- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Foundation level Anti Wrinkle and Dermal Fillers Course -Choose your own dates .

By Sassthetics Training Academy

One-2 one training in Aesthetics -Anti Wrinkle and Dermal fillers . Choose your own dates

Trade secrets - the business perspective (In-House)

By The In House Training Company

Trade barriers are going up across the globe. And cybercrime is on the increase. The link between the two? The value of trade secrets. As countries become increasingly protectionist as regards international trade, so their IP law has been changing, with the result that companies that previously would have sought protection through patents are opting to go down the trade secret route instead. But is this a high-risk strategy? Technology is changing and this is having an impact on forms of commercial co-operation. Collaborative or open forms of innovation by their very nature involve the sharing of intellectual property (IP), and in many instances this IP is in the form of valuable confidential business information (ie, trade secrets). Little surprise, then, that trade secrets disputes have increased accordingly. At the same time, the changes in technology make trade secrets more vulnerable to attack, misappropriation, theft. So just how effective are the legal protections for trade secrets? How can organisations safeguard the value in their IP (increasingly, the single biggest line in their balance sheets)? This programme is designed to help you address these issues. Note: this is an indicative agenda, to be used as a starting point for a conversation between client and consultant, depending on the organisation's specific situation and requirements. This session is designed to give you a deeper understanding of: Emerging trends in trade secrets protection and exploitation The current situation in key jurisdictions Recent case law How leading companies are responding The importance of trade secret metadata Different external stakeholders and their interests Key steps for effective protection of trade secrets Note: this is an indicative agenda, to be used as a starting point for a conversation between client and consultant, depending on the organisation's specific situation and requirements. 1 What are trade secrets? Definitions Examples Comparison with other forms of IP (patents, confidential information, know-how, copyright) 2 Current trends The various changes taking place affecting trade secrets - legal changes, trade wars, cybercrime, technology, commercial practice The current position in the UK, Europe, USA, China, Japan, Russia Corporate best practice 3 Trade secret disputes - how to avoid them Trade secret policies, processes and systems Administrative, legal and technical protection mechanisms The role of employees The sharing of trade secrets with others 4 Trade secret disputes - how to manage them Causes Anatomy of a trade secret court case 'Reasonable particularity' 5 Related issues Insurance Tax authorities and investigations Investor relations 6 Trade secret asset management roadmap Maturity ladder First steps Pilot projects

Contract and commercial management for practitioners (In-House)

By The In House Training Company

This five-day programme empowers participants with the skills and knowledge to understand and effectively apply best practice commercial and contracting principles and techniques, ensuring better contractor performance and greater value add. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Practitioner (CCMP) qualification. By the end of this comprehensive programme the participants will be able to: Develop robust contracting plans, including scopes of work and award strategies Undertake early market engagements to maximise competition Conduct effective contracting and commercial management activities, including ITT, RFP, negotiated outcomes Understand the legalities of contract and commercial management Negotiate effectively with key stakeholders and clients, making use of the key skills of persuading and influencing to optimise outcomes Undertake effective Supplier Relationship Management Appreciate the implications of national and organisational culture on contracting and commercial activities Appreciate professional contract management standards Set up and maintain contract and commercial management governance systems Take a proactive, collaborative, and agile approach to managing commercial contracts Develop and monitor appropriate and robust KPIs and SLAs to manage the contractor and facilitate improved contractor performance Appreciate the cross-functional nature of contract management Collaborate with clients to deliver sustainable performance and to manage and exceed client expectations Understand the roles and responsibilities of contract and commercial managers Use effective contractor selection and award methods and models (including the 10Cs model) and use these models to prepare robust propositions to clients Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Effectively manage the process of change, claims, variations, and dispute resolution Develop and present robust propositions Make appropriate use of best practice contract and commercial management tools, techniques, and templates DAY ONE 1 Introduction Aims Objectives KPIs Learning strategies Plan for the programme 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Critical success factors Essential features of professional commercial and contract management and administration The 6-step model 4 Putting the 'management' into commercial and contract management Traditional v 'new age' models The need for a commercial approach The added value generated 5 Definitions 'Commercial management' 'Contract management' 'Contracting' ... and why have formal contracts? 6 Stakeholders Stakeholder mapping and analysis The 'shared vision' concept Engaging with key functions, eg, HSE, finance, operations 7 Roles and responsibilities Contract administrators Stakeholders 8 Strategy and planning Developing effective contracting plans and strategies DAY TWO 1 Contract control Tools and techniques, including CPA and Gantt charts A project management approach Developing effective contract programmes 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Tendering Overview of the contracting cycle Requirement to tender Methods Rationale Exceptions Steps Gateways Controls One and two package bids 4 Tender assessment and contract award I - framework Tender board procedures Role of the tender board (including minor and major tender boards) Membership Administration Developing robust contract award strategies and presentations DAY THREE 1 Tender assessment and contract award II - processes Pre-qualification processes CRS Vendor registration rules and processes Creating bidder lists Disqualification criteria Short-listing Using the 10Cs model Contract award and contract execution processes 2 Minor works orders Process Need for competition Role and purpose Controls Risks 3 Contract strategy Types of contract Call-offs Framework agreements Price agreements Supply agreements 4 Contract terms I: Pricing structures Lump sum Unit price Cost plus Time and materials Alternative methods Target cost Gain share contracts Advance payments Price escalation clauses 5 Contract terms II: Other financial clauses Insurance Currencies Parent body guarantees Tender bonds Performance bonds Retentions Sub-contracting Termination Invoicing 6 Contract terms III: Risk and reward Incentive contracts Management and mitigation of contractual risk DAY FOUR 1 Contract terms IV: Jurisdiction and related matters Applicable laws and regulations Registration Commercial registry Commercial agencies 2 Managing the client-contractor relationship Types of relationship Driving forces Link between type of contract and style of relationships Motivation - use of incentives and remedies 3 Disputes Types of dispute Conflict resolution strategies Negotiation Mediation Arbitration DAY FIVE 1 Performance measurement KPIs Benchmarking Cost controls Validity of savings Balanced scorecards Using the KPI template 2 Personal qualities of the contract manager Negotiation Communication Persuasion and influencing Working in a matrix environment 3 Contract terms V: Drafting skills Drafting special terms 4 Variations Contract and works variation orders Causes of variations Risk management Controls Prevention Negotiation with contractors 5 Claims Claims management processes Controls Risk mitigation Schedules of rates 6 Close-out Contract close-out and acceptance / completion HSE Final payments Performance evaluation Capturing the learning 7 Close Review Final assessment Next steps

Body Piercing Training Course 1 or 2 Days-choose your own dates .

By Sassthetics Training Academy

One -2- One Body Piercing Training Course . 1 or 2 days depending on the level of mentorship you require. Blackpool based

Overview 1 day course to gain real insight into the Solvency 2 balance sheet dynamics, both under standard formula and our illustrative internal model Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on key interest rate derivative products, covering both theory (product mechanics, market conventions and valuation) and practice (wide range of applications for wide range of market participants showcased) Who the course is for Interest rate traders, salespeople and quants Asset-liability management staff with banks and insurance companies Fixed income and credit asset managers / hedge funds / pension funds / insurance companies Corporate treasurers Risk management Anyone using interest rate derivatives Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Financial Crime

By Global Risk Alliance Ltd

This course aims to increase and enhance delegates’ understanding of the various financial crime threats which impact upon the organisations, sectors and regions in which they operate and provide them with the tools to mitigate those threats. It assumes no prior knowledge of the subject but ensures through a high level of interactivity that delegates with any level of experience in the field will be able to share and receive the collective knowledge of the group.

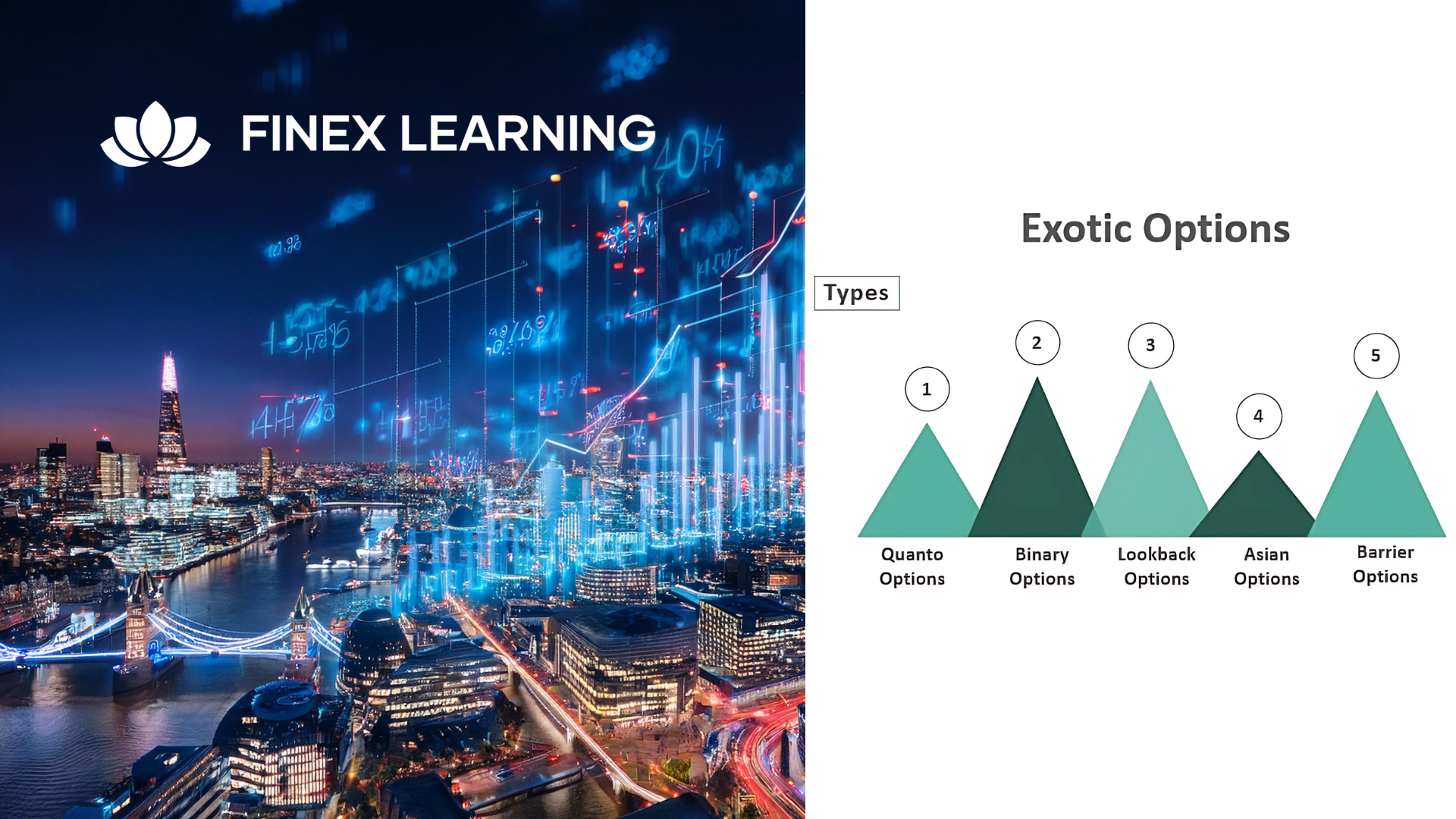

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham