- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

61 Insurance courses in Warlingham

Financial Crime

By Global Risk Alliance Ltd

This course aims to increase and enhance delegates’ understanding of the various financial crime threats which impact upon the organisations, sectors and regions in which they operate and provide them with the tools to mitigate those threats. It assumes no prior knowledge of the subject but ensures through a high level of interactivity that delegates with any level of experience in the field will be able to share and receive the collective knowledge of the group.

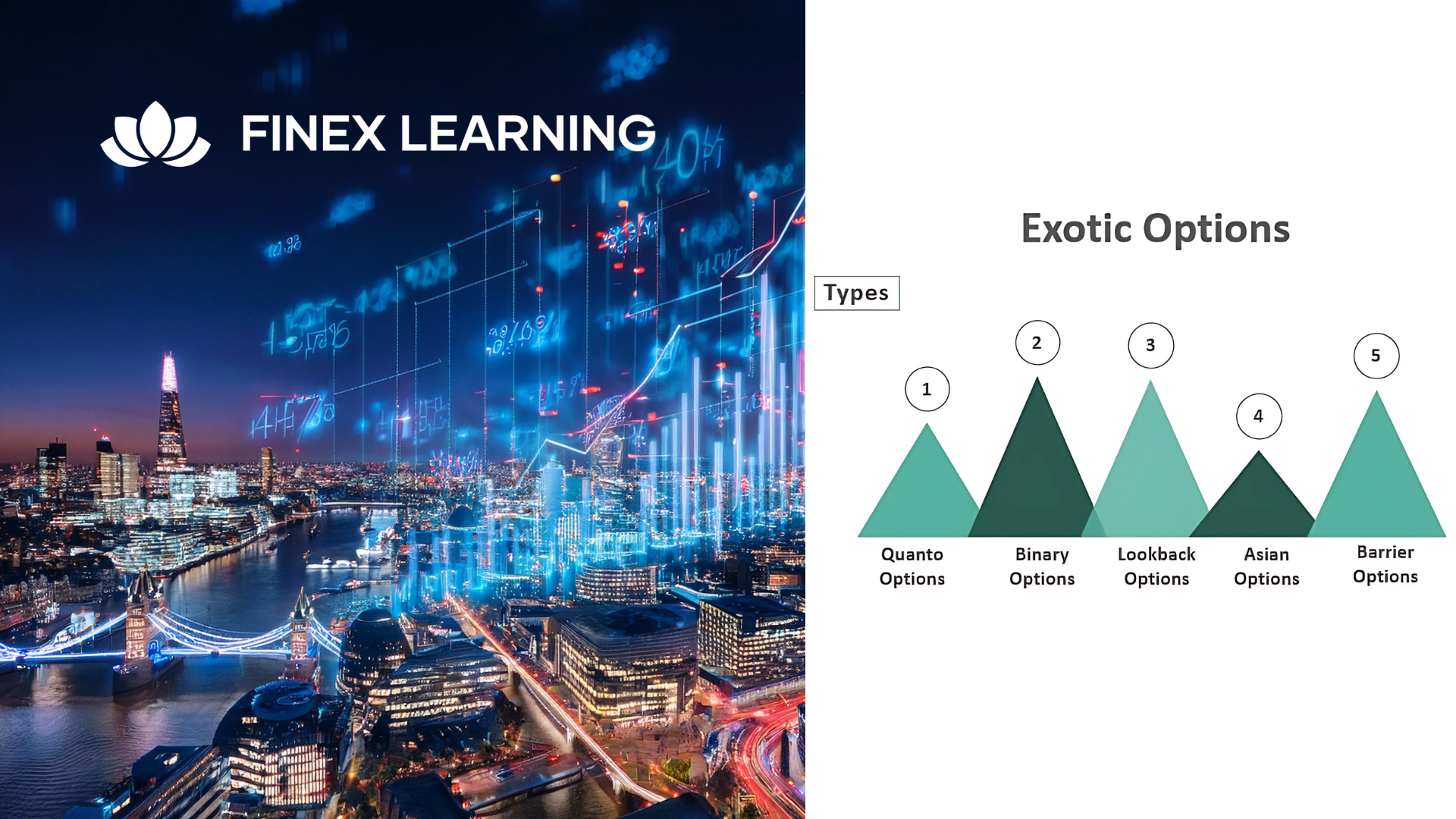

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A comprehensive and practical 3 days workshop on pricing, using and managing structured interest rate derivatives. What used to be called exotic interest rate derivatives are now commonplace and an essential part of the financial marketplace either as legacy transactions or embedded in new structures. This intensive course is for anyone who wishes to be able to use, price, manage, market or evaluate standard interest rate derivatives such as Constant Maturity Swaps, Range Accruals and Quantos. We also look in detail at such important products as CMS spread-linked structures and volatility/variance swaps, always from a pragmatic practitioner’s perspective. Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers IPV professionals Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

This 3 Days programme will equip you to use, price, manage and evaluate interest rate and cross-currency derivatives. The course starts with the building blocks of money markets and futures, through yield curve building to interest-rate and cross-currency swaps, and applications. The approach is hands-on and learning is enhanced through many practical exercises covering hedging, valuation, and risk management. This course also includes sections on XVA, documentation and settlement. The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation.

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

NPORS Appointed Person Course or Training NPORS Appointed Person Lifting Operations Training is aimed at anyone who is required to plan safe systems of work using lifting equipment and to gain the NPORS Appointed Person operator card. The aim of the course is to provide candidates with underpinning knowledge to prepare them for the role and responsibility. It is recommended that prior to attending this course individuals should have some experience of working with lifting equipment, especially mobile cranes. It is important that all delegates have a good understanding of spoken and written English for the appointed person course. NPORS is an approved CSCS Partner Card Scheme, firstly providing evidence that individuals working on construction sites have the appropriate training and qualifications but more importantly for the safe operation of the appointed person. Furthermore, training criteria is based on the approved standards of the Construction leadership Council. Experienced Appointed Person Test For experienced Appointed Persons you must complete a 1 day refresher training course. For refresher training you must have held a certificate or card in the past Appointed Person Course Duration: Experienced Worker Test: 1 day refresher training, maximum of 6 candidates Novice: 5 day’s training, maximum of 6 candidates Location*: Tewkesbury or at our clients’ site nationwide Mileage and accommodation charges may apply Certification NPORS Traditional card – lasts for 5 years and is mainly accepted with housebuilders, utilities, port and marine as proof of competence OR NPORS card with CSCS logo – accepted by all major building contractor’s. The initial card is the RED trained operator card which lasts for 2 years and can be upgraded to BLUE competent operator card further to completion of relevant NVQ. CSCS Health & Safety Test If you require the NPORS Appointed Person Red operator card with the CSCS logo on then you must have completed the operatives health and safety test within the last two years. In house certificates: suitable as proof of operator competence accepted for insurance and HSE compliance. The Appointed Person Course Includes: This Appointed Person Course covers essential legislation, crane appreciation, lifting accessories, and planning lifting operations. It culminates in writing a risk assessment and method statement. Legislation LOLER, PUWER, HASAWA. Codes of practice BS7121. Roles and responsibilities of personnel involved with lifting operations. Crane appreciation, crane types, capabilities and limitations. Duty charts. Crane terminology. Documentation and certification for lifting equipment and lifting accessories. Crane stability/ground conditions. Safe Load Indicators (SLI) and Safe Working Loads (SWL). Lifting accessories. Types of accessories and use. Slinging techniques. Down rating of accessories. Sling angles. Communications. Planning a lifting operation. Writing a risk assessment (end test). Writing a method statement (end test). Appointed Person Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of lifting equipment and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment for the AP Course. Our Appointed Person training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS Appointed Person Tester to your site nationwide, to reduce the amount of time away from work Frequently Asked Questions 1. What is the NPORS Appointed Person Lifting Operations Training? This training is designed for individuals required to plan safe systems of work using lifting equipment. It provides the knowledge necessary to prepare for the role and responsibilities of an Appointed Person. 2. Who should take this course? Anyone involved in planning and managing lifting operations, especially those with prior experience with lifting equipment, should take this course. 3. What does the course cover? The course covers legislation, codes of practice, roles and responsibilities, types of cranes, duty charts, lifting accessories, risk assessment, and method statement preparation. 4. How long is the course? The course duration is 5 days for novices and 1 day for experienced individuals seeking a refresher. 5. What certification do I receive upon completion? Participants receive an NPORS Appointed Person operator card, valid for 5 years or an NPORS card with CSCS logo. 6. Are there any prerequisites? Candidates should have a good understanding of English. For the NPORS card with CSCS logo, a CSCS Health & Safety test must have been completed within the last two years. Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today.

Slinger Signaller Training The aim of the NPORS Slinger Signaller Training or Slinger Signaller Course is to provide both theoretical and practical training in the safe and efficient operation of slinging and moving loads using hand signals or radios Guided by the Lift Supervisor. On successful completion of the slinger and signaller course you will be issued with the NPORS Slinger Signaller trained identity card with or without the CSCS Logo or testing can be carried out on your site nationwide or at our training centre in Gloucestershire NPORS Slinger Signaller Test Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Slinger And Signaller Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Slinger and Signaller Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Slinger Signaller Experienced Worker Test .This test is for operators who have received some form of training in the past or alternatively has been operating as a Slinger Signaller for a period of time. If you are unsure if you qualify to go down the test route please contact us to discuss this in more detail. This test is held at our test centre in Gloucestershire or at your site nationwide. Discounts are available for multiple bookings Turn your Slinger Signaller red card to blue with our hassle free NVQ, for more information CLICK HERE Slinger Signaller Course Duration Novice: 2 days, maximum of 3 candidates Experienced Worker Test: 1 day test only, maximum of 6 candidates. Location: Tewkesbury Training Centre At Our Customers Site*: Our instructors travel throughout the UK to deliver the slinger signaller training *Mileage and accommodation charges may apply Certification NPORS Traditional card – lasts for 5 years and is mainly accepted with housebuilders, utilities, port and marine as proof of competence OR NPORS card with CSCS logo – accepted by all major building contractor’s. The initial card is the RED trained operator card which lasts for 2 years and can be upgraded to BLUE competent operator card further to completion of relevant NVQ. CSCS Health & Safety Test If you require the NPORS Slingers Red operator card with the CSCS logo on then you must have completed the operatives health and safety test within the last two years. In house certificates: suitable as proof of operator competence accepted for insurance and HSE compliance. Slinger Signaller Course Contents: A Slinger Signaller course typically covers a range of topics related to the safe operation of lifting equipment and the signalling procedures involved in crane and lifting operations. While specific course contents may vary depending on the training provider and the regulations of the region, here’s a general outline of what will be included: 1. Introduction to Lifting Operations: Overview of lifting equipment and machinery. Importance of safe lifting operations. Legal and regulatory requirements for lifting operations, LOLLER, PUWER and BS 7121. 2. Roles and Responsibilities of Slinger and Signaller: Duties of the slinger signaller. Understanding the roles of other personnel involved in lifting operations (crane operator, banksman, etc.). Importance of effective communication and coordination. 3. Health and Safety: Risk assessment and hazard identification. Personal protective equipment (PPE) requirements. Safe working practices around lifting equipment and machinery. 4. Lifting Equipment and Accessories: Types of lifting equipment (cranes, hoists, slings, etc.). Inspection and maintenance requirements for lifting gear. Proper selection and use of lifting accessories. 5. Signals and Communication: Standard hand signals for crane operations. Radio communication procedures between Crane Driver & The Slinger and Signaller. Clear and effective communication techniques. 6. Load Identification and Weight Estimation: Methods for identifying loads and determining their weights. Estimating centre of gravity and load stability. 7. Slinging Techniques: Types of slings and their applications. Correct methods for attaching and securing loads. Precautions for different types of loads (e.g., fragile, hazardous). 8. Lifting Operations Planning: Pre-lift checks and planning considerations. Site-specific factors affecting lifting operations (e.g., terrain, weather). Emergency procedures and contingency planning. 9. Practical Exercises and Demonstrations: Hands-on training with lifting equipment and machinery. Practice sessions for signalling and communication. Simulation of real-world lifting scenarios. 10. Assessment and Certification: Written tests to assess theoretical knowledge. Practical assessments of signalling and slinging skills. Certification upon successful completion of the course. It’s essential for the Slinger Signaller Course to provide a balance of theoretical knowledge and practical skills to ensure that participants can effectively carry out their duties as slinger signallers in various lifting operations. Additionally, the course should emphasise the importance of safety and adherence to regulations throughout all aspects of lifting operations. Slinger Signaller Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of the Slinger Signaller and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment as a slinger signaller Our slinger and signaller training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS slinger Tester to your site nationwide, to reduce the amount of time away from work Other courses: Master the operation of essential machinery with our Lift Supervision Training, Telehandler Training, Cat & Genny Training, Ride-On Road Roller, Scissor Lift, Abrasive Wheel Training, Lorry Loader Training and Telehandler Training. Elevate your skills for safer and more efficient operations in construction and maintenance projects. Enrol today to advance your career prospects in these industries. Location Advantage: NPORS Slinger Signaller Training Near Me For those looking for a “NPORS Slinger Signaller Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham