- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

36 Insurance courses in Chorleywood

Overview This is a 2 day course to learn ALM tools to achieve strong and market-resilient, actuarially-resilient Solvency 2 (S2) ratios at Group consolidated level and at key cash-remitting entities to ensure dividend stability. For those not fully familiar with Solvency 2, this course is best taken in conjunction with “Solvency 2” Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tripod Beta Practitioner - Bronze Level

By EnergyEdge - Training for a Sustainable Energy Future

About this VILT Tripod can be used in any area of business where the organisation has a management system in place to prevent unwanted events e.g., health, safety, environment, quality, security, productivity, project management, and many more Tripod Beta is one of several tools based on Tripod's fundamental principles. Tripod Beta is based on proven theories, man years of academic research, and testing in the workplace. The Swiss Cheese Model originated from this work. Features of the methodology are: 1) the Tripod Beta diagram; it provides an easy-to-read summary of the entire investigation on a single page, 2) it accommodates deficiencies in leadership and worker participation, 3) it accommodates deficiencies in human behaviour, and 4) it highlights missing controls (not just controls that failed). Quality throughout all aspects of Tripod is assured by the Stichting Tripod Foundation (STF) and the Energy Institute. The participants will gain a theoretical understanding of the Tripod Beta methodology and terminology. They will be able to read Tripod diagrams and reports, and be able to assist incident investigation/analysis as a team member. This is the first step to becoming an accredited silver or gold practitioner. Tripod Beta Practitioner Accreditation is meant to build these skills, through a blend of support, coaching and assessments. Feedback is provided on Tripod incident investigation reports, giving the Practitioner the opportunity to hone their skills and become confident in their ability to use Tripod effectively. Training Objectives Upon completion of this course, participants will be able to: Pass the Tripod Beta Practitioner (Bronze Level) exam Act as a team member or Tripod facilitator on an incident investigation Plan and schedule activities for an incident investigation Focus line of enquiry during an investigation Engage with the most relevant people at each stage of the investigation Describe the incident causation paths in terms that align with their management system Consider issues relating to leadership, worker participation and human behaviour Assess the quality of an incident report Apply the process to any type of unwanted event that should have been prevented by a management system e.g., health, safety, environment, financial, security, productivity, quality, project management etc. Combine the findings from many incidents with data from other initiatives e.g., audits and inspections, to spot trends to prioritise actions and product a single improvement plan Target Audience The course is recommended for anyone who is expected to play a role in designing, reviewing, auditing, and following your organizations OH&S management system. Successful participants will be awarded the Stitching Tripod Foundation Tripod Beta Bronze certificate. The following oil & gas company personnel will benefit from the knowledge shared in this course: CEO Team Leaders Legal, insurance and finance departments Managers (Line and Function) Maintenance Engineers Quality Assurance Engineers Process Engineers Incident Investigators (Team member & Tripod facilitator) Project Managers System Custodians Technical Authorities Key Contractor's Management Contract Managers/Holders Safety Representatives Risk Management Engineers HSE Advisors Supervisors Auditors Regulators Course Level Basic or Foundation Trainer Your expert course leader has over 30 years of experience in construction, operations and maintenance with the upstream exploration and production sector. He joined Shell International E&P in 1971 and for 28 years worked in several locations around the world. Following the Piper Alpha incident he led Shell's two year, £10M major overhaul of their permit to work system. He first made use of the Tripod Beta principles during this period and since then he has delivered over 100 Tripod Beta courses in more than 25 locations around the world. He is a Chartered Engineer, a member of the Institution of Engineering and Technology and holds a postgraduate diploma from the University of Birmingham (UK). POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

IFRS Accounting for the Oil and Gas Sector

By EnergyEdge - Training for a Sustainable Energy Future

Gain expertise in IFRS accounting for the oil and gas sector with our industry-focused training course. Enroll today with EnergyEdge.

CAIA Level 2 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. The Level II curriculum takes a top-down approach and provides Candidates with the skills and tools to conduct due diligence, monitor investments, and appropriately construct an investment portfolio. In addition, the Level II curriculum contains Emerging Topic readings; articles written by academics and practitioners designed to further inform and provoke the Candidate’s investment management process. After passing the Level II exam you are eligible, with relevant professional experience, to join the CAIA Association as a Member and receive the CAIA Charter. You will be part of an elite group of more than 13,000 professionals worldwide. Only after joining the Association, you are eligible to add the CAIA designation to your professional profiles. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Emerging Topics • Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets • Technical Guide for Limited Partners: Responsible Investing in Private Equity • Channels for Exposure to Bitcoin • Assessing Long-Term Investor Performance: Principles, Policies and Metrics • Demystifying Illiquid Assets: Expected Returns for Private Equity • An Introduction to Portfolio Rebalancing Strategies • Longevity and Liabilities: Bridging the Gap • A Short Introduction to the World of Cryptocurrencies Topic 2: Ethics, Regulation and ESG • Asset Manager Code • Recommendations and Guidance • Global Regulation • ESG and Alternative Investments • ESG Analysis and Application Topic 3: Models • Modeling Overview and Interest Rate Models • Credit Risk Models • Multi-Factor Equity Pricing Models • Asset Allocation Processes and the Mean-Variance Model • Other Asset Allocation Approaches Topic 4: Institutional Asset Owners and Investment Policies • Types of Asset Owners and the Investment Policy Statement • Foundations and the Endowment Model • Pension Fund Portfolio Management • Sovereign Wealth Funds • Family Offices and the family office Model Topic 5: Risk and Risk Management • Cases in Tail Risk • Benchmarking and Performance Attribution • Liquidity and Funding Risks • Hedging, Rebalancing, and Monitoring • Risk Measurement, Risk Management, and Risk Systems Topic 6: Methods for Alternative Investing • Valuation and Hedging Using Binomial Trees • Directional Strategies and Methods • Multivariate Empirical Methods and Performance Persistence • Relative Value Methods • Valuation Methods for Private Assets: The Case of Real Estate Topic 7: Accessing Alternative Investments • Hedge Fund Replication • Diversified Access to Hedge Funds • Access to Real Estate and Commodities • Access through Private Structures • The Risk and Performance of Private and Listed Assets Topic 8: Due Diligence and Selecting Managers • Active Management and New Investments • Selection of a Fund Manager • Investment Process Due Diligence • Operational Due Diligence • Due Diligence of Terms and Business Activities Topic 9: Volatility and Complex Strategies • Volatility as a Factor Exposure • Volatility, Correlation, and Dispersion Products and Strategies • Complexity and Structured Products • Insurance-Linked and Hybrid Securities • Complexity and the Case of Cross-Border Real Estate Investing DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Production Sharing Contracts (PSC) & Related Agreements

By EnergyEdge - Training for a Sustainable Energy Future

Gain a deep understanding of Production Sharing Contracts (PSC) and related agreements through our expert-led course. Enroll now and excel in your field with EnergyEdge.

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Foundation level Anti Wrinkle and Dermal Fillers Course -Choose your own dates .

By Sassthetics Training Academy

One-2 one training in Aesthetics -Anti Wrinkle and Dermal fillers . Choose your own dates

A personalized 1-1 session of Shamanic Yoga is a session of healing of the body according to the blockages and limitations that appear to your eyes, which give us the key to solve in a marvellous way what your soul needs. This yoga is suitable to everyone and it is very easy and creative. SHAMANIC YOGA is ancestral, ancient, pre-vedic. It has the element of ecstasy, of a non ordinary state of consciousness, where you work with nature, animals, yantras, mantras, mudras, rituals, initiations in the imaginal forest, in the natural code, non the social code. Merceliade says that this yoga is the oldest form of yoga and we find it in various traditions: Hindu tradition (Shaktism), Himalayan (Naropa, Milarepa etc), South America (Andean yoga), Siberia, Mongolia, Japan (Yamabushi), Taoism, Alchemy. Shamanic yoga is not an exercise of the body, but a mystical, esoteric and initiatory healing practice that is distinguished by two characteristics; the first is ecstasy, the ability to communicate with the invisible, regaining the state of non-duality that is the typical goal of the yogin’s path. Ecstasy is not achieved by hypnosis or drugs or external means, but by means of instruments such as the drum, the breath and is not the trance of the medium. The shaman does not speak through the voice of spirits but draws knowledge directly from them. The second characteristic is the ability to bring back through narration or storytelling what has been grasped in the invisible worlds, during the shamanic journey, and to convince the matter to transform into reality what is told. Through narrative I awaken forces that then I can bring to life. Giada’s teachings are also combined with INTEGRAL OR PURNA YOGA founded by Sri Aurobindo “Purna’ means ‘complete’ and Purna Yoga distils and integrates the vast aspects of yoga into an invaluable set of tools for transformation and healing. It offers more than just physical exercise. Purna Yoga teaches the mind, body and emotions how to be at home with the spirit. Purna Yoga is the art of loving oneself by living from the heart. By attending to our classes, workshops, 1 to 1 sessions and retreats you agree to our TERMS AND CONDITIONS Payment Bookings are non-refundable. Disclaimer By booking a class or workshop or retreat or 1-1 session -online or any other venues – with us, you release Giada Gaslini, Invisible Caims and any business partners working with Invisible Caims from any liability arising out of any personal injuries, emotional or physical release, death, expectations of results, theft in the venue or damages that may happen to people and objects while attending. We recommend that you consult your GP regarding the suitability of undertaking an exercise programme, if the class you are booking includes it like with yoga or similar, and following all the safety instructions required before beginning to exercise. When participating in an exercise, there is the possibility of sustaining a physical injury. If you engage in this exercise programme, you agree that you do so at your own risk, are voluntarily participating in these activities and assume all risk of injury to yourself. You acknowledge that coaching, shamanic healing and counselling are not to be used as a substitute for psychotherapy, psychoanalysis, mental health care, or other professional advice by legal, medical or other professionals. Our sessions are aimed at inner research, problem solving and personal growth, they do not replace the work of doctors and psychotherapists because they do not consider, treat or aim to solve pathologies and symptoms that are strictly medical. All contracts subject to and governed by the law according to my current insurance. Added element of the disclaimer If the class happens in any venue and you are causing any damage to the property, you are taking responsibility of your actions. It is down to the individual to take personal responsibility when participating in physical activity and when entering a space that is used and shared by other parties. Invisible Caims does not take any responsibility about possible risks that may arise but can only advise and enforce guidelines and legal requirements as defined by the Scottish Government and local authorities.

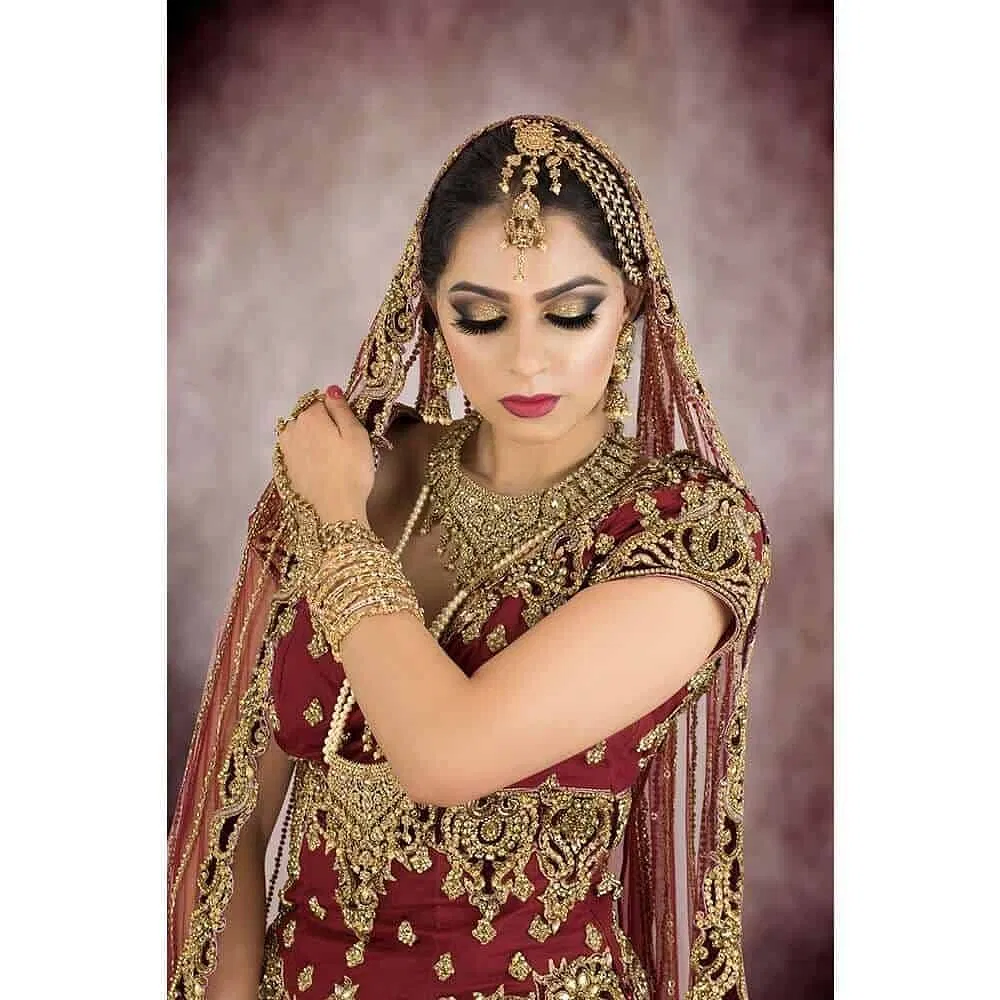

ASIAN BRIDAL HAIRSTYLING and MAKEUP COURSE (8 DAYS) – Accredited, Certified, & Insurable

5.0(48)By Asian Bridal Looks

In this Advanced Bridal Hair and Makeup Course you are taught 20+ Bridal Makeup Looks and 37+ Bridal Hairstyles with scope to creating more than 50 makeup looks and more than 50 hairstyles. This course is suitable for beginners (no experience required) and professionals wishing to update their existing knowledge and skills and add new ones. The course is accredited by the Guild of Beauty Therapists, one of the largest trade bodies in the beauty industry. Accredited certificates help to obtain liability insurance, discounts (upto 35%) from makeup brands, and access to specialised hairstyling products through trade only companies. Whereas, non-accredited courses run by many academies are unable to provide such benefits. Students Work After Course All makeup, hairstyling, jewellery and outfit setting is done solely by the student. Practice Sessions All makeup, false eyelashes, hair pieces, padding, hair products tools and equipment will be provided for students to use during the course in their practice sessions. During this Advanced Bridal Hair and Makeup Course you will be given full details of all products and tools used, both high end and cheaper alternatives. A lot of information is covered therefore students should take suitable notes and photographs to assist in further practice after the course. For the first 4 days you will be practising makeup techniques learnt on the course on a model which you can bring, or one can be provided for you for an extra fee of £60 per day. Training heads / mannequins will be provided for students to use during the hairstyling part of the course. It is not practical to use live models as multiple hairstyles are demonstrated each day and it is necessary to use different hair products and backcombing. Continuous backcombing and application of strong hair products on a live model would cause severe damage to the hair. View Content for Advanced Bridal Course: Day 1, Makeup : Health and Safety including safety practices for covid-19. Importance of using correct PPE. Keeping Products and equipment clean – brush cleaners and makeup sanitisers. Different types of lighting, makeup chairs, additional equipment for speed and efficiency. How to make your business cost effective. Different types of primers for eye makeup and face makeup, and which ones to use according to skin type and skin tone. Different types of foundations. How to assess different skin types and skin tones. How to select the correct eye primer, face primer and foundation. Different makeup removers. Different moisturisers for different skin types. Recommendations for eyeshadow palettes especially for beginners. How to blend eyeshadows seamlessly. How to do eyebrows, ombre, natural, and 3D. Different types of eyebrow products. Different types of eyelashes. How to correctly apply false lashes. Different types of colour correctors, and how to use them. How to highlight and contour. Highlights and contouring products. How to apply blusher. Recommendations for blusher colours for different looks. How to identify different skin undertones to help select correct face and eye products. How to set makeup for lasting results. How to avoid creasing under eyes and around mouth. How to stop lipstick bleeding. Covering dark circles and blemishes. How to apply lipstick including over-lining lips. Different types of lipsticks.x How to do eyeliner including winged eyeliner. How to do smokey eyes. Which brushes to use. Different types of eyeliner and how to preserve gel eyeliner. Traditional Asian Bridal Makeup. How to change soft bridal makeup to bold bridal makeup. Foundation colours required for different ethnicities. How to do Glitter makeup How to apply mascara. Day 2, Makeup : Smokey eye makeup Registry makeup Mehndi makeup Engagement makeup How to transform one makeup look into a completely different makeup look to save time where clients have booked for more than one event on the same day, and time constraints apply. Bold Makeup – how to Smokey Eye Makeup. Spotlight or halo makeup Subtle makeup. Ombre Makeup. Ombre glitter makeup How to apply pigments. How to use or apply liquid foundation. Different tools for different applications. Where to purchase makeup tools and makeup products. How to apply for pro makeup artist discount schemes. Soft cut crease makeup Different types of setting sprays. How to use different highlighting products. How to prevent creasing under the eye and mouth. How to makeup last longer. How to conduct client trials. How to manage bookings. How to avoid scams. How to conduct phone consultations. How to deal with difficult / fussy clients. Must have products for beginners and how to build up your kit. Reverse highlighting and contouring. Colour correction theory. How to use an artist colour wheel to coordinate eyeshadow colours. Customer care. How to use glitter. Day 3, Makeup : How to highlight and contour for different face shapes i.e. corrective highlighting and contouring. How to identify different eye shapes. How to apply makeup for different eye shapes. Advanced foundation makeup technique for flawless bridal makeup. Monolid eye makeup Protruding eye makeup Hooded eye makeup. Downturned eye makeup. How to select the correct style of lashes for different eye shapes. How to make small eyes look bigger. Different lip shapes and how to correct them. Ombre lips. How to make lips look bigger. Arabic makeup Cut crease makeup Double cut crease makeup Floating cut crease makeup Glitter cut crease makeup Day 4, Makeup : Photographic makeup technique. How to make your client look more than 2 tones lighter than their natural skin tone without skin looking grey or ashy. Dos and Don’ts of baking. Sweatproof / waterproof makeup. How to set makeup for hot weather and destination weddings in hot countries such as Dubai, etc. Glass skin technique and products. Nude lipstick for different skin tones. 3D eye makeup How to customise / change foundation colour for different skin tones. Makeup products for dark skin tones Mature ladies makeup techniques and products. Marketing and social media. How to organise your own photoshoots. Advice and tips on photography to showcase your work. European bridal makeup Day 5, Hairstyling : Health and Safety including safety practices for covid-19. Importance of using correct PPE. Advice on purchasing mannequins for further practice after the course. How to wash the mannequins hair and which products to use. How to apply for trade cards for specialist hair products. Must have hair products, high end and cheaper alternatives. Must have tools for hairstyling, high end and cheaper alternatives. What advice to give clients for prepping hair. How to conduct trials. How to prepare and conduct bookings. Customer care. How to avoid customer scams. Phone consultations. Which hair pieces required for different hairstyles and where to purchase. Different types of padding required for different hairstyles. How to make your own padding. Traditional bridal bun. How to create different designs on a bridal bun. How to section hair. How to create a vintage fringe with side parting. How to backcomb correctly. Half up half down. Layered vintage fringe with middle parting. Messy Plait. Low messy / curly bun. How to change one hairstyle into another to save time for clients with multiple bookings. How to pop synthetic hair. Different types of pins. How to secure jewellery where padding has been used in the hairstyle. How to secure the dupatta where padding has been used in the hairstyle. Day 6, Hairstyling : Side bun 1. Side bun 2. Greek braid 1. Greek braid 2. Structured bun. Simple curls (barrel or ringlet). Hollywood waves. How to prep hair. Products required to create different textures for different hairstyles. Textured updo. Messy updo. Textured updo. Messy updo. Textured fringe. How to curl synthetic hair. Mermaid hair. How to make curls last longer. Sleek bun. Sleek low bun. How to secure jewellery when no padding has been used for the hairstyle. How to secure the dupatta when no padding has been used for the hairstyle. Day 7, Hairstyling : French braid. Fishtail braid. Boho pull through braid. Textured plait. How to create extra long plaits for asian brides. Solutions for thinning hair. How to create volume for fine hair and medium thickness hair. Backcombing to create volume. How to apply clip-in hair extensions. Boho frech braid updo. French braid bridal updo. French twist. Textured hairstyle for the and / or short hair. Plaited fringe. Dutch twist braid. Dutch braid. Day 8, Hairstyling : Textured High Bun / Top Knot Low Textured Bun Textured Low Bun with Pulled Lines 3D Curls Half Up Half Down Textured Low Curly Bun Introduction to Russian / textured hairstyling. How to prep Hair for Russian Hairstyles. Products and tools required for Russian Hairstyling. How to create Texture for Russian Hairstyles. How to create lines for Russian Hairstyles. Different types of padding for Russian Hairstyling. Correct way to crimp hair. Correct way to backcomb hair. Optional Day 9, Photoshoot You will receive professionally edited images for your portfolio to kick start your new career. The model, photographer, jewellery and outfit are all provided. The tutor is present to provide guidance with the hairstyle and makeup thus reinforcing all that has been learnt on the course. Photoshoots take place on Tuesdays, Wednesdays, and Thursdays following the end of the hair and makeup course. The Photoshoot is Evidence of the Students Achievement The students portfolio work is strictly the students work only i.e. the student has done all the makeup, all the hairstyle, and all the jewellery and outfit setting by themselves at the end of the course without any physical help from the tutor or anyone from her team. Many other teaching establishments pass off pictures as students work whereas the tutor or helper usually do all the hairstyling, and dupatta and jewellery setting themselves, and the student only does the makeup, and in some instances makeup by the student is done on only half the face, whereas the tutor has done makeup on the other half. The whole point of doing a hair and makeup course should be so that the student can complete total hair and makeup looks by themselves by the end of the course without any further help. Course Benefits The Advanced Bridal Hair and Makeup Course teaches students to confidently style hair and apply makeup on asian, middle eastern and European brides and party guests for different functions. You will learn about hair and makeup products and tools. You will be able to offer your clients different styles of makeup both bold and subtle. You will be taught how to deal with clients with different features and skin tones (including dark skin tones). You are taught advanced bridal makeup techniques on the fourth day of the course. We teach you how to create several hairstyles from one basic foundation. We also show you how to transform one hairstyle into another within minutes. You will learn how to prep different hair textures. Students are taught a huge range of hairstyles including advanced bridal hairstyles. On the eighth day of the course students are taught how to create some Russian hairstyles and the latest textured hairstyles.You will gain a detailed knowledge of techniques and products both high end and cheaper brands. You will be able to start your business as a professional hair and makeup artist without wasting money on unnecessary products and equipment. Successful completion of the course rewards students with 3 accredited certificates: Asian Bridal Makeup, Asian Bridal Hairstyling, and Professional Standards for Therapists. Thus enabling students to apply for makeup discount schemes, and gain access to specialised tools and products from trade only companies for professional hairstylists. This course is designed to maximise the success of your business and earning potential. We teach you not just the current makeup trends and hairstyles but also the types of looks and hairstyles expected to be in demand in the near future. We are probably the only training academy offering students advice and tips on how to create their own portfolio to suit their budget. Fees & Enrolment for Advanced Bridal Course Class Size: All courses are limited to a maximum of 3 students per class. Each student receives plenty of individual attention in all aspects of learning to fully benefit from the course. Course Location: Slough, near Heathrow, Hounslow and Southall. Easily accessible by road (Junction 5 of M4) and train (Slough Station – Elizabeth Line (London Underground) and National Rail (15 minutes from Paddington station, central London)). Course Timings: 10am – 5pm Course Fee: £1595 for 8 Days without photoshoot or £2400 for 9 Days with photoshoot Course Dates are below. If these dates are not suitable then we may be able to accommodate provided we have 1-2 months advance notice, please ask. (Refreshments and lunch is provided free of charge)

Trade secrets - the business perspective (In-House)

By The In House Training Company

Trade barriers are going up across the globe. And cybercrime is on the increase. The link between the two? The value of trade secrets. As countries become increasingly protectionist as regards international trade, so their IP law has been changing, with the result that companies that previously would have sought protection through patents are opting to go down the trade secret route instead. But is this a high-risk strategy? Technology is changing and this is having an impact on forms of commercial co-operation. Collaborative or open forms of innovation by their very nature involve the sharing of intellectual property (IP), and in many instances this IP is in the form of valuable confidential business information (ie, trade secrets). Little surprise, then, that trade secrets disputes have increased accordingly. At the same time, the changes in technology make trade secrets more vulnerable to attack, misappropriation, theft. So just how effective are the legal protections for trade secrets? How can organisations safeguard the value in their IP (increasingly, the single biggest line in their balance sheets)? This programme is designed to help you address these issues. Note: this is an indicative agenda, to be used as a starting point for a conversation between client and consultant, depending on the organisation's specific situation and requirements. This session is designed to give you a deeper understanding of: Emerging trends in trade secrets protection and exploitation The current situation in key jurisdictions Recent case law How leading companies are responding The importance of trade secret metadata Different external stakeholders and their interests Key steps for effective protection of trade secrets Note: this is an indicative agenda, to be used as a starting point for a conversation between client and consultant, depending on the organisation's specific situation and requirements. 1 What are trade secrets? Definitions Examples Comparison with other forms of IP (patents, confidential information, know-how, copyright) 2 Current trends The various changes taking place affecting trade secrets - legal changes, trade wars, cybercrime, technology, commercial practice The current position in the UK, Europe, USA, China, Japan, Russia Corporate best practice 3 Trade secret disputes - how to avoid them Trade secret policies, processes and systems Administrative, legal and technical protection mechanisms The role of employees The sharing of trade secrets with others 4 Trade secret disputes - how to manage them Causes Anatomy of a trade secret court case 'Reasonable particularity' 5 Related issues Insurance Tax authorities and investigations Investor relations 6 Trade secret asset management roadmap Maturity ladder First steps Pilot projects

Search By Location

- Insurance Courses in London

- Insurance Courses in Birmingham

- Insurance Courses in Glasgow

- Insurance Courses in Liverpool

- Insurance Courses in Bristol

- Insurance Courses in Manchester

- Insurance Courses in Sheffield

- Insurance Courses in Leeds

- Insurance Courses in Edinburgh

- Insurance Courses in Leicester

- Insurance Courses in Coventry

- Insurance Courses in Bradford

- Insurance Courses in Cardiff

- Insurance Courses in Belfast

- Insurance Courses in Nottingham