- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

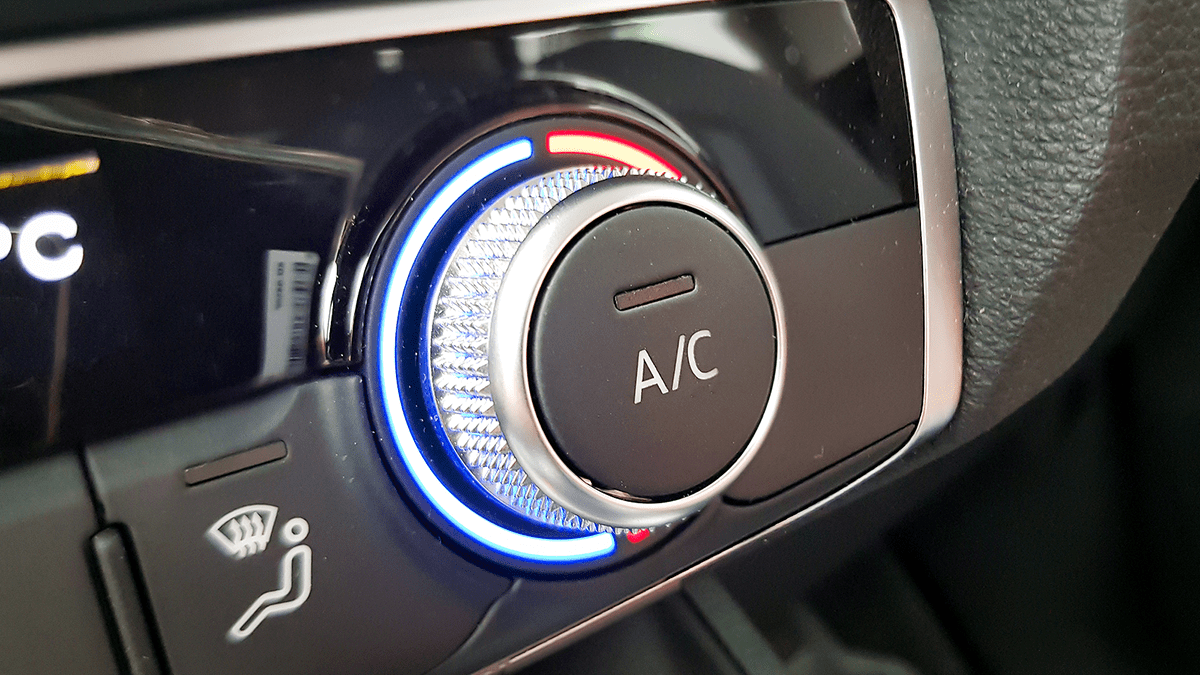

F-Gas – Automotive Refrigerant Handling (Level 3)

By PFTP Ltd

The 1 day IMI award in “Automotive Refrigerant Handling” has been specifically designed to provide the knowledge, training and qualification necessary to satisfy EU legislation in the mobile air conditioning market. It is designed for anyone handling refrigerants within the automotive industry including mobile mechanics, garages, body shops, main dealerships and automotive dismantlers. Course Details: Half day classroom based theory session Half day workshop practice and assessment session Course Fees £290.00 + VAT. per person *Please contact us for group rates and onsite training Course Content Theoretical Introduction to Automotive Air Conditioning Basic heat processes Pressure and temperature relationships The refrigeration cycle Lubrication How a MAC system works The electrical components Types of Refrigerants used The Environmental Impact Regulations Service Equipment Practical Health & Safety Precautions and PPE System Inspection and Testing Refrigerant Recovery Refrigerant Re-charge IMI assessment and test An online multi-choice theory question paper Practical Assessment observed by an IMI approved assessor. What’s included Fully qualified and experienced trainers Course booklet (normally sent out as pre-reading before the course) Examinations Fees and Certification To find out more, please use the live chat function, visit our contact page or call us on 024 76325880

Licensed Vehicle Service Technician Course (LVST)

By PFTP Ltd

This route is considered a progression for the tyre technician. To qualify for the LVST vehicle Technician course, you must already hold the LRTT and in addition be assessed as a competent practitioner with the relevant knowledge in the following covering car, light van and 4×4: Customer liaison Vehicle inspection and appraisal Battery and related components Exhaust systems Braking systems Computer-based testing equipment. We evaluate your current skills and certifications to create a training package perfectly suited to you. Each LVST course is unique as we provide additional training, where required, to complement your current certifications and knowledge. The light vehicle service technician license shows that you have all the know-how and skills required to proficiently and independently diagnose and repair light vehicles. On achieving this auto technician license, you will be able to practically and proficiently demonstrate the skills required for repairing light vehicles. Offered by our fully licensed and experienced technicians, this license has been designed for mechanics/technicians that do not necessarily hold any formal qualifications. With decades of experience delivering high-quality automotive training courses, we are a small business that takes pride in the value and quality of service we provide. INTERESTED? PFTP is proud to have been awarded approval by the NTDA to offer this valuable licence to our customers. To find out more, please either telephone us on 024 76325880 or enquire below. We look forward to hearing from you!

Manual Handling (Objects)

By Prima Cura Training

Moving and Handling is so much more than lifting and carrying. Whether we lift, carry, support, push, pull and hold any load then we need to be aware of the correct way to do it. We are only born with one back and we need to look after it. This course will inform you of the legislation surrounding any moving and handling operation, the correct techniques to employ, the process of ergonomics and risk assessing. You should always be safe when moving and handling any load so this course is essential for your health. Course Aims: Explain the theory behind moving and handling Be aware of safe practice using a range of techniques when moving a variety of inanimate loads Manual handling defines “any transporting or supporting of a load by hand or by bodily force This includes: Lifting, putting down, pushing, pulling, carrying or moving Use of mechanical aids, e.g. tr By the end of this module you will be able to: Explain the term manual handling and provide examples Know who to contact Techniques for lifting Techniques for pushing and pulling Carry out manual handling safely Legislation

NVQ DIPLOMA IN PLASTERING

By Oscar Onsite

REFERENCE CODE 600/6511/4 COURSE LEVEL NVQ Level 2 THIS COURSE IS AVAILABLE IN Course Overview This qualification is aimed at those who are involved in plastering activities in the workplace. It is not expected that candidates working in this industry all do the same activities so the qualification has been developed to allow opportunities for those carrying out work in any one of the following broad categories: solid basic plastering, solid full plastering, basic fibrous plastering and full fibrous plastering. Those taking the qualification must also prove knowledge and competence in working at heights, calculating quantities and wastage and the use of powered and hand tools and equipment. All work completed must be done in accordance with building regulations and industry recognised safe working practices, including the disposal of waste. The qualification is structured to ensure that there is a high degree of flexibility within the units available and will allow employees from companies of all sizes and specialisms equal opportunity to complete. To provide this opportunity in addition to the core skills above, candidates will also be able to select optional units recognising skills including, working with direct bond dry linings, laying sand and cement screeds, installing mechanically fixed plasterboard and carrying out repair work. The standards cover the most important aspects of the job. This qualification is at Level 2, although some units may be at different levels and should be taken by those who are fully trained to deal with routine assignments. Candidates should require minimum supervision in undertaking the job

NVQ DIPLOMA IN PLASTERING (CONSTRUCTION)

By Oscar Onsite

REFERENCE CODE 601/4322/8 COURSE LEVEL NVQ Level 3 THIS COURSE IS AVAILABLE IN Course Overview Who is this qualification for? This qualification is aimed at those who are involved in Plastering activities in the workplace. It is not expected that candidates working in this industry all do the same activities so the qualification has been developed to allow opportunities for those carrying out work in either solid or fibrous Plastering. Those taking the qualification must also prove knowledge and competence in working at heights, calculating quantities and wastage and the use of powered and hand tools and equipment. All work completed must be done in accordance with Building Regulations and Industry recognised safe working practices, including the disposal of waste. The qualification is structured to ensure that there is a high degree of flexibility within the units available and will allow employees from companies of all sizes and specialisms equal opportunity to complete. See the qualification Rules of Combination for more details on the specific skills required. In addition to this qualification there is a Level 2 qualification in Plastering and a number of other Construction and Construction related qualifications available through Oscar Onsite Academy. What is required from candidates? GQA qualifications are made up of a number of units that have a credit value or credits. This qualification consists of 4 mandatory units and 2 pathways, Solid and Fibrous. The qualification mandatory units have a total credit value of 31 credits-in addition the Solid plastering pathway requires achievement of 54 credits from the pathway mandatory units and a minimum of 14 credits required from the pathway optional group, giving a total of 99 credits. The fibrous plastering pathway requires achievement of all of the qualification mandatory units (31 credits) 45 credits from the pathway mandatory units and a minimum of 16 credits required from the pathway optional group a total of 92 credits for this pathway. The units are made up of the things those working in these job roles need to know to be able to do to carry out the work safely and correctly. These are called Learning Outcomes, and all must be met to achieve the unit. Mandatory units Level Credit Confirming Work Activities and Resources for an Occupational Work Area in the Workplace Developing and Maintaining Good Occupational Working Relationships in the Workplace Confirming the Occupational Method of Work in the Workplace Conforming to General Health, Safety and Welfare in the Workplace Additional units A/600/7882 Producing Granolithic Paving Work in the Workplace Producing Specialised Plasterer’s Surfaces in the Workplace 3 29 Pathway C – Solid – Pathway C1 – Solid Mandatory Units (54 credits) Producing Complex Internal Solid Plastering Finishes in the Workplace 3 27 Producing Complex External Rendering Finishes in the Workplace 3 27 Pathway C2 – Solid Optional Units – candidates must achieve a minimum of 14 credits Installing Direct Bond Dry Linings in the Workplace Installing Mechanically Fixed Plasterboard in the Workplace Running In-situ Mouldings in the Workplace Pathway D – Fibrous – Pathway D1 – Fibrous Mandatory Units (45 credits) Producing Complex Plasterwork Moulds in the Workplace Summary of the: GQA LEVEL 3 NVQ DIPLOMA IN PLASTERING (CONSTRUCTION) Installing Complex Fibrous Plaster Components in the Workplace 3 18 Pathway D2 – Fibrous Optional Units – candidates must achieve a minimum of 16 credits Running In-situ Mouldings in the Workplace 3 25 Repairing Complex Fibrous Plaster Components in the Workplace 3 16 Assessment Guidance Evidence should show that you can complete all of the learning outcomes for each unit being taken. Types of evidence: Evidence of performance and knowledge is required. Evidence of performance should be demonstrated by activities and outcomes, and should be generated in the workplace only, unless indicated under potential sources of evidence (see below). Evidence of knowledge can be demonstrated though performance or by responding to questions. Quantity of evidence: Evidence should show that you can meet the requirements of the units in a way that demonstrates that the standards can be achieved consistently over an appropriate period of time. Potential sources of evidence: Suggested sources of evidence are shown above, these can be supplemented by physical or documentary evidence, e.g. Accident book/reporting system Notes and memos Safety record Telephone/e-mail records Training record Customer and colleague feedback Audio evidence Records of equipment and materials Witness testimonies Work records Photographic/ video evidence Please Note that photocopied or downloaded documents such as manufacturers or industry guidance, H&S policies, Risk Assessments etc, are not normally acceptable evidence for qualifications unless accompanied by a record of a professional discussion or Assessor statement confirming candidate knowledge of the subject. If you are in any doubt about the validity of evidence, please contact Oscar Onsite Academy

The Principles of Asset Management

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Asset maintenance and equipment reliability teams play a significant role to ensure that there is no room for downtime and losses in production. They are often recognised for their contribution and ability to keep assets running productively in today's organisations. This 4 full-day Certificate in Asset Management course will provide those involved in Asset Management with a full explanation of the key processes to manage assets across their lifecycle. This course has been designed to equip participants with practical skills to take back to work. This course enables participants to ensure their organisation's assets are realising their full value in support of the organisation's objectives. Accredited by the Institute of Asset Management (IAM), this course will prepare participants to sit for the IAM Asset Management Certificate qualification. The IAM exam is offered as an option for participants of this course. Training Objectives Upon completion of this course, the participants will be able to: Understand the key principles, tools and terminology of Asset Management, and demonstrate how it will benefit their organisation Gain familiarity in the application of ISO 55000 in practice Access a range of models that will support the implementation of asset management in their organisation Have their understanding of Asset Management tools and concepts assessed Learn new Asset Management skills and models that will enhance their current performance Be better prepared for the Institute of Asset Management (IAM) Certificate Examination Target Audience This course will benefit maintenance managers, operations managers, asset managers and reliability professionals, planners and functional specialists. It will also be useful for facilities engineers, supervisors/managers and structural engineers/supervisors/ and managers. Course Level Basic or Foundation Training Methods Other than world-class visuals and slides, this course will include a high level of interaction between the facilitator and participants and group discussion among the participants themselves. There will be a number of exercises & quizzes to demonstrate key points and to give participants the chance to apply learning and appreciate key aspects of best practice. Participants will also have the chance to share examples from their own experience, discuss real problems they are facing and develop actions for improvement when they return to work. Trainer Your expert course leader is a is a highly experienced in maintenance and turnaround specialist. He is a Chartered Mechanical Engineer, having spent 19 years working for BP in engineering, maintenance and turnaround management roles. During this time, he worked on plants at all ages in the lifecycle, from construction, commissioning and operating new assets to maintaining aging assets and decommissioning. He has taken roles in Projects, Human Resources and Integrity Management which give real breadth to his approach. He also specialized in Continuous Improvement, gaining the award of International Petrochemical Coach of the year. He stays up to date with the latest industrial developments through his consulting support for major clients. He is also the Asset Management lead and a VILT specialist, having delivered over 70 days of VILT training in the last year. He has an engaging style and will bring his current industrial experience, proficiency of VILT techniques and diverse content, gathered from a comprehensive training portfolio, to deliver a distinctive training experience. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

The Principles of Asset Management - IAM Certificate in Asset Management - Virtual Instructor Led Certificate Training Course

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Certificate Training Course (VILT) Asset maintenance and equipment reliability teams play a significant role to ensure that there is no room for downtime and losses in production. They are often recognised for their contribution and ability to keep assets running productively in today's organisations. The Certificate in Asset Management Virtual Instructor Led Training (VILT) course will provide those involved in Asset Management with a full explanation of the key processes to manage assets across their lifecycle. This recognised VILT course has been designed to equip participants with practical skills to take back to work. This VILT course enables participants to ensure their organisation's assets are realising their full value in support of the organisation's objectives. Accredited by the Institute of Asset Management (IAM), this VILT course will prepare participants to sit for the IAM Asset Management Certificate qualification. The IAM exam is offered as an option for participants of this VILT course. Training Objectives By the end of this VILT course, participants will be able to: Understand the key principles, tools and terminology of Asset Management, and demonstrate how it will benefit your organisation Gain familiarity in the application of ISO 55000 in practice Access a range of models that will support the implementation of asset management in your organisation Assess your understanding of the current tools and concepts applied in Asset Management Capture new ideas and skills that will enhance performance and be better prepared for the Institute of Asset Management (IAM) Certificate Examination Target Audience This VILT course will benefit maintenance managers, operations managers, asset managers and reliability professionals, planners and functional specialists. It will also be useful for facilities engineers, supervisors/managers and structural engineers/supervisors/ and managers. IAM Qualifications Syllabi This document details the scope of the individual topics which comprise the examination modules, and how the exams are assessed. It is important that prospective candidates understand the scope of the modules to determine the preparation required. Download here IAM Qualifications Candidate Handbook This handbook provides more detailed information on registering as a candidate, learning resources, training courses, booking an exam, exam regulations and what happens after an exam - whether you are successful or unsuccessful. Download here Course Level Basic or Foundation Training Methods The VILT course will be delivered online in 5 half-day sessions comprising 4 hours per day, with 2 breaks of 15 minutes per day. Course Duration: 5 half-day sessions, 4 hours per session (20 hours in total) Other than world-class visuals and slides, this VILT course will include a high level of interaction between the facilitator and participants and group discussion among the participants themselves. There will be a number of exercises & quizzes to demonstrate key points and to give participants the chance to apply learning and appreciate key aspects of best practice. Participants will also have the chance to share examples from their own experience, discuss real problems they are facing and develop actions for improvement when they return to work. Examples of the exercises that are used in this VILT course are as follows: Exercises: Aligning Assets to Business Objectives, Planning for Contingencies, Understanding Function and Failure. Group exercises: Asset Management Decision Making, Incident Review & Operations Optimisation. The workshop content will be adjusted based on the discussions, interests and needs of the participants on the course. Trainer Your expert course leader is a is a highly experienced in maintenance and turnaround specialist. He is a Chartered Mechanical Engineer, having spent 19 years working for BP in engineering, maintenance and turnaround management roles. During this time, he worked on plants at all ages in the lifecycle, from construction, commissioning and operating new assets to maintaining aging assets and decommissioning. He has taken roles in Projects, Human Resources and Integrity Management which give real breadth to his approach. He also specialized in Continuous Improvement, gaining the award of International Petrochemical Coach of the year. He stays up to date with the latest industrial developments through his consulting support for major clients. He is also the Asset Management lead and a VILT specialist, having delivered over 70 days of VILT training in the last year. He has an engaging style and will bring his current industrial experience, proficiency of VILT techniques and diverse content, gathered from a comprehensive training portfolio, to deliver a distinctive training experience. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

NPORS Crusher Training The aim of the NPORS Crusher Training is to provide theoretical and practical training for operators of Mobile Crushing equipment in the workplace. This Crusher training Course Or Test is carried out on your site using your own equipment. Please contact us for a competitive quote The Crusher Training Course is designed to provide candidates with the skills and knowledge required in order to operate a crusher safely and competently in the workplace. NPORS is an approved CSCS Partner Card Scheme, providing evidence that individuals working on construction sites have the appropriate Crusher training and qualifications for the Crusher Operation. Furthermore, training criteria is based on the approved standards of the Construction Leadership Council. Most major contractors should accept the NPORS Crusher card when presented on-site, which displays the silver CSCS logo. This NPORS crusher training meets the statutory requirements of the Health & Safety at Work Act 1974 and other relevant statutory provisions and Approved Codes of Practice. NPORS Crusher Test For Experienced Operators Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Crusher Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Crusher Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Crusher Test is for operators who have received some form of training in the past or alternatively has been operating Crusher for a number of years. If you are unsure if you qualify to go down the test route please contact us to discuss this in more detail. Discounts are available for multiple bookings There are two parts to the Crusher Test, a theory section comprised of 25 questions and a practical session operating the Crusher, revision notes are available when booking. Crusher Course Content Crushers are essential equipment in mining, quarrying, and construction industries, tasked with breaking down large rocks and materials into smaller, more manageable sizes. Operating mobile crushers requires specialised skills and knowledge to ensure safety, efficiency, and optimal performance. In this comprehensive course overview, we will explore the essential content covered in a crusher training course, designed to equip participants with the expertise needed to operate crushers safely and effectively in the workplace. 1. Introduction to Crushers: Overview of crusher types: jaw crushers, cone crushers, impact crushers, etc. Understanding the components and operating principles of crushers Different configurations and applications for specific tasks 2. Crusher Safety Procedures: Importance of safety in crusher operation Pre-operational checks and inspections Understanding crusher capacities and limitations Personal protective equipment (PPE) requirements Emergency procedures: shutdown, lockout/tagout, and evacuation protocols 3. Crusher Operation Basics: Starting, stopping, and controlling the crusher, including emergency stops Familiarisation with crusher controls: power source, conveyor belts, feeders, etc. Monitoring and adjusting crusher settings for optimal performance Understanding crusher dynamics: feed size, speed, and throughput 4. Material Handling and Crushing Techniques: Proper assessment of materials: hardness, size, and moisture content Loading and feeding materials into the crusher safely and efficiently Adjusting crusher settings for different material types and sizes Maximising crusher efficiency and product quality 5. Site Safety and Hazard Awareness: Identifying potential hazards in the crusher area Working safely around moving parts, conveyor belts, and rotating equipment Recognising environmental hazards: dust, noise, and vibration Understanding site-specific safety rules and regulations 6. Maintenance and Inspections: Importance of regular maintenance for crusher performance and reliability Daily, pre-shift, and post-shift inspection procedures Lubrication points and maintenance schedules Identifying and reporting mechanical issues and wear parts replacement 7. Practical Hands-On Crusher Training: Moving the crusher in reverse and forwards through obstructions Loading and feeding materials into the crusher using excavator and loading shovels Adjusting crusher settings and monitoring performance for efficiency Emergency response drills: simulated scenarios to test response and decision-making skills 8. Assessment and Certification: Written examination to assess theoretical knowledge Practical assessment of crusher operation skills Certification upon successful completion of the course Conclusion: A crusher training course equips participants with the essential knowledge, skills, and confidence to operate crushers safely and efficiently in various work environments. By covering topics such as safety procedures, operation techniques, material handling, site safety awareness, best maintenance practices, and practical hands-on training, participants can enhance their proficiency and contribute to a safer and more productive workplace. Whether you’re a novice operator or an experienced professional, investing in crusher training with Vally Plant Training is essential for ensuring compliance, reducing risks, and maximising productivity in crushing operations. Frequently Asked Questions About Crusher Training What is Crusher Training, and why is it necessary? Crusher Training provides individuals with the skills and knowledge required to safely and effectively operate crushers, heavy machinery used in mining, construction, and recycling industries. It’s essential for ensuring operator safety, maximising productivity, and preventing accidents on job sites. Who should undergo Crusher Training? Crusher Training is essential for anyone involved in operating or working around crushers, including quarry workers, machine operators, maintenance personnel, and site supervisors. Proper training ensures that individuals understand equipment operation procedures and safety protocols. What topics are covered in Crusher Training programs? Crusher Training programs cover a range of topics, as above, including equipment familiarisation, safety precautions, preventive maintenance, operational techniques, troubleshooting, and emergency procedures. Participants learn how to operate crushers efficiently while prioritising safety and minimising risks. How long does Crusher Training take? The duration of Crusher Training programs varies depending on factors such as the complexity of the equipment and the depth of the curriculum. Basic training courses may last a couple of days, while more comprehensive programs could extend over 1 week to cover advanced concepts and practical applications. Is Crusher Training mandatory in certain industries? While Crusher Training may not be legally mandated in all areas, many employers in the mining, construction, and recycling industries require operators to undergo training as part of their occupational health and safety policies. Compliance with training requirements helps prevent accidents and ensures regulatory compliance along with productivity. Where can I find reputable Crusher Training courses? Reputable Crusher Training courses are offered by various institutions, including industry associations, equipment manufacturers, and specialised training providers like Vally Plant Training. It’s important to choose a program that offers accredited certification and covers relevant industry standards and best practices. Crusher Courses Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable Crusher instructors, who have a wealth of knowledge of crushers and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment, however, Crusher Training can only be conducted on your sites Our Crusher course and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS Crusher Tester to your site nationwide, to reduce the amount of time away from work and complete the crusher test Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today.

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please click here. To learn more about schedule, pricing & delivery options speak to a course specialist now

Search By Location

- Mechanic Courses in London

- Mechanic Courses in Birmingham

- Mechanic Courses in Glasgow

- Mechanic Courses in Liverpool

- Mechanic Courses in Bristol

- Mechanic Courses in Manchester

- Mechanic Courses in Sheffield

- Mechanic Courses in Leeds

- Mechanic Courses in Edinburgh

- Mechanic Courses in Leicester

- Mechanic Courses in Coventry

- Mechanic Courses in Bradford

- Mechanic Courses in Cardiff

- Mechanic Courses in Belfast

- Mechanic Courses in Nottingham