- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

OL19 IBM i System Administration

By Nexus Human

Duration 4.5 Days 27 CPD hours This course is intended for This is an intermediate course intended for IBM i system administrators, data processing managers and other individuals who implement and manage security, backup and recovery, system software and problem determination. This course is not recommended for s Overview Describe and implement the components of IBM i security, such as user profile, group profile, authorization list, adopted authority and object / resource security Develop a security plan for your Power Systems with IBM i Describe the options to implement security auditing Develop a plan to audit security on your Power Systems with IBM i Describe the IBM i availability products and features and choose the option(s) that best fit your company requirements Describe how to backup and recover user, IBM and full system data on your Power Systems with IBM i Develop a backup and recovery plan for your Power Systems with IBM i Describe the system diagnostics and problem determination procedures available on your Power Systems with IBM i Learn how to plan for, implement, and manage the ongoing operations of an IBM i. Class administration and introductions . IBM i overview and concepts . Management central overview . Security concepts and overview . System values . User security . Resource security . Security auditing . Designing security . IBM i availability overview . Disk management . Backup and recovery strategy using Save/Restore . Journal management . Commitment control overview . Backup and recovery planning . Problem determination . Overview of Systems Director Navigator for i . Introduction to BRMS .

Overview Embarking on a journey with the 'HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma' course presents an illuminating path into the intricacies of modern business management. Diving deep into twelve comprehensive modules, learners uncover the nuances of Human Resource Management, from recruitment strategies to understanding the bedrock of the UK's payroll system. Grasping the essence of organisational culture, performance metrics, and the technicalities of PAYE and Tax, participants will be primed to navigate the complex web of today's corporate world with confidence and finesse. With a spotlight on both theoretical insights and real-world applications, this diploma aims to equip you with a robust foundation in HR processes and the pivotal role of finance in business management. As businesses evolve, so does the demand for specialists who are adept at merging HR practices with financial wisdom. By the end of this course, you'll be empowered with the expertise to bridge these two vital domains, heralding success in the ever-evolving business landscape. Your learning journey culminates with a comprehensive conclusion and a pointer to the subsequent steps, ensuring you're not only well-versed in the subject but also equipped to apply this knowledge in practical scenarios. A world of opportunities awaits the ambitious learner, and this course is your compass to navigate it. Learning Outcomes Demonstrate a clear understanding of HR management's core principles and practices. Apply the UK recruitment legislation and industry statistics in organisational contexts. Design and implement effective strategies for employee training, development, and performance appraisals. Master the intricacies of payroll management, including the specifics of the UK system. Interpret and manage financial records, statistics, and the core elements of PAYE, Tax, and NI. Why buy this HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Individuals looking to launch or advance their careers in HR and financial management. Business owners wanting a deeper understanding of HR processes and financial systems. Job seekers aiming to diversify their skill set in the corporate domain. Graduates keen on specialising in HR and finance. HR professionals wishing to update their knowledge in line with the latest UK legislations and industry standards. Prerequisites This HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning.This HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Human Resource Manager: £30,000 - £55,000 Annually Recruitment Specialist: £25,000 - £50,000 Annually Payroll Administrator: £20,000 - £35,000 Annually Financial Accountant: £35,000 - £60,000 Annually Tax Consultant: £28,000 - £52,000 Annually Bookkeeping Specialist: £22,000 - £40,000 Annually Course Curriculum Module 01: Human Resource Management Human Resource Management 01:00:00 Module 02: HR Planning, Recruitment and Selection HR Planning, Recruitment and Selection 01:00:00 Module 03: Induction, Training and Development Induction, Training and Development 00:45:00 Module 04: HR Department's Responsibilities HR Department's Responsibilities 00:45:00 Module 05: The UK Recruitment Legislations Guide The UK Recruitment Legislations Guide 00:20:00 Module 06: Organizational Culture Organisational Culture 00:45:00 Module 07: Motivation, Counseling, Resignations and Retirement Motivation, Counseling, Resignations and Retirement 01:00:00 Module 08: Performance Appraisal & Remuneration Policy Performance Appraisal 00:45:00 Remuneration Policy 00:15:00 Module 09: Records and Statistics Records and Statistics 00:30:00 Module 10: Industrial Relations Industrial Relations 00:15:00 Module 11: The UK Recruitment Industry Statistics The UK Recruitment Industry Statistics 00:25:00 Module 12: Introduction to Payroll Management Introduction to Payroll Management 00:10:00 An Overview of Payroll 00:17:00 Module 13: The UK Payroll System Running the payroll - Part 1 00:14:00 Running the payroll - Part 2 00:18:00 Manual payroll 00:13:00 Benefits in kind 00:09:00 Computerised systems 00:11:00 Total Photo scenario explained 00:01:00 Module 14: Brightpay Brightpay conclude 00:03:00 Find software per HMRC Brightpay 00:03:00 Add a new employee 00:14:00 Add 2 more employees 00:10:00 Payroll settings 00:04:00 Monthly schedule - Lana 00:14:00 Monthly schedule - James 00:08:00 Directors NI 00:02:00 Reports 00:02:00 Paying HMRC 00:05:00 Paying Pensions 00:04:00 RTI Submission 00:02:00 Coding Notices 00:01:00 Journal entries 00:07:00 Schedule 00:03:00 AEO 00:06:00 Payroll run for Jan & Feb 2018 00:13:00 Leavers - p45 00:03:00 End of Year p60 00:02:00 Installing Brightpay 00:13:00 Module 15: Paye, Tax, NI PAYE TAX 00:13:00 NI 00:11:00 Pensions 00:06:00 Online calculators 00:07:00 Payslips 00:03:00 Journal entries 00:07:00 Conclusion and Next Steps Conclusion and Next Steps 00:08:00 Assignment Assignment - HR, Payroll, Paye, Tax, Accounting and Bookkeeping Diploma 00:00:00

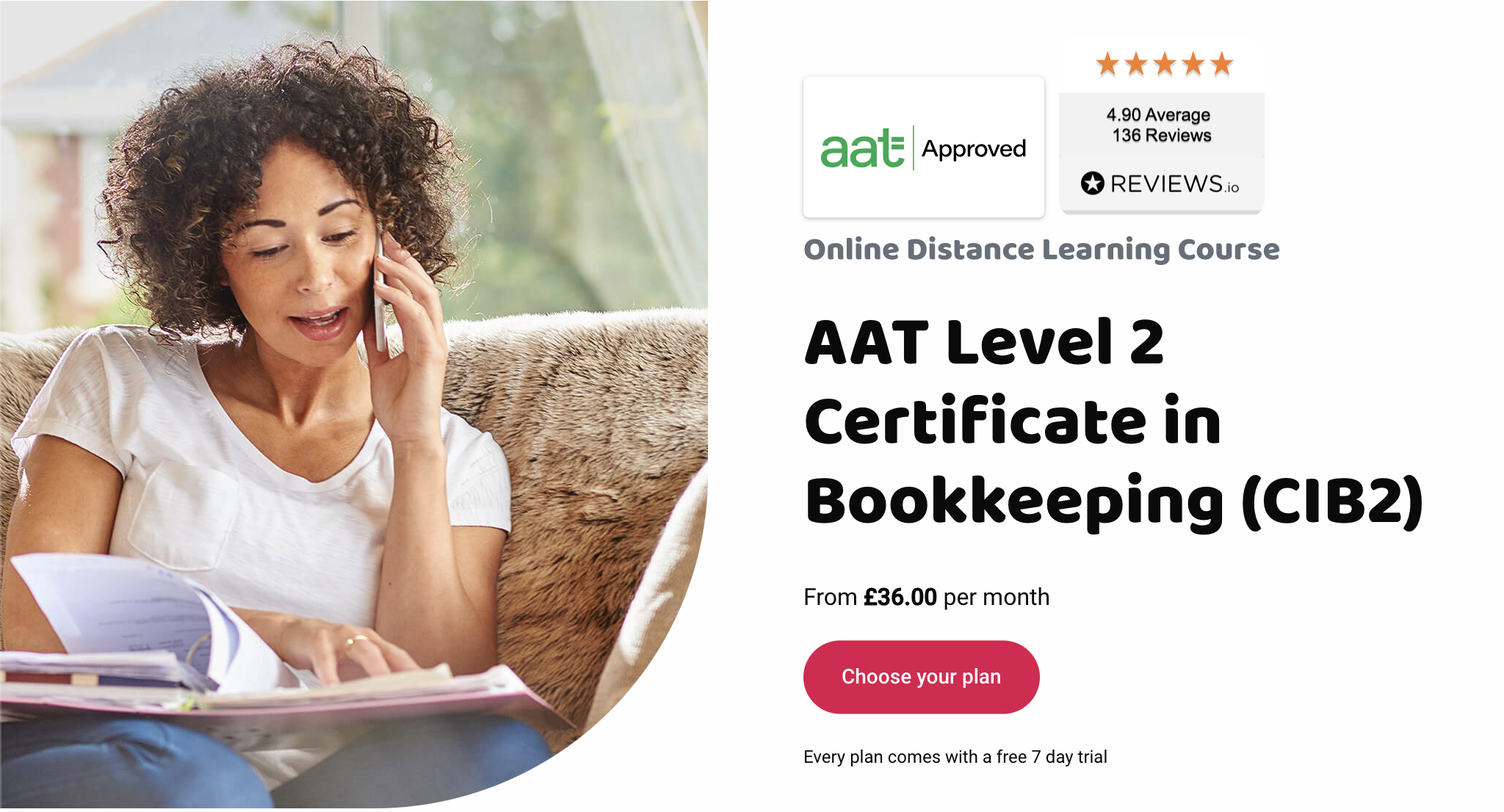

Do you want to become a bookkeeper and work in any business sector you like? No experience but eager to learn? Well then this is the qualification for you. This qualification will give you the skills to become a bookkeeper, and you’ll gain an industry-recognised qualification. Plus, with Eagle you’ll have the option to move onto the full AAT qualification when you finish at no extra cost. The course is made up of two units: Introduction to Bookkeeping (ITBK) and Principles of Bookkeeping Controls (POBC). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 to 5 months About AAT Level 2 Certificate in Bookkeeping Entry requirementsYou don’t need any previous accounting experience or qualifications to start studying AAT bookkeeping, just a willingness to learn. It’s ideal if you’re a school or university leaver, or thinking of changing career.Syllabus By the end of the AAT Level 2 Bookkeeping course, you will be able to confidently process daily business transactions in a manual and computerised bookkeeping system. This course provides comprehensive coverage of the traditional double-entry bookkeeping system which underpins accounting processes world-wide. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Introduction to Bookkeeping (ITBK) How to set up bookkeeping systems How to process customer transactions How to process supplier transactions How to process receipts and payments How to process transactions into the ledger accounts Principles of Bookkeeping Controls (POBC) How to use control accounts How to reconcile a bank statement with the cash book How to use the journal How to produce trial balances How is this course assessed? The course is assessed by two exams – one for each unit. Unit assessment A unit assessment only tests knowledge and skills taught in that unit. For Bookkeeping they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours after you have sat your assessment. AAT approved venuesYou can search for your nearest venue via the AAT websitelaunch.What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 2 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You could start work as an entry-level bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 3 Certificate in Bookkeeping at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable directly to AAT. Exam fees are paid to the exam centre. AAT one-off Level 2 Certificate in Bookkeeping Registration Fee: £65 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Accounting Basics

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Accounting Basics Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Accounting Basics Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Accounting Basics Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Accounting Basics Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Accounting Basics ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Accounting Basics there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Accounting Basics course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This Accounting Basics does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Accounting Basics was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Accounting Basics is a great way for you to gain multiple skills from the comfort of your home. Accounting Basics Introduction 00:01:00 Debits and Credits 00:22:00 Preparing Journal Entries 00:21:00 Posting Entries 00:13:00 Preparing Financial Statements 00:14:00 Additional Resource Additional Resource Assignment Assignment -Accounting Basics 00:39:00 Order Your Certificate Order Your Certificate QLS

Description Learn how to control cash and deal with internal controls through our Bank Reconciliations and Cash Control Diploma course. It will assist you to learn how to control both small and large companies. Take a look at our course. Its precise contents help you to learn all good aspects must. The course deals with internal controls briefing about their types, usefulness, and objectives. As bank reconciliation is very vital internal controls, the course will teach you some methods how to distinguish the bank statement to the cash book balance pointing at a time to settle the variation between them. The course will also teach you how to reconcile the bank accounts in a regular basis to ensure the accounts, justify the accuracy of account, and monitoring the all transactions through bank statement for its internal controls. At the end of the course, you will able to learn a board range of skill that may contribute to promotion. Assessment: This course does not involve any MCQ test. Students need to answer assignment questions to complete the course, the answers will be in the form of written work in pdf or word. Students can write the answers in their own time. Once the answers are submitted, the instructor will check and assess the work. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Bank Reconciliations and Cash Control Diploma is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Bank Reconciliations and Cash Control Diploma is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Introduction Introduction FREE 00:06:00 Internal Controls Overview and Cash Internal Controls Introduction 2 Internal Controls Overview and Cash Internal Controls Introduction 00:01:00 10 Internal Controls. 00:19:00 PDF - 20 Cash Internal Controls Overview 00:01:00 20 Cash Internal Controls Overview 00:08:00 Multiple Choice Questions 1 - Cash and Internal Controls 00:08:00 Accounting Comic Break 00:01:00 Cash Receipts Internal Controls 3 Cash Receipts Internal Controls 00:01:00 30 Cash Receipts Internal Controls 00:08:00 Multiple Choice Questions 2 - Cash and Internal Controls 00:09:00 Accounting Comic Break 00:01:00 Cash Disbursements Internal Controls 4 Cash Disbursements Internal Controls 00:01:00 PDF - 40 Cash Dismemberment Internal Controls 00:01:00 40 Cash Disbursements Internal Controls 00:08:00 Multiple Choice Questions 3 - Cash and Internal Controls 00:08:00 Accounting Comic Break 00:01:00 Bank Reconciliations 5 Bank Reconciliations 00:02:00 PDF - 50 Bank Reconciliation D & D 00:01:00 50 Bank Reconciliation-Accounting%2C Financial 00:20:00 Excel Download 00:01:00 9.10 Bank Reconciliation January 00:23:00 Excel Download 00:01:00 Worksheet - 9.12 Bank Reconciliation Adjusting Entries January 00:18:00 Excel Download 00:01:00 Worksheet - 9.15 Bank Reconciliation February 00:21:00 Excel Download 00:01:00 Worksheet - 9.20 Bank Reconciliation Feb. Adjusting Entries 00:14:00 Multiple Choice Questions 4 - Cash and Internal Controls 00:08:00 Short Calculation 1 00:10:00 Accounting Comic Break 00:01:00 Petty Cash 6 Petty Cash 00:02:00 PDF - 60 Petty Cash 00:01:00 60 Petty Cash 00:20:00 Excel Download 00:01:00 Worksheet - 800.10 Petty Cash Journal Entries Part 1-Accounting%2 00:10:00 Worksheet 800.20 Petty Cash Journal Entries Part 2-Accounting%2C 00:11:00 Multiple Choice Questions 5 - Cash and Internal Controls 00:08:00 Short Calculation 2 00:10:00 Accounting Comic Break 00:01:00 Comprehensive Problem 7 Comprehensive Problem 00:01:00 Excel Download 00:01:00 1 Accounting%2C Financial - Comp Prob Service Co 1 Part 1 00:15:00 2 Accounting%2C Financial - Comp Prob Service Co 1 Part 2 00:15:00 3 Accounting%2C Financial - Comp Prob Service Co 1 Part 3 00:15:00 4 Accounting%2C Financial - Comp Prob Service Co 1 Part 4 00:22:00 5 Accounting%2C Financial - Comp Prob Service Co 1 Adjusting Entr. 00:15:00 6 Comp Prob Service Co 1 Adjusting Entries part 6 00:20:00 7 Accounting%2C Financial - Comp Prob Service Co 1 Financial Stat 00:15:00 8 Accounting%2C Financial - Comp Prob Service Co 1 Financial Stat 00:17:00 9 Accounting%2C Financial - Comp Prob Service Co 1 Closing Proces 00:10:00 10 Comp Prob Service Co 1 Closing Process part 10 00:11:00 Multiple Choice Questions 6 - Cash and Internal Controls 00:08:00 Multiple Choice Questions 7 - Cash and Internal Controls 00:09:00 Accounting Comic Break 00:01:00 Definitions & Key Terms 8 Definitions & Key Terms 00:01:00 Bank Statement Definition - What is Bank Statement%3F 00:03:00 Canceled Checks Definitions - What are Canceled Checks%3F 00:02:00 Cash Definition - What is Cash%3F 00:01:00 Cash Equivalents Definition - What are Cash Equivalents%3F 00:02:00 Cash Over and Short - What is Cash Over and Short%3F 00:02:00 Check Definition - What is Check%3F 00:02:00 Check Register Definition - What is Check Register%3F (1) 00:03:00 Deposits in Transit - What are Deposits in Transit%3F 00:03:00 Gross Method Definition - What is Gross Method%3F 00:04:00 Invoice Definition - What is Invoice%3F (1) 00:02:00 Liquid Assets Definition - What are Liquid Assets%3F 00:03:00 Liquidity Definition - What is Liquidity%3F 00:03:00 Outstanding Check Definition - What are Outstanding Checks%3F 00:03:00 Petty Cash Definition - What is Petty Cash%3F 00:03:00 Purchase Requisition Definition - What is Purchase Requisition%3F 00:02:00 Bank Reconciliation Definition - What is Bank Reconciliation 00:05:00 Vendee Definition - What is Vendee%3F 00:02:00 Vendor definition - What is vendor%3F 00:02:00 Accounting Comic Break 00:01:00 Resources Resources - Bank Reconciliations and Cash Control Diploma 00:00:00 Assessment Assignment - Bank Reconciliations and Cash Control Diploma 00:00:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

HR, Payroll, PAYE, TAX

By IOMH - Institute of Mental Health

Overview of HR, Payroll, PAYE, TAX Do you dream of a career in Human Resources (HR) or Payroll? The UK HR industry is anticipated to reach a staggering £41.2 billion by 2025, with a rising demand for skilled professionals. This HR, Payroll, PAYE, TAX course provides a solid foundation in HR practices, payroll management, and tax implications, giving you a head start in this dynamic sector. More than just theoretical knowledge, this course equips you with practical skills and real-world experience, ensuring you're prepared and capable for the challenges of the HR, payroll, and tax industry. The dynamic world of HR, payroll, and taxation presents a wealth of opportunities for ambitious professionals. In the UK, these fields are paramount to the success of any organisation, with stringent regulations and ever-evolving best practices. Our HR, Payroll, PAYE, and TAX course empowers you with a comprehensive understanding of HR processes, payroll administration, and tax compliance, equipping you with the skills to navigate this intricate landscape seamlessly. By the end of this course, you'll have the confidence and expertise to excel in your chosen career path. Our course is designed to unlock your potential for success in the dynamic HR, payroll, and tax industries. With a focus on practical application and in-depth knowledge, you'll delve into the intricacies of employee recruitment, training, performance management, and termination, ensuring a cohesive and legally compliant workforce. Dive into the complexities of payroll systems, mastering the art of accurate calculations, deductions, and submissions. Gain invaluable insights into UK employment law, PAYE, and taxation, enabling you to make informed decisions and mitigate risks. This course is your gateway to a career in a high-demand industry, where HR, payroll, and tax professionals are in high demand, commanding competitive salaries and opportunities for growth. This HR, Payroll, PAYE, TAX course will help you to learn: Develop a comprehensive understanding of HR processes and payroll systems. Master employee lifecycle management from recruitment to termination. Acquire proficiency in administering payroll and ensuring compliance. Gain expertise in UK employment law and regulations. Implement effective strategies for employee engagement and retention. Calculate accurate payroll deductions and tax obligations. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online — Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion – Digital / PDF Certificate After completing the HR, Payroll, PAYE, TAX course, you can order your CPD Accredited Digital/ PDF Certificate for £5.99. Certificate of Completion – Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This HR, Payroll, PAYE, TAX is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don’t have the time to devote to traditional education. Requirements You don’t need any educational qualification or experience to enrol in the HR, Payroll, PAYE, TAX course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this HR, Payroll, PAYE, TAX Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Course Curriculum HR Management Module 01: Introduction to Human Resource 00:17:00 Module 02: Employee Recruitment and Selection Procedure 00:32:00 Module 03: Employee Training and Development Process 00:22:00 Module 04: Performance Appraisal Management 00:19:00 Module 05: Employee Relations 00:14:00 Module 06: Motivation and Counselling 00:19:00 Module 07: Ensuring Health and safety at the Workplace 00:17:00 Module 08 :Employee Termination 00:15:00 Module 09: Employer Record and Statistics 00:11:00 Module 10: Essential UK Employment Law 00:26:00 Payroll Management Introduction to Payroll Management Introduction to Payroll Management 00:10:00 An Overview of Payroll 00:17:00 The UK Payroll System Running the payroll - Part 1 00:14:00 Running the payroll - Part 2 00:18:00 Manual payroll 00:13:00 Benefits in kind 00:09:00 Computerised systems 00:11:00 Total Photo scenario explained 00:01:00 Brightpay Brightpay conclude 00:03:00 Find software per HMRC Brightpay 00:03:00 Add a new employee 00:14:00 Add 2 more employees 00:10:00 Payroll settings 00:15:00 Monthly schedule - Lana 00:14:00 Monthly schedule - James 00:08:00 Directors NI 00:02:00 Reports 00:02:00 Paying HMRC 00:05:00 Paying Pensions 00:04:00 RTI Submission 00:02:00 Coding Notices 00:01:00 Journal entries 00:07:00 Schedule 00:03:00 AEO 00:06:00 Payroll run for Jan & Feb 2018 00:13:00 Leavers - p45 00:03:00 End of Year p60 00:02:00 Installing Brightpay 00:13:00 Payee Tax NI PAYE TAX 00:13:00 NI 00:11:00 Pensions 00:06:00 Online calculators 00:07:00 Payslips 00:03:00 Journal entries 00:07:00 Conclusion and Next Steps Conclusion and Next Steps 00:08:00

Whether it is a small local business or a multinational company, there is always a spot open for accountants and bookkeepers. This line of profession provides a secure job with a good salary and other additional benefits. The Accounting, Bookkeeping & Payroll - Complete Video Course(US) is here to equip you with the vital skills to establish a promising career in the accounting and bookkeeping sector. In this Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will first receive a detailed introduction to accounting. Then the course will educate you on accounting equations, transactions and financial statements. You will be able to develop the ability to prepare worksheets, complete the accounting cycle, and post and adjust entries. The second section of the course will educate you on the principles of bookkeeping. You will learn how to manage the budget and sales tax. This valuable course will also ensure that you have the essential skills for payroll management. After completing the Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will receive a valuable certificate to enrich your resume. Enrol in this excellent course today to boost your skills and your career. Learning Outcomes Enrich your knowledge of accounting equations, transaction and financial statements Develop the skills for posting and adjusting entries Understand the process of preparing a worksheet Learn about the steps of the accounting cycle Familiarise yourself with the principles of bookkeeping Grasp the skills for budgeting and managing sales tax Acquire the essential skills and abilities for payroll management Who is this Course for? Accounting, Bookkeeping & Payroll - Complete Video Course(US) is certified by CPD Quality Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Accounting, Bookkeeping & Payroll - Complete Video Course(US) is fully compatible with any kind of device. Whether you are using Windows computers, Mac, smartphones or tablets, you will get the same experience while learning. You will be able to access the course with any internet connection from anywhere at any time without any kind of limitation. Assessment At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Why Choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet, or desktop from anywhere, anytime; The benefit of career advancement opportunities; 24/7 student support via email. Certification After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. Career Path After completing this Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will be able to build up accurate knowledge and skills with proper confidence to enrich your career in the following professions Accountant Bookkeeper Finance Officer Payroll Supervisor Accounts Assistant Module 01 : Business Accounting Professional Bookkeeper Introduction Professional Bookkeeper FREE 00:09:00 Introduction to Accounting and Business Defining a Business 00:07:00 Ethics in Accounting 00:05:00 Generally Accepted Accounting Principles (GAAP) 00:10:00 The Accounting Equation The Accounting Equation 00:07:00 Transactions 00:11:00 Financial Statements 00:13:00 Analyzing Transactions The Accounting Equation and Transactions 00:16:00 Double-Entry System 00:11:00 Transactions - Journalizing 00:17:00 Entering Information - Posting Entries Posting Entries 00:10:00 The Trial Balance 00:10:00 Finding Errors Using Horizontal Analysis 00:09:00 Adjusting Process The Purpose of the Adjusting Process 00:15:00 Adjusting Entries Adjusting Entries - Prepaid Expenses 00:13:00 Adjusting Entries - Accrued Revenues 00:10:00 Adjusting Entries - Depreciation Expense 00:09:00 Adjustment Summary Adjustment Summary - Review 00:13:00 Vertical Analysis 00:33:00 Preparing a Worksheet Preparing a Worksheet 00:06:00 Financial Statements The Income Statement 00:11:00 Financial Statements - Definitions 00:12:00 Completing the Accounting Cycle Temporary vs. Permanent Accounts 00:19:00 The Accounting Cycle Illustrated Accounting Cycle Illustrated - Steps 1-5 00:11:00 Accounting Cycle Illustrated - Steps 6-10 00:12:00 Fiscal Year Fiscal Year 00:09:00 Spreadsheet Exercise Spreadsheet Exercise - Steps 1-4 00:11:00 Spreadsheet Exercise - Steps 5-7 00:37:00 Module 02 : Bookkeeping and Payroll Principles Introduction - GAAP FREE 00:15:00 Transactions 00:11:00 Overview of Internal Controls The Need for Internal Controls 00:24:00 Control Concepts 00:25:00 Subsidiary Ledgers and Special Journals Subsidiary Ledgers 00:16:00 Special Journals - Posting Sales Journal 00:18:00 Special Journals - Posting Cash Receipts 00:13:00 Reconciliations Purpose 00:14:00 Reconciliation 00:22:00 Who Should Perform the Reconciliation 00:12:00 Correcting Entries Correcting Entries 00:08:00 The Wrong Account 00:05:00 Sales Tax Sales Tax 00:13:00 Sales Tax Rules and Filing 00:13:00 Budgeting All Businesses Must Have a Strategic Plan 00:28:00 Types of Budgets 00:19:00 Accounting for Merchandising Merchandising Income Statement 00:17:00 Sales Discounts 00:15:00 Purchase Discounts 00:17:00 Accounting for Cash Defining Petty Cash 00:12:00 Accounting for Cash Over or Short 00:13:00 Cash Controls - The Bank Reconciliation 00:27:00 Payroll The Payroll Process 00:35:00 Payroll Process - Deduction Tables 00:21:00 Payroll Process - Earnings Record 00:24:00 Partnerships and Corporations The Partnership 00:19:00 Corporations 00:09:00 Preferred Stock 00:18:00 Accounts Receivable and Bad Debts Accounts Receivable 00:22:00 Bad Debts 00:17:00 Interim Profit or Loss Interim 00:09:00 Year End - Preparing to Close the Books Inventory 00:21:00 Inventory Obsolescence 00:20:00 Year End - Closing the Books Year End - Closing Journal Entries 00:14:00 Year End - Post Closing Trial Balance 00:18:00 Cash Flow What is Cash Flow 00:19:00 Cash Flow - The Indirect Method 00:23:00 The Direct Method 00:22:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Goal Setting Course - Turn Your Dreams Into Reality

By Lead Academy

Quality Guarantee: Promising training excellence, satisfaction gurantee Accredited by CPD UK & Quality License Scheme Tutor Support Unlimited support via email, till you complete the course Recognised Certification: Accepted by thousands of professional bodies Start Anytime With 1 year access to the course materials Online Learning Learn from anywhere, whenever you want From this course, you will learn proven strategies to set clear, achievable goals, create actionable plans and stay motivated. You will acquire effective techniques for overcoming obstacles, tracking progress and transforming your dreams into tangible reality. This course at a glance Accredited by CPD UK Endorsed by Quality Licence Scheme Understand what is goal setting Recognise how to set goals Acquire the steps to reaching your goals Learn how to set goals for the success of your business Know how to create an action plan so as to achieve your goals Learn the importance of setting goals Recognise the 5 ways to stay focused in a world full of distractions Learn the importance of activation triggers in reaching your goals Discover the magic of thinking big Understand the 6 steps to accomplishing your life goals and resolutions Learn the 7 things you should do when you fail to achieve your goals Why Goal Setting Course - Turn Your Dreams Into Reality right for you? This comprehensive goal setting - turn your dreams into reality course will help you enhance your focus and motivation and enable you to sustain the momentum in life. You will also recognise what is goal setting and how to set goals by taking this popular goal setting online course. Using this extensive online course, you will also understand the importance of goal setting, the magic of big thinking, and how to set an achievable goal. This goal setting online course will also help you learn how to incorporate growth in real life, how to plan your day, the benefits of keeping a journal and much more. By the end of the course, you will acquire the knowledge required to master the art of setting goals and also develop the necessary skills to become a confident coach or a leader. Goal Setting Course - Turn Your Dreams Into Reality Details Accredited by CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Course Curriculum Introduction Introduction Steps to Reaching Your Goals How to Set Specific Goals to Improve Business Success Time Management Tips for Achieving Your Goals 4 Tips to Writing Down Your Goals Effectively How to Create an Action Plan to Achieve Your Goals Why It's So Important to Set Daily Goals Why Goals are So Important 5 Ways to Stay Focused in a World Full of Distractions 5 Ways to Stay Focused in a World Full of Distractions 5 Simple Steps Toward Reaching Your Goals with Help from Activation Triggers Setting Goals Leads to Higher Performance Planning & Setting Goals 3 Steps to Setting Good Goals 6 Steps to Accomplishing Your Life Goals and Resolutions How to Write an Action Plan to Help You Achieve Your Goals 7 Things You Should Do When You Fail to Achieve Your Goals The Magic of Thinking Big Incorporating Goals into Your Daily Life The Power of Daily Goals (and 15 ideas to get you started) How to Turn Goals into Monthly Actions, Weekly Routines, and Daily Habits Setting Smarter Daily Goals 5 Daily Habits That Will Help You Manifest Your Goals The Complete Guide to Planning Your Day Incorporating Goals into Your Business How can I Make Goals Measurable? 10 Guidelines for Effective Goal Setting 8 Ways to Stay Committed to Your Goals When You Should Keep Your Goals to Yourself Set the Deadline to Achieve Your Goals Worksheets and Exercises for Goal Setting Benefits of Keeping a Journal The Importance of a Social Support Network in Achieving Your Goals The 'Average Perfect Day' Exercise The 'Treasure Mapping' Exercise The 'One Year from Now' Exercise Review Who should take this course? This comprehensive goal setting - turn your dreams into reality course is suitable for anyone looking to improve their job prospects or aspiring to accelerate their career in this sector and want to gain in-depth knowledge of goal setting. Entry Requirements There are no academic entry requirements for this goal setting - turn your dreams into reality course, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This goal setting - turn your dreams into reality course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Certification Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Technical Writing for Developers Course

By Cherryleaf

An affordable way for developers to develop skills in technical writing Cherryleaf's Technical Writing for Developers e-learning course teaches the basics of technical writing to developers who are writing documentation. It teaches you how to write clearer technical documentation, plus topics such as creating sample code, tutorials, images and diagrams. The course will improve your technical writing skills. You’ll gain confidence you’re approaching each writing project in the right way, and creating content that follows best practice. Who are these courses for? The courses have been designed for: Software engineers Software engineering students In addition, other people involved in software development (such as product managers) can benefit from these courses, especially if they: Want to communicate more clearly and effectively Want to know how little, or how much, they should write Struggle with planning their writing Want people to answer their own support questions Prerequisites Delegates need to have basic writing proficiency in English. What will I learn? You’ll learn: How to communicate clearly, even if writing doesn’t come naturally How to save time and write in an efficient way Confidence in the work you produce You’ll have access to a framework and templates to help you with your writing. You can also get feedback on your completed exercises. Course duration The course typically takes 1 to 1.5 days to complete, but you can go at the pace that suits you. Your Instructor Cherryleaf Cherryleaf is a technical writing services company formed in 2002 by people with a passion for technical communication and learning development. Cherryleaf is recognised as a leader within the technical communication profession. Our staff have written articles for the Society for Technical Communication's (STC) Intercom magazine, the Institute of Scientific and Technical Communicator's Communicator journal and tekom's TCWorld magazine. They've also written books on technical communication. We've presented webinars for Adobe, Madcap Software or the STC, and we've spoken at various conferences around the world. Today, organisations throughout Europe use Cherryleaf’s services so they can provide clear information that enables users and staff to complete tasks productively. Course Curriculum First Section Introduction (0:52) Writing clearly (24:47) Writing headings, lists, and links (7:00) Structuring the information (13:12) Planning and outlining your writing (7:43) Using Information Types (15:34) Using images and videos (7:58) Writing in Markdown Writing clear code samples (8:22) Reviewing and editing your content (8:40) Summary (1:29) Frequently Asked Questions When does the course start and finish? The course starts now and never ends! It is a completely self-paced online course - you decide when you start and when you finish.How long do I have access to the course?How does lifetime access sound? After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you own.What if I am unhappy with the course?We would never want you to be unhappy! If you are unsatisfied with your purchase, contact us in the first 30 days and we will give you a full refund.

Kafka Streams with Spring Cloud Stream

By Packt

In this course, you will learn to create Kafka Streams microservices using the Spring cloud framework. This is an example-driven course, and you will learn to use Confluent Kafka distribution for all the examples. By the end of this course, you will learn to create Kafka Streams microservices using different types of serializations, Confluent schema registry, and creating stateless and stateful event processing applications.