- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Investment courses in Romiley

We couldn't find any listings for your search. Explore our online options and related educators below to see if they help you.

Know someone teaching this? Help them become an Educator on Cademy.

Online Options

Show all 2685GLOBALIZATION AND THE GLOBAL POLITICAL ECONOMY | Live Online | Learning University-Level Course (Non-Credit)

By Gada Academy

Master Globalization and the Global Economy 🌍💡 Discover the forces driving our interconnected world in this live online course. Explore the interplay of politics and economics through key theories, global trade, finance, and governance. Perfect for aspiring policymakers, business leaders, and global thinkers—enroll today to unlock the skills to navigate the global political economy!

GLOBALIZATION AND THE GLOBAL POLITICAL ECONOMY | Live Online | Learning University-Level Course (Non-Credit)

By Gada Academy

This course offers a dynamic introduction to Globalization and the Global Political Economy (GPE), exploring the intricate relationship between political actors and the global economic marketplace. Through a theoretically rich and historically grounded lens, you’ll examine the development, operations, and future trajectory of the global political economy. You’ll learn to apply diverse theoretical frameworks to critically analyze global economic processes. The course begins with an in-depth look at foundational GPE perspectives—mercantilism, liberalism, and structuralism—each built on distinct assumptions that shape our understanding of global economic events. From there, we’ll investigate the international "structures" of production, trade, finance, and knowledge, addressing critical questions: Who controls these structures, and to what end? What rules govern international trade? How do institutions like the IMF, World Bank, and multinational corporations shape global flows of goods and investment? Who benefits from controlling knowledge? The course culminates with an exploration of 21st-century global governance, highlighting the rise of new economic and political power centers and their evolving roles in the world. The course concludes with an exploration of 21st-century global governance, spotlighting the emergence of new economic and political power centers, such as BRICS, and their evolving roles in the world. We’ll also examine how the United States under Donald Trump shifted from traditional liberal internationalism toward more transactional and bilateral approaches, reshaping global relationships and challenging established norms Learning Outcomes By the end of this course, you will be able to: Analyze the major political themes in the historical evolution of the international economy. Understand debates surrounding the emergence and impacts of a globalized economy, including patterns of inequality. Evaluate key GPE theories and perspectives in both historical and contemporary contexts. Apply theoretical insights to explain the causes and effects of international trade, capital flows, monetary relations, and globalization debates. Recognize the vital role of human and environmental security in political economy studies. Demonstrate strong analytical and critical thinking skills when assessing political phenomena. Why Study Global Political Economy? Global Political Economy (GPE), also known as International Political Economy (IPE), untangles the complex interplay between global politics and economics. It’s an ideal field for anyone eager to understand how international policies, trade, finance, and institutions shape the world’s economic landscape. Whether you’re aiming for a career in policymaking, international relations, or a related field, this course equips you with essential tools to navigate the complexities of the global economic system and its profound influence on our world. Who Should Take This Course? This course is perfect for professionals, academics, and students interested in international relations, the global economy, or related disciplines. Whether your focus is policymaking, economic analysis, or global studies, you’ll gain valuable insights and analytical skills to deepen your understanding. Take the Next Step Don’t miss out—register today to secure your spot and immerse yourself in the fascinating world of globalization and political economy!

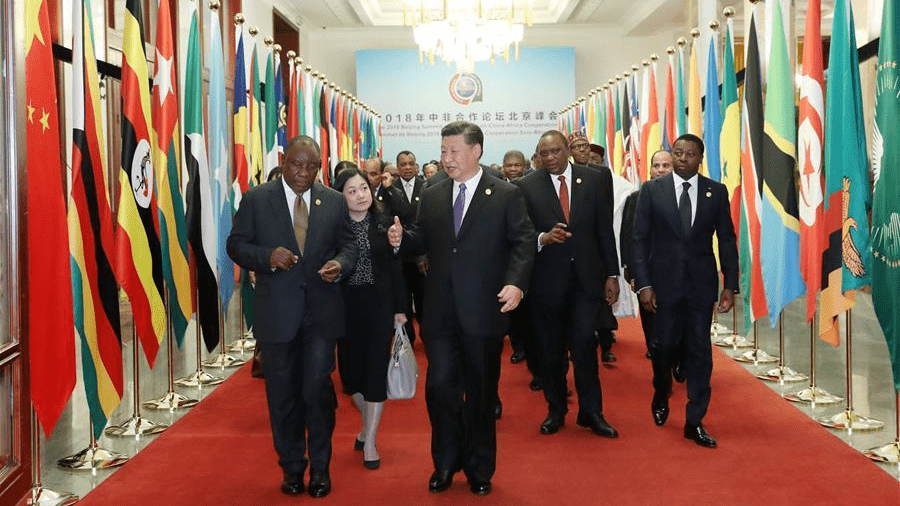

Global Power Shifts and China's Evolving Role in Africa | Live Online Learning

By Gada Academy

Explore China’s growing influence in Africa through this in-depth course. Weekly themes blend history, trends, and analysis to unpack the economic, political, and social layers of this evolving relationship. Gain a nuanced view of its impact on Africa’s global role

Master the intricacies of Investment with a focus on time management, from understanding the success formula to harnessing productivity tools. This course guides you through managing distractions, enhancing focus, and optimizing energy for investment success.

Master the intricacies of Investment with a focus on time management, from understanding the success formula to harnessing productivity tools. This course guides you through managing distractions, enhancing focus, and optimizing energy for investment success.

Level 2 & 3 Investment: Investment

By Imperial Academy

Level 3 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 120 CPD Points | Lifetime Access

Investment Banking

By Compete High

ð¼ Unlock the Secrets of Investment Banking: Your Path to Financial Success! ð° Are you ready to dive into the fast-paced world of investment banking? Enroll in our Investment Banking text course and embark on a journey towards mastering the intricacies of finance, mergers, acquisitions, and more. Whether you're a seasoned professional looking to advance your career or a novice eager to enter the world of high finance, this course is your gateway to success. ð Why Invest in Investment Banking? Investment banking is a dynamic and lucrative field that plays a crucial role in the global economy. By understanding the fundamentals of investment banking, you'll gain invaluable insights into financial markets, corporate finance, and strategic decision-making. Whether you aspire to become an investment banker, financial analyst, or corporate strategist, this course will equip you with the knowledge and skills needed to thrive in a competitive industry. ð What Will You Learn? In our Investment Banking text course, you'll explore a wide range of topics, including: Financial Markets and Instruments Corporate Valuation and Financial Modeling Mergers and Acquisitions Capital Markets and Fundraising Risk Management and Regulatory Compliance With each module, you'll deepen your understanding of key concepts and principles, preparing you to tackle real-world challenges with confidence and expertise. ð Who is This For? Our Investment Banking course is perfect for: Finance Professionals Seeking Career Advancement Students Pursuing Careers in Investment Banking or Finance Entrepreneurs and Business Owners Looking to Navigate Financial Markets Anyone Interested in Understanding the Dynamics of Corporate Finance and Capital Markets No matter your background or experience level, this course offers something for everyone interested in mastering the art of investment banking. ð Career Path Upon completing our Investment Banking course, you'll be well-positioned to pursue a variety of exciting career opportunities, including: Investment Banking Analyst Financial Analyst Corporate Finance Manager Mergers and Acquisitions Advisor Asset Manager Private Equity Associate With the foundational knowledge and skills acquired in this course, you'll be equipped to excel in diverse roles within the finance industry, paving the way for a rewarding and prosperous career. ð Frequently Asked Questions (FAQs) Q: Is this course suitable for beginners with no prior finance experience? A: Yes, our Investment Banking course is designed to accommodate learners of all levels, from beginners to seasoned professionals. We provide clear explanations and practical examples to ensure that even those with minimal finance background can grasp complex concepts. Q: How long does it take to complete the course? A: The duration of the course varies depending on your learning pace and schedule. On average, most students complete the course within [insert estimated time frame], but you can progress at your own pace and revisit materials as needed. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successfully completing the Investment Banking course, you'll receive a certificate of achievement, showcasing your newfound expertise in investment banking and finance. Q: Can I access the course materials on mobile devices? A: Absolutely! Our course materials are accessible on all devices, including desktops, laptops, tablets, and smartphones, allowing you to learn anytime, anywhere. Q: Is there any prerequisite knowledge required to enroll in the course? A: While prior knowledge of finance or accounting may be beneficial, it is not required. Our course covers fundamental concepts and builds upon them progressively, making it accessible to learners of all backgrounds. ð Begin Your Journey to Financial Mastery Today! Don't miss out on this opportunity to gain invaluable skills and insights into the world of investment banking. Enroll now in our Investment Banking text course and take the first step towards a successful and rewarding career in finance. Your path to financial success starts here! ðð¼ð Course Curriculum Module 1 Introduction to Investment Banking Introduction to Investment Banking 00:00 Module 2 Financial Markets and Instruments Financial Markets and Instruments 00:00 Module 3 Capital Markets and Investment Banking Capital Markets and Investment Banking 00:00 Module 4 Trading and Sales in Investment Banking Trading and Sales in Investment Banking 00:00 Module 5 Research and Analysis in Investment Banking Research and Analysis in Investment Banking 00:00 Module 6 Asset Management in Investment Banking Asset Management in Investment Banking 00:00

Overview In order to determine if capital investment is beneficial to their organisation, Return on Investment Analysis will provide you with the tools and techniques. This course will teach you the basics of Return on Investment analysis such as estimating future revenues, ongoing expenses, and the initial investment. It will also explore more advanced aspects such as risk, changes in net working capital and the calculation of manufacturing overhead. It then assembles these projected expenses and revenues into a financial - the method experts agree is the best for evaluating capital investments.

Investment Banking Analyst

By Compliance Central

Incredible Things Originate from a Little Bundle Special Price Cut Offer Are you looking to enhance your Investment Banking Analyst skills? If yes, then you have come to the right place. Our comprehensive courses on Investment Banking Analyst will assist you in producing the best possible outcome by mastering the Investment Banking Analyst skills. Get 6 CPD Accredited Courses for only £41! Offer Valid for a Limited Time!! Hurry Up and Enrol Now!!! Course 01: Investment Banking Course 02: Business Analysis Course 03: Capital Budgeting & Investment Decision Rules Course 04: Making Budget & Forecast Course 05: Financial Reporting Course 06: Financial Modelling for Decision Making and Business plan The Investment Banking Analyst bundle is for those who want to be successful. In the Investment Banking Analyst bundle, you will learn the essential knowledge needed to become well versed in Investment Banking Analyst. Our Investment Banking Analyst bundle starts with the basics of Investment Banking Analyst and gradually progresses towards advanced topics. Therefore, each lesson of this Investment Banking Analyst course is intuitive and easy to understand. Why would you choose the Investment Banking Analyst course from Compliance Central: Lifetime access to Investment Banking Analyst courses materials Full tutor support is available from Monday to Friday with the Investment Banking Analyst course Learn Investment Banking Analyst skills at your own pace from the comfort of your home Gain a complete understanding of Investment Banking Analyst course Accessible, informative Investment Banking Analyst learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Investment Banking Analyst bundle Investment Banking Analyst Curriculum Breakdown of the Investment Banking Analyst Bundle Investment Banking Module 01: Introduction to Investment Banking Module 02: Structure and Side of Investment Banking Module 03: Valuation Methods in Investment Banking Module 04: Leveraged Buyout (LBO) Module 05: Initial Public Offering (IPO) Module 06: Merger and Acquisition Module 07: Ethics in Investment Banking Business Analysis Module 01: Introduction to Business Analysis Module 02: Business Environment Module 03: Business Processes Module 04: Business Analysis Planning and Monitoring Module 05: Strategic Analysis and Product Scope Module 06: Solution Evaluation Module 07: Investigation Techniques Module 08: Ratio Analysis Module 09: Stakeholder Analysis and Management Module 10: Process Improvement with Gap Analysis Module 11: Documenting and Managing Requirements Module 12: Business Development and Succession Planning Module 13: Planning & Forecasting Operations Module 14: Business Writing Skills Capital Budgeting & Investment Decision Rules Section 01: Introduction Section 02: NPV Method Section 03: Payback Period Method Section 04: Internal Rate of Return (IRR) Section 05: Evaluating Projects in Different Lives Section 06: Conclusion Making Budget & Forecast Unit 01: Introduction Unit 02: Detail Budget Requirement Unit 03: Process of Making Budget Financial Reporting Module 01: Financial Reporting Module 02: The Cash Flow Statement Module 03: Credit Analysis Module 04: The Balance Sheet AND MORE..... Financial Modelling for Decision Making and Business plan Section 01: Introduction Section 02: Case Study: Restaurant - Basic Model for Selecting Initial Idea Section 03: Business Plan and 3 Financial Statement Models CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Investment Banking Analyst bundle helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Investment Banking Analyst. It is also great for professionals who are already working in Investment Banking Analyst and want to get promoted at work. Requirements To enrol in this Investment Banking Analyst course, all you need is a basic understanding of the English Language and an internet connection. Career path The Investment Banking Analyst bundle will enhance your knowledge and improve your confidence. Investment Banking Associate: £70,000 to £120,000 per year Financial Analyst: £35,000 to £60,000 per year Equity Research Analyst: £45,000 to £75,000 per year Portfolio Manager: £60,000 to £100,000 per year Risk Analyst: £35,000 to £60,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included 6 CPD Accredited PDF Certificate for Free Hard copy certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate for £9.99 each. Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

Search By Location

- Investment Courses in London

- Investment Courses in Birmingham

- Investment Courses in Glasgow

- Investment Courses in Liverpool

- Investment Courses in Bristol

- Investment Courses in Manchester

- Investment Courses in Sheffield

- Investment Courses in Leeds

- Investment Courses in Edinburgh

- Investment Courses in Leicester

- Investment Courses in Coventry

- Investment Courses in Bradford

- Investment Courses in Cardiff

- Investment Courses in Belfast

- Investment Courses in Nottingham