- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

377 Law courses in Viewpark delivered Live Online

IAAS: Casework Assistant Exam Preparation Course

By DG Legal

This half day online course will assist candidates in preparing for the forthcoming initial Casework Assistant exam.

Competition Law in the telecoms sector

By Cullen International SA

Competition in the communications sector is complex and fast-changing. This presents both risks and opportunities to providers, as well as challenges for public authorities. Would you like to gain expert insights on the practical applications of competition law in the regulated telecoms industry? Then, this training is for you! Presented by experts through practical case examples, this online training will guide you through the latest competition law developments affecting the telecoms industry and give you a full overview of the role played by competiton law in shaping the telecoms market. Topics covered include: Relationship between competition law and sector-specific telecoms regulation Market definition Telecoms mergers Antitrust aspects of network co-operation Typical abuses of dominance in the telecoms sector Broadband state aid When: 17-19 September 2024 - 9 hours of interactive sessions spread over 3 days Where: Online, using Microsoft Teams Cannot make it to one of the sessions? All sessions will be recorded and made available to registered participants.

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

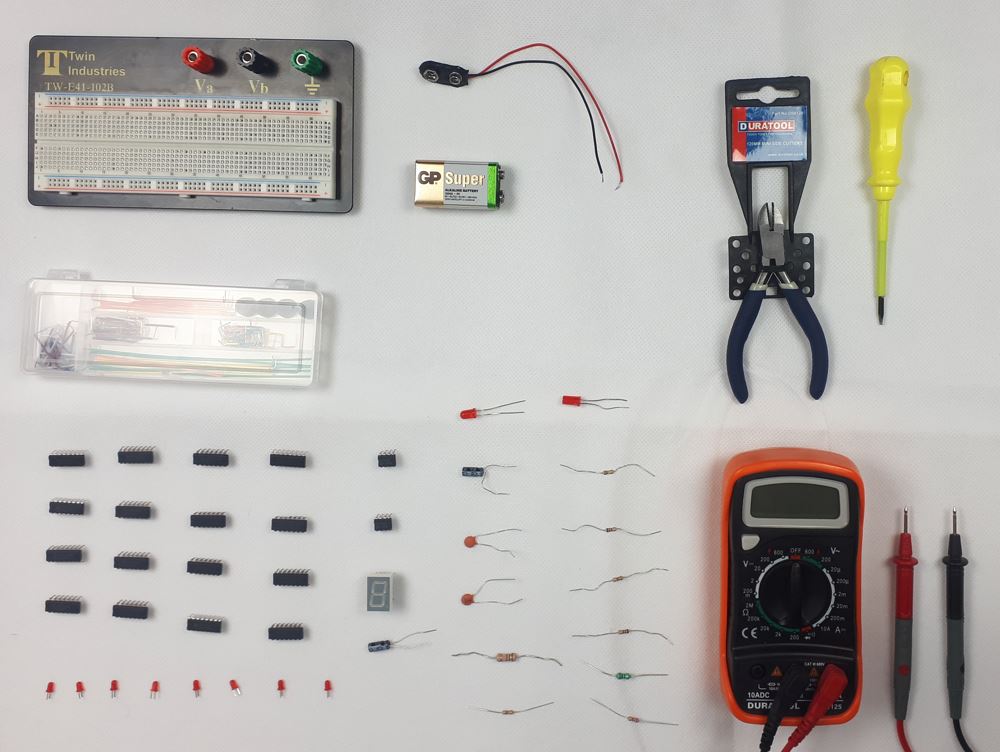

Digital Electronics Course Online

By Hi-Tech Training

This Digital Electronics Course is designed to give practical knowledge of the type of electronic circuitry used in a modern Computer System or in any type of Computer Controlled equipment such as Photocopiers, Cash Registers, Tablets, mobile phones and many other types of IT equipment. Digital Electronics involves the use of Silicon chips (Integrated Circuits). The internal structure of a computer is to a large extent comprised of Digital Electronic Circuits.

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

IAAS: Senior Caseworker Exam Preparation Course

By DG Legal

This one day online course will assist candidates in preparing for the forthcoming initial Senior Caseworker exam.

OISC Level 2 Training Course

By Immigration Advice Service

Our OISC Level 2 preparation course is a two-day training course which offers a closer look at immigration advice and follows on from the training at Level 1. Throughout this course, we cover the syllabus at Level 2, as according to OISC standards. View our course dates below, delivered via Microsoft Teams Course Overview: Take your expertise to the next level with our OISC Level 2 Accreditation Course. Designed as a two-day training program, this course builds upon the foundation established in Level 1 training. Delving deeper into immigration advice, we cover the Level 2 syllabus as prescribed by the OISC. Throughout this course, you’ll explore intermediate structures, frameworks, and concepts of UK immigration law. Gain insights into Humanitarian Protection and Asylum law, as well as the complexities of European Economic Area (EEA) free movement law. Additionally, our curriculum covers Business immigration law and Points-Based System (PBS) visas, along with the intricacies of detention and bail. We’ll also address major immigration offences to ensure a well-rounded understanding. Don’t forget to check out our Exam Technique Training (Level 2) which is designed to help prepare learners for their accreditation exam. Course joining links, materials and instructions are sent out 24hours before the course starts. What is included in the OISC Level 2 Syllabus? The OISC Level 2 Training introduces new learning objectives for immigration adviser applicants. The course includes: Intermediate structures, frameworks and concepts of UK immigration law Humanitarian Protection and Asylum law European Economic Area (EEA) free movement law Business immigration law and PBS visas Detention and bail Major immigration offences Join over 92% of satisfied customers who found their training with IAS useful and beneficial. You will also be provided with training materials to keep after completing the course. Who can attend the OISC Training Level 2 classes? The immigration procedures and structures introduced by the OISC Level 2 Course follow directly on from the objectives covered in the Level 1 Training. For this reason, participants should attend an OISC Level 2 class only after completing the Level 1 assessment. This course is also useful for participants who aim to become acquainted with UK immigration law. On the other hand, those who hold an OISC accreditation and wish to learn more about the latest development in this field can also benefit from this training class.

Compliance Officer For Legal Practice (COLP) Course

By DG Legal

The COLP role goes beyond just ensuring your firm follows the rules in the SRA Standards and Regulations, it also comes with a personal accountability factor that demands your attention. Fear not! This 3 hour course will usher you through the intricacies of being a COLP, ensuring you not only meet but excel in your regulatory obligations. The course will cover: Navigating the Regulatory Landscape: Understanding the Framework for COLPs Dive into the intricate regulatory framework that Compliance Officers for Legal Practice (COLPs) operate under. Shouldering the Responsibility: Unpacking the Duties of a COLP Explore the multifaceted responsibilities that come with the role of a COLP. Choosing the Right Leader: Identifying the Ideal COLP Candidate Learn the criteria for selecting the most suitable individual to take on the crucial role of COLP. Cracking the Codes: Key Elements of Codes and SRA Principles Delve into the essential components of the Codes and SRA Principles that form the backbone of legal compliance. Building a Robust Foundation: Understanding Compliance Systems for All Firms Explore the concept of compliance systems, what they entail, and why every firm should have one in place. Reporting Matters: Recognising 'Serious' Issues, SRA Enforcement Strategy, and Reporting Protocols Uncover the definition of 'serious' matters, grasp the SRA Enforcement Strategy, and gain practical insights on making effective reports to the SRA. Paper Trails Matter: Effective Record Keeping, Including Non-material Breaches Master the art of comprehensive record-keeping, including strategies for recording non-material breaches, and understand why it's integral to compliance. Personal Liability: Understanding and Mitigating Risks Navigate the landscape of personal liability for COLPs and develop strategies to mitigate associated risks. Staying Ahead: Keeping Abreast of Regulatory Changes and Guidance Develop effective strategies for staying up to date with dynamic regulatory changes and evolving guidance. Planning for Compliance: Crafting a Robust Strategy, Assessing Risk, and File Reviewing Formulate a comprehensive plan for tackling compliance, including risk assessment, maintaining risk registers, and implementing effective file reviewing. Across the Board: Legal and Regulatory Compliance Areas Every COLP Must Master Gain a high-level overview of crucial legal and regulatory compliance areas, including AML, transparency rules, and other pivotal aspects that demand the attention of all COLPs. Target Audience This online course is suitable for those new to the COLP role, or those supporting the COLP and for those that would like a refresher of the role and their responsibilities. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

Anti-Money Laundering (AML) Training For MLROs, MLCOs And Law Firm Management Course

By DG Legal

In January 2024 alone, reports were published about the SRA taking enforcement action against 3 firms and 4 individuals for failure to comply with the Money Laundering Regulations 2017. The fines issued for these non-compliances total over £570,000 plus costs. The absence of staff training, or requirement to complete additional training, was noted in a number of these cases. As a manager of a law firm, or more crucially an MLRO or MLCO, the ultimate responsibility for the firm's compliance, including with the MLR 2017, lies with you. It is your responsibility to ensure that the firm puts in place, reviews and updates compliant policies, controls and procedures. You must ensure that the firm maintains an up to date practice wide risk assessment. You are required to ensure that your employees are regularly given training on the MLR 2017 and associated risks. If a breach occurs, the SRA will take a wider look at the firm and identify any supervisory deficiencies that may have contributed to failures by fee earners or support staff. It has proven that it will not shy away from holding to account managers, compliance officers and MLRO/MLCOs for failures by their firms to comply with requirements of the MLR 2017. This course will cover the following to assist firms MLROs, MLCOs and Management with fulfilling their AML management responsibilities: How to comply with your obligations and stay compliant FWRA – linked with PCPs Mandatory AML Policies and Procedures - SRA have concerns Training and supervising staff Audits SRA requirements Reporting SARS POCA/TA Fulfilling reporting officer and compliance officer duties Target Audience The online course is suitable for MLROs, MLCOs, firm management and those supporting these roles. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

Data Protection (GDPR) Practitioner Certificate - live, online

By Computer Law Training

GDPR Practitioner