- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2236 Insurance courses

LED Light Therapy Training Course

By Cosmetic College

LED Light Therapy is a non-invasive treatment which can address skin problems such as: sun damage, acne, fine line and wrinkles. LED Facials are extremely popular and effective treatments which can treat a variety of skin concerns. They can easily be added onto any facial for extra income with minimal extra time and preparation required. The LED light absorbed by the skin energises cells to give beneficial improvement by: Produce & stimulate collagen, elastin and brighten the skin rejuvenation Improve Skin Elasticity, texture and tone Increase Blood Circulation Increase Oxygen Levels Increase collagen synthesis Help reduce fine lines and wrinkles Improve blood circulation Increase hydration naturally Calming redness & healing the skin after other aesthetic treatments Reduce breakouts and problem skin & prevent future breakouts killing bacteria Regulate the sebum production in the skin Target multiple skin conditions such as acne, pigmentation, rosacea, scaring Helps improve the sun damage/photo-ageing of the skin Course prerequisites We accept students aged 18 and over. Students must have good written and spoken English. No qualifications or certifications are required for this course. Students must have good written and spoken English. Course agenda This intensive course includes 4 hours of theory study via our e-learning portal and 5 practical hours delivering treatments to model clients. All courses are kept intimate with a maximum of 6 learners to a class. Areas covered in this course: Industry regulation Insurance Client care/consultation Contra-indications and precautions Application of brow lamination products Aftercare Maintenance Further treatment advice Promotion of this exciting treatment Practical demonstration Practice sessions Practical on-going assessments Health and Safety Be ready to treat your clients by upgrading your training with an exclusively discounted starter kit including LED Light Therapy machine with a 50% saving at 150.

Power Analysis - AC Circuits Online Course for Beginners

By Study Plex

Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. Course Curriculum Introduction Introduction 00:04:00 Ch - 1 Alternating Current 00:33:00 Ch - 2 Vectors & Phasors 00:36:00 Ch - 3 Reactance and Impedance R, L, C Circuits 00:53:00 Ch - 4 Kirchhoff's Laws in AC Circuits 00:08:00 Ch - 5 Power flow in AC Circuits 00:46:00 Final Assessment Assessment - AC Circuit Analysis For Beginners 00:10:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

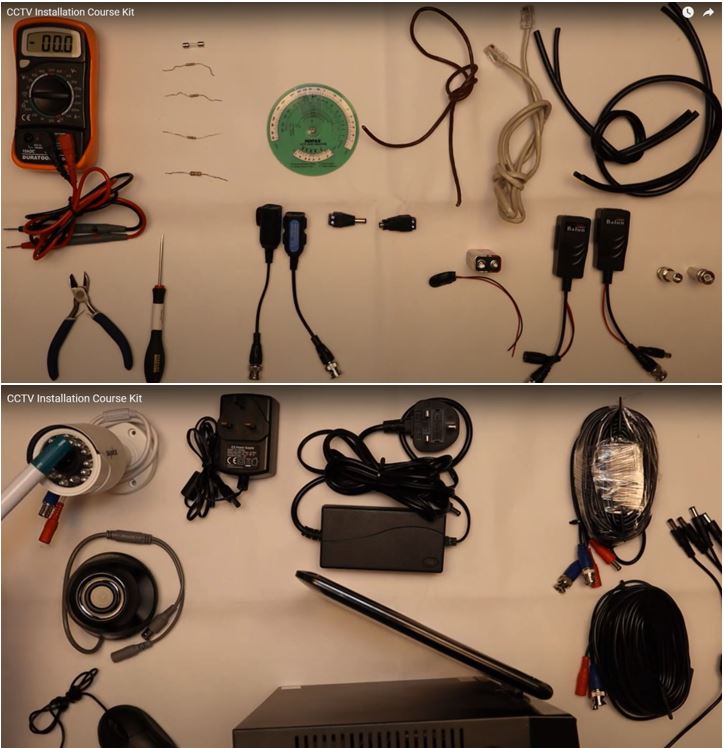

CCTV Installation Course

By Hi-Tech Training

Hi-Tech Training Closed Circuit Television (CCTV) Installation Course is designed to give participants a practical knowledge of the operation and installation of CCTV systems at a foundation level.

Actuary

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Actuary Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Actuary Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Actuary Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Actuary Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Actuary ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Actuary there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Actuary course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This Actuary does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Actuary was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Actuary is a great way for you to gain multiple skills from the comfort of your home. Module 1 Introduction to Actuary Introduction to Actuary 00:12:00 Module 2 Actuaries and Their Environment Actuaries and Their Environment 00:14:00 Module 3 The Valuation of Cash Flows The Valuation of Cash Flows 00:12:00 Module 4 The Basic Deterministic Model The Basic Deterministic Model 00:11:00 Module 5 The Life Table The Life Table 00:11:00 Module 6 Life Annuities Life Annuities 00:14:00 Module 7 Life Insurance Life Insurance 00:12:00 Module 8 The Stochastic Life Contingencies Model The Stochastic Life Contingencies Model 00:11:00 Module 9 The Stochastic Approach to Insurance and Annuities The Stochastic Approach to Insurance and Annuities 00:11:00 Module 10 Taxation and Inflation Taxation and Inflation 00:08:00 Module 11 Probabilistic Models, Uncertain Payment and Profit Testing Probabilistic Models, Uncertain Payment and Profit Testing 00:08:00 Model 12 Individual Risk Models Individual Risk Models 00:07:00 Module 13 Principles of Premium Calculation (1)3 Principles of Premium Calculation (1) 00:10:00 Module 14 Multiple Decrement Theory3 Multiple Decrement Theory 00:09:00

Master the art of financial control and embark on a journey to financial freedom with our comprehensive course on Managing Personal Cash Flow. Designed to empower you with the knowledge and tools needed to navigate the intricate world of personal finance, this course is your ultimate guide to securing a stable and prosperous financial future. Key Features: CPD Certified Developed by Specialist Lifetime Access In this course, you will learn all about managing your money effectively. First, you'll understand why it's important to know about personal finance and how it affects your life. Then, you'll dive into the basics of personal cash flow and learn how to manage it wisely. You'll also explore tax and financial strategies to make sure you're handling your money smartly. Understanding personal insurance and how it fits into your financial plan will also be covered. Accounting principles related to personal finances will be introduced to give you a solid foundation. You'll then learn how to plan your cash flow and design a personal budget to meet your financial goals. Additionally, you'll explore borrowing, credit, and debt management to avoid financial pitfalls. Finally, you'll understand the relationship between money and mental health and how to manage your money for overall well-being. Course Curriculum Module 01: Understanding the Importance of Personal Finance Module 02: Introduction to Personal Cash Flow Module 03: Understanding Tax and Financial Strategies Module 04: Managing Personal Insurance Module 05: Accounting and Personal Finances Module 06: Cash Flow Planning Module 07: Designing a Personal Budget Module 08: Borrowing, Credit and Debt Module 09: Money and Mental Health Module 10: Understanding Personal Money Management Learning Outcomes: Understand the significance of personal finance for long-term financial stability. Analyze personal cash flow and its role in financial planning. Apply tax and financial strategies to optimize personal finances effectively. Evaluate different types of personal insurance and their management strategies. Implement basic accounting principles to manage personal finances efficiently. Develop and maintain a personal budget to achieve financial goals. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals seeking to enhance personal financial management skills. Those interested in understanding personal cash flow dynamics. Anyone looking to optimize tax and financial strategies for personal gain. Individuals aiming to manage personal insurance effectively. Those seeking to improve personal accounting and financial planning skills. Career path Financial Advisor Tax Consultant Insurance Broker Personal Accountant Budget Analyst Credit Counsellor Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Health Economics and Health Technology level 1,2,3 at QLS

By Imperial Academy

Level 3 QLS Endorsed Course | Endorsed Certificate Included | Plus 5 Career Guided Courses | CPD Accredited

Taxation in the UK: Laws, Regulations, and Compliance

By Imperial Academy

QLS Level 5 Diploma | QLS Endorsed Certificate | 11 CPD Courses & PDF Certificates | 145 CPD Points | CPD Accredited

Scalp Micropigmentation Training With Full Equipment Kit

By Alex James Smp - Scalp Micropigmentation Clinic & Training Academy

Award Winning Scalp Micropigmentation 3 Day Training Course including a full equipment kit. £2499. Near Manchester

Unlock the complexities of property law with our comprehensive Level 2 Property Law course. Whether you're looking to advance your career in real estate, law, or simply deepen your understanding of property rights, this course offers essential knowledge and practical insights. Key Features: CPD Certified Developed by Specialist Lifetime Access In the Level 2 Property Law course, learners will explore fundamental concepts of property ownership and management. They will understand how property rights and interests are defined and protected under the law, whether through ownership, possession, or lease agreements. Students will learn about the differences between registered and unregistered land, and how legal principles apply to co-ownership scenarios. The course also covers aspects of property security, such as mortgages and proprietary estoppel, which ensure legal protections and rights related to property. Additionally, learners will gain insights into property law licenses and the role of insurance in maintaining and protecting property assets. This course equips learners with essential knowledge to navigate various legal aspects of property ownership and management effectively. Course Curriculum Module 01: Introduction to Property Law Module 02: Land Law Principles - Rights and Interests Module 03: Ownership and Possession of the Property Module 04: Registered and Unregistered Land Module 05: Leases and Bailment Module 06: Co-Ownership in Property Module 07: Security Interests in Property Module 08: The Mortgage Law Module 09: Insurance for Property Maintenance Module 10: Proprietary Estoppel (Property Rights) Module 11: Property Law Licence Learning Outcomes: Understand foundational principles in Land Law and Property Ownership. Identify rights, interests, and legal frameworks in property transactions. Analyze the distinctions between registered and unregistered land properties. Explain the legal implications of leases, bailment, and co-ownership arrangements. Assess the role of security interests, mortgages, and insurance in property law. Discuss the principles and applications of proprietary estoppel in property rights. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring legal professionals seeking specialized knowledge in property law. Real estate agents aiming to deepen their understanding of property transactions. Individuals involved in property management or administration roles. Law students interested in specializing in property law. Professionals in finance or insurance sectors related to property. Career path Property Lawyer Real Estate Solicitor Land Law Consultant Property Manager Insurance Claims Officer Legal Advisor Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham