- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

23 Investing & Trading courses in Leeds

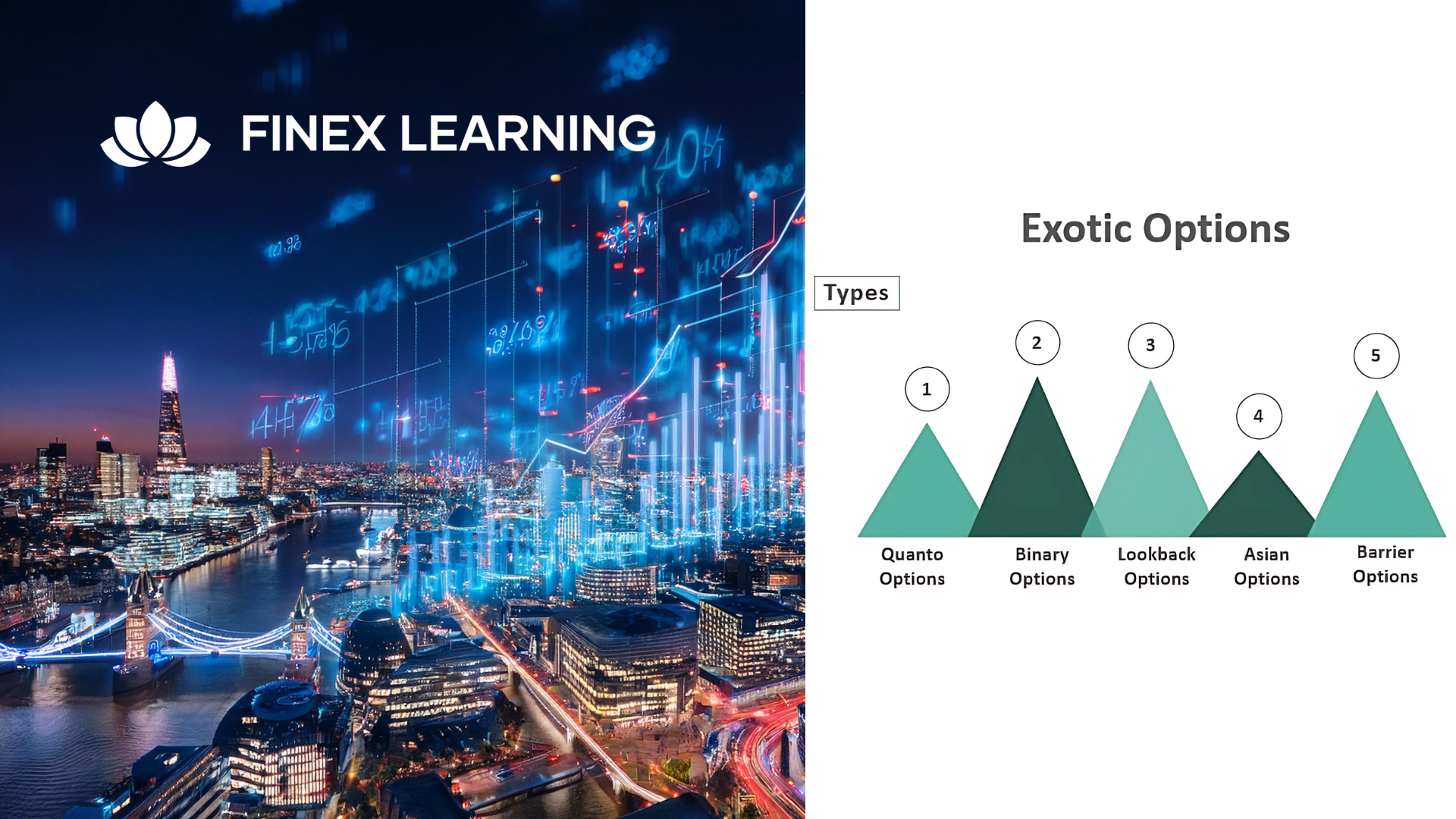

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day applied course with comprehensive case studies covering both Standardized Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on scorecards, rating agency frameworks, regulation and integration and quantification of Environmental, Social and Governance (ESG) analysis into equity and credit investing / lending for / to corporates, banks and other financial institutions, applied to many case study companies and industries Who the course is for Investors and analysts – equity and credit; public and private Bank loan officers M&A advisors Restructuring advisors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please click here. To learn more about schedule, pricing & delivery options speak to a course specialist now

Overview A review of the most enduringly popular structured equity-linked products. This 1 day hands-on programme will help you gain familiarity with 1st generation & 2nd generation structured products convexity – and their applications. Discover techniques for maximising the participation rate to enhance returns for investors. Explore the trade-offs between coupon payments and gearing, and how they affect the risk-return profile of the notes. Explore ladder structures, their relationship to lookbacks, and the benefits they offer to investors. Learn about accumulators, their structuring, and the reasons behind their controversy in the market. Who the course is for Structured Products Desks, Financial Engineers, Product Controllers Traders, Dealing Room Staff and Sales People Risk Managers, Quantitative Analysts and Middle Office Managers Fund Managers, Investors, Senior Managers Researchers and Systems Developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn about contract triggers, including European vs. American style, and variations like one-touch, no-touch, and double no-touch options. Who the course is for Risk managers IT System developers Traders and derivatives teams Consultants and brokers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on key interest rate derivative products, covering both theory (product mechanics, market conventions and valuation) and practice (wide range of applications for wide range of market participants showcased) Who the course is for Interest rate traders, salespeople and quants Asset-liability management staff with banks and insurance companies Fixed income and credit asset managers / hedge funds / pension funds / insurance companies Corporate treasurers Risk management Anyone using interest rate derivatives Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Investing & Trading Courses in London

- Investing & Trading Courses in Birmingham

- Investing & Trading Courses in Glasgow

- Investing & Trading Courses in Liverpool

- Investing & Trading Courses in Bristol

- Investing & Trading Courses in Manchester

- Investing & Trading Courses in Sheffield

- Investing & Trading Courses in Leeds

- Investing & Trading Courses in Edinburgh

- Investing & Trading Courses in Leicester

- Investing & Trading Courses in Coventry

- Investing & Trading Courses in Bradford

- Investing & Trading Courses in Cardiff

- Investing & Trading Courses in Belfast

- Investing & Trading Courses in Nottingham