- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

59 Insurance courses in Bradford delivered Live Online

Advanced Certificate in Impression Taking including Intra Oral Scanning

By Cavity Dental Training

This course, worth 30 hours of verifiable CPD, will demonstrate your ability to grade and reflect upon your impression technique and demonstrate competence to take impressions unsupervised under prescription. Learn about the Cavity Training Impression Taking Course The course is suited to nurses who aspire to treat patients directly and to take impressions or scan for impressions under the prescription of a registered dentist or clinical dental technician. To enrol, you must be GDC-registered, work in surgery and hold indemnity insurance. (extended duties) You will need a GDC registered dental professional able and willing to supervise you. You also need to complete an Anaphylaxis Awareness course – we offer a free CPD course for this. Frequently Asked Questions How long is the course? The course duration is 2 to 6 months. When are the classes held? You will attend a live webinar class for two Saturday mornings. Is there an exam at the end? There is no exam at the end, you need to successfully complete 24 assessments with your practice mentor and a complete a 500 word dissertation. What qualifications do I need to start the course? Preferable English and Maths level 4 and above, you must also be GDC registered. What opportunities for progression is there? This qualification allows candidates to further progress onto various post registration qualifications or career opportunities, such as: The Certificates in Orthodontic Nursing Extending a career in prosthetics. Training as a Lab Technician Course Dates 13th - 27th April 2024 9:30am - 1:30pm 11th - 25th May 2024 9:30am - 1:30pm 8th - 22nd June 2024 9:30am - 1:30pm 13th - 27th July 2024 9:30am - 1:30pm 3rd - 17th August 2024 9:30am - 1:30pm 7th - 21st September 2024 9:30am - 1:30pm Costs £180.00 per person (inc. VAT) Please choose from one of the course dates above. Each course is 2 days. The dates above indicate the 2 days of the course.

Production Sharing Contracts (PSC) & Related Agreements

By EnergyEdge - Training for a Sustainable Energy Future

Gain a deep understanding of Production Sharing Contracts (PSC) and related agreements through our expert-led course. Enroll now and excel in your field with EnergyEdge.

Sage Payroll Training Course - Fast Track

By Osborne Training

Sage Payroll Training Course - Fast Track This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. You will receive a CPD Completion certificate from Osborne Training once you finish the course. What skills will I gain? In this course you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land on your dream job in Payroll sector. Level 1 Introduction to payroll Introduction to Real Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the payroll Procedures Level 2 Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3 Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Payroll Accounting Training Fast Track

By Osborne Training

Payroll Accounting Training Fast Track (Level 1-3): This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. In this course, you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land your dream job in the Payroll sector. As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) All exams are conducted online through Sage (UK). Level 1: Introduction to payroll Introduction to Real-Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the Payroll Procedures Level 2: Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3: Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Blockchain for Healthcare Professionals

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for CliniciansUniversitiesHospitalsHealthcare ExecutivesEntrepreneursInvestors Overview Intro to blockchainMajor healthcare use cases of blockchainUnderstand different use cases of PEB that have already been implemented and encourage thought of new potential use cases. This course covers the intersection of healthcare and Blockchain. Training will include an overview of Blockchain, and uses for Blockchain in the healthcare industry, from medical records, to medical devices, insurance and more. Day 1 History of blockchain Blockchain 101 Decentralization/centralization Distributed ledger-private vs public Mining and consensus mechanisms Intro to healthcare on blockchain including Medical records FHIR, HL7 Day 2 Patient identity Value-based care and concepts (discuss outcome-based smart contracts) Medical devices, Wearables, IoT Patient adherence monitoring (with tokenized incentives-could also discuss with pt. empowerment), incentives, etc. Interoperability and other obstacles of implementation (industry inertia, large data sets, inherent resistance to change) Day 3 Supply chain (substandard and falsified medicines, divergence, compliance with DSCSA) Logistics Insurance (eligibility, reduced overhead, claims processing) Data sets AI technology (theoretical use cases) PT empowerment 1 & 2 (digital health wallet with access driven by smart contracts, monetizing data for sharing) Additional course details: Nexus Humans Blockchain for Healthcare Professionals training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Blockchain for Healthcare Professionals course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Digital, Text & Voice Communicators Course

By Hi-Tech Training

The Hi-Tech Training Digital Text & Voice Communicator Course is designed to provide participants with the skills required to connect Digital, Text & Voice Communicators to an Alarm Control Panel for transmission of Digital status signals via the telephone line, GSM Network or IP network to a central monitoring station. The Digital Communicator Course’s practical application and our highly experienced trainers ensure that this course is second to none. The course is technical and practical in nature and is suitable for participants who have successfully completed the Hi-Tech Training Intruder Alarm Installation Course or equivalent.

A personalized 1-1 session of Shamanic Yoga is a session of healing of the body according to the blockages and limitations that appear to your eyes, which give us the key to solve in a marvellous way what your soul needs. This yoga is suitable to everyone and it is very easy and creative. SHAMANIC YOGA is ancestral, ancient, pre-vedic. It has the element of ecstasy, of a non ordinary state of consciousness, where you work with nature, animals, yantras, mantras, mudras, rituals, initiations in the imaginal forest, in the natural code, non the social code. Merceliade says that this yoga is the oldest form of yoga and we find it in various traditions: Hindu tradition (Shaktism), Himalayan (Naropa, Milarepa etc), South America (Andean yoga), Siberia, Mongolia, Japan (Yamabushi), Taoism, Alchemy. Shamanic yoga is not an exercise of the body, but a mystical, esoteric and initiatory healing practice that is distinguished by two characteristics; the first is ecstasy, the ability to communicate with the invisible, regaining the state of non-duality that is the typical goal of the yogin’s path. Ecstasy is not achieved by hypnosis or drugs or external means, but by means of instruments such as the drum, the breath and is not the trance of the medium. The shaman does not speak through the voice of spirits but draws knowledge directly from them. The second characteristic is the ability to bring back through narration or storytelling what has been grasped in the invisible worlds, during the shamanic journey, and to convince the matter to transform into reality what is told. Through narrative I awaken forces that then I can bring to life. Giada’s teachings are also combined with INTEGRAL OR PURNA YOGA founded by Sri Aurobindo “Purna’ means ‘complete’ and Purna Yoga distils and integrates the vast aspects of yoga into an invaluable set of tools for transformation and healing. It offers more than just physical exercise. Purna Yoga teaches the mind, body and emotions how to be at home with the spirit. Purna Yoga is the art of loving oneself by living from the heart. By attending to our classes, workshops, 1 to 1 sessions and retreats you agree to our TERMS AND CONDITIONS Payment Bookings are non-refundable. Disclaimer By booking a class or workshop or retreat or 1-1 session -online or any other venues – with us, you release Giada Gaslini, Invisible Caims and any business partners working with Invisible Caims from any liability arising out of any personal injuries, emotional or physical release, death, expectations of results, theft in the venue or damages that may happen to people and objects while attending. We recommend that you consult your GP regarding the suitability of undertaking an exercise programme, if the class you are booking includes it like with yoga or similar, and following all the safety instructions required before beginning to exercise. When participating in an exercise, there is the possibility of sustaining a physical injury. If you engage in this exercise programme, you agree that you do so at your own risk, are voluntarily participating in these activities and assume all risk of injury to yourself. You acknowledge that coaching, shamanic healing and counselling are not to be used as a substitute for psychotherapy, psychoanalysis, mental health care, or other professional advice by legal, medical or other professionals. Our sessions are aimed at inner research, problem solving and personal growth, they do not replace the work of doctors and psychotherapists because they do not consider, treat or aim to solve pathologies and symptoms that are strictly medical. All contracts subject to and governed by the law according to my current insurance. Added element of the disclaimer If the class happens in any venue and you are causing any damage to the property, you are taking responsibility of your actions. It is down to the individual to take personal responsibility when participating in physical activity and when entering a space that is used and shared by other parties. Invisible Caims does not take any responsibility about possible risks that may arise but can only advise and enforce guidelines and legal requirements as defined by the Scottish Government and local authorities.

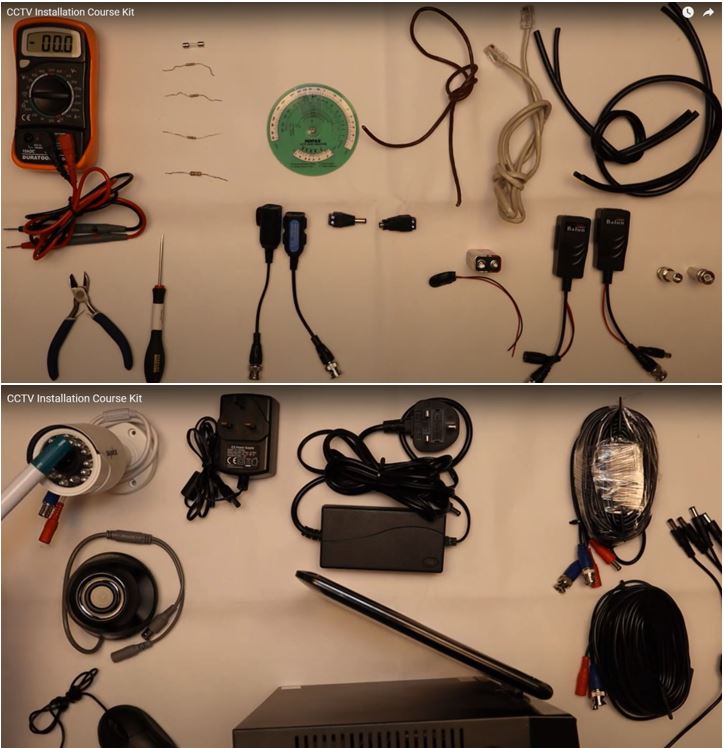

CCTV Installation Course

By Hi-Tech Training

Hi-Tech Training Closed Circuit Television (CCTV) Installation Course is designed to give participants a practical knowledge of the operation and installation of CCTV systems at a foundation level.

Alarm Installation Course

By Hi-Tech Training

The Alarm Installation Course is designed to teach participants how to install an intruder alarm system in domestic, commercial or industrial premises. The Alarm Installation Course simulates the practical installation of many different alarm control panels. The course is designed to equip students with the skills and expertise to competently install a wide variety of Alarm systems on the market.

Autoskool Driving School offers you a very competitive rate of Automatic driving lessons with a quality service to match. We also offer you a simple price structure, we don’t believe in charging you extra during the evening or the weekend. Our lessons are conducted on a 1-1 basis and we will give you a full two hour lesson. We accept payment via PayPal, credit card over the phone or you can pay cash to the instructor on the day of your lesson.