- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

18 Legal Practice Course (LPC) courses in Manchester

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems

By Airborne Environmental Consultants Ltd

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in leisure, display, therapy and other non-industrial water systems. It is a requirement of this course that candidates have successfully completed P901- Legionella- Management and Control of Building Hot and Cold Water Services [Syllabus GM.1]. Where both P901 and P904 courses are run on subsequent days or as a combined course then this pre-requirement is waived.

Contract management for practitioners (In-House)

By The In House Training Company

This two-day programme gives the key insights and understanding of contracting principles and the impact they have on business and operations. The course is designed for individuals involved in or supporting contracting who want to improve their commercial management skills; individuals in functions such as project management, business development, finance, operations who need practical training in commercial management; general audiences wanting to gain a basic understanding of commercial management. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Associate (CCMA) qualification. The programme addresses 31 different subject areas, across the five stages of the contracting process. By the end of the course the participants will be able, among other things, to: Develop robust contract plans, including scope of work and award strategies Conduct effective contracting activities, including ITT, RFP, negotiated outcomes Negotiate effectively with key stakeholders, making use of the key skills of persuading and influencing and to work with stakeholders to improve outcomes Set up and maintain contract management systems Take a proactive approach to managing contracts Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Develop and monitor appropriate and robust Key Performance Indicators to manage the contractor and facilitate improved performance Understand the approvals process and how to develop and present robust propositions Make appropriate use of best practice contract management tools, techniques and templates DAY ONE 1 Introductions Aims Objectives Plan for the day 2 Commercial context Explaining the contracting context Define the key objective The importance of contact management Impact upon the business 3 Stakeholders How to undertake stakeholder mapping and analysis Shared vision concept, How to engage with HSE, Finance, Operations 4 Roles and responsibilities Exploring the key roles and responsibilities of contract administrators, HSE, Finance, Divisional managers, etc 5 Initiating the contract cycle Overview of the contracting cycle Requirement to tender Methods Rationale and exceptions 6 Specifications Developing robust scope of works Use of performance specifications Output based SOW 7 Strategy and award criteria Developing a robust contract strategy Award submissions/criteria 8 Managing the tender process Review the pre-qualification process Vendor registration rules and processes Creation of bidder lists Evaluation, short listing, and how to use of the 10Cs© model template and app 9 Types of contract Classify the different types of contracts Call-offs Framework agreement Price agreements Supply agreements 10 The contract I: price Understanding contract terms Methods of compensation Lump sum, unit price, cost plus, time and materials, alternative methods Cost plus a fee, target cost, gain share contracts Advanced payments Price escalation clauses DAY TWO 11 Risk How to manage risks Risk classification Mitigation of contractual risks 12 Contractor relationship management session Effectively managing relationships with contractors, Types of relationships Driving forces? Link between type of contract and style of relationship 13 Disputes Dealing with disputes Conflict resolution Negotiation Mediation Arbitration 14 Contract management Measuring and improving contract performance Using KPIs and SLAs Benchmarking Cost controls 15 The contract II: terms and conditions Contract terms and conditions Legal aspects Drafting special terms 16 Managing claims and variations How to manage contract and works variations orders Identifying the causes of variations Contractor claims process 17 Completion Contract close-out process Acceptance/completion Capture the learning/HSE Final payments, evaluation of performance 18 Close Review Final assessment

INTERNATIONAL CUSTOMS

By Export Unlocked Limited

This module aims to develop knowledge and understanding of customs procedures associated with international trade. The module includes trade agreements, tariffs and taxes, immigration, intellectual property rights, clearance procedures, transport regulations, sanitary and Phyto-sanitary measures, customs valuation, preference systems and anti-dumping measures.

Commercial awareness for project staff and engineers (In-House)

By The In House Training Company

Nowadays not only do we rely on our commercial and sales staff to hit that bottom line but we expect our engineers and project teams to play their part too - not only through their engineering and management skills but by behaving in a commercially minded way in their dealings with their counterparts in customer or supplier organisations. This means understanding, amongst other things, the issues surrounding the commencement of work ahead of contract, having a clear contract baseline, recognising the broader implications of contract change, the need for timeliness and the consequences of failing to meet the contracted timetable. This practical one-day programme has been designed specifically to give engineers, project staff and others just that understanding. The course is designed principally to provide engineers and project staff with an appreciation of contractual obligations, liabilities, rights and remedies so that they understand the implications of their actions. It is also suitable for business development staff who are negotiating contracts on behalf of the business. The main focus of the day is on creating an awareness of when a situation may have commercial implications that would harm an organisation's business interests if not recognised and handled appropriately and how taking a positive but more commercial approach to those situations can lead to a more positive outcome for the business. As well as providing an understanding of the commercial imperatives the day also focuses on specific areas affecting engineers and project staff, such as the recognition and management of change, the risks when working outside the contract and managing delays in contracts. The course identifies the different remedies that may apply according to the reasons for the delay and provides some thoughts on pushing back should such situations arise. On completion of this programme the participants will: appreciate the need for contractual controls and will have a better understanding of their relevance and how they can be applied, particularly the issues of starting work ahead of contract, implementing changes and inadvertently creating a binding contract by their behaviour; have gained an understanding of the terminology and procedural issues pertaining to contracting within a programme; and be more commercially aware and better equipped for their roles. 1 Basic contract law - bidding and contract formation Purpose of a contract Contract formation - the key elements required to create a legally binding agreement Completeness and enforceability Express and implied terms Conditions v warranties The use of, and issues arising from, standard forms of sale and purchase Use of 'subject to contract' Letters of intent Authority to commit 2 Change management Recognising changes to a contracted requirement Pricing change Implementation and management of change 3 Key contracting terms and conditions By the end of this module participants will be able to identify the key principles associated with: Pricing Getting paid and retaining payment Cashflow Delivery and acceptance Programme delaysExamining some reasons for non-performance...Customer failureContractor's failureNo fault delays ... and the consequences of non-performance: Damages claimsLiquidated damagesForce majeureContinued performance Waiver clauses and recent case law Use of best/reasonable endeavours Contract termination 4 Warranties, indemnities and liability Express and implied warranties Limiting liability 5 Protection of information Forms of intellectual property Background/foreground intellectual property Marking intellectual property Intellectual property rights Copyright Software Confidentiality agreements Internet

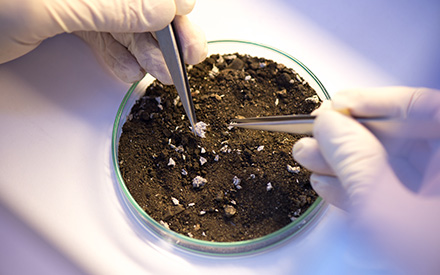

Asbestos in soils and contaminated land Online

By Airborne Environmental Consultants Ltd

The course covers investigation and risk assessment of asbestos-contaminated soils and sites, including waste classification and land remediation. It will cover the current HSE and EA legislation and guidance, assessing risk to health from asbestos in soils and how to assess the land, analysis types and interpretation, and remedial actions.

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems Online

By Airborne Environmental Consultants Ltd

BOHS P904 - Management and control in leisure, display, therapy and other non-industrial systems is there to provide background and an overview of the risk of Legionella infection and how it can be controlled in leisure, display, therapy and other non-industrial water systems. It is a requirement of this course that candidates have successfully completed P901- Legionella- Management and Control of Building Hot and Cold Water Services [Syllabus GM.1]. Where both P901 and P904 courses are run on subsequent days or as a combined course then this pre-requirement is waived.

Credit control and debt recovery - legal issues (In-House)

By The In House Training Company

It is essential that those charged with responsibility for credit control and debt recovery have a full appreciation of the relevant law: no-one can negotiate effectively to recover a debt if they don't understand the ultimate sanctions they can apply. This programme is designed to give them a practical, up-to-date understanding of the law as it applies to your particular organisation. This course will help ensure that participants: Understand the relevant laws Know how and when to invoke legal processes Avoid legal pitfalls in debt collection negotiations Specific, practical learning points include: Definition of 'harassment' How to set up an in-house collection identity Whether cheques in 'full and final settlement' are binding The best steps to trace a 'gone away'... and many, many more. 1 Data protection and debt recovery There are a whole range of things which can be checked on members of the public and which are not affected by the restraints of the Data Protection Act. These will be explained in simple, clear terms so that staff can use this information immediately. 2 County Court suing The expert trainer will show how to sue for money owed, obtain judgment and commence enforcement action without leaving your desk. This module is aimed at showing how to make the Courts work for you instead of the other way around! 3 Enforcement of judgments There are many people who have a County Court Judgment (CCJ) against their debtor but who still remain unpaid. This session explains each of the enforcement methods and how to use them to best effect. Enforcement methods covered include: Warrant of Execution Using the sheriff (now known as High Court Enforcement Officers) Attachment of earnings Third Party Debt Orders Charging Orders (over property and goods) Winding-up companies and making individuals bankrupt 4 Office of Fair Trading rules on debt recovery Surprisingly few people are aware of the Office of Fair Trading rules on debt recovery and many of those that do know think they don't apply to them - but they do. Make sure you know what you need to! 5 New methods to trace elusive, absentee and 'gone away' debtors Why write the money off when you can trace the debtor and collect the money you are owed? 6 Credit checking of new and existing customers It makes sense to credit check would-be, new and existing customers to evaluate the likelihood of payment delays or perhaps not being paid at all. This session shows a range of credit checking steps, many of which can be done completely free of charge, including a sample credit application/ account opening form. 7 Late Payment of Commercial Debts Regulations Do your staff understand this legislation and how to use it to make people pay quicker than ever before? The trainer shows how. 8 The Enterprise Act The Enterprise Act made some startling changes to corporate and personal insolvency. What are the implications for credit control and debt recovery within your organisation?

Credit control and debt recovery - practical issues (In-House)

By The In House Training Company

This course is designed specifically to help improve your collection rates. The UK's leading trainer in the subject uses practical examples and case studies to show how to use debt collection techniques that really work. This programme will help participants to: Understand debtors and communicate with them effectively Improve their telephone and writing skills Appreciate the key legal issues Track down 'gone-aways' Improve their collection rates 1 Giving credit and collecting debts The benefits when you get it right The cost of getting it wrong 2 Analysing yourself The importance of making the right 'first impression' Assessing your own personal communication style and how this affects your results How do you (or might you) look in the debtor's eyes? What would you like to change? 3 Analysing your debtors Types of debtorThe delaying debtorThe genuine debtorThe cashflow or hardship problem debtorThe ones who never intended to pay Spot the most common reasons and excuses for non-payment - and learn how to deal with them 4 Understanding debt recovery and the law Data protection issues County Court suing enforcement methods Human rights and debt recovery Retention of title matters 5 Telephone skills for debt recovery A 7-point plan which works every time Learning by example: listening to and analysing some pre-recorded (or live) collection callsWhat was done well?What should have been done differently?Did the collector recognise opportunities?Did the collector create opportunities where seemingly none existed?Did the collector negotiate well or not at all? 6 Writing skills for debt recovery Key phrases to avoid What to include A sample letter which gets results in over 90% of cases 7 Tracking down the 'gone aways' A unique debtor-tracing plan Why spend money on external tracers when you can find those 'gone away' debtors for yourself? 8 Course review The traps to avoid Key personal learning points

Educators matching "Legal Practice Course (LPC)"

Show all 1Search By Location

- Legal Practice Course (LPC) Courses in London

- Legal Practice Course (LPC) Courses in Birmingham

- Legal Practice Course (LPC) Courses in Glasgow

- Legal Practice Course (LPC) Courses in Liverpool

- Legal Practice Course (LPC) Courses in Bristol

- Legal Practice Course (LPC) Courses in Manchester

- Legal Practice Course (LPC) Courses in Sheffield

- Legal Practice Course (LPC) Courses in Leeds

- Legal Practice Course (LPC) Courses in Edinburgh

- Legal Practice Course (LPC) Courses in Leicester

- Legal Practice Course (LPC) Courses in Coventry

- Legal Practice Course (LPC) Courses in Bradford

- Legal Practice Course (LPC) Courses in Cardiff

- Legal Practice Course (LPC) Courses in Belfast

- Legal Practice Course (LPC) Courses in Nottingham