- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

883 Microsoft Excel courses delivered Online

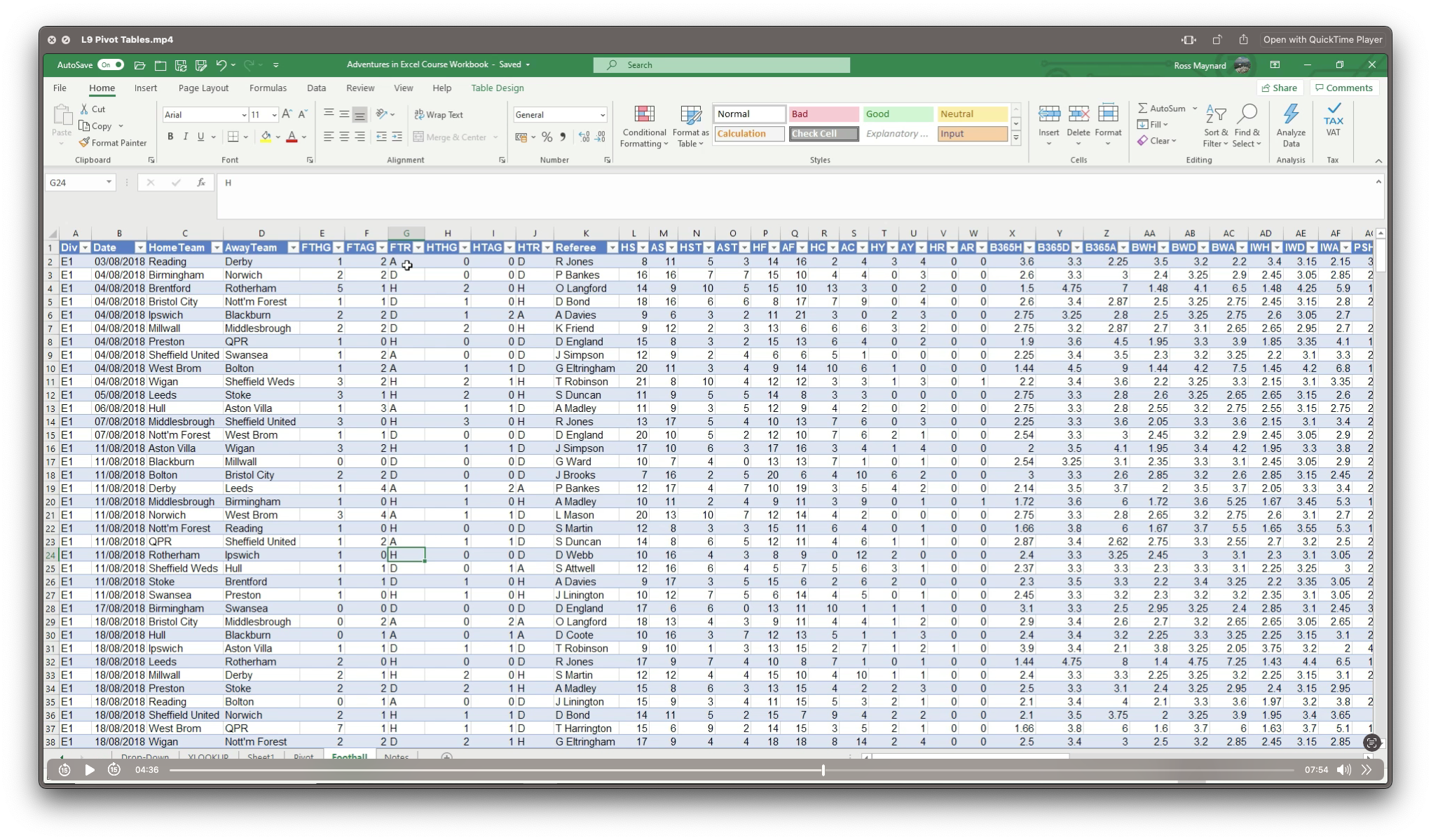

Adventures in Excel

By Ideas Into Action

Description Microsoft Excel has hundreds, if not thousands, of functions and features. This course aims to cover some of the best – that is the ones I find most useful. In “Adventures in Excel”, I cover the simple-to-use but powerful functions that I use most often: Basic features including products and powers Key date functions including the calculation of due dates and days past due Generating random numbers and random dates The new IFS functions (new to Office365) Text functions The most useful logical functions and IS functions How to create a drop-down list The new XLOOKUP function Pivot tables These functions are easy to use, and, unless your role is extremely specialised, they are probably the ones you’ll use 90% of the time. I hope you find the course helpful. Learning Outcomes Participants in this course will learn: Basic Excel functions including SUM, AVERAGE, MIN, MAX, PRODUCT, POWER and SQRT Useful date functions including TODAY, EOMONTH, EDATE, and DAYS Generating random numbers using RAND and RANDBETWEEN; generating random dates; and randomly picking an item from a list or table The new RANDARRAY function in Office365 The new IFS functions in Office365 including AVERAGEIFS, MAXIFS, MINIFS, COUNTIFS, and SUMIFS Text functions including TRIM, LOWER, UPPER, PROPER, LEFT, MID, RIGHT, FIND, TEXTJOIN and CONCATENATE Logical functions AND, OR, and NOT and IS functions ISTEXT, ISNUMBER, ISBLANK and ISERROR How to create a drop-down list The new SORT and FILTER functions in Office365 VLOOKUP and the new XLOOKUP function How to create a Pivot table and analyse data with one Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Excel 2016 Advanced

By iStudy UK

If you are looking forward to advance your skills with Microsoft Excel 2016 and want to learn more advanced skills or want to learn the topics covered in this course in the 2016 interface, this Excel 2016 Advanced will be the perfect choice for you! Through the course you will gain the skills necessary to use pivot tables, audit and analyze worksheet data, utilize data tools, collaborate with others, and create and manage macros. Additionally, you will experiment with auditing formulas and error checking, use the What-If Analysis tools, learn the options for worksheet and workbook protection, review advanced use of PivotTables and PowerPivot add-in, work with Macros, use form controls, and ensure data integrity in your worksheets and workbooks. You will also learn about Excel's many collaboration features, as well as how to import and export data to and from your workbooks. What Will I Learn? Use Advanced IF Statements Use Advanced Lookup Functions Use Complex Logical and Text Functions Auditing Formulas Working with What-If Analysis Tools Protecting Worksheet and Workbook Use Advanced PivotTables and PowerPivot Tools Automate with Macros Work with Form Controls Ensure Data Integrity Collaborate in Excel Import and Export Data to a Text File Requirements Excel Introduction and Intermediate courses or equivalent experience. Who is the target audience? Students who want to expand their Excel knowledge. Introduction Introduction FREE 00:01:00 Using Advanced IF Statements Summarize Data with SUMIF FREE 00:04:00 Summarize Data with AVERAGIF 00:03:00 Summarize Data with COUNTIF 00:02:00 Using Advanced Lookup Functions Using VLOOKUP with TRUE to find an Approximate Match 00:04:00 Using HLOOKUP TRUE to find an Approximate Match 00:01:00 Using the Index Function 00:03:00 Using the Match Function 00:02:00 Creating a Combined Index and Match Formula 00:04:00 Comparing Two Lists with VLOOKUP 00:02:00 Comparing Two Lists with VLOOKUP and ISNA 00:04:00 Using Complex Logical and Text Functions Creating a Nested IF Function 00:03:00 Using the IFERROR Function 00:02:00 Using the LEN Function 00:02:00 Using the TRIM Function 00:01:00 Using the Substitute Function 00:02:00 Formula Auditing Showing Formulas 00:01:00 Tracing Cell Precedents and Dependents 00:03:00 Adding a watch Window 00:02:00 Error Checking 00:02:00 What-If Analysis Tools Using the Scenario Manager 00:03:00 Using Goal Seek 00:02:00 Analyzing with Data Tables 00:02:00 Worksheet and Workbook Protection Protection Overview 00:02:00 Excel File Password Encryption 00:03:00 Allowing Specific Worksheet Changes 00:01:00 Adding Protection to only Certain Cells in a Worksheet 00:03:00 Additional Protection Features 00:02:00 Advanced Use of PivotTables and PowerPivot Using the Pivot Tables Charts Wizard 00:02:00 Adding a Calculated Field 00:02:00 Adding a Caculated Item 00:02:00 Apply Conditional Formatting to a Pivot Table 00:03:00 Using Filters in the Pivot Table Fields Pane 00:02:00 Creating Filter Pages for a Pivot Table 00:01:00 Enabling a Power Pivot Add In 00:04:00 Automating with Macros What are Macros 00:03:00 Displaying the Developer Tab and Enabling Macros in Excel 00:03:00 Creating a Basic Formatting Macro 00:03:00 Running a Macro 00:02:00 Assigning a Macro to a Button 00:02:00 Creating a More Complex Macro 00:02:00 Viewing and Editing the VBA Code for an Existing Macro 00:03:00 Adding a Macro to the Quick Access Toolbar 00:02:00 Working with Form Controls What are Form Controls 00:02:00 Adding Spin Buttons and Check Boxes to a Spreadsheet 00:02:00 Adding a Combo Box to a Spreadsheet 00:02:00 Ensuring Data Integrity What is Data Validation 00:01:00 Restricting Data Entries to Whole Numbers 00:02:00 Data Validation Restricting Data Entry to a List 00:01:00 Data Validation Restricting Data Entry to a Date 00:01:00 Data Validation Restricting Data Entry to Different Text Lengths 00:01:00 Composing Input Messages 00:02:00 Composing Error Alters 00:02:00 Finding Invalid Data 00:02:00 Editing and Deleting Data Validation Rules 00:01:00 Collaborating in Excel Working with Comments 00:03:00 Printing Comments and Errors 00:02:00 Sharing a Workbook 00:03:00 Tracking Changes in a Workbook 00:03:00 Working with Versions 00:02:00 Sharing Files via Email 00:02:00 Importing and Exporting Data to a Text File Importing a Text File 00:03:00 Exporting a Text File 00:01:00 Conclusion Course Recap 00:01:00 Course Certification

Level 7 Data Science & Machine Learning (Python, R, SQL & Microsoft Azure) - - QLS Endorsed

4.8(9)By Skill Up

Flat Discount: 52% OFF! QLS Endorsed| 40 Courses Diploma| 400 CPD Points| Free PDF+Transcript Certificate| Lifetime Access

Microsoft Excel - Automating Tasks by Programming in VBA

By AXIOM Learning Solutions

Immerse yourself in the dynamic realm of data management with the 'Data Entry Course for Beginners: Building Data Management Skills'. Embarking on this enlightening journey, you'll navigate the nuances of essential tools and techniques. Venture through the intricacies of Microsoft Word and Excel, broadening your horizon as you delve into advanced methods that set you apart in this digital age. Discover the keystones of accuracy and establish a robust foundation with best practices. Concluding with the creation of a compelling career portfolio, this course is your passport to becoming adept at data entry. Learning Outcomes Recognise the foundational tools and concepts in data entry. Demonstrate proficiency in data input within Microsoft Word and Excel. Employ advanced techniques to optimise data management. Implement best practices to maintain data accuracy. Construct an impactful portfolio that showcases data entry prowess. Why buy this Data Entry Course for Beginners: Building Data Management Skills? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Data Entry Course for Beginners: Building Data Management Skills there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Data Entry Course for Beginners: Building Data Management Skills course for? Individuals keen on kickstarting a career in data management. Office administrators aiming to upgrade their skills. Freelancers desiring a comprehensive introduction to data entry. Students yearning for a practical addition to their academic achievements. Entrepreneurs aiming to manage their business data efficiently. Prerequisites This Data Entry Course for Beginners: Building Data Management Skills does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Data Entry Course for Beginners: Building Data Management Skills was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Data Entry Clerk: £18,000 - £22,000 Office Administrator: £20,000 - £25,000 Database Manager: £30,000 - £40,000 Data Coordinator: £28,000 - £35,000 Freelance Data Entry Specialist: £15/hour - £25/hour (full-time equivalent: £31,200 - £52,000 annually, based on 40-hour weeks and 52 weeks/year) Portfolio Manager (Data Specialism): £35,000 - £45,000 Course Curriculum Module 01: Introduction to Data Entry and Essential Tools Introduction to Data Entry and Essential Tools 00:15:00 Module 02: Data Entry in Microsoft Word Data Entry in Microsoft Word 00:13:00 Module 03: Data Entry in Microsoft Excel Data Entry in Microsoft Excel 00:16:00 Module 04: Advanced Data Entry Techniques and Tools Advanced Data Entry Techniques and Tools 00:17:00 Module 05: Data Entry Best Practices and Accuracy Data Entry Best Practices and Accuracy 00:13:00 Module 06: Building Your Data Entry Career and Portfolio Building Your Data Entry Career and Portfolio 00:24:00

Fall into Savings. Enjoy the biggest price fall this Autumn! Get Hard Copy + PDF Certificates + Transcript + Student ID Card as a Gift - Enrol Now Tired of searching for the perfect course to meet all your bookkeeping needs? Look no further! The Bookkeeping Diploma - CPD Accredited offers a comprehensive 14-in-1 bundle that provides everything you need to succeed in the bookkeeping field. This all-inclusive package covers essential aspects of bookkeeping, ensuring you have the skills and knowledge to excel in the competitive job market. Designed by industry experts and based on valuable feedback from thousands of learners, this bookkeeping diploma addresses key areas you need to master. With advanced audio-visual learning modules broken down into manageable chunks, you can learn at your own pace without feeling overwhelmed. Additionally, our bookkeeping experts are available to answer your queries and support you throughout your learning journey. To further enhance your career prospects, we offer a special gift of one hardcopy certificate and one PDF certificate upon completion of the course. These certificates are designed to boost your credibility and make you stand out to potential employers. Enrol in the Bookkeeping Diploma - CPD Accredited today and take the next step towards a successful career in bookkeeping. This Bundle Consists of the following Premium courses: Course 01: Diploma in Accounting and Bookkeeping Course 02: Diploma in Quickbooks Bookkeeping Course 03: Introduction to Accounting Course 04: Level 3 Tax Accounting Course 05: Level 3 Xero Training Course 06: Payroll Management - Diploma Course 07: Diploma in Sage 50 Accounts Course 08: Advanced Diploma in MS Excel Course 09: Microsoft Excel Training: Depreciation Accounting Course 10: Team Management Course 11: Document Control Course 12: GDPR Data Protection Level 5 Course 13: Touch Typing Essential Skills Level 3 Course 14: Decision-Making and Critical Thinking Key Features of the Course: FREE Bookkeeping Diploma - CPD Accredited certificate Get a free student ID card with Bookkeeping Diploma - CPD Accredited training (£10 applicable for international delivery) Lifetime access to the Bookkeeping Diploma - CPD Accredited course materials The Bookkeeping Diploma - CPD Accredited program comes with 24/7 tutor support Get instant access to this Bookkeeping Diploma - CPD Accredited course Learn Bookkeeping Diploma - CPD Accredited training from anywhere in the world The Bookkeeping Diploma - CPD Accredited training is affordable and simple to understand The Bookkeeping Diploma - CPD Accredited training is entirely online Learning Outcomes: Upon completing this comprehensive bundle, you will be able to: Master fundamental accounting and bookkeeping principles. Use QuickBooks and Xero for effective bookkeeping. Implement tax accounting strategies at a Level 3 standard. Manage payroll efficiently with advanced payroll management skills. Utilize Sage 50 Accounts for precise financial record-keeping. Apply advanced functions in MS Excel and depreciation accounting. Develop strong team management and document control abilities. Description Curriculum of the Diploma Bundle Course 01: Diploma in Accounting and Bookkeeping Introduction to the course Bookkeeping systems Basics Functionality On a personal note Accounting Skills Course 02: Diploma in Quickbooks Bookkeeping Getting prepared - access the software and course materials Getting started Setting up the system Nominal ledger Customers Suppliers Sales ledger Purchases ledger Sundry payments Course 03: Introduction to Accounting Accounting Fundamental Accounting Policies Course 04: Level 3 Tax Accounting Tax System and Administration in the UK Tax on Individuals National Insurance How to Submit a Self-Assessment Tax Return Fundamentals of Income Tax Advanced Income Tax Payee, Payroll and Wages Capital Gain Tax Value Added Tax Import and Export Corporation Tax Inheritance Tax Double Entry Accounting Management Accounting and Financial Analysis Career as a Tax Accountant in the UK Course 05: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 06: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 07: Diploma in Sage 50 Accounts Sage 50 Bookkeeper - Coursebook Introduction and TASK 1 TASK 2 Setting up the System TASK 3 a Setting up Customers and Suppliers TASK 3 b Creating Projects TASK 3 c Supplier Invoice and Credit Note TASK 3 d Customer Invoice and Credit Note TASK 4 Fixed Assets TASK 5 a and b Bank Payment and Transfer TASK 5 c and d Supplier and Customer Payments and DD STO TASK 6 Petty Cash TASK 7 a Bank Reconciliation Current Account TASK 7 b Bank Reconciliation Petty Cash TASK 7 c Reconciliation of Credit Card Account TASK 8 Aged Reports TASK 9 a Payroll TASK 9 b Payroll TASK 10 Value Added Tax - VAT Return Task 11 Entering opening balances on Sage 50 TASK 12 a Year-end journals - Depre journal TASK 12 b Prepayment and Deferred Income Journals TASK 13 a Budget TASK 13 b Intro to Cash Flow and Sage Report Design TASK 13 c Preparation of Accountants Report & correcting Errors (1) Course 08: Advanced Diploma in MS Excel Microsoft Excel 2019 New Features Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks And many more... Course 09: Microsoft Excel Training: Depreciation Accounting Introduction Depreciation Amortization and Related Terms Various Methods of Depreciation and Depreciation Accounting Depreciation and Taxation Master Depreciation Model Conclusion Course 11: Document Control Introduction to Document Control Principles of Document Control and Elements of Document Control Environment Document Control Lifecycle Document Control Strategies and Instruments Document Management Quality Assurance and Controlling Quality of Documents Project Document Control Electronic Document Management Systems and Soft Copy Documentation Course 12: GDPR Data Protection Level 5 GDPR Basics GDPR Explained Lawful Basis for Preparation Rights and Breaches Responsibilities and Obligations Course 13: Touch Typing Essential Skills Level 3 Getting Started DRILL 1 The home keys DRILL 2 e and i, g and h DRILL 3 o and n, shift keys and t DRILL 4 extra practice . and y DRILL 5, and w DRILL 6 m and u DRILL 7 v and x DRILL 8-sentence drills DRILL 9 figures DRILL 10 alphabetical paragraphs Recap Course 14: Decision-Making and Critical Thinking Introduction to Critical Thinking Critical Thinking and the Judgment of Claims Benefits and Barriers of Critical Thinking Importance of Critical Thinking Recognising a Critical Thinker What Are the Critical Thinking Steps? Critical Thinking Strategies Problem-Solving Through Critical Thinking Decision-Making with Critical Thinking How will I get my Certificate? After successfully completing the Bookkeeping Diploma course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement.PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) CPD 150 CPD hours/points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Bookkeeping Diploma bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future. Requirements Our Bookkeeping Diploma is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so that you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this Bookkeeping Diploma course; it can be studied in your own time at your own pace. Career path Advance your career with the Bookkeeping Diploma - CPD Accredited. This qualification opens doors to various roles in the bookkeeping and accounting fields, including: Bookkeeper: £22,000 - £35,000 Accounts Clerk: £20,000 - £30,000 Junior Accountant: £25,000 - £35,000 Payroll Administrator: £23,000 - £32,000 Financial Administrator: £24,000 - £34,000 Senior Accountant: £30,000 - £45,000 Certificates Certificate of completion Digital certificate - Included

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £180 as a Gift - Enrol Now Give your career a boost and take it to the next level with the Bookkeeping Diploma for Accountants. This comprehensive program is designed to provide you with essential bookkeeping knowledge that will help you excel professionally. Whether you’re aiming to develop new skills for your next job or looking to enhance your expertise for a promotion, this diploma is your gateway to staying ahead of the competition. The Bookkeeping Diploma for Accountants covers everything from basic to advanced bookkeeping skills, offering in-depth training to illuminate your path and elevate your career. By strengthening your bookkeeping expertise, you’ll add significant value to your resume, making you stand out to potential employers. Throughout the program, you'll improve your competency in bookkeeping and gain valuable career insights that will help you see a clearer picture of your future growth. Enrol in the Bookkeeping Diploma for Accountants today and equip yourself with the critical bookkeeping skills needed to thrive in a competitive job market. Along with this course, you will get 10 premium courses, an originalHardcopy, 11 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This Bundle Consists of the following Premium courses: Course 01: Diploma in Accounting and Bookkeeping Course 02: Diploma in Quickbooks Bookkeeping Course 03: Introduction to Accounting Course 04: Level 3 Tax Accounting Course 05: Level 3 Xero Training Course 06: Payroll Management - Diploma Course 07: Diploma in Sage 50 Accounts Course 08: Advanced Diploma in MS Excel Course 09: Microsoft Excel Training: Depreciation Accounting Course 10: Team Management Course 11: Document Control So, enrol now to advance your career! Key Features of the Course: FREE Bookkeeping Diploma for Accountants CPD-accredited certificate Get a free student ID card with Bookkeeping Diploma for Accountants training (£10 applicable for international delivery) Lifetime access to the Bookkeeping Diploma for Accountants course materials The Bookkeeping Diploma for Accountants program comes with 24/7 tutor support Get instant access to this Bookkeeping Diploma for Accountants course Learn Bookkeeping Diploma for Accountants training from anywhere in the world The Bookkeeping Diploma for Accountants training is affordable and simple to understand The Bookkeeping Diploma for Accountants training is entirely online Learning Outcomes: Upon completing the course, you will be able to: Understand and apply core bookkeeping systems and principles. Utilize basic accounting skills for effective financial record-keeping. Set up and manage QuickBooks software for bookkeeping tasks. Handle nominal ledger, sales ledger, and purchases ledger entries. Implement accounting policies and procedures in financial management. Apply accounting fundamentals to real-world scenarios and decision-making. Description Curriculum of the Bundle Course 01: Diploma in Accounting and Bookkeeping Introduction to the course Bookkeeping systems Basics Functionality On a personal note Accounting Skills Course 02: Diploma in Quickbooks Bookkeeping Getting prepared - access the software and course materials Getting started Setting up the system Nominal ledger Customers Suppliers Sales ledger Purchases ledger Sundry payments Course 03: Introduction to Accounting Accounting Fundamental Accounting Policies Course 04: Level 3 Tax Accounting Tax System and Administration in the UK Tax on Individuals National Insurance How to Submit a Self-Assessment Tax Return Fundamentals of Income Tax Advanced Income Tax Payee, Payroll and Wages Capital Gain Tax Value Added Tax Import and Export Corporation Tax Inheritance Tax Double Entry Accounting Management Accounting and Financial Analysis Career as a Tax Accountant in the UK Course 05: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 06: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 07: Diploma in Sage 50 Accounts Sage 50 Bookkeeper - Coursebook Introduction and TASK 1 TASK 2 Setting up the System TASK 3 a Setting up Customers and Suppliers TASK 3 b Creating Projects TASK 3 c Supplier Invoice and Credit Note TASK 3 d Customer Invoice and Credit Note TASK 4 Fixed Assets TASK 5 a and b Bank Payment and Transfer TASK 5 c and d Supplier and Customer Payments and DD STO TASK 6 Petty Cash TASK 7 a Bank Reconnciliation Current Account TASK 7 b Bank Reconciliation Petty Cash TASK 7 c Reconciliation of Credit Card Account TASK 8 Aged Reports TASK 9 a Payroll TASK 9 b Payroll TASK 10 Value Added Tax - Vat Return Task 11 Entering opening balances on Sage 50 TASK 12 a Year end journals - Depre journal TASK 12 b Prepayment and Deferred Income Journals TASK 13 a Budget TASK 13 b Intro to Cash flow and Sage Report Design TASK 13 c Preparation of Accountants Report & correcting Errors (1) Course 08: Advanced Diploma in MS Excel Microsoft Excel 2019 New Features Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks And many more... Course 09: Microsoft Excel Training: Depreciation Accounting Introduction Depreciation Amortization and Related Terms Various Methods of Depreciation and Depreciation Accounting Depreciation and Taxation Master Depreciation Model Conclusion Course 10: Presenting Financial Information Presenting Financial Information The Hierarchy of Performance Indicators The Principle of Effective Reports Guidelines for Designing Management Reports Methods of Presenting Performance Data The Control Chart: Highlighting the Variation in the Data And many more... Course 11: Document Control Introduction to Document Control Principles of Document Control and Elements of Document Control Environment Document Control Lifecycle Document Control Strategies and Instruments Document Management Quality Assurance and Controlling Quality of Documents Project Document Control Electronic Document Management Systems and Soft Copy Documentation How will I get my Certificate? After successfully completing the Bookkeeping course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) If you want to get hardcopy certificates for other courses, generally you have to pay £20 for each. But with this special offer, Apex Learning is offering a Flat 50% discount on hard copy certificates, and you can get each for just £10! PS The delivery charge inside the UK is £3.99, and the international students have to pay £9.99. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Bookkeeping bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future. Requirements Our Bookkeeping Diploma is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones, so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course; it can be studied in your own time at your own pace. Career path Having this various expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before In today's competitive business environment, understanding the intricacies of business law is more crucial than ever. With over 70% of UK businesses facing legal issues annually, the need for comprehensive legal knowledge cannot be overstated. Are you ready to gain confidence and protect your business from legal pitfalls? The Business Law Training - CPD Certified bundle equips you with a practical understanding of the legal principles that govern businesses in the UK. Across six in-depth courses, you'll gain essential knowledge in areas like business formation, contracts, employment law, intellectual property, and taxation. Develop the skills to identify legal risks, make informed decisions, and ensure your business operates compliantly. This Business Law Training Bundle Contains 6 of Our Premium Courses for One Discounted Price: Course 01: Business Law Course 02: Business Studies Course 03: Business Lead Generation Course 04: Level 3 Diploma in Business Etiquette Course 05: Ultimate Microsoft Excel For Business Bootcamp Course 06: UK Tax Accounting Whether you're a new entrepreneur, an established business owner, or a professional looking to enhance your career prospects, the Business Law Training - CPD Certified bundle provides a valuable foundation for success. Invest in your future and enrol today! Learning Outcomes of Business Law Training Gain a comprehensive understanding of business law and legal frameworks. Develop expertise in business studies, strategies, and lead generation techniques. Learn professional etiquette and communication skills for effective business relationships. Master advanced Microsoft Excel skills for data analysis and reporting. Understand UK tax accounting principles and compliance requirements. Acquire time management strategies for enhanced productivity and efficiency. With this comprehensive Business Law Training bundle, you can achieve your dreams and train for your ideal career. This Business Law Training bundle covers essential aspects in order to progress in your chosen career. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of Business Law Get a free student ID card with Business Law Training program (£10 postal charge will be applicable for international delivery) The Business Law is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Business Law course materials The Business Law comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Course 01: Business Law Module 1: Introduction Module 2: European Community Law Module 3: The Court System Module 4: Civil and Alternative Dispute Resolution Module 5: Contract & Business Law Module 6: Employment Law Module 7: Agency Act Module 8: Consumer Protection Act Module 9: Act of Tort Module 10: Business Organisations Module 11: Company Act Module 12: Business Property Module 13: Competition Law Course 02: Business Studies Module 01: Introduction To Business Management Module 02: Operations Management Module 03: Introduction To Business Analysis Module 04: Project Management Module 05: Business Process Management Module 06: Planning & Forecasting Operations Module 07: Performance Management Module 08: Management Of Cash And Credit Module 09: Managing Risk And Recovery Module 10: Business Environment Module 11: Human Resource Management Module 12: Customer Service Course 03: Business Lead Generation Introduction To Lead Generation Module 01: Lead Generation Marketing Module 02: What Is Attraction Marketing? Module 03: Strategies For Lead Generation Module 04: Using Customer Relation Management (CRM) For Relationship Building Module 05: Using Social Media For Lead Generation Module 06: Using Pay Per Click (PPC) For Lead Generation Module 07: Conclusion =========>>>>> And 2 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*6 = £78) CPD Hard Copy Certificate: £29.99 CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Business professionals Entrepreneurs and managers Legal and compliance officers Accounting and finance professionals Marketing and sales teams Requirements You will not need any prior background or expertise to enrol in this bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Business Owner Consultant Manager Legal Assistant Accountant Entrepreneur Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - £29.99 Please note that International students have to pay an additional £10 as a shipment fee.

Master IT: Data Analysis, Data Science & Data Protection Career Based Job Focused Program

4.9(27)By Apex Learning

Transform Your Career with Our IT: Data Analysis, Data Science & Data Protection Program - an all-in-one Program Designed for Mastery! Do you know the demand for IT professionals with expertise in data science is skyrocketing? This Ultimate IT: Data Analysis, Data Science & Data Protection Program is your gateway to a thriving career in this dynamic industry. This program is meticulously designed to equip you with the knowledge and skills demanded by hiring managers across various sectors. By enrolling in this IT: Data Analysis, Data Science & Data Protection program, you'll embark on a journey that opens doors to exciting opportunities and empowers you to shape your future in the IT industry. Our IT: Data Analysis, Data Science & Data Protection program will give you a comprehensive understanding of data analysis, from data collection and preparation to data visualisation and communication. You will be equipped with the necessary skills and guidance to uncover insights from data, solve real-world problems, and make informed decisions. Also, you will discover the ethical and legal implications of data handling, how to protect sensitive information & develop a career in this sector. Moreover, we're your dedicated partners on this exciting journey. Our goal isn't just to teach you; it's to support you 24/7 so you can get closer to your dream job. We're so confident with our program that we offer a 100% money-back guarantee, ensuring your complete satisfaction. Learning Outcomes By completing this IT: Data Analysis, Data Science & Data Protection program, you will gain expertise in the following: Data analysis techniques and methodologies. Python programming for data analysis. Business intelligence and data mining. Advanced Excel techniques, including VBA and Power Query. SQL programming and big data technologies. Data Science & Data Protection, Machine Learning with Python and R. Data visualisation with tools like Tableau and Power BI. Statistics and probability for data science. Effective career development and job-seeking skills. Design an engaging resume and excel in the job search. Succeed in interviews, including video interviews. Build a strong LinkedIn profile to connect with professionals and enhance your online visibility in IT: Data Analysis- Data Science & Data Protection field. Courses Included in the Program You get 25 in-demand courses once you enrol in our IT: Data Analysis, Data Science & Data Protection program. => Course 01: Introduction to Data Analysis => Course 02: Data Analytics => Course 03: Python for Data Analysis => Course 04: Basic Google Data Studio => Course 05: Business Intelligence and Data Mining Masterclass => Course 06: Microsoft Excel: Automated Dashboard Using Advanced Formula, VBA, Power Query => Course 07: SQL Programming Masterclass => Course 08: SQL NoSQL Big Data and Hadoop => Course 09: Data Science & Machine Learning with Python => Course 10: Machine Learning with Python => Course 11: Data Science & Machine Learning with R => Course 12: Data Analytics with Tableau => Course 13: Develop Big Data Pipelines with R & Sparklyr & Tableau => Course 14: Complete Introduction to Business Data Analysis Level 3 => Course 15: Data Analysis in Microsoft Excel Complete Training => Course 16: Excel Data Analysis for Beginner => Course 17: GDPR Data Protection Level 5 => Course 18: Master JavaScript with Data Visualization => Course 19: Data Visualization and Reporting with Power BI => Course 20: Statistics & Probability for Data Science & Machine Learning => Course 21: Career Development Plan Fundamentals => Course 22: CV Writing and Job Searching => Course 23: Interview Skills: Ace the Interview => Course 24: Video Job Interview for Job Seekers => Course 25: How to Create a Professional LinkedIn Profile Enrol in our highly regarded IT: Data Analysis, Data Science & Data Protection program, featuring a job-relevant curriculum that ensures your skills align with employer expectations across various sectors. Don't miss this opportunity - your success story starts now! Our IT: Data Analysis, Data Science & Data Protection Program is a comprehensive and industry-relevant journey through data analysis, data science, and IT analytics. With a focus on providing theoretical knowledge and academic depth, this program is your gateway to a promising career in IT: Data Analysis, Data Science & Data Protection sector. Why Choose Us? We take great pride in offering you a great learning experience that stands out. When you consider enrolling in our IT: Data Analysis, Data Science & Data Protection program, you're making a decision that will positively impact your career and knowledge in various aspects related to IT: Data Analysis, Data Science & Data Protection. Here's why choosing us is a smart choice: Updated Materials: We're committed to providing the most up-to-date learning materials. Our dedicated team continuously reviews and updates our content, ensuring you're always learning from the latest sources. When you choose us, you select the most current and relevant information, giving you the edge in your IT career. Flexible Timing: We understand that life can get busy, and you may have existing commitments that can make pursuing further education challenging. That's why we offer flexibility in your study schedule. With our courses, you can learn at your own pace, on your terms. You're in control and can adjust your learning to fit your life. No Hidden Cost: When choosing our program, you won't incur additional expenses. The certification and course materials are all-inclusive within the program's price. You can focus on your studies without worrying about hidden fees. Money-Back Guarantee: Your satisfaction is our top priority. We're so confident in the quality of our courses that we back them up with a 14-day money-back guarantee. We'll refund your investment if you're unsatisfied with your learning experience. Lifetime Access: When you choose to learn with us, you gain access to a course and a lifetime of knowledge. We offer lifetime access to our course materials, allowing you to revisit and refresh your knowledge whenever you need. 24/7 Support: Learning doesn't just happen during traditional working hours; neither should support. Our commitment to your success extends beyond the classroom. We provide 24/7 support, so you can contact us with your questions and concerns anytime. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This IT: Data Analysis, Data Science & Data Protection program is suitable for: Aspiring IT: Data Analysis, Data Science & Data Protection professionals. Students and recent graduates looking to enter the field. Career changers interested in data analytics. Security professionals seeking to upskill in data security. Anyone interested in learning about IT: Data Analysis, Data Science & Data Protection. Requirements No prior experience is required in our IT: Data Analysis, Data Science & Data Protection program. Career path Upon completing the program, you'll get edges in various IT: Data Analysis, data science & data protection-related jobs including: Data Analyst: £25,000 - £45,000 Business Intelligence Analyst: £30,000 - £50,000 Data Scientist: £35,000 - £60,000 Machine Learning Engineer: £40,000 - £70,000 SQL Developer: £30,000 - £55,000 Tableau Developer: £35,000 - £60,000 Power BI Developer: £35,000 - £60,000 Certificates CPD Accredited (e-Certificate) Digital certificate - Included CPD Accredited (Hard Copy Certificate) Hard copy certificate - Included e-Transcript Digital certificate - Included Hard Copy Transcript Hard copy certificate - Included Student ID Card Digital certificate - Included