- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

25527 Industry courses

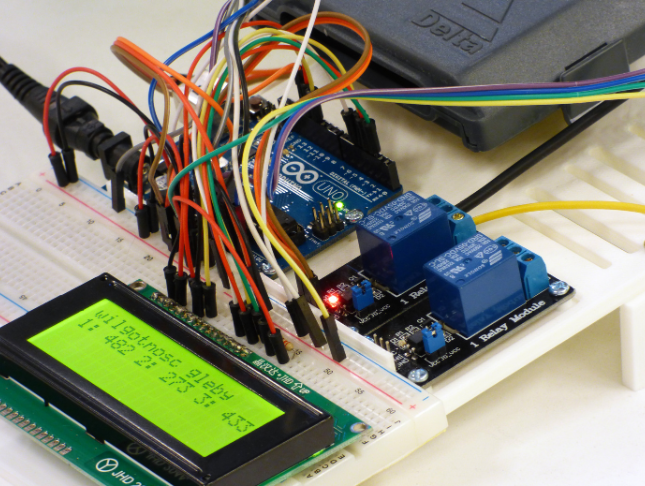

Embark on a coding odyssey like no other with our course, 'Start Learning Arduino without Writing a Single Line of Code.' Imagine a journey where the intricacies of Arduino unfold effortlessly, without the need for complex coding. From the basics of Arduino and embedded systems to the installation of ArduinoBlockly, this course revolutionizes learning by offering a code-free approach. Visualize yourself effortlessly interfacing LEDs, switches, buzzers, and even mastering advanced concepts like pulse width modulation and ultrasonic distance sensing. Each module is a gateway to a new project, from traffic light controllers to digital thermometers, all achieved without a single line of code. This course is not just an introduction; it's an invitation to witness the magic of Arduino without the constraints of traditional coding barriers. Learning Outcomes Attain a profound understanding of Arduino basics and embedded systems without the need for traditional coding syntax. Master the installation and program downloading process using ArduinoBlockly and Arduino IDE. Acquire hands-on experience in interfacing LEDs, switches, buzzers, and tri-color LEDs, realizing projects like chasers and traffic light controllers without writing a single line of code. Explore advanced concepts such as serial communication, ADC, pulse width modulation, ultrasonic distance sensing, and servo motor interfacing, unlocking a world of possibilities without coding complexities. Gain the ability to create functional projects, including digital thermometers, water level indicators, and servo-based angular control, utilizing a code-free approach. Why choose this Start Learning Arduino without Writing a Single Line of Code course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Start Learning Arduino without Writing a Single Line of Code for? Coding beginners and enthusiasts eager to explore Arduino without delving into traditional programming. Students and hobbyists looking for a hands-on, code-free introduction to embedded systems. DIY enthusiasts intrigued by the prospect of building innovative projects without the complexities of coding. Technology enthusiasts interested in mastering Arduino interfaces, sensors, and advanced concepts without traditional coding barriers. Anyone seeking a creative and accessible entry point into the world of Arduino and embedded systems. Career path Arduino Specialist: £25,000 - £40,000 Electronics Technician: £20,000 - £35,000 Embedded Systems Technician: £22,000 - £38,000 IoT Device Developer: £28,000 - £45,000 Automation Engineer: £30,000 - £50,000 Electronics Design Assistant: £23,000 - £38,000 Prerequisites This Start Learning Arduino without Writing a Single Line of Code does not require you to have any prior qualifications or experience. You can just enrol and start learning. This Start Learning Arduino without Writing a Single Line of Code was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Introduction To Arduino Introduction To Course 00:01:00 Introduction to Embedded System and Arduino 00:04:00 Arduino Basics 00:09:00 Difference between C Syntax of Arduino and C Coding 00:10:00 Arduino And Ardublockly Installation And Program Downloading Arduino IDE and ArduinoBlockly Installation 00:10:00 Writing Program into ArduioBlockly and downloading on Board 00:11:00 Program Downloading using Arduino IDE 00:05:00 Arduino Interfaces Breadboard 00:08:00 LEDs LED Interfacing 00:11:00 Project 1: All LED Blinking 00:01:00 Project 2: Alternate LED Blinking 00:01:00 Project 3: Four LEDs ON - OFF 00:01:00 Project 4: Chaser 00:01:00 Ten Times LED Blinking 00:01:00 Switches Switch Interfacing 00:11:00 Project 6: LED and Switch Program 00:02:00 Project 7: Two LEDs and Two Switches Program 00:02:00 Buzzer Buzzer 00:03:00 Project 8: Buzzer Programming 00:01:00 Project 9: Buzzer and LED Program 00:01:00 Tri Color LED Tri-Color LED 00:05:00 Project 10: Tri-Color LED Based Red, Green, Blue Color Generation 00:01:00 Project 11: Tri Color LED Based Yellow, Cyan and Magenta Color Generation 00:01:00 Project 12: Traffic Light Controller 00:01:00 Project 13: Tri Color LED and Switch Based Color Generation 00:02:00 Seven Segment Display Seven Segment Display Interfacing 00:07:00 Project 14: Up Counter Using Seven Segment Display 00:04:00 Serial Communication Introduction Serial Communication 00:13:00 Project 15: Printing a Message into Monitor Window 00:01:00 Project 16: Message Reading Using Serial Communication 00:01:00 Project 17: Device Control 00:03:00 ADC And Analog Sensors ADC concepts 00:17:00 Project 18: Digital Thermometer 00:02:00 Project 19: Digital Voltmeter 00:02:00 Project 20: Digital Light Meter 00:01:00 Project 21: Temperature Controller 00:01:00 Pulse Width Modulation In Arduino Introduction To Pulse Width Modulation and its Concepts 00:12:00 Project 22: LED Fading 00:01:00 Ultrasonic Distance Sensing Ultrasonic Sensor concept 00:14:00 Project 23: Distance Meter 00:02:00 Project 24: Water Level Indicator 00:01:00 Servo Motor Interfacing Servo Interfacing with Arduino 00:15:00 Project 25: Servo Based Angular Control 00:01:00 Conclusion Conclusion 00:01:00

Maintaining your bike can be difficult, especially if you haste or become confused, resulting in mistakes. So, relax and join us on this bike repair adventure! Whether you want to fix bikes as a pastime or as a possible career, we've got you covered. Put this course in your shopping cart and obtain the confidence to perform basic bicycle maintenance. Are you looking to improve your current abilities or make a career move? Our unique Course might help you get there! Expand your expertise with high-quality training - study the course and get an expertly designed, great value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the Bike Maintenance online training course. This Bike Maintenance online training course is accredited by CPD with 10 CPD points for professional development. Students can expect to complete this Bike Maintenance training course in around 05 hours. You'll also get dedicated expert assistance from us to answer any queries you may have while studying our course. The Bike Maintenance course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the course, an instant e-certificate will be exhibited in your profile that you can order as proof of your new skills and knowledge. Add these amazing new skills to your resume and boost your employability by simply enrolling on this course. With this comprehensive course, you can achieve your dreams and train for your ideal career. The course provides students with an in-depth learning experience that they can work through at their own pace to enhance their professional development. You'll get a Free Student ID card by enrolling in this course. This ID card entitles you to discounts on bus tickets, movie tickets, and library cards. This training can help you to accomplish your ambitions and prepare you for a meaningful career. So, join the course today - gear up with the essential skills to set yourself up for excellence! Some FAQ from Learners: Question: What are the minimum things you should take out with you when you go out on your ride? Answer: Mike: Drinks, banana/gels, mobile phone (charged), multi-tool, spare inner tube, puncture repair kit, tyre levers, CO2 cartridge and/or pump, emergency cash and a spare 'magic' chain link. You might also consider extra rain-protective clothing and a mini-chain tool. A motor-pacing scooter can also be handy! And if you are riding to get away from it all forget the phone. Question: How often should you clean your bike if you're riding 2-3 times a week or more? Is there any particular method you'd advise following? Mike: After every ride! Degrease your chain and any other oil-soiled components first - (I use a chain cleaning tool Car Plan degreaser), then clean with a proprietary detergent, rinse off, dry, lubricate the chain. Check cable operation and lubricate if necessary. Experts created the Beginner Bike Maintenance course to provide a rich and in-depth training experience for all students who enrol in it. Enrol in the course right now and you'll have immediate access to all of the course materials. Then, from any internet-enabled device, access the course materials and learn when it's convenient for you. Start your learning journey straight away with this Beginner Bike Maintenance course and take a step toward a brighter future! Why should you choose the course with Academy for Health & Fitness? Opportunity to earn a certificate accredited by CPD after completing this course Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Globally accepted standard structured lesson planning Innovative and engaging content and activities Assessments that measure higher-level thinking and skills Complete the program in your own time, at your own pace Each of our students gets full tutor support on weekdays (Monday to Friday) *** Course Curriculum *** Beginner Bike Maintenance Module 01: Introduction to Motorbike Maintenance Things to Be Learnt Motorbike Tools Hand Tools Big Ticket Tools Safety Concerns Summary Module 02: Basics of Engine Two-Stroke Basics Four-Stroke Basics The Top and Bottom Ends Valves and Cams Engine Layout Summary Module 03: Engine Cooling and Lubrication Engine Cooling Air and Oil Cooling Changing Coolant Liquid Cooling Lubrication Synthetic Oil Vs. Mineral Oil Detergent Vs. Non-Detergent Oil Engine Oil and Lubrication Oil Change and Conventional Fork Oil Change Cartridge-Type Fork Oil Change Summary Module 04: Ignition Ignition Basic Battery, Coil Ignition and Installing Spark Plugs. Adjusting Ignition Timing and Maintaining Ignition System. Summary Module 05: Suspension Suspension Work of springs and Aftermarket Spring Kits Dampers and Suspension Tuning Front, Rear Suspension and Improving Suspension Setting Ride Height and Adjusting Rebound Damping Summary Module 06: Intake, Fuel, Clutch and Exhaust Systems Maintaining Fuel System and Fuel Injection Installing an Inline Fuel Filter Maintaining Clutch Adjusting and Replacing Clutch Improving Clutch and Automotive-Style Clutch Carburettor Types of Carburettors Synchronizing Carburettors Cleaning Petcock Strainers Exhaust System Scavenging Power Pipe Design Chain Cleaning and Lubrication Chain Adjustment Sprocket Replacement Summary Module 07: Electrical Maintenance How Wet-Cell Batteries Work Installing a New Battery Battery Breather Quick Charge Test Basic Wiring Technique Basic Circuit Facts Light Bulbs Checking Resistance Checking Sending Units Electrical Dos and Don'ts Summary Module 08: Wheels, Tires and Brakes Maintenance Wheels Wheels and Its Specifications Checking and Adjusting Wheel Alignment Checking and Truing Spoked Wheels Replacing Wheel Bearings and Seals Wheel Building and Truing Tires Changing Tubes and Tires. Balancing Tires. Brakes Replacing Brake Shoe Changing Brake Fluid Changing Brake Pads Rebuilding Callipers and Improving Brakes Maintaining Wheels and Tires Summary Module 09: Transmission, Frame and Steering Transmission Constant Mesh Transmission Shifting Gears Oil Additives Transmission Oil Change Frame The Motorbike Frame Types of Frame How the Frame Influence Handling Wheelbase Maintaining the Chassis Steering Checking and Adjusting Steering-Head Bearings Replacing Steering-Head Bearings Checking and Adjusting Swingarm Bearings Bolt Checking and Crash Damage Summary Module 10: Cleaning, Setting Up and Storage Washing, Waxing and Polishing Touching-Up Paint Winter Storage Storage Procedure Summary Module 11: Troubleshooting What to Do If a Bike Does not Start? Go with The Flow Basics of Troubleshooting Things Checking for Spark and Running Problem Troubleshooting the Charging System Checking Compression and Heli-Coil Installation Removing a Seized Bolt and a Stuck Screw Lubricating a Control Cable and Hand-Packing a Bearing Removing and Replacing a Seal Changing Hydraulic Fluid Summary Assessment Process Once you have completed all the course modules, your skills and knowledge will be tested with an automated multiple-choice assessment. You will then receive instant results to let you know if you have successfully passed the Beginner Bike Maintenance course. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this course. This course is open to everybody. Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this course, you are to start your career or begin the next phase of your career.

Buy Big. Save Big; Save: £400! Offer Ends Soon; Hurry Up!! Are you considering home-schooling your child because he/she seems to do better at home, but feeling unsure if it's the right thing to do? Then you need some home-schooling too! Pick up this Home Education Training online course and start your journey to explore the ins and outs of the idea, the pros and cons surrounding it, and also how to execute it with ease! This Home Education Training course is endorsed by The Quality Licence Scheme and accredited by CPD (with 120 CPD points) to make your skill development and career progression related to Home Education substantial and easier than ever! This Home Education Training course will hand over all the information necessary to get started on home-schooling your children with care. You will learn what home-schooling involves and when children are ready to be homeschooled. This Home Education Training course also covers different assessment methods and also exam entry for Home-Schooled children. Throughout this Home Education Training course, you will get familiar with the University admissions criteria and figure out a structured approach to progress. And by the end of the Home Education Training course, you will learn how to deal with the challenges all too common with Bearing Sole Responsibility for Child's Education. It will also provide you with the tools to build up a new and exciting career related to home schooling! So, we'd like to welcome you to take a journey with us to understand the methods of Homeschooling as well as know the crucial factors contributing to Home Education. Skills You Will Gain from this Home Education Training course: Consider your ability and desire to take on this leading role in a child's education. Useful strategies that can help you maximise the home-schooling experience. Determine whether a child is showing ongoing signs of psychological distress. Have good communication and emotional closeness within a family. Help your children develop into responsible people with healthy boundaries. Create a disciplined and peaceful homeschooling routine. The Home Education Training course has been designed by experts, to create a rich and in-depth training experience for all the students who enrol on it. Enrol on the Home Education Training course now and get instant access to all course materials. Then, enjoy the course materials online from any internet-enabled device and learn when it suits you. Start your learning journey with this Home Education Training course straight away and take a step forward in securing a better future! Why Prefer this Home Education Training Course? Get a Free CPD Accredited Certificate upon completion of Home Education Training Get a free student ID card with Home Education Training Training program (£10 postal charge will be applicable for international delivery) The Home Education Training is affordable and simple to understand This Home Education Training course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Home Education Training course materials The Home Education Training comes with 24/7 tutor support ***Course Curriculum*** Here is the curriculum breakdown of the Home Education Training course: Module 01: Introduction to Home Education Introduction Defining Reasons Objectives Factors Contributing Module 02: Formal Requirements for Home-Schooling Legality Frequently Asked Questions By Parents Deregistration Process Sample Letters to Deregister Module 03: Advantages and Disadvantages Pros Cons Module 04: Methods of Homeschooling (Part -A) Classical Homeschooling Method Charlotte Mason Method Montessori Method Unschooling Module 05: Methods of Homeschooling (Part - B) Homeschooling on the Road Traditional Homeschooling Homeschool Unit Studies Eclectic Homeschooling Module 06: Methods of Homeschooling (Part - C) World schooling Waldorf Homeschool Module 07: Assessment How to Track Your Home-Educated Child's Progress An Autonomous Approach to Progress A Structured Approach to Progress Formal Exams for Home-Educated Children Using Past Papers for Exam Going Through a Practice Paper Homeschooling and GCSEs GCSE Examination Boards Are Not All the Same Information About Exam Entry for Home Schooled Children Homeschooled Candidates Advice on Examination Officers Different Types of Exams A-Levels Home Schooling and Making a University Application More Detail on University Admissions Criteria Home Schooling And The UCAS Form For University Admission Module 08: Challenges Over-Scheduling Parent vs Teacher Younger Siblings Organisation and Record-Keeping Bearing Sole Responsibility for the Child's Education Maintaining Balance Parenting Lack of Effort in Children Wearing Too Many Hats Troubleshooting Technology Issues Household Chores in Study Hours Module 09: Advice for Prospective Homeschooler's Parents Create a Designated Learning Space Follow a Daily Schedule Map Out the School Year Ahead of Time Make Learning a Family Activity Ease into School Stay Organised Empower Students Set Goals for and with Students Socialise the Learning Accept Imperfections Limit Access to Non-educational Software and Websites Get Ahead of the Technical Requirements Preserve Your Work Day at Home Follow the Rules You Set Help Them Organise Their Day Look for Online Support Passion Projects We offer an integrated assessment framework to make the process of evaluation and accreditation for learners easier. You have to complete the assignment questions given at the end of the Home Education Training course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Home Education Training exams. Show off Your New Skills With a Certification of Completion Endorsed Certificate of Achievement from the Quality Licence Scheme After successfully completing the Home Education Training course, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with a pricing scheme of - £99 GBP inside the UK £109 GBP (including postal fees) for international delivery Certification Accredited by CPD Upon finishing the Home Education Training course, you will receive an accredited certification that is recognised all over the UK and also internationally. The pricing schemes are - 10 GBP for Digital Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (international delivery) CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Home Education Training course is ideal for anyone interested in this topic and who wants to learn more about it. This Course will help you gain a strong understanding of the core concepts and will allow you to gain in-depth knowledge of the subject matter. This Home Education Training course is suitable for everyone. There are no specific entry requirements, and you can access the course materials from anywhere in the world. Requirements There are no previous knowledge requirements for the Home Education Training program; this is open to anyone! Any learning enthusiast from anywhere in the world can enrol on this Home Education Training course without any hesitation. All students must have a passion for learning and literacy, as well as being over the age of 16. Browse this 100% online course from any internet device, including your computer, tablet or smartphone. Study at your own pace and earn an industry- skillset with this Home Education Training course. Career path You can make a big change by helping to change the lives of students and start a career in: Online Teacher Online Tutor Writing Coach Curriculum Developer Educational Writer Educational Consultant Home Educational Technology Consultant

Hydroponics garden is one of the most revolutionary endeavours undertaken by modern technology. Now you can see your plants grow faster than outdoor plants. So if you find this idea intriguing, then avoid getting confused by ads full of nonsense. Instead, enrol in Hydroponics Gardening Online Course to broaden your horizon of hydroponics gardening and its marketing process. This Diploma in Hydroponics Gardening at QLS Level 5 course is endorsed by The Quality Licence Scheme and accredited by CPDQS (with 150 CPD points) to make your skill development & career progression more accessible than ever! Why Prefer This Hydroponics Gardening Course? Opportunity to earn certificate a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS after completing the Hydroponics Gardening course Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. When you grow plants, you just don't grow plants; rather, you grow an oxygen factory. Hydroponics gardening is a source of encouragement for people who want to decrease their carbon footprint and keep the environment green. If you lead a hectic lifestyle and are unable to manage yourself to maintain an outdoor garden but still can't resist the passion for growing plants, then a hydroponics garden could be the best solution for you. Hydroponics gardening is the process of growing plants anchored in a container or pot with a solution of water and nutrients. With this proven method now, you can grow plants faster than ever without soil and can use them around the year. Moreover, this process requires less space and water than the conventional process, and there is no chance of growing weeds. However, this method can be expensive and takes a lot of attention and instruction. Pondering over its demand and advantages, we developed a staggering course for you. Now you can enjoy your comfort zone from dusk till dawn through the greenery of the hydroponics garden. Learning Outcome Realise the cruciality of hydroponics gardening Appreciate the aesthetic charm and economic feasibility of hydroponic gardening List the plants you can grow in a hydroponics garden Enable the optimal temperature, light, carbon dioxide and nutrients needed Get familiar with the equipment and tools needed for developing a hydroponics garden Realise the vitality of greenhouse plants Tackle the problem of food scarcity by supplying organic food Adopt pest control strategies Manage the irrigation system aptly Prevent plant diseases and mortality of plants Endow your indoor space with ornamental herbs, foliage and flowers Spread awareness about hydroponics gardening Inaugurate your business of hydroponics gardening Know the marketing strategies of hydroponic plants Observe the technological advancement in this area This course will show the proven way to grow hydroponic plants likelettuce, spinach, Swiss chard, parsley, oregano, cilantro, and mint. You will also learn to grow fruiting plants like tomatoes, strawberries, and hot peppers. Beginners who want to enhance their indoors with ornamental plants or want to take entrepreneurial initiatives can follow three simple hydroponics systems: wick, water culture, and ebb and flow. There are some advanced and complex systems, such as the nutrient film technique and the aeroponic system. You will be taught how to implement these techniques successfully through our pocket-sized modules. You will learn about the measurements and proportions of nutrients and water for different kinds of plants, maintaining the optimal environmental conditions required. You will perform regular monitoring to make sure the systems are functioning properly. As plants are susceptible to waterborne diseases, we will demonstrate the scientific way to prevent these troubles. Roots are vulnerable without soil around them. Therefore, with the help of our digital assistance, you will take care of them with due diligence. Going through multiple assessments, you will gain mastery of this important topic. Ensure the perfect blend of luxury and comfort of your indoors by signing up for Hydroponics Gardening Online Course. Assessment Process You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam.Our expert trainers will assess your assignment and give you feedback after you submit the assignment. After passing the Diploma in Hydroponics Gardening at QLS Level 5 course exam, you will be able to request a certificate at an additional cost that has been endorsed by the Quality Licence Scheme. CPD 150 CPD hours / points Accredited by CPD Quality Standards Module 1: Introduction to Hydroponics 11:59 1: Module 1: Introduction to Hydroponics Preview 11:59 Module 2: Systems of hydroponic culture 19:19 2: Module 2: Systems of hydroponic culture 19:19 Module 3: Plant Nutrition 21:05 3: Module 3: Plant Nutrition 21:05 Module 4: Equipment 41:33 4: Module 4: Equipment 41:33 Module 5: Rooting media 10:20 5: Module 5: Rooting media 10:20 Module 6: Seedling and Plant Maintenance 21:24 6: Module 6: Seedling and Plant Maintenance 21:24 Module 7: Nutritional Problems and Solutions in Plant 32:58 7: Module 7: Nutritional Problems and Solutions in Plant 32:58 Module 8: Growing in Greenhouses 29:18 8: Module 8: Growing in Greenhouses 29:18 Assessment (Optional) 14:00 9: Assessment 14:00 Order Your Certificate 02:00 10: Order Your CPD Certificate 01:00 11: Order Your QLS Endorsed Certificate 01:00 Who is this course for? Are you the right candidate for this course? Anyone interested in learning more about the topic is advised to take this course. This course will help you understand the topic thoroughly and enable you to understand the basic concepts. Enrollment in this course is open to everybody. You can access the Hydroponics Gardening course materials from anywhere in the world; there are no restrictions. You should enrol in this course if you: Wish to gain a better understanding of Hydroponics Gardening. Already working in this field and want to learn more about Hydroponics Gardening. Is a student pursuing a relevant field of study? looking for a job in the Hydroponics Gardening industry. Requirements The Hydroponics Gardening program does not require any prior knowledge; everyone may participate! This course is open to anyone interested in learning from anywhere in the world. Career path After completing the course, you will be able to serve a myriad of job prospects. Eventually, you will find a good feat in this promising area. Agricultural equipment technician Sales representatives Project manager Grower These professionals can earn about £30K-£70 yearly on average. Certificates Cademy certificate of completion Digital certificate - Included Will be downloadable when all lectures have been completed Certificate of completion Digital certificate - £10 Diploma in Hydroponics Gardening at QLS Level 5 Hard copy certificate - £119 Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Hydroponics Gardening at QLS Level 5, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with a pricing scheme of - 119 GBP inside the UK 129 GBP (including postal fees) for International Delivery Certificate Accredited by CPDQS 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (International Delivery)

Domestic Violence and Abuse Diploma

By Training Tale

Domestic violence is often neglected because it occurs behind closed doors and is a social taboo that is rarely discussed. This has to stop, and the most effective way to deal with the problem is to raise awareness, educate people, and intervene at the earliest possible stage. This Violence and Abuse Diploma course will teach you how to recognise violence and abuse, who is most vulnerable, and how to assist both adult and child victims. Understanding domestic abuse and violence is the first step toward overcoming them. This course covers the fundamentals of violence and abuse, including who is most vulnerable, the various types of domestic abuse, and how domestic violence affects women and children. Through thiscourse, you will also learn how to assist adults you suspect are victims of violence and advice on recognising the signs and approaching someone with sensitivity and confidence. Learning Outcomes After completing this course, the learner will be able to: Understand the fundamentals of violence & abuse. Understand the dynamics of violence. Gain a solid understanding of the impact of violence on victims. Know how to assess the risks of violence and abuse of Children. Know how to help children recover from domestic abuse. Know how to support the victim and report incidents. Work with victims of domestic abuse. Why Choose Violence and Abuse Awareness Diploma Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. This Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing this course. **Courses are included in this Course Course 01: Domestic Violence and Abuse Diploma Course 02: Clinical Psychology Diploma Course 03: Level 2 Certificate in Understanding Safeguarding and Prevent ***Others Included of Violence and Abuse Diploma Course Free 3 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Violence and Abuse Diploma Course: Module 1: An Overview of Domestic Violence & Abuse Define Domestic Violence Identify Who is at Risk of Domestic Violence Identify Different Types of Domestic Violence Identifying the Myths and Reality about Domestic Violence Module 2: Understanding the Dynamics of Domestic Violence Why Do Victims Stay? Understanding the Cycle of Abuse Why Victims Do Not Report Understanding the Components of Power and Control Understanding the Signs of an Abusive Relationship Module 3: How Does Domestic Abuse and Violence Begin What Causes Domestic Abuse and Violence? Indications of Abusive Behaviour Dating Abuse Module 4: The Impact of Domestic Violence on Victims Who Can Be a Victim of Domestic Violence? Understanding the Effects on Health Financial Abuse Post-Separation Understanding the Impact of Physical Abuse Understanding the Violence Against Women & Children Module 5: The Impact of Domestic Violence on Children & Young People The Impact of Domestic Abuse on Children: Key Facts Recognise the Types of Domestic Abuse Affecting Children and Young People Recognise the Indicators of Abuse in Children Understanding How Children are Affected by Domestic Violence Module 6: Assessing the Risks of Domestic Violence and Abuses on Children Understanding the Factors That May Increase the Risk Understanding the Single Assessment Process Understanding How to Assess If the Child is at Risk of Harm? Module 7: Helping Children Recover from Domestic Abuse Interventions in Domestic Abuse Involving Children Helping Children Deal with Their Experience Coping with the Violence Module 8: The Ways of Supporting the Victim and Reporting Incidents Things to Do If a Victim Discloses Understand Why Children Do Not Disclose Taking Action Supporting Friends, Family and Colleagues in Domestic Abuse Situations Why Access to Support for Domestic Abuse can be Difficult Domestic Abuse and Violence Assessment Tools Module 9: Understanding the Process of Record Keeping What to Record? How to Record? What is Confidentiality? Storage of Information Sharing of Information Module 10: Working with Victims of Domestic Abuse Violence Services Volunteer Careers for Domestic Violence Counsellors The Multi-Agency Risk Assessment Conference ------------------- ***GIFT Courses: ------------------- ***Clinical Psychology Diploma*** Module 01: An Overview of Mental Health Module 02: Different Viewpoints in Psychology Module 03: Social Psychology Module 04: Utilising Cognitive Psychology Module 05: Understanding Childhood and Adolescent Psychiatric Disorders Module 06: Understanding Stress and Anxiety Disorders Module 07: Understanding Schizophrenia Module 08: Understanding Personality Disorders Module 09: Understanding Mood Disorders Module 10: Understanding Eating & Sleeping Disorders Module 11: Understanding Self-Harm and Suicide Module 12: Treating Mental Illness: Medication and Therapy ------------------- ***Level 2 Certificate in Understanding Safeguarding and Prevent*** Module 01: Understanding the Prevent Duty Module 02: Understanding Safeguarding Module 03: Understanding Online Safety Assessment Method After completing each module of the Violence and Abuse Diploma, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? The Violence and Abuse Diploma course is ideal for anyone who works or wants to work with vulnerable people, especially if you work or volunteer in domestic violence. Requirements There are no specific requirements for this Violence and Abuse Diploma course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Domestic Violence and Abuse Diploma course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Certificates Certificate of completion Digital certificate - Included

Business Writing Complete Course

By Training Tale

You must not miss out on the four Business Writing Complete courses if you want to thrive in your workplace and stand out from the crowd. Writing is one of the four domains of language, and it is widely used in business communication in different forms. In this Business Writing Complete Course, we have combined four highly valuable courses, namely - Level 5 Proofreading & Copy Editing Level 5 Report Writing Course Level 4 Copywriting Minute Taking Business Writing Complete Course - Level 5 Proofreading & Copy Editing course will give you in-depth knowledge of proofreading and why it is necessary. It will also cover the aspects of copy editing. If you complete this course, you will be able to proofread and edit any writing at your workplace. Thus, through this Course, your area of expertise will be widened, and subsequently, your value as an employee will be increased. Business Writing Complete Course - Level 5 Report Writing Course also has various advantages. In any organisation, there are various types of reports to be written, for example, project reports, project proposals, partnership proposals etc. With this Course, you will become an expert Report Writer. Business Writing Complete Course - Level 4 Copywriting is highly trending. Copywriters are behind the catchy advertisements you see on different platforms. Imagine you are writing such copies and as a result, the sales get increased in a great number! With thisCourse, you can learn all the basics, tips and tricks of copywriting. Business Writing Complete Course - Minute Taking is also important. In any organisation, you need to attend or facilitate numerous meetings. And, in the meeting, one dedicated person needs to record the details of the meeting. Here comes minute taking. If you know how to take minutes of any meeting, you will get a competitive edge over your coworkers. Won't you love to unlock all the contents of this Business Writing Complete Course? Learning Outcomes By the end of this Business Writing Complete Course, you will be able to - Become an expert in proofreading and copy editing. Write different types of business reports. Write sales copies. Write copies of ads for different mediums, including TV, Website, Email marketing etc. Take minutes of meetings effectively. Why Choose Business Writing Complete Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF 4 certificate as soon as completing the course. Others Benefits Include Business Writing Complete Course 4 PDF Certificate Free Free Retake Exam Full Tutor Support 100% Online Course 24/7 Live Support Lifetime Access [ Business Writing Complete Course 01 ] Level 5 Proofreading & Copy Editing Module 01: An Overview of Proofreading Module 02: Use of the Style Guide Module 03: Spelling and Grammar Module 04: Paper-based Proofreading Module 05: On the Screen Proofreading Module 06: Basics of Copy Editing Module 07: Copy Editing - the Use of Language Module 08: Copy Editing - Checking Accuracy and Facts Module 09: Copy Editing - Legal Checks Module 10: Career Development [ Business Writing Complete Course 02 ] Level 5 Report Writing Course Module 01: Introduction to Report Writing Module 02: The Basics of Business Report Writing Module 03: The Practical Side of Report Writing (Part-1): Preparation & Planning Module 04: The Practical Side of Report Writing (Part-2): Collecting and Handling Information Module 05: The Practical Side of Report Writing (Part-3): Writing and Revising Report Module 06: The Creative Side of Report Writing (Part -1): A Style Guide to Good Report Writing Module 07: The Creative Side of Report Writing (Part -2): Improving the Presentation of Your Report Module 08: Developing Research Skills Module 09: Developing Creativity & Innovation Module 10: Develop Critical Thinking Skills Module 11: Interpersonal Skill Development [ Business Writing Complete Course 03 ] Level 4 Copywriting Module 1: Introduction to Copywriting Module 2: Writing to Get Attention Module 3: Writing to Communicate Module 4: Writing to Sell Module 5: Getting Ready to Write Module 6: Writing Print Advertisements Module 7: Writing Direct Mail Module 8: Writing Brochures, Catalogues, and Other Sales Materials Module 9: Writing Commercials and Multimedia Presentations Module 10: Writing for the Web Module 11: Writing Email Marketing [ Business Writing Complete Course 04 ] Minute Taking Course Module 01: Introduction to Minute Taking Module 02: The Role of a Minute Taker Module 03: Minutes Styles & Recording Information Module 04: Techniques for Preparing Minutes Module 05: Developing Active Listening Skills Module 06: Developing Organizational Skills Module 07: Developing Critical Thinking Skills Module 08: Developing Interpersonal Skills Module 09: Assertiveness and Self Confidence Module 10: Understanding Workplace Meetings Assessment Method After completing each module of Business Writing Complete Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Business Writing Complete Course is ideal for all. This course is highly valuable if you want to be a successful executive in your workplace. It is also needed for business owners, managers, supervisors, freelance writers. Requirements There is no specific requirement to enrol for this Business Writing Complete Course. However, you must have a strong desire to learn new things and apply those in your relevant field. Career path This Business Writing Complete Course will open the door for many positions! Such as - Freelance Writer Copywriter Proofreader Business Executives Executives in TV, Media Communication Executives in different organisations Certificates Certificate of completion Digital certificate - Included

Leadership and Management level 7

By Training Tale

Leadership and Management level 7 This Level 7 Leadership & Management course will help you advance your career by providing you with the most up-to-date leadership and management information. The course requires no prior knowledge or experience, as candidates are introduced to the characteristics and qualities of an effective leader. The term 'leader' refers to someone who is followed by others, while 'manager' refers to someone who has people working for them. To guide his or her team to achieve organizational goals, a successful business owner must be both an influential leader and an active manager. Whether you are a novice or a seasoned pro, this Training Tale course will help you develop the leader within you. Learn how to build and optimize a high-performing team, cultivate an engaging organizational culture, and provide constructive feedback to coworkers by enrolling in this course. This Level 7 Leadership & Management course will help you get closer to your goals if you are new to leadership or looking to advance in your current position! By the end of the Leadership & Management course, you will have a solid understanding of what makes a great leader and how to put the strategies you have learned into practice to advance your career. Enrol in this Course to learn how to improve your leadership and management skills. Learning Outcomes After completing this Leadership and Management Course you will be able to: Become a successful leader. Distinguish between management and leadership and their impact. Encourage and reward workers who increase their production. Improve your professional communication skills. Examine various approaches, causes, and tactics that can help you advance your leadership skills and capabilities. Define the terms 'delegation' and 'leading by example.' Improve your team-building abilities. Give and receive positive reviews. Improve interviewing skills for effective employee recruitment. Why Choose Leadership and Management level 7 Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Leadership and Management level 7*** Course 01: Leadership and Management level 7 Course 02: Anger Management Course 03: Level 3 Business Administration ***Other Benefits of this Course Free 3 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] ***Leadership and Management level 7*** ***Course Curriculum*** Module 1: Understanding Management and Leadership Introduction Defining Leadership Leadership Styles Role of a Leader Managers Vs. Leaders Ethics Summary Module 2: Leadership over Yourself Understand what Self-leadership is Time Management Set Goals Decision Making and Problem Solving Summary Module 3: Creativity and Innovation Introduction Creativity Innovation Organisation and Innovation Summary Module 4: Leadership and Teambuilding What a Leader Must Do? Functions of Leadership Leadership Exists at Different Levels Leadership Skills Team Building Summary Module 5: Motivation and People Management Introduction Theories on Motivation Managers/Leaders and Motivation Getting Best from the People Summary Module 6: Communication and Leadership Introduction Listening Skills Reading Skills Writing Skills Speaking Skills Summary Module 7: Presentation, One-to-one Interview and Meeting Management Profile the Occasion, Audience and Location Plan and Write the Presentation One-to-One Interview Meeting Management Within Your Organisation Summary Module 8: Talent Management Define Talent and Talent Management Understand the Benefits of Talent Management Talent Management Types Talent Gap Talent Management Methodology Summary Module 9: Strategic Leadership The Function of a Strategic Leader Strategic Management Process Mission and Strategic Leadership Vision and Strategic Leadership The Importance of Practical Wisdom Summary Module 10: Stress Management Introduction Defining Stress Practice the 4 A's of Stress Management Maintain Balance with a Healthy Lifestyle Manage Your Time Better Make Time for Fun and Relaxation Summary ---------------------------- **GIFT courses: ---------------------------- ***Anger Management Module 01: Introduction to Anger Module 02: The Process in Anger Module 03: Effect of Anger on Our Thinking Module 04: How to Manage Anger ---------------------------- ***Level 3 Business Administration Module 01: Introduction to Business Administration Module 02: Principle of Business Module 03: Principles of Business Communication Module 04: Principles of Administration Module 05: Understand How to Improve Business Performance Module 06: Understand Equality, Diversity and Inclusion in the Workplace Module 07: Principles of Leadership and Management Assessment Method After you have finished the Leadership and Management level 7 Course, you will need to take an electronic multiple-choice exam or Assignment to see if you have grasped everything. To pass the exam and be eligible for the pending certificates, you must achieve at least 60%. As soon as you pass the examination, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Leadership and Management level 7 This Leadership and Management Course is for anyone serious about their professional development. This Course is designed primarily for group leaders, managers at all levels, and business professionals. Students and recent graduates who want to improve their resumes and gain experience are also welcome to enrol in this Leadership and Management Course. Requirements Leadership and Management level 7 There are no specific requirements for this Leadership and Management Course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Certificates Certificate of completion Digital certificate - Included

Support Worker :Mental Health Support Worker

By Training Tale

This Mental Health Support Worker is designed to help students understand the skills required to work with people who have mental health conditions. The course will introduce the topic of mental health before looking deeper into the types, meanings, treatments, and support available for service users and support workers. Our Mental Health Support Worker course is broken down into 13 easy-to-digest, in-depth modules that will equip you with a detailed, expert level of knowledge. By the end of this course, you will have a clear understanding of the importance of mental healthcare teams working in the community, as well as how to provide treatment for those diagnosed with a range of mental health conditions. The Mental Health Support Worker is designed to boost your employability and provide you with the necessary skills to succeed at the highest level. Enroll today and start learning! Learning Outcomes After completing this Mental Health Support Worker course, the learner will be able to: Understand the fundamentals of mental health. Understand the duties & responsibilities of a mental health support worker. Gain a thorough understanding of attention deficit hyperactivity disorder (ADHD). Identify various types of mental disorders. Explain the use of medication and therapy in the treatment of mental illness. Understand the mental health legislation and services. Gain in-depth knowledge about the Mental Health System. Why Choose Mental Health Support Worker Course from Us Self-paced course, access available from anywhere. Mental Health Support Worker Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the Mental Health Support Worker course. Our Mental Health Support Worker course is broken down into 13 easy-to-digest, in-depth modules that will equip you with a detailed, expert level of knowledge. This Mental Health Support Worker training course will prepare you to make a difference in the mental health and well-being of children and adults. By the end of this course, you will have a clear understanding of the importance of mental healthcare teams working in the community, as well as how to provide treatment for those diagnosed with a range of mental health conditions. ***Others Benefits of this Mental Health Support Worker Course: Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course] Detailed Course Curriculum of this Mental Health Support Worker Course: Module 1: An Overview of Mental Health Define Mental Health Aspects of Good Mental Health Define Mental Illness Module 2: Mental Health Support Worker Who is a Mental Health Support Worker? Understanding the Duties & Responsibilities of a Mental Health Support Worker Identifying the Qualities of a Great Support Worker Module 3: Understanding Childhood and Adolescent Psychiatric Disorders Understanding Attention Deficit Hyperactivity Disorder (ADHD) Understanding Autism spectrum Disorder (ASD) Understanding Conduct Disorder Module 4: Understanding Stress and Anxiety Disorders What is Anxiety? What is Acute Stress Disorder? What is Generalized Anxiety Disorder (GAD)? What is panic disorder? Module 5: Understanding Schizophrenia Understanding Schizophrenia Disorder Understanding Hallucinations What is Delusion? Module 6: Understanding Personality Disorders Understanding Personality and Personality Disorders What is antisocial personality disorder? What is Avoidant Personality Disorder? Module 7: Understanding Mood Disorders What is Mood Disorder? What is Depression? What is bipolar disorder? What is Major Depressive Disorder (MDD)? Module 8: Understanding Eating & Sleeping Disorders What is eating disorder? Define Anorexia Nervosa Disorder Define Bulimia Nervosa Disorder Define Binge-eating disorder Define Sleep Disorders What is Breathing-Related Sleep Disorder? What is Circadian Rhythm Sleep Disorder? What is Narcolepsy Disorder? What is Primary Hypersomnia Disorder? What is Insomnia Disorder? What is Sleep Paralysis? Module 9: Understanding Self-Harm and Suicide Define Self-Harm What is the Self-Harm Cycle? Cause and ways of Self-Harm Support Services and Treatments What is Self-Care? Understanding Suicide Risk Factors Suicide Prevention Module 10: Treating Mental Illness with Medication and Therapy What is Psychiatric Medication? Understanding the Talking Therapy and Counselling Understanding Cognitive Behavioural Therapy (CBT) Module 11: Laws Related to Mental Health Understanding the Mental Health Act Understanding the Advice for Carers and Families Responsible People for Deciding Who should be Detained Module 12: Mental Health System What is the Mental Health System? Mental Health Teams Who Makes up a Mental Health Team? Referral to Mental Health Team Module 13: The Participation of the Service User Define Service User Service User Involvement What are the Advantages of Service User Involvement Assessment Method After completing each module of the Mental Health Support Worker, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Mental Health Support Worker course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Mental Health Support Worker course is ideal for professionals helping people suffering from mental issues and people interested in personal mental development. Requirements There are no specific requirements for Mental Health Support Worker course because it does not require any advanced knowledge or skills. Career path This course will open up new career opportunities for you, some of which are stated below: Mental Health Nurse (Average Annual Salary in the UK: £24,907 to £44,503) Psychological Wellbeing Practitioner (Average Annual Salary in the UK: £24,907 to £44,503) Health Promotion Specialist (Average Annual Salary in the UK: £21,892 to £37,890) Certificates Certificate of completion Digital certificate - Included

Safeguarding in Adult Health and Social Care

By Training Tale

This Safeguarding in Adult Health and Social Care course is designed for individuals who work or intend to work with vulnerable adults in the health and social care sectors in various settings, such as hospitals, domiciliary care, or nursing homes. This Safeguarding in Adult Health and Social Care qualification aims to provide learners with knowledge and understanding of the key principles of dignity, the duty of care, and safeguarding as applied to adult health social care. Through this Safeguarding in Adult Health and Social Care course, learners will understand the principles and how they are applied in everyday work situations. They will also have an opportunity to examine the dilemmas that can arise and the consequences of not adhering to these principles. Learning Outcomes After completing thiscourse, the learner will be able to: Gain a thorough understanding of safeguarding in adult health and social care. Understand the principles of dignity in adult health and social care practice. Gain a solid understanding of the Duty of Care in Adult Health and Social Care. Gain a thorough understanding of dilemmas encountered in adult health and social care. Understand the issues of public concern in adult health and social care. Why Choose this Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing this course. ***Courses are included in this Bundle Course Course 01: Safeguarding in Adult Health and Social Care Course 02: Mental Health Support Worker Course 03: Level 5 Mental Health Care - MCA and DOLS ***Other Benefits of Safeguarding in Adult Health and Social Care Bundle Course Free 3 PDF Certificate Lifetime Access Free Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Safeguarding in Adult Health and Social Care*** Detailed course curriculum Module 1: Understand Safeguarding in Adult Health and Social Care Understand the national and local context of safeguarding and protection from abuse Know how to recognise potential and actual abuse and harm Know how to respond if abuse or harm is disclosed, suspected or alleged Understand ways to reduce the likelihood of abuse or harm Know about information and support in relation to abuse or harm Module 2: Principles of Dignity in Adult Health and Social Care Practice Understand the principles of dignity in adult health and social care Understand the potential impact on individuals when accessing and using health and social care services Understand how to apply the principles of dignity in adult health and social care Understand how person centred approaches contribute to dignity in adult health and social care Understand the role of the health and social care worker in relation to promoting dignity Understand the importance of professional relationships for dignity and service provision Module 3: Understand Duty of Care in Adult Health and Social Care Understand what is meant by 'duty of care' Know about dilemmas and conflicts relating to duty of care Know how to recognise and report unsafe practices Understand the impact of own actions on individuals and others Understand the importance of consent in health and social care practice Module 4: Understand Dilemmas and Public Concerns in Adult Health and Social Care Understand dilemmas that may be encountered in adult health and social care Know about issues of public concern in adult health and social care ------------------------- ***Other Courses: ------------------------- ***Mental Health Support Worker*** Module 01: An Overview of Mental Health Module 02: Mental Health Support Worker Module 03: Understanding Childhood and Adolescent Psychiatric Disorders Module 04: Understanding Stress and Anxiety Disorders Module 05: Understanding Schizophrenia Module 06: Understanding Personality Disorders Module 07: Understanding Mood Disorders Module 08: Understanding Eating & Sleeping Disorders Module 09: Understanding Self-Harm and Suicide Module 10: Treating Mental Illness with Medication and Therapy Module 11: Laws Related to Mental Health Module 12: Mental Health System Module 13: The Participation of the Service User ------------------------- ***Level 5 Mental Health Care - MCA and DOLS*** Module 01: An Overview of Mental Capacity Act Module 02: Assessing Mental Capacity Module 03: How to make Best Interest Decision Module 04: Mental Capacity Advocates and Forward Planning Module 05: Treatment Protocols for People Who Lack Capacity Module 06: Confidentiality and Record Keeping Module 07: Public Bodies and Services Created by MCA Act 2005 Module 08: Interface with Legislation, Policy and Procedures Module 09: Deprivation of Liberty Safeguards Module 10: Lawful Deprivation Module 11: Legal Background to DOLS Module 12: The Mental Capacity Act (2005) and Deprivation of Liberty Safeguards During a Pandemic Module 13: Liberty Protection Safeguards (LPS) ------------------------- Assessment Method After completing each module of the Safeguarding in Adult Health and Social Care, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Safeguarding in Adult Health and Social Care course is ideal for those who work with or intend to work with vulnerable adults in the health and social care sectors. Requirements There are no specific requirements for this Safeguarding in Adult Health and Social Care course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Certificates Certificate of completion Digital certificate - Included

Negotiation Skills - Level 5

By Training Tale

'Are you looking to start a career in negotiation or enhance your existing negotiation skills? Then this Negotiation Skills - Level 5 will provide you with a solid foundation to become a confident negotiator and help you develop your skills. Negotiation skills can be useful throughout one's life. It is about influencing outcomes in a way that maximizes your benefit or value. In sales, negotiation works toward closing the deal in a mutually satisfactory manner. Those who master the art of negotiation can convince the opposite party that they have got the best deal possible. When, in reality, it is the seller or the business that has come out on top. This exclusive course is designed to assist candidates in taking the most important step in their lifelong career journey. Taking on a leadership role for the first time can be both exciting and intimidating. Taking charge of a team or business of any size essentially takes on much more responsibility and accountability. This course will help candidates deal with the different challenges of entry-level leadership roles in an organization. Candidates who complete the course will have the skills, knowledge, and confidence to take on a leadership role for the first time. Learning Outcomes After completing this Negotiation Skills - Level 5 course, the learner will be able to: Gain a thorough understanding of the true value of leadership. Know how management and leadership are different yet equally important. Understand the relationship between employee motivation and performance. Master professional-level communication skills. Understand the characteristics and qualities of effective negotiation skills. Understand feedback gathering and effective employee interview skills. Know the difference between delegation and leading by example. Know the techniques for developing a high-performance team. Gain the confidence to step into a leadership role. Why Choose this Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Negotiation Skills - Level 5 Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the Negotiation Skills - Level 5 course. ******Courses are included in this Negotiation Skills - Level 5 Course: Course 01: Level 1 Business Management Course 02: Level 3 Business Administration ******Others included in this Negotiation Skills - Level 5 course: Free 3 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] Detailed course curriculum of the Negotiation Skills - Level 5 Course: Module 1: An Overview of Negotiation Defining Negotiation Different Types of Negotiation What is Positional Bargaining? What is Principled Negotiation? Module 2: How to Prepare For Negotiations How to Manage Your Fear Personal Preparation Establishing Your WATNA and BATNA Identify your WAP Identifying Your ZOPA Module 3: The Process of Negotiation Preparation and Planning Clarification and Justification How to Exchange Information The Bargaining Stage Conclude and Implement Module 4: Ways of Developing Persuasion & Influencing Skills Different Steps in the Persuasion Process Influencing Skills Module 5: Ways of Developing Communication Skills Ways of Asking Questions Understanding and Using Probing What are the Listening Skills? Interpretation Module 6: How to Develop Active Listening Skills Fundamentals of Active Listening Communication Process Explained Module 7: Comprehending Body Language Comprehending Body Language Comprehending Facial Expressions Module 8: Assertiveness and Self Confidence What is Self-Esteem? Symptoms of Low Self-Esteem and the Root Causes of It How to Improve Self-Esteem How to Build Self-Esteem Module 9: Managing Anger What is Anger? Managing Anger and its Dimensions The Costs of Anger The Anger Process and How It Affects Our Thinking Module 10: Managing Stress How to Define and Identify Stress Manage Stress Module 11: Negotiation Tactics to Closing a Better Deal Develop Clear Outcomes Treat The Other Party With Respect At All Times Ask a Lot of Questions Ask For What You Want Ask or Offer Something of Relative Value, Including Intangibles Don't Be the First to Offer to 'Split the Difference' Close with Confidence and Clarity Module 12: Ways of Overcoming Sales Objections How to Overcome Sales Objections? Building Credibility Observation Skills ---------------- ***Level 1 Business Management*** Course Curriculum: Module 01: Management and Leadership Explained Module 02: How to Manage Resources Module 03: Effective Management of Time, Stress and Crises ---------------- ***Level 3 Business Administration*** Course Curriculum: Module 01: Introduction to Business Administration Module 02: Principle of Business Module 03: Principles of Business Communication Module 04: Principles of Administration Module 05: Understand How to Improve Business Performance Module 06: Understand Equality, Diversity and Inclusion in the Workplace Module 07: Principles of Leadership and Management ---------------- Assessment Method After completing each module of the Negotiation Skills - Level 5, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Negotiation Skills - Level 5 course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This course is suitable for candidates committed to their ongoing professional development. This Negotiation Skills - Level 5 could prove instrumental in taking that important step into a leadership position for the first time. Existing managers and business owners could also find the teachings of this course invaluable. Requirements There are no specific requirements for this Negotiation Skills - Level 5 course because it does not require any advanced knowledge or skills. Career path This qualification could hold the key to the leadership career of your dreams. Typical job titles in management and leadership include: Team Leader Manager Controller Certificates Certificate of completion Digital certificate - Included

Search By Location

- Industry Courses in London

- Industry Courses in Birmingham

- Industry Courses in Glasgow

- Industry Courses in Liverpool

- Industry Courses in Bristol

- Industry Courses in Manchester

- Industry Courses in Sheffield

- Industry Courses in Leeds

- Industry Courses in Edinburgh

- Industry Courses in Leicester

- Industry Courses in Coventry

- Industry Courses in Bradford

- Industry Courses in Cardiff

- Industry Courses in Belfast

- Industry Courses in Nottingham