- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

88 Investment courses in Bristol

Bespoke Management Training

By Dickson Training Ltd

One of our greatest strengths is our ability to tailor any of our open management courses to the needs and requirements of different businesses in different industries. We understand that whilst our open management training courses provide a wealth of knowledge in their particular area of focus, not all of it may be relevant for your business and the particular industry you operate in.Rather than making delegates sit through management training that is irrelevant to their job role, we offer bespoke management training where we tailor the course to cover the specific needs of your organisation, ultimately relieving the inevitable boredom and "switching off" that would come with having to sit through training that a person knew they would not need. Why choose us for your bespoke management training needs? We have provided tailored, bespoke management training courses to some of the largest organisations in the UK. Using our acquired experience and knowledge of running these courses, we will be able to work with you to create a bepoke management training programme that delivers a significant return on investment, both in terms of tangible and intangible results. ILM accredited management training courses Because we charge a daily training rate rather than a per delegate fee, if you have a number of delegates requiring management training, a bespoke management training course can often be less expensive than putting them all on an open course. A number of courses have been accredited by the ILM, which means you can be assured as to the standard of the course content and delivery. For more information on these, please see our page on ILM Management Training. All of our ILM Programmes are provided in partnership with BCF Group Limited, which is the ILM Approved Centre we deliver under. Interested in finding out more about bespoke management training? Between us, we can come up with a training plan which will provide relevant, bespoke management training for your delegates which will maximise the return on both your time and cost. We are happy to come to your premises or arrange training facilities nearer to your location if this would be more convenient. Feedback Below is a small selection of past feedback for our management training and development courses and programmes: "Excellent instructor. I looked forward to our monthly lectures knowing that I would have a good laugh but also that I would learn more about the subject and myself. He has been very helpful to me and the rest of the students, not just during the lectures but often in his own time. His enthusiasm for all of the subjects covered during the course was evident throughout, which again helped me to enjoy and understand the subjects and lectures. If I get the chance in future to attend a further course with you, I would jump at the chance."Senior Acquisitions SurveyorGalliford Try "A very accomplished trainer and someone who I would very much like to be involved in our business training going forward. The feedback I have had from all levels of our team structure is excellent."Group HR OperationsEADS Personnel Services UK "Phil has a lot of energy which he throws into the course. This visably broke down resistance and attendees entered into the exercises wholeheartedly."Senior QSBullock Construction Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

School of Economic and Financial Modelling

By Mindset Resource Consulting

Our Economic and Financial Modelling courses are suitable for economists, researchers and regulators in policy making institutions such as central banks, ministries of finance, trade and investment, economic planning authorities, regional/international policy institutions, think tanks, petroleum industry and other business/economic sectors that make use of statistical and econometric modelling techniques.

Banking and Risk Management School

By Mindset Resource Consulting

Our banking and risk management courses are aimed at empowering finance professionals with the knowledge and skills needed in banking, risk management, financial services and regulation. Our courses are suitable for a wide range of audience including bank executives/directors, senior managers, financial risk managers, credit officers, relationship managers, bank operational staff, treasury/asset managers, compliance officers, investment bankers, and financial services regulators and supervisors.

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Foundation

By Tableau Training Uk

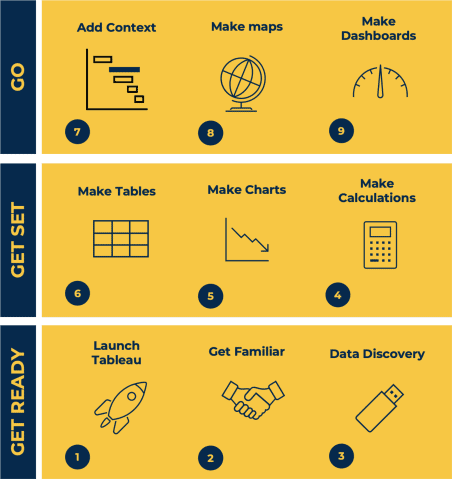

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2 day course focuses on best practice bank ALM in today’s environment of a multiplicity of regulatory constraints on the balance sheet Who the course is for Asset Liability Committee (ALCO) members Treasury Risk Finance and internal audit capital management Funding management Liquidity buffer investment team Derivative structurers and salespeople; IT software providers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

This course will move a manager’s focus away from simply reviewing last year’s financial performance, toward the development of an interactive approach, designed to really understand financial performance and the consequence of inaction. PARTICIPANTS WILL LEARN HOW TO: • The confidence to use budgeting tools and techniques • An understanding of the demands of financial management • The ability to analyse and challenge financial and accounting • Information • An understanding of fixed and variable costs and how these affect the sales price and profitability • Understanding the challenges of overhead allocation • Understanding the P&L • Developing awareness of fundamental investment appraisal techniques COURSE TOPICS INCLUDE: • Budget Definitions & Planning • Designing and developing a budget • Performance reporting systems & cost control • Zero-based budgeting systems • Understanding business costs (FC & VC) • Understanding variance analysis • Profit and Loss & Balance Sheet

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

The course helps participants understand the role of demand and inventory planning in the wider context of supply chain management. It aims to demonstrate how to improve the alignment between supply and demand to maintain good levels of customer service and on-shelf availability whilst eliminating excess stock and reducing inventory investment. PARTICIPANTS WILL LEARN HOW TO: • Understand the role of demand management and its benefits • Identify the key demand characteristics and patterns; learn how to use them to improve forecast accuracy • Develop an understanding of key qualitative and quantitative forecasting methods • Learn how to conduct fundamental inventory analyses with a view to achieving the appropriate trade-off between stock and service level COURSE TOPICS INCLUDE: The role of Demand Management • The end-to-end view of Supply Chain Management • Demand Characteristics and the Product Life Cycle • Demand patterns • Push and pull systems Background to forecasting • The forecasting Process • Time-series methods of forecasting • Calculating forecast errors Inventory Analysis • Categorisation of stock • ABC Analysis • Economic order quantity and minimum order quantity • Safety stock and stock cover Inventory Management • Materials requirements planning (MRP) • Stock replenishment systems • Practical inventory management • The cost of managing stock

Search By Location

- Investment Courses in London

- Investment Courses in Birmingham

- Investment Courses in Glasgow

- Investment Courses in Liverpool

- Investment Courses in Bristol

- Investment Courses in Manchester

- Investment Courses in Sheffield

- Investment Courses in Leeds

- Investment Courses in Edinburgh

- Investment Courses in Leicester

- Investment Courses in Coventry

- Investment Courses in Bradford

- Investment Courses in Cardiff

- Investment Courses in Belfast

- Investment Courses in Nottingham