- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1191 Management courses in Luton

MoD contract terms and conditions (In-House)

By The In House Training Company

This very practical two-day workshop analyses the content and implications of key MoD terms and conditions of contract. The programme explains the principles and terminology of the contractual aspects of defence procurement as well as considering a number of relevant policies and initiatives. The course covers key components, constructs and methodologies associated with any commercial venture entered into with the UK MoD. Starting at the MoD organisational level the workshop sets the scene by looking at the acquisition process and organisation, detailing the various roles and responsibilities of MoD personnel. The workshop provides an in-depth examination of MoD DEFCONs and many narrative terms, setting them in the context of the organisation and its structures. The workshop helps participants to gain an understanding of the content and purpose of the range of MoD DEFCONs and narrative conditions commonly used throughout the acquisition lifecycle. It includes a review of Part 2 of the Defence Reform Act 2014 regarding Single Source Pricing, which comes into effect in 2015 and is already starting to be applied to significant contracts. On completion of this programme the participants will understand the terminology associated with the MoD terms and conditions of contract and will have an accurate view of their relevance, usage and their legal basis and how they can affect contractual and commercial decision-making. They will have gained an insight into defence acquisition contracting and they will be more commercially aware. DAY ONE 1 The commercial environment Key roles and responsibilities of the MoD organisations at the heart of the acquisition process 2 Tendering to MoD An appraisal of some of the obligations placed upon contractors when they are submitting a proposal to the MoD pre-contract 3 Standardised contracting MoD have introduced non-negotiable standardised contracts for certain levels of procurement. This section considers their use and relevance to defence contracting 4 Pricing, profit, post-costing and payment The parameters specific to a costing structure and the differences between competitive and non-competitive bidding The role of the QMAC, the profit formula, the requirements for equality of information and post-costing Different types of pricing and issues surrounding payment 5 Defence Reform Act - Single Source Pricing Single Source Pricing under Part 2 of the new Defence Reform Act Changes from the existing position, how contractors are affected and the compliance regime that accompanies the new requirements 6 Delivery and acceptance Specific requirements and the significance and impact of failing to meet them Acceptance plans Non-performance and the remedies that may be applied by the Customer - breach of contract, liquidated damages and force majeure DAY TWO 7 Protection of information and IPR Contractor's and MoD's rights to own and use information How to identify background and foreground intellectual property Technical information and copyright in documentation and software How to protect IPR at the various stages of the bidding and contracting process 8 Defence Transformation and Defence Commercial Directorate Widening and increasing roles and functions of the Defence Commercial Directorate Background to the Defence Reform Act 2014 9 Legal requirements Terms used in MoD contracts to reflect basic legal requirements Records and materials required for MOD contracts and therefore the obligations, responsibilities and liabilities that a company undertakes when it accepts these conditions Overseas activities 10 Subcontracting and flowdown Understanding the constructs required by the MoD for subcontracting Which terms must be flowed down to the subcontractor and which are discretionary 11 Termination Termination of a contract for default Termination for convenience How to optimise the company's position on termination 12 Warranties and liabilities Obligations and liabilities a company might incur and how they might be mitigated MoD policy on indemnities and limits of liability 13 Electronic contracting environment Electronic forms of contracting Progress toward a fully electronic contracting environment

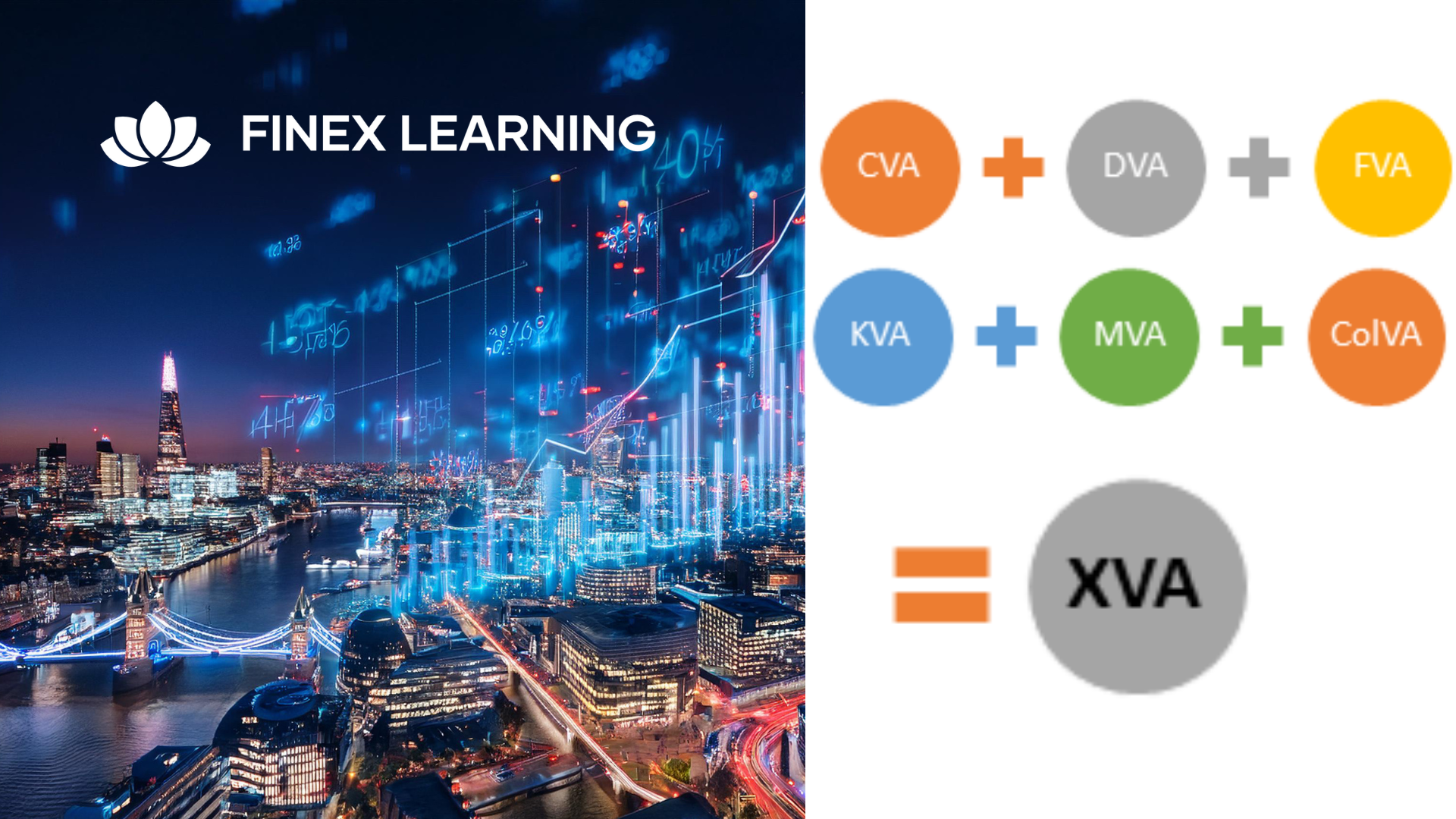

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Consultative selling (In-House)

By The In House Training Company

'Selling' doesn't work. You've got to help customers buy. And that means engaging with the customer in a positive way, showing that you understand their requirement and giving them confidence that your product or service is the best possible way of meeting that requirement. This may sound painless but there's more to it than meets the eye and it's all too easy to get it wrong. You need to follow a process. This programme will help participants: Understand 'how buyers buy' and align their selling activities accordingly Recognise the difference between 'latent pain' and 'active vision' opportunities Conduct effective pre-call planning and research Stimulate interest and establish credibility with your prospects Get prospects to share / admit high priority pain Engage in consultative dialogue that promotes the differentiating strengths of your offerings Gain access to 'power' people within an opportunity Effectively qualify and disqualify opportunities based on objective decision criteria Better control and manage sell cycles Improve their chances of winning competitive opportunities Shorten sales cycles and avoid 'no decision' Negotiate the steps leading to a successful sale 1 An introduction to selling Understanding the key points that encourage a customer to purchase from us The difference between consultative selling and a transactional sale Understanding the roles that trust and empathy play in a sale Understanding how tricks and manipulation can sink a sale Vital pre-meeting research that must take place before a conversation Understanding how the customer sees us and why positioning is important 2 Structuring the sales conversation process Defining a set process for structuring a sales call with a chance to demonstrate understanding How the first minute of a conversation can destroy a sale Understanding BPO objectives for a sale How a step-by-step sales conversation process helps win more sales Understanding the mis-match between the customers buying process How our sales processes can lead to mistakes 3 How and why people buy An insight into the emotional factors behind how people arrive at purchasing decisions Using research from neuroscience that shows how sales people can really make mistakes Understanding how people make decisions about larger purchases Understanding the stakeholders in companies and their buying motives How to analyse the stakeholders and determine a win-plan 4 Understanding the funnel Studying the sales and buying process to understand the ratios of sales to prospects and better forecasting Understanding the role of forecasting in sales analysis Why many forecasts are nearly always wrong Understanding the stages of a sales process How 'verifiable outcomes' can really change forecasting 5 Questioning techniques Understanding the different questioning techniques and when they should be used Using the 'knowledge tree' as a framework for questioning Understanding the use of real empathy to help customers uncover their needs How effective research can really empower your questions How to ask 'high gain' questions How to ask difficult questions without feeling intrusive 6 Features and benefits How to practically apply them in a sales scenario How to align the benefits to customers' business goals Really understanding the difference and how to demonstrate true economic benefits to a customer How to discover business goals, and align value propositions to these How to craft an effective value proposition for a customer Using the SAR storytelling method to really engage customers to align their thinking patterns Using the latest neuroscience research that explains what customers are really thinking 7 Overcoming objections How 'confirmation bias' can hinder any sales conversation How the CLARA method of responding to customer concerns can dramatically improve the chances of customers responding to us in a positive way Practising the method to become comfortable and congruent with it 8 Closing the sale A deep dive into what closing is How different sales have different closes How too many closing methods can destroy a sale How to lead up to a close with a logical sequence of questions Using the ACSAT trust method of closing A clear methodology with a chance to practise the skills in a fun way

Advanced sales skills (In-House)

By The In House Training Company

Do you hear yourself saying the same thing over and over again? Do you want to bring some new skills to your role? If you have been in a sales role for some time it is easy to fall into a comfortable pattern. This workshop will help you incorporate advanced techniques drawn from NLP, behavioural science and social psychology into your existing skills. This course will help you: Use the consultative sales process to achieve more cross-sales Employ advanced rapport-building skills Assess the buying preferences of a customer Articulate the link between customer goals and needs Identify your customer's needs and wants Use advanced questioning techniques to gather information Resist the temptation to tell when it would be better to ask Identify communication preferences Given various scenarios, present a product to the explicit need of a customer Appreciate the impact of the language used during this stage of the sale and decide what language is appropriate with a variety of customers Handle objections positively Close the sale or gain commitment to further action 1 Introduction Aims and objectives of the training Personal introductions and objectives Self-assessment of existing sales skills Overview of content 2 Understanding yourself and your customers Personal communication style and what this means in a sales situation Wants versus needs What motivates people to buy Using social media tools such as LinkedIn Managing your portfolio to maximise sales Preparing to sell 3 The sales process Overview of the consultative sales process Review personal strengths and weaknesses as a salesperson Habits of top-performing sales people Common pitfalls Articulate sales goals 4 Building rapport 11 decisions that customers make in the first 9 seconds Spotting buyer communication preferences Building rapport with a wide variety of customers Dealing with emotions Keeping control 5 Questioning and listening Assumptions and how they trip us up Structured questioning Looking for cross-sales Honing your listening skills Identifying buyers' motivation Using summaries to move the customer forward 6 Presenting products and services to customers Choosing the right time to present Using features, advantages and benefits Tailoring your presentation of products and services to match buyer preferences and motivations 7 Gaining commitment When to close Dealing with difficult customers 5 things to avoid when handling a customer objection 8 Managing your business The link between service and sales Using customer surveys Winning back lost business 9 Putting it all together Skills practice Personal learning summary and action plans

Advanced sales negotiation skills (In-House)

By The In House Training Company

The 'golden rule' of negotiation is simple - don't! But life's rarely that simple and very often we do have to negotiate, particularly if we want to win the business and especially if we want to win it on our terms. Such negotiations are crucial. We need to prepare for them. We need a strategy, and the skills to execute it. Does your team have a structured approach? Is it flawlessly executed, every time? Or is there room for improvement? This programme will help them master the six fundamentals of closing better business: Manage all these elements well and you will win more business, more profitably. This course will help participants: Negotiate from a position of partnership, not competition Deal more effectively and profitably with price objections Identify and practise successful sales negotiating skills Identify strengths and weaknesses as a sales negotiator Understand different types of buyer behaviour Learn to recognise negotiating tactics and stances Apply a new and proven structure to their business negotiations Identify and adapt for different behavioural styles Be alert to unconscious (non-verbal) communication Prepare and present a proposal at a final business negotiation stage Project confidence and exercise assertiveness in all sales negotiations 1 Planning for successful business negotiations This session introduces the concept of business negotiation and looks at its importance in the context of the participants' roles and activities. It briefly examines why we negotiate and the dynamics involved. Session highlights: What kind of a negotiator are you? Negotiation skills self-assessment and best practice How to establish roles and responsibilities for both parties How to identify and set objectives for both buyer and seller How to research and establish the other person's position (business negotiation stance) 2 How to structure your negotiations This module presents an eight-step framework or structure for use in negotiations and considers how best to prepare and plan your negotiations within the context of a supplier/customer relationship or business cycle. It also includes a brief review of legal responsibilities and what constitutes a 'deal'. Session highlights: Learn and apply a formal structure to use when negotiating How to establish short- and longer-term objectives and opportunities How best to plan, prepare and co-ordinate a major business negotiation meeting, or on-going negotiations Understanding of basic legal and organisational requirements 3 Verbal negotiation skills This session examines the human and communication dynamics inherent in any negotiation situation. It emphasises the importance of professional skills in preparing for a negotiation by identifying needs, wants and requirements accurately and by qualifying the competitive and organisational influences present. Session highlights: How to fully 'qualify' the other party's needs, requirements and constraints during the negotiation process by using advanced questioning and listening skills How to pre-empt negotiation objections by promoting and gaining commitment to options, benefits, value and solutions How best to propose and suggest ideas, using drawing-out skills 4 Non-verbal negotiation skills This module highlights how different personal styles, corporate cultures and organisation positions can influence events, and demonstrates practical methods for dealing with and controlling these factors. It also examines key principles of body language and non-verbal communication in a practical way. Session highlights: Gaining rapport and influencing unconsciously Understanding the importance of non-verbal communication; reading other people's meaning and communicating effectively as a result Ensure that non-verbal behaviour is fully utilised and observed to create maximum impact and monitor progress (eg, buying signals) Recognising that business negotiations are precisely structured and agreements gained incrementally 5 Proposing and 'packaging' This session highlights how best to present and package your proposal. It looks at how to pre-empt the need for negotiating by creating minor-options and 'bargaining' points, as well as how to manage the expectations and perceptions of the customer or buyer. Session highlights: How to identify the key variables that can be negotiated The power and use of 'authority' within your negotiations How to structure and present your proposal, ideas or quotation to best effect The importance of when and how to identify and influence buyer's objections 6 Dealing with price This module highlights how to best present and package price within your proposal or negotiation. In most cases, price has more to do with psychology than affordability and preparation and careful handling are essential. Session highlights: The three reasons that people will pay your asking price How to set price in a competitive market The key differences between selling and negotiating Ten ways to present price more effectively and persuasively 7 Getting to 'Yes': tactics and strategies There are many different tactics and strategies common to successful negotiators. This session looks at those that are most appropriate to the participants' own personal styles and situations. The importance of 'follow-through' is also explained and how to deal with protracted or 'stale-mate' business negotiations. Session highlights: How to negotiate price and reduce discounting early in the process How to recognise negotiating tactics and strategies in your customer or supplier Key strategies, techniques and tactics to use in negotiation The importance of follow-through and watching the details How to deal with stalled business negotiations or competitor 'lock-out' 8 Case studies and review This session examines a number of different situations and participants discuss ways to approach each. This will allow learning to be consolidated and applied in a very practical way. There will also be a chance to have individual points raised in a question and answer session. Session highlights: Case studies Question and answer Planning worksheet Negotiation 'toolkit' and check-list 9 Personal action plans Session highlights: Identify the most important personal learning points from the programme Highlight specific actions and goals Flag topics for future personal development and improvement

Leader As Coach

By Verax International

Coaching workshop for managers who want to use their coaching capabilities to improve the business performance of their coachees.

FORENSIC ACCOUNTING FOR INSTITUTIONAL INVESTORS

By Behind The Balance Sheet

Our Forensic Accounting Course is designed to help investment analysts detect earnings manipulation. It focuses on creative accounting rather than conducting detailed forensic analysis but we explain the tools short sellers employ to detect fraud and some of the techniques we used at hedge funds to identify short opportunities.

Agile product development: an introduction (In-House)

By The In House Training Company

The aim of this course is to provide an overview of Agile approaches to product development. It explains what Agile is and when and why to use it. The scope of the programme includes: The course emphasises the collaborative nature of Agile and the flexibility it offers to customers. The principal training objectives for this programme are to help participants understand: Why and when to use Agile How to use Agile The roles involved in Agile development The cultural factors to take into account How to manage Agile developments 1 Introduction (Course sponsor and trainer) Why this programme has been developed Review of participants' needs and objectives 2 Background to Agile Issues with traditional approaches to product development How Agile helps Roots of Agile Agile lifecycles Product v project 3 How Agile works The Agile Manifesto Agile principles Process control: defined v empirical Different Agile methods The Scrum framework DSDM Atern 4 Managing Agile When to use Agile Managing Agile projects Team organisation 5 Agile techniques Daily stand-ups User stories Estimating MoSCoW prioritisation 6 Course review and action planning (Course sponsor present) Are there opportunities to use Agile? What actions should be implemented to adopt Agile? Conclusion

Agile: an introduction (In-House)

By The In House Training Company

Agility has become a prized business attribute. Although Agile methods were once most associated with software development, they are now applied in a host of different areas. Agile continues to find new applications because it is primarily an attitude. This programme delivers a solid grounding in both the Agile mindset and Agile methods. It covers three methods, illustrates the benefits of each and shows how they can be integrated. It includes practical techniques as well as background knowledge. By the end of the session, participants will be able to: Apply Agile concepts to self-manage their work Understand the roles people take on in Agile teams Use a variety of techniques to help deliver customer satisfaction Focus on delivering against priorities Employ a range of estimating techniques 1 Introduction Overview of the programme Review of participants' needs and objectives 2 The basics of Agile What makes Agile different Agile Manifesto and Principles Using feedback to deliver what is needed 3 Agile teams Multi-disciplinary teams Team size and empowerment Agile values 4 Agile at the team level - Scrum Scrum roles Scrum 'events' Scrum 'artifacts' 5 Agile for teams juggling multiple demands - Kanban Taking control of the work Improving throughput Dealing with bottlenecks 6 Agile in projects - AgilePM The phases of an Agile project Managing change requests Delivering on time 7 Estimating T-shirt / Pebble sizing Yesterday's weather Planning poker 8 Pick 'n' mix - some useful techniques The daily stand-up User stories Retrospectives Work-in-process limits Burndown charts Minimum viable product A / B testing 9 Review and action planning Identify actions to be implemented individually Conclusion

Business writing skills (In-House)

By The In House Training Company

This very practical workshop is designed to enable participants to improve the impact, clarity and accuracy of their business documents - both internal and external.: This workshop will help participants: Identify the purpose of writing their documents - to themselves and to their readers Recognise and meet the needs of their readers Plan documents systematically and improve the layout, flow and structure Express the content more clearly, concisely and correctly Adapt the tone and style of writing to the circumstances Proof-read and edit work effectively, using formal marks and techniques Improve visual layout, format and appearance 1 Course objectives Welcome and Introductions The problems now - group discussion 2 Writing better business documents What points to highlight / exclude Starting off Introductions Conclusions Executive summaries 3 Rules and standards George Orwell's famous maxim Why write? - clarifying your aims and objectives A seven-step method for better preparation The three-stage process for writing well Grouping information for your reader 4 Proof-reading and editing The difference between proof-reading and editing Proof-reading methods and strategies Proof-reading marks and techniques Training your eye for detail Knowing what to look for 5 Effective editing Grammar and English standards Words - usage and spelling Sentences - units of thought Paragraphs - themes Punctuation - spotting and correcting common errors Say what you mean - active v passive language 6 How's your English? Grammar quizzes and punctuation test Spotting spelling errors Rephrasing jargons and clicheÌs Common error's and mistakes 7 Document layout House style Use of white space Fonts and effects 8 One-to-one workshops These are practical sessions with one-to-one consultation with colleagues and the trainer They are held at key points to consolidate the learning from different sessions 9 Course summary Summary of key points Action plans

Search By Location

- Management Courses in London

- Management Courses in Birmingham

- Management Courses in Glasgow

- Management Courses in Liverpool

- Management Courses in Bristol

- Management Courses in Manchester

- Management Courses in Sheffield

- Management Courses in Leeds

- Management Courses in Edinburgh

- Management Courses in Leicester

- Management Courses in Coventry

- Management Courses in Bradford

- Management Courses in Cardiff

- Management Courses in Belfast

- Management Courses in Nottingham