential Code (IRC) and the International Fire Code (IFC) Lesson 4: Electrical Hazards- Electrical shock hazards, electrical arc flash hazards, electrical PPE, electrical connection hazards Lesson 5: Other Hazards- Chemical hazards, fire hazards, gas hazards, physical hazards, storage and transportation hazards, temperature effects on batteries, working space and clean installations

Search By Location

- National Courses in London

- National Courses in Birmingham

- National Courses in Glasgow

- National Courses in Liverpool

- National Courses in Bristol

- National Courses in Manchester

- National Courses in Sheffield

- National Courses in Leeds

- National Courses in Edinburgh

- National Courses in Leicester

- National Courses in Coventry

- National Courses in Bradford

- National Courses in Cardiff

- National Courses in Belfast

- National Courses in Nottingham