- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1262 Management courses in Westhoughton

IOSH Managing Safely

By Mha Training Ltd - Aitt | Ipaf | Iosh | First Aid | Mental Health First Aid

The aim of the course is to ensure that safety requirements are appreciated by managers. To enable them to review their own safety systems. It give’s the ability to introduce new controls and possibly implement changes as appropriate to ensure safety in the workplace. Who Should Attend? The course is designed for managers and supervisors in any sector, who are required to manage health and safety risk and resources within their organisation. It is also beneficial for anybody wishing to get into the Health and Safety profession or Management. The IOSH qualification is an impressive qualification to add to a CV. Course Duration: 3 days. Learning Objectives: On successful completion of the course, delegates should be able to: Explain ‘managing safely’. Explain the component parts of a recognised safety management system such as HSG65. Identify the data and techniques required to produce an adequate record of an incident. To demonstrate the procedure for an accident investigation, recognising the human factors involved. Describe statutory requirements for reporting and procedures for checking non-reporting. Describe methods of basic trend analysis for reactive monitoring data. Define ‘hazard’ and ‘risk’, and describe the legal requirements for risk assessment. Demonstrate a practical understanding of risk assessment technique and the data required for records. Describe workplace precaution hierarchies. Prepare and use active monitoring checklists. To implement schedules for active monitoring, recording results and analysing records. Outline the main provisions of the Health and Safety at Work etc Act and the Management of Health and Safety at Work Regulations. Outline relevant health and safety legislation, codes of practice, guidance notes and information sources such as the HSE. Syllabus: 1. Module 1 – Introduction and Overview. 2. Module 2 – Risk Assessment. 3. Module 3 – Risk Control. 4. Module 4 – Health and Safety Legislation. 5. Module 5 – Common Hazards. 6. Module 6 – Investigating Accidents and Incidents. 7. Module 7 – Measuring Performance. What do IOSH Managing Safely Courses involve? The course has seven comprehensive modules. These modules cover risk assessment and control, Health and Safety Legislation, common hazards, accident and incident investigation. Also covered is performance measurement. Effectively covering all aspects of safety management in the workplace. To obtain the IOSH Managing Safely certificate, attendees will need to complete a four day course. The course is delivered using high quality animated graphics. This includes sophisticated, fun presentations to make the content of the course more memorable. With training tools including board games, DVDs and quizzes displaying clear scenarios and essential practical content. We have worked hard to ensure that taking an IOSH Managing Safely course is as enjoyable as possible. Attendees will officially attain their IOSH Managing Safely certificate upon successful completion of both the written and practical assessments of the course. Certification: An IOSH Managing Safely certificate is awarded to all those who attend the course successfully completing both written and practical assessments. Candidates will also receive an excellent workbook from IOSH, with all the tools to help them once they are back in the workplace. Understanding of the course material is evaluated by means of a 45-minute written assessment paper consisting of 20 multi-format questions. There is also a practical assessment. MHA Training was established in 2008 based at our training centre in Warrington, Cheshire. We provide an array of services On-Site also for clients around the North West in areas such as Manchester, Liverpool, Widnes, St Helens, Runcorn, Wigan, Preston and Leeds. Over the years we have expanded and have instructors available for all of our courses Nationwide. IOSH Managing Safely Refresher Course: Recently IOSH have introduced a one day refresher course. This enables candidates having previously sat a course within 3 years to keep their qualification current and upto date in just a one day course. For more information please see the factsheet below.

Asthma Awareness

By Prima Cura Training

This course aims to raise awareness about the triggers, signs and symptoms, and preventive measures to better manage and support people living with asthma.

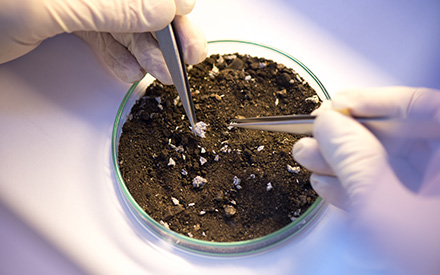

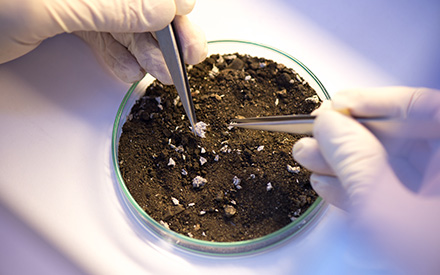

Asbestos in soils and contaminated land

By Airborne Environmental Consultants Ltd

The course covers investigation and risk assessment of asbestos-contaminated soils and sites, including waste classification and land remediation. It will cover the current HSE and EA legislation and guidance, assessing risk to health from asbestos in soils and how to assess the land, analysis types and interpretation, and remedial actions.

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

RSPH - Level 3 Award in Asbestos Surveying

By Airborne Environmental Consultants Ltd

This course provides the necessary knowledge, understanding and skills to persons who will knowingly disturb asbestos containing materials during the course of their work activities, including building maintenance workers and supervisory personnel, and building maintenance managers.

Asbestos in soils and contaminated land Online

By Airborne Environmental Consultants Ltd

The course covers investigation and risk assessment of asbestos-contaminated soils and sites, including waste classification and land remediation. It will cover the current HSE and EA legislation and guidance, assessing risk to health from asbestos in soils and how to assess the land, analysis types and interpretation, and remedial actions.

Building services and maintenance - introduction (In-House)

By The In House Training Company

To provide a fundamental understanding of building services in the context of: The working environment The success of the core business The health and safety of the occupants Operating cost and environmental impact The optimisation of cost and value Strategies for continuous improvement DAY ONE 1 Building services fundamentals The function of services in commercial buildings and their importance to the core businessElectrical servicesLightingHeatingVentilation and air conditioningLiftsWater Understanding IT and communication systems Practical exercises 2 The provision of comfort and safety Statutory requirementsHealth and safety legislationControl of contractorsRisk assessmentFire precautionsLegionella, sick building and other risks Business requirementsUnderstanding user requirementsMatching systems to business needs Practical exercises 3 Getting the design right What the FM needs to know about design and its procurementSuccessful space planningRelationship between services, space planning and designGetting the brief rightSupplier selection and management Practical exercises DAY TWO 4 Operation and maintenance Why maintain?Maintenance contractsInput and output specificationsResource optionsContracts - principal elementsTendering - key stepsSelection criteriaOperational criteriaMaintenance trends Performance-based service provisionInput and output specificationsKPIs and thresholdsRisk containmentValue-add opportunitiesPerformance contract strategy Practical exercises 5 Contingency planning Being ready for the unexpected Identifying and reducing riskInternal risksExternal risksIdentifying threats at your site Managing riskProtective systemsOccupier obligationsFire managementTesting Practical exercises 6 Commissioning services systems Physical commissioning Common problems Typical costs Commissioning stages Continuous commissioning Energy efficiency and the scope for environmental improvement Practical exercises 7 Satisfying the occupants Obtaining and responding to feedbackWhen to get feedbackWhyHowWhat to do with it Practical exercises 8 'Air time' Sharing experience and addressing specific issues of interest to participants Course review Close

10 practical ways to save time using ChatGPT and AI tools (In-House)

By The In House Training Company

ChatGPT, along with other AI tools, aims not to replace the human touch in management, but to enhance it. By addressing repetitive, daily tasks, these tools free up managers to concentrate on core responsibilities like strategic decision-making, team development, and innovation. As we move further into the digital age, integrating tools such as ChatGPT isn't a luxury; it's the future of proactive leadership. In this guide, we'll delve into 10 practical ways through which AI can elevate your efficiency and refine the quality of your work. Gain familiarity with prominent AI tools in the market Efficiently compose and respond to emails Generate concise summaries of complex reports and data. Obtain quick insights, data, and research across varied topics Streamline the writing of articles, training notes, and posts Craft interview tests, form relevant questions, and design checklists for the hiring process 1 Streamlining emails An inbox can be a goldmine of information but also a significant time drain for managers. Here's how to optimise it: Drafting responses: Give the AI a brief, and watch it craft a well-structured response. Sorting and prioritising: By employing user-defined rules and keywords, ChatGPT can flag important emails, ensuring no vital communication slips through the cracks. 2 Efficient report writing Reports, especially routine ones, can be time-intensive. Here's a smarter approach: Automate content: Supply key data points to the AI, and let it weave them into an insightful report. Proofreading: Lean on ChatGPT for grammar checks and consistency, ensuring each report remains crisp and error-free. 3 Rapid research From competitor insights to market trends, research is a pivotal part of management. Data synthesis: Feed raw data to the AI and receive succinct summaries in return. Question-answering: Pose specific questions about a dataset to ChatGPT and extract swift insights without diving deep into the entire content. 4 Reinventing recruitment Hiring can be a lengthy process. Here's how to make it more efficient: Resume screening: Equip the AI to spot keywords and qualifications, ensuring that only the most fitting candidates are shortlisted. Preliminary interviews: Leverage ChatGPT for the initial rounds of interviews by framing critical questions and evaluating the responses. 5 Enhancing training Especially for extensive teams, training can be a monumental task. Here's how ChatGPT can assist: Customised content: Inform the AI of your training goals, and it will draft tailored content suitable for various roles. PowerPoint design: Create visually appealing slide presentations on any topic in minimal time.

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: Overcome the barrier of the accountants' strange language Deal confidently with financial colleagues Improve their understanding of your organisation's finance function Radically improve their planning and budgeting skills Be much more aware of the impact of their decisions on the profitability of your organisation Enhance their role in the organisation Boost their confidence and career development 1 Review of the principal financial statements What each statement containsOutlineDetail Not just what the statements contain but what they mean Balance sheets and P&L accounts (income statements) Cash flow statements Detailed terminology and interpretation Types of fixed asset - tangible, etc. Working capital, equity, gearing 2 The 'rules' - Accounting Standards, concepts and conventions Fundamental or 'bedrock' accounting concepts Detailed accounting concepts and conventions What depreciation means The importance of stock, inventory and work in progress values Accounting policies that most affect reporting and results The importance of accounting standards and IFRS 3 Where the figures come from Accounting records Assets / liabilities, Income / expenditure General / nominal ledgers Need for internal controls 'Sarbox' and related issues 4 Managing the budget process Have clear objectives, remit, responsibilities and time schedule The business plan Links with corporate strategy The budget cycle Links with company culture Budgeting methods'New' budgetingZero-based budgets Reviewing budgets Responding to the figures The need for appropriate accounting and reporting systems 5 What are costs? How to account for them Cost definitions Full / absorption costing Overheads - overhead allocation or absorption Activity based costing Marginal costing / break-even - use in planning 6 Who does what? A review of what different types of accountant do Financial accounting Management accounting Treasury function Activities and terms 7 How the statements can be interpreted What published accounts contain Analytical review (ratio analysis) Return on capital employed, margins and profitability Making assets work - asset turnover Fixed assets, debtor, stock turnover Responding to figures EBIT, EBITEDIA, eps and other analysts' measure 8 Other key issues Creative accounting Accounting for groups Intangible assets - brand names Company valuations Fixed assets / leased assets / off-balance sheet finance

Search By Location

- Management Courses in London

- Management Courses in Birmingham

- Management Courses in Glasgow

- Management Courses in Liverpool

- Management Courses in Bristol

- Management Courses in Manchester

- Management Courses in Sheffield

- Management Courses in Leeds

- Management Courses in Edinburgh

- Management Courses in Leicester

- Management Courses in Coventry

- Management Courses in Bradford

- Management Courses in Cardiff

- Management Courses in Belfast

- Management Courses in Nottingham