- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

240 Investment courses in Cardiff delivered Live Online

ISTQB Certified Tester - Advanced Level Test Manager

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Test Programme Managers, Test Managers, and anyone else wishing to take the ISTQB© Certified Tester Advanced Level Test Manager examination. Overview Whilst this course is focused on the syllabus, giving participants the maximum chance of passing the examination, it also contains many real world practical examples. On completion of this course, attendees will have an advanced understanding of test design techniques and will be fully prepared to take the ISTQB© Certified Tester Advanced Level Test Manager examination. ISTQB© is the standard for international qualifications in software testing at an advanced level. The course thoroughly prepares attendees for the ISTQB© Certified Tester Advanced Level Test Manager examination. Testing Process The fundamental test process Test levels and test types Test planning, monitoring and control Test analysis Test design Test implementation Test execution Evaluating exit criteria and reporting Test closure activities Test Management Test management in context Risk-based testing and other approaches for test prioritization and effort allocation Test documentation and other work products Project risk management Other test work products Test estimation Defining and using test metrics Business value of testing Distributed, outsourced, and insourced testing Managing the application of industry standards Reviews Management reviews and audits Managing reviews Metrics for reviews Managing formal reviews Defect Management The defect lifecycle and the software development lifecycle Cross-functional defect management Defect report information Assessing process capability with defect report information Improving the Testing Process Introduction Test improvement process Improving the testing process Improving the testing process with TMMI Improving the testing process with TPI Next Improving the testing process with CTP Improving the testing process with STEP Test Tools and Automation Tool selection Return on investment (ROI) Selection process Tool lifecycle Tool metrics People Skills ? Team Composition Individual skills Test team dynamics Fitting testing within an organization Motivation Communication

Finance for Non Finance Managers (1 Day)

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for Those who need to understand the financial implications of their day-to-day decisions to increase the profitability and performance of their business. This course is suitable for managers with little or no financial knowledge. Overview Understanding of financial accounts and reports The ability to use and understanding of financial concepts Analytical skills to interpret financial results using ratios This course shows how to interpret key financial statements highlighting the questions and areas that matter. It identifies warning signals that managers need to be aware of and shows how to understand key performance indicators to drive profitability. Course Outline The Business Cycle: understand how money flows in a business Business objectives: use financial data to achieve business targets The income statement, the cash flow statement and the balance sheet Accrual and cash accounting Operational & Financial Gearing Profit vs Cash and other key financial ratios, how to use them effectively Working capital management Cash flow management EBIT, EBITDA, Free & Operating Cash Flow & other measures of profit / cash Understanding Return on Investment & asset valuations Additional course details: Nexus Humans Finance for Non Finance Managers (1 Day) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Finance for Non Finance Managers (1 Day) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

VMCE95-Veeam Certified Engineer

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for Any IT specialist eager to become an industry recognized expert on Veeam software solutions. Overview This certification is an excellent investment for an IT professional looking to increase productivity, reduce operating costs, increase potential for personal career advancement and gain recognition from the employer and customers. By completing the Veeam Certified Engineer (VMCE) course you should be able to: Get more functionality out of Veeam solutions Identify and resolve issues more efficiently Gain a distinction from your peers The Veeam Certified Engineer (VMCE) course is a 3-day technical deep-dive focused on teaching engineers to architect, implement, optimize and troubleshoot the Veeam software solution. Module 1 Introduction Module 2 Veeam Products Veeam Availability Suite Key Concepts Module 3 Auto Discovery of Backup and Virtual Infrastructure Business Categorization Pre-Defined Alerting Unattended Monitoring Reporting and Dashboards Agentless Data Gathering Hyper-V Specific Features Veeam One Deployment Veeam One Assessment Tool Module 4 Core Components and Their Interaction Optional Components Deployment Scenarios Prerequisites Upgrading Veeam Backup & Replication Module 5 Adding Servers Adding a VMware Backup Proxy Adding a Hyper-V Off-host Backup Proxy Adding Backup Repositories Performing Configuration Backup and Restore Managing Network Traffic Global Notification Settings Getting to Know User Interface Module 6 Creating Backup Jobs Creating Restore Points with VeeamZIP and Quick Backup Backup Copy Replication Creating VM/File Copy Jobs Module 7 SureBackup Recovery Verification SureReplica Module 8 Data Recovery Working with Veeam Backup & Replication Utilities Insight into Recovery from Replica Module 9 Item-Level Recovery Guest OS File Recovery Module 10 Tape Device Support SAN Storage Systems Support Support for Deduplicating Storage Systems Veeam Cloud Connect Veeam Backup Enterprise Manager vCloud Director Support Module 11 Product Editions Comparison Full and Free Functionality Modes Module 12 How to Identify the Problem How to review and analyze the issue Search for additional information Veeam Support

VEEAM-VMCE Veeam Certified Engineer

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for Any IT specialist eager to become an industry recognized expert on Veeam software solutions. Overview This certification is an excellent investment for an IT professional looking to increase productivity, reduce operating costs, increase potential for personal career advancement and gain recognition from the employer and customers. By completing the Veeam Certified Engineer (VMCE) course you should be able to:Get more functionality out of Veeam solutionsIdentify and resolve issues more efficientlyGain a distinction from your peers The Veeam Certified Engineer (VMCE) course is a 3-day technical deep-dive focused on teaching engineers to architect, implement, optimize and troubleshoot the Veeam software solution. Module 1 Introduction Module 2 Veeam Products Veeam Availability Suite Key Concepts Module 3 Auto Discovery of Backup and Virtual Infrastructure Business Categorization Pre-Defined Alerting Unattended Monitoring Reporting and Dashboards Agentless Data Gathering Hyper-V Specific Features Veeam One Deployment Veeam One Assessment Tool Module 4 Core Components and Their Interaction Optional Components Deployment Scenarios Prerequisites Upgrading Veeam Backup & Replication Module 5 Adding Servers Adding a VMware Backup Proxy Adding a Hyper-V Off-host Backup Proxy Adding Backup Repositories Performing Configuration Backup and Restore Managing Network Traffic Global Notification Settings Getting to Know User Interface Module 6 Creating Backup Jobs Creating Restore Points with VeeamZIP and Quick Backup Backup Copy Replication Creating VM/File Copy Jobs Module 7 SureBackup Recovery Verification SureReplica Module 8 Data Recovery Working with Veeam Backup & Replication Utilities Insight into Recovery from Replica Module 9 Item-Level Recovery Guest OS File Recovery Module 10 Tape Device Support SAN Storage Systems Support Support for Deduplicating Storage Systems Veeam Cloud Connect Veeam Backup Enterprise Manager vCloud Director Support Module 11 Product Editions Comparison Full and Free Functionality Modes Module 12 How to Identify the Problem How to review and analyze the issue Search for additional information Veeam Support

Jiwsi Relationships and Sex Education Training (Feb/March 2026)

5.0(9)By Cwmni Addysg Rhyw - Sex Education Company

Free relationships and sex education training for professionals working in North Wales. Cwmni Addysg Rhyw - Sex Education Company has been commissioned to deliver relationships and sex education (RSE) training to BCUHB staff and partner organisations in North Wales. The aim of this training is to increase confidence and skills to work more effectively with issues concerning sexual health and vulnerable young people. 'The best training I have ever attended!' 'Fun & informative' Attend the first day of the course if you simply want to update your RSE information and attend both days if you want to gain skills and confidence in delivering RSE to individuals or groups. Day one Vulnerable clients Attitudes and values in relation to practice The law and sex Key sexual health issues, including safer sex Gender identity and sexual orientation Communication and sexual health Relevant resources Day two - Additional second day/module for delivering RSE - participants must have completed day one before attending day two. Assessing learning needs Developing purpose and learning outcomes Managing safety and boundary issues Planning, delivering and evaluating sessions Each day will run from 9.30am to 4.30pm via Teams or Zoom. For more information and/or to be added to our mailing list contact Mel Gadd mel@sexeducationcompany.org Terms & conditions: Cwmni Addysg Rhyw facilitates externally funded training to staff that work in the public, private, voluntary and independent sectors. There is significant investment of resources in terms of time, planning and budget to deliver this service and due to repeated incidents of non-attendance without notice it has now become necessary to introduce a charging policy for cancellation and non attendance. Although this course is free of charge to attend we will charge late cancellation administration fees as follows: No notification of non-attendance - £50, less than 48 hours notice of non-attendance £30, Less than 1 weeks notice of non-attendance £25. By registering on the course you agree to these charges on late cancellation or failure to attend. As we usually have a reserve list for our courses we ask you to only book on the course if you can attend the whole day. Arriving late or leaving early will be classed as non-attendance and may be charged as such. We will be delivering this training via Teams or Zoom. It is your responsibility to ensure you can use the platform before booking. If you are unable to access the training on the day because you can't access the platform this will be classed as non attendance and will be charged as such. If you want to check that you can access the training via teams/zoom before booking please contact us. We are happy to set up a quick call for you to check access.

Personal Tax Return and Self Assessment Accounting training Course

By Osborne Training

Personal Tax Return and Self Assessment Accounting training Course Overview: Most self-employed people and directors of companies have to do submit a Tax Return every year. If you are a self-employed person you may learn how to do tax return yourself. As a result, you can save money by not having to pay an external agent. Don't forget You can also save more money as you will know more about how to apply for a tax rebate. According to statistics, more than 60% of taxpayers not sure how to do tax return correctly and lose money for not knowing how to apply for a tax rebate correctly. If you want to offer tax services to the general public, then skills in this sector can dramatically improve your job prospect or business prospect. How to do a tax return? Firstly, you need to be registered with HMRC to process your tax return. You should get a UTR (Unique Tax Reference) no, which is your personal identification no for tax purpose. Once you have details for all incomes and expenditure, you can submit them electronically to HMRC. The deadline for submitting a personal tax return is 31 January for the previous tax year. Apply for a Tax Rebate It is possible that you could be eligible for a tax rebate. The most possible scenarios are: When you pay more tax than required Submitting an incorrect tax return Claiming special Tax relief There could be many more reasons why should you get a tax refund. It is vital to know the scenarios under which you should apply for a tax rebate. Certificate of Attendance Identify the type(s) of returns that may be completed Understand the duties and responsibilities of a bookkeeper/tax agent when completing self-assessment tax returns Calculating the taxes on profits for Self Employed & on income for Employed individuals Understanding differences between Drawings & Dividends Introduction to UTR and NI Classes Understanding Tax Return submission procedures to HMRC (using 2 individual Scenarios) Analysing Class 2 & Class 4 NIC Analysing Personal Allowance Analysing Income from Self Employments Employment benefits Analysis Analysis of Car & Fuel benefits Analysis of savings and investment income and tax implications on them. Introduction to Capital Gains Tax analysis Introduction to Inheritance Tax Analysis Understanding the procedure for payment and administration of both tax and National Insurance Contributions

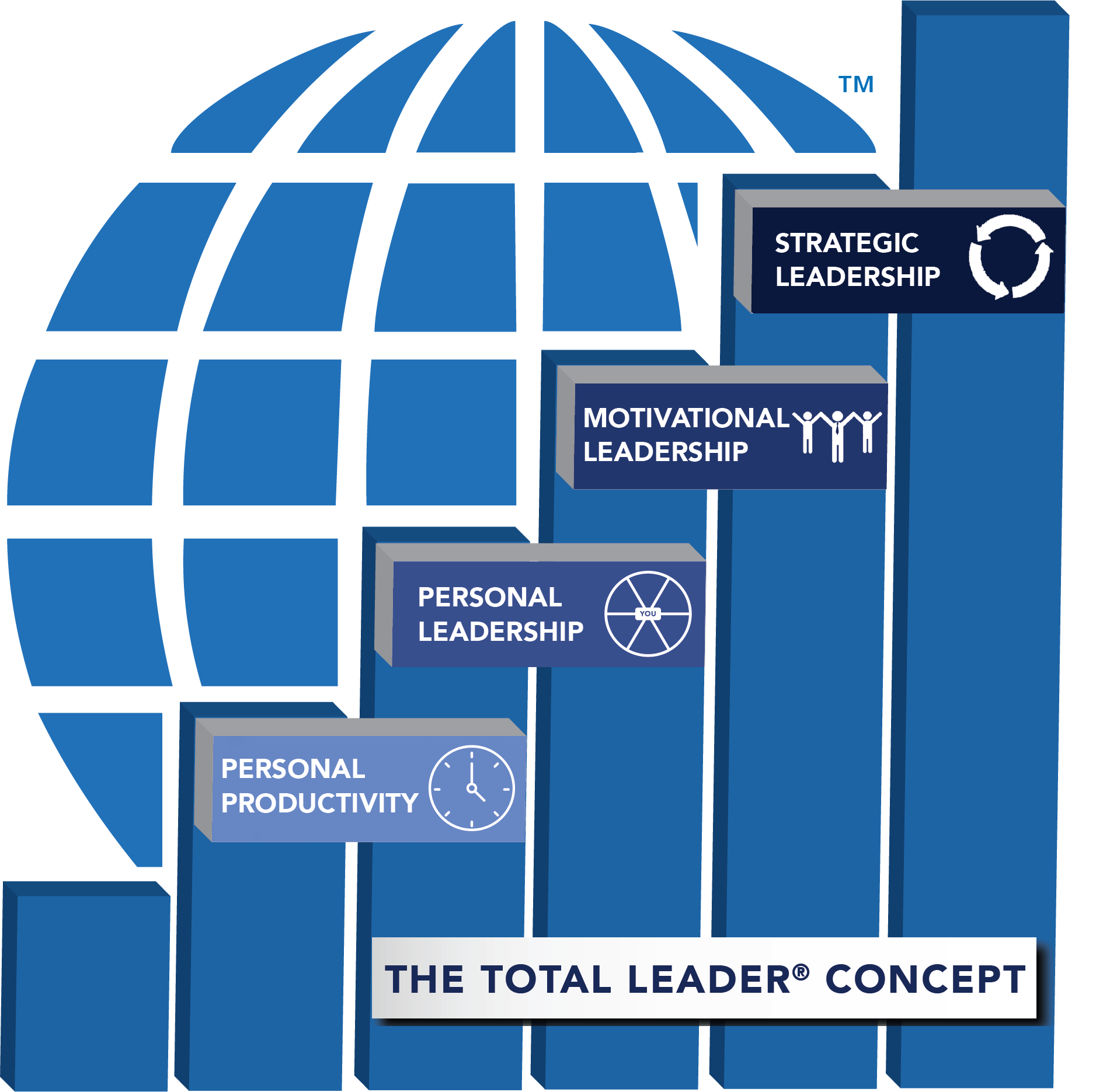

Foundations of Success

By Leadership Management International (LMI) UK

The LMI Foundations of Success workshop introduces the concepts and practical tools used to help countless individuals within thousands of organisations, of all sizes and complexity in both the public and private sector, realise more of their true potential.

MSc in Accounting and Finance (Advanced Entry)- Inclusive of Level 7 Pathway Diploma

By School of Business and Technology London

Getting Started The MSc in Accounting and Finance is designed to help students become leaders in the financial sector.The programme aims to extend and enhance students' understanding and competence gained through professional qualifications. It seeks to develop their ability to think strategically about management and organisational change within accounting and finance. The programme suits AIA, ACA, ACCA, CIMA, ICAP, or CPA Australia graduates. It provides a means to support accounting practitioners & ongoing professional and personal development needs. Upon completing the programme, students are awarded the prestigious MSc in Accounting and Finance degree from the University of Buckingham. Additionally, students can attend the graduation ceremony held in the UK to celebrate their achievements and join fellow graduates in this momentous event. The programme comprises two phases; the first is the Level 7 Diploma in Accounting and Finance, awarded by OTHM and delivered by the School of Business and Technology London. The second phase is the MSc in Accounting and Finance (Advanced Entry), delivered by the London Graduate School and awarded by the University of Buckingham through distance learning. You will receive excellent support from academic team of London Graduate School, including your programme manager and your supervisor who will be with you every step of the way. About Awarding Body Buckingham is unique. It is the only independent University in the UK with a Royal Charter and probably the smallest, with around 2,700 students (approx 1,600 on campus). The University campus is well known for being one of the most attractive locations in the region. The Great Ouse River, home to much wildlife, winds through the heart of campus. Each student mixes with over 100 other different nationalities, so being at Buckingham is just like being in a mini global village. These contacts, acquaintances and friendships carry on long after life at Buckingham is over. Ranked Top 10 for Student Satisfaction Ranked Top 10 for Graduate Prospect Recognised by World Education Services (WES) OTHM Qualifications are approved and regulated by Ofqual (Office of Qualifications and Examinations Regulation) and recognised by Qualifications Wales. OTHM qualifications have achieved a reputation for maintaining significant skills in various job roles and industries like Business Studies, Leadership, Tourism and Hospitality Management, Health and Social Care, Information Technology, Accounting and Finance, Logistics and Supply Chain Management. OTHM serves the progression option with several UK universities that acknowledges the ability of learners after studying Level 3-7 qualifications to be considered for advanced entry into corresponding degree year/top-up and Master's/top-up programmes. Regulated by ofqual.gov.uk Recognised by World Education Services (WES) Assessment Assignments and Project No Examinations Entry Requirements A Bachelor's degree or an equivalent or higher qualification. A copy of a valid photo ID. A Statement of Purpose outlines your motivations for joining the course and your career aspirations in accounting and finance. An updated Curriculum Vitae (CV) that highlights at least two years of work experience at the graduate level in either a managerial or professional capacity. English Language Requirements A pass in English at A-level. A bachelor's degree that was studied and assessed in English. An IELTS overall score of 6.5, with a minimum of 6.0 in each component. A TOEFL score of 72 overall, with a minimum of 18 in reading, 17 in listening, 20 in speaking, and 17 in writing. This includes the TOEFL Home Edition. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. Structure Phase 1 - OTHM Level 7 Diploma in Accounting and Finance Programme Structure The OTHM Level 7 Diploma in Accounting and Finance qualification consists of 6 mandatory units for a combined total of 120 credits, 1200 hours Total Qualification Time (TQT) and 600 Guided Learning Hours (GLH) for the completed qualification. Investment Analysis Unit Reference Number : R/615/3236 TQT : 200 Credit : 20 This unit aims to enhance learners' comprehension of investment theories and market equilibrium models. It encompasses tasks such as conducting bond valuations and assessing current investment performance. Upon successful completion, learners will possess the skills to critically analyze the impact of global developments on capital markets and make sound recommendations for future investments. Corporate Reporting Unit Reference Number : D/615/3241 TQT : 200 Credit : 20 This unit aims to develop learners' ability to prepare and interpret financial statements for various business organisations. Learners will be able to apply relevant accounting concepts and principles. The unit allows learners to enhance their quantitative and qualitative analytical skills by interpreting financial data. Global Finance and Strategy Unit Reference Number : D/615/3238 TQT : 200 Credit : 20 This unit aims to cultivate learners' comprehension of the decisions that are crucial when venturing into global markets. Learners will grasp the significance of autonomy in resolving financial matters within specific timeframes for achieving business success. Strategic Financial Management Unit Reference Number : H/615/3242 TQT : 200 Credit : 20 This unit seeks to enhance learners' grasp of planning and overseeing the allocation of an organization's financial resources. They will appreciate the significance of achieving business objectives and optimizing shareholder returns. Additionally, learners will acquire practical knowledge in designing business strategies and crafting comprehensive business plans. Strategic Audit Unit Reference Number : Y/615/3240 TQT : 200 Credit : 20 The objective of this unit is to foster learners' comprehension of how managers can effectively formulate and implement business strategies. This encompasses thoroughly examining the strategic auditing process and its associated methodologies. Learners will learn to employ appropriate investigative techniques in favourable and challenging environments. Business Research Methods Unit Reference Number : T/508/0626 TQT : 200 Credit : 20 The objective of this unit is to cultivate learners' comprehension of research principles, which encompass crafting research proposals, conducting literature reviews, proper referencing, employing data collection techniques such as interviews and surveys, designing questionnaires, conducting statistical analysis using SPSS, handling qualitative data, and employing methods to draw meaningful conclusions from the analyzed data. Phase 2 - MSc in Accounting and Finance (Advanced Entry) Programme Structure Research Methods Consultancy Project Report Delivery Methods The programme comprises two phases; the first is the Level 7 Diploma in Accounting and Finance, awarded by OTHM and delivered by the School of Business and Technology London. The School of Business and Technology London offers flexible learning methods, including online and blended learning, allowing students to choose the mode of study that suits their preferences and schedules. The programme is self-paced and facilitated through an advanced Learning Management System. Students can easily interact with tutors through the SBTL Support Desk Portal System for course material discussions, guidance, assistance, and assessment feedback on assignments. School of Business and Technology London provides exceptional support and infrastructure for online and blended learning. Students benefit from dedicated tutors who guide and support them throughout their learning journey, ensuring a high level of assistance. The second phase is the MSc in Accounting and Finance (Advanced Entry), delivered by the London Graduate School and awarded by the University of Buckingham through distance learning. You will receive excellent support from academic team of London Graduate School, including your programme manager and your supervisor who will be with you every step of the way. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Account management (In-House)

By The In House Training Company

Successful account management requires time and investment to achieve high levels of customer satisfaction and develop new business opportunities. Ensuring you are equipped with the right tools to approach every customer interaction in a structured way will help you have productive relationships with your clients. Whether you're new to account management or experienced in business development and looking to expand your skillset, understanding how you can maximise customer relationships will be key to your success. We have developed this programme to be practical, fun and interactive. Participants will have the opportunity to learn and practice a number of key skills that will see successful results, and are encouraged to bring real life examples to the course so that learning can be translated to real world scenarios. This course will help participants: Learn how to plan growth and increase revenue from existing accounts Develop skills to build and develop essential relationships to increase value and visibility Learn how best to create loyalty and customer satisfaction Identify how to set account targets and development plan for building contacts and cross-selling Develop persuasion and influencing skills to better define needs and develop opportunities Learn how to add value at all stages; plus gaining competitive advantage Develop an up-selling, cross-selling strategy 1 Performance metrics for account management Introduction to the PROFIT account management model Using practical tools to measure account performance and success Planning your account strategy - red flags and green lights 2 Relationships for account management How to build and manage key relationships Producing a 'relationship matrix' Developing a coach or advocate 3 Setting objectives for your account Developing an upselling cross-selling strategy Setting jointly agreed goals, objectives and business plans Planning session 4 Feedback and Retention - building loyal and satisfied customers How to monitor and track your customer's satisfaction Building a personalised satisfaction matrix Customer service review meetings 5 Influence Getting your message and strategy across to C-level contacts Being able to better develop a business partnership within an accountes 6 Teamwork and time management Working with others to achieve your account goals Managing and working with a virtual team Managing your time and accounts effectively 7 Gaining commitment and closing the sale Knowing when to close for commitment How to ask for commitment professionally and effectively Key negotiation skills around the closing process - getting to 'yes' Checklist of closing and negotiation skills Practice session

Account management essentials (In-House)

By The In House Training Company

Maximising the relationship and sales potential of each active account is key to the sustainability of any business relying on repeatable custom. In this workshop we start by looking at key techniques for analysing the profitability and development opportunities for different clients before deciding upon the strategy and skills needed for moving the relationship to that of trusted adviser and partner. By understanding and creating the need we can use our influencing skills to harness any sales development potential. By creating the habit of explaining our ideas in a way that also meets the need of the other party we help everybody make the right decisions for them. This course will help participants: Assess the sales profitability and potential of existing key accounts Prioritise where time and energy is directed for maximum profitability Understand the key players in the decision making unit Create a strategic plan for the development of each client target Develop proactive sales consultancy skills Learn advanced communication and influencing techniques 1 What makes an effective account manager? The difference between order taking and account management How do you define a key account in your business? Why should existing customers remain with your company? How do you compare to the competition? 2 How do I prioritise my account management activity? Use practical tools to help you assess revenue potential Analyse the investment required versus the return on your time Create a SWOT analysis on your clients - Strengths, Weaknesses, Opportunities & Threats Appreciate how this knowledge will improve your sales development 3 Planning strategies for each account Create a list of priority accounts and activities Learn how to develop a long-term and sustainable relationship Discover how they make their purchasing decisions Research the make-up of the Decision Making Unit for each client 4 Learning and utilising the six principles of influence Learn the secrets these principles offer sales people Discover how these principles will work for you Create an influencing strategy for influencers within the client Learn new habits of influence 5 Proactive sales skills Plan proactive sales meetings for key accounts Set primary and secondary objectives for every touch point with the customer Structure sales meetings for maximum effectiveness Help the customer commit and achieve their objectives 6 Putting it into practice Discuss real scenarios to plan for putting these skills into practice Share common issues with fellow sales people Create a personal development plan