- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

CE533: Comparing Battery Technologies

By Solar Energy International (SEI)

In this class, we'll review basic PV system types that use battery storage, the various use cases, and we'll take an in-depth look at what metrics are used to compare technologies. We'll discuss features of the most common battery chemistries currently used with PV systems and compare them. We'll look at how battery chemistry impacts battery bank sizing by reviewing a couple of design examples. Finally, we'll use a design example as the basis for a cost comparison of different battery technologies looking at both upfront and life cycle costs.

CE529: Hazards of Electrochemical Energy Storage in Solar + Storage Applications

By Solar Energy International (SEI)

Common chemistries, including lead acid, lithium ion, and nickel iron, each have different installation, maintenance, storage, and transportation requirements that can lead to fatal consequences if not conducted properly. This 8-hr online course, produced under an OSHA Susan Harwood Training Grant, provides training on the hazards associated with each energy storage technology and the control measures to eliminate or mitigate those hazards. This training includes five lessons for a total of 4 contact training hours. Lessons includes presentations, field videos, interactive exercises, and quizzes. Lesson content includes Lesson 1: Introduction to the Course and OSHA requirements Lesson 2: Energy Storage Technologies- Energy storage basics, lead-acid energy storage systems, lithium-ion energy storage, other types of electrochemical energy storage systems Lesson 3: Energy Storage Safety Regulations- OSHA safety regulations, NFPA 70 (the National Electrical Code) and NFPA 70E (Standard for Electrical Safety in the Workplace) NFPA 855 (Installation of Stationary Energy Storage Systems), the International Residential Code (IRC) and the International Fire Code (IFC) Lesson 4: Electrical Hazards- Electrical shock hazards, electrical arc flash hazards, electrical PPE, electrical connection hazards Lesson 5: Other Hazards- Chemical hazards, fire hazards, gas hazards, physical hazards, storage and transportation hazards, temperature effects on batteries, working space and clean installations

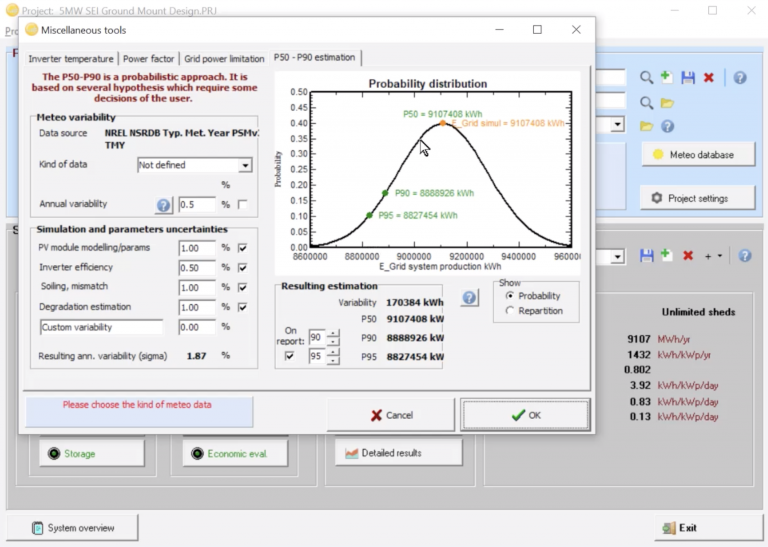

CE524: PVsyst for PV System Production Modeling

By Solar Energy International (SEI)

This short course is targeted towards beginning users, and will show you in detail how to get started creating accurate production estimates for any size PV system, from residential to large-scale. Learn how to find and import the correct meteorological data, create system variants for any size system, and accurately define the orientation, shading scene, and detailed system losses. By the end of this course you will be confidently simulating production and printing reports to share.

CE527: Thermography and Drones in PV Applications

By Solar Energy International (SEI)

Thermal inspections of PV arrays specifically can safely provide fast and accurate information regarding system health. We will present the fundamental theories and considerations for proper thermal camera use including the various applications in solar operations and maintenance (O&M) and how to read test images. We will also review several IR cameras that are commercially available and commonly used in PV inspections. Drones are another tool whose use in PV installation and inspection has increased in recent years. We will discuss the fundamentals of drones and discuss considerations when selecting a drone for commercial use. Drones can be used in a variety of applications: to obtain site information pre-sale; site or system mapping; during and after installation to determine progress; and finally to perform aerial thermographic inspections. Examples of the latter will be looked at and assessed in this course. We will introduce licensure requirements as well as common models of drones - and price points - that are commercially available which can be used in PV applications.

Are you looking to improve your current abilities or make a career move? Our unique Insurance Broker course might help you get there! Expand your expertise with high-quality training - study the Insurance Broker course and get an expertly designed, great-value training experience. Learn from industry professionals and quickly equip yourself with the specific knowledge and skills you need to excel in your chosen career through the Insurance Broker online training course. The Insurance Broker course is broken down into several in-depth modules to provide you with the most convenient and rich learning experience possible. Upon successful completion of the Insurance Broker course, an instant e-certificate will be exhibited in your profile that you can order as proof of your Insurance skills and knowledge. Add these amazing new Insurance skills to your resume and boost your employability by simply enrolling in this Insurance course. This Insurance Broker training can help you to accomplish your ambitions and prepare you for a meaningful career in Insurance industry. So, join us today and gear up for excellence! Why Prefer Us? Opportunity to earn a certificate accredited by CPDQS. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and Engaging Content on Insurance. Free Assessments with Insurance 24/7 Tutor Support. The Insurance Broker Training course has been designed by experts, to create a rich and in-depth training experience for all the students who enrol on it. Enrol on the Insurance Broker Training course now and get instant access to all Insurance Broker Training course materials. Then, enjoy the Insurance Broker Training course materials online from any internet-enabled device and learn when it suits you. Start your learning journey with this Insurance Broker Training course straight away and take a step forward in securing a better future! Show off Your New Skills With a Certificate of Completion The learners have to successfully complete this Insurance Broker Training course to achieve the CPDQS accredited certificate. Digital certificates can be ordered for only £10. The learner can purchase printed hard copies inside the UK for £29, and international students can purchase printed hard copies for £39. CPD 15 CPD hours / points Accredited by CPD Quality Standards Module 1: An Overview of the UK Insurance Industry 17:09 1: Module 1: An Overview of the UK Insurance Industry Preview 17:09 Module 2: Principles of Insurance 13:03 2: Module 2: Principles of Insurance 13:03 Module 3: Types of Insurance 16:45 3: Module 3: Types of Insurance 16:45 Module 4: Career in the Insurance Industry 06:05 4: Module 4: Career in the Insurance Industry 06:05 Module 5: Skills of an Insurance Agent 08:24 5: Module 5: Skills of an Insurance Agent 08:24 Module 6: Business Insurance 11:35 6: Module 6: Business Insurance 11:35 Module 7: Risk Management in Insurance 08:43 7: Module 7: Risk Management in Insurance 08:43 Module 8: Underwriting Process 06:36 8: Module 8: Underwriting Process 06:36 Module 9: Insurance Claims Handling Process 09:28 9: Module 9: Insurance Claims Handling Process 09:28 Module 10: Fraud Finding in Insurance 12:57 10: Module 10: Fraud Finding in Insurance 12:57 Module 11: Code of Ethics and Conduct 10:18 11: Module 11: Code of Ethics and Conduct 10:18 Order Your Certificate 02:00 12: Order Your CPD Certificate 01:00 13: Order Your QLS Endorsed Certificate 01:00 Who is this course for? Anyone interested in learning more about the topic is advised to take this Insurance Broker course. This course is open to everybody. Requirements You will not need any prior background or expertise to enrol in this Insurance course. Career path After completing this course, you are to start your career or begin the next phase of your career. Certificates Cademy certificate of completion Digital certificate - Included Will be downloadable when all lectures have been completed

Overview This comprehensive course on Insurance Agent Training will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Insurance Agent Training comes with accredited certification, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Insurance Agent Training. It is available to all students, of all academic backgrounds. Requirements Our Insurance Agent Training is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 2 sections • 12 lectures • 03:10:00 total length •Module 01: An Overview of the UK Insurance Industry: 00:28:00 •Module 02: Principles of Insurance: 00:19:00 •Module 03: Types of Insurance: 00:28:00 •Module 04: Career in the Insurance Industry: 00:10:00 •Module 05: Skills of an Insurance Agent: 00:15:00 •Module 06: Business Insurance: 00:17:00 •Module 07: Risk Management in Insurance: 00:13:00 •Module 08: Underwriting Process: 00:11:00 •Module 09: Insurance Claims Handling Process: 00:17:00 •Module 10: Fraud Finding in Insurance: 00:17:00 •Module 11: Code of Ethics and Conduct: 00:15:00 •Assignment - Insurance Agent Training: 00:00:00

Financial advisor, Fraud detection & Capital Budgeting

By Training Tale

Financial Advisor : Financial Advisor Training Discover Your Path to Success as a Financial Advisor with Our Comprehensive Course Are you ready to embark on a rewarding and lucrative career as a financial advisor? Look no further! Our comprehensive Financial Advisor Course is designed to equip you with the knowledge, skills, and confidence to excel in the dynamic world of financial planning. Why Choose Our Financial Advisor Course? Expert-Led Curriculum: Our course is crafted by seasoned financial advisors with extensive industry experience. You'll learn from professionals who have successfully navigated the complexities of the financial advisory field, gaining insights and strategies that are tried and tested. Comprehensive Skill Development: We cover a wide range of essential topics, including investment planning, retirement strategies, risk management, tax planning, and more. Our curriculum is designed to provide you with a holistic understanding of financial advisory principles, ensuring you're well-prepared to meet the diverse needs of your clients. Practical Learning Opportunities: Theory alone is not enough. Our financial advisor course incorporates practical exercises, case studies, and simulations to enhance your real-world problem-solving abilities. You'll develop hands-on skills, analyze complex financial scenarios, and create tailored solutions that align with your clients' goals. Industry-Recognized Certification: Upon completion of the course, you'll receive a prestigious certification that carries weight in the industry. This financial advisor credential will not only validate your expertise but also open doors to career opportunities with established financial firms, banks, or as an independent advisor. Networking Opportunities: Our financial advisor course provides a platform to connect with fellow aspiring advisors and established professionals. Networking events, industry guest speakers, and online forums offer opportunities to build relationships, gain mentors, and expand your professional network. Don't miss out on the chance to launch your successful career as a financial advisor. Enroll in our Financial Advisor Course today and unlock your potential in the world of finance. Take the first step towards a fulfilling and prosperous future. Invest in yourself and seize the opportunity to make a meaningful difference in people's lives as a trusted financial advisor. Enroll now and let our course be your stepping stone to a successful and rewarding career. Financial : Financial Advisor Training Industry Experts Designed this Financial Advisor course into 05 detailed modules. Assessment Method of financial advisor After completing each module of the Financial Advisor course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of financial advisor After completing the MCQ/Assignment assessment for this Financial Advisor course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. Who is this course for? Financial Advisor : Financial Advisor Training The Financial Advisor course is ideal for those already working in this field or are interested in becoming one. This Financial Advisor course is designed to broaden your knowledge and boost your CV. Requirements Financial : Financial Advisor Training There are no specific requirements for this Financial Advisor course because it does not require any advanced knowledge or skills. Career path Financial : Financial Advisor Training

Hydrogen for Road Transport

By Cenex (Centre of Excellence for Low Carbon & Fuel Cell Technologies)

Join us for a micro-learning course in hydrogen for transport and learn about this potentially game-changing technology which brings the world a step closer to achieving net-zero emissions. Part of our Net Zero Transport Fundamentals Collection, where we look to provide bite-sized training on all the core technologies and topics relating to decarbonising the transport industry.

Construction Management, Architectural Studies & Cost Estimation -QLS Endorsed Diploma

4.7(47)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Construction Management, Architectural Studies & Cost Estimation -QLS Endorsed Diploma Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Elevate your understanding of the built environment with our enriching bundle of courses on "Construction Management, Architectural Studies & Cost Estimation." Immerse yourself in three QLS-endorsed courses designed to provide an intricate understanding of Construction Management, Architectural Studies, and Construction Cost Estimation. Upon successful completion, you will receive hardcopy certificates as an acknowledgment of your mastery. Our "Construction Management, Architectural Studies & Cost Estimation" bundle brings together a suite of topics to fortify your knowledge and prepare you for the challenges of the construction industry. Key Features of the Construction Management, Architectural Studies & Cost Estimation Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Construction Management, Architectural Studies & Cost Estimation bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Construction Management QLS Course 02: Architectural Studies QLS Course 03: Construction Cost Estimation Diploma 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Construction Site ManagementCourse 02: Construction Industry Scheme (CIS)Course 03: Construction Cost Estimation DiplomaCourse 04: Construction SafetyCourse 05: LEED V4.1 - Building Design and Construction In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV WritingCourse 02: Job Search SkillsCourse 03: Self Esteem & Confidence BuildingCourse 04: Professional Diploma in Stress ManagementCourse 05: Complete Communication Skills Master Class Convenient Online Learning: Our Construction Management, Architectural Studies & Cost Estimation courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: Understand the nuances of Construction Management. Develop an appreciation for Architectural Studies. Gain proficiency in Construction Cost Estimation. Acquire knowledge of Construction Site Management. Learn about the Construction Industry Scheme (CIS). Understand principles of Construction Safety. Comprehend LEED V4.1 - Building Design and Construction. Step into the vast world of construction and architecture with our carefully curated bundle. The courses introduce you to the multifaceted sphere of Construction Management, and the aesthetic and functional dimensions of Architectural Studies. The Construction Cost Estimation Diploma will enable you to gain insights into the economic aspects of construction projects. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in Construction Management, Architectural Studies, and Cost Estimation. Aspiring architects and project managers. Individuals interested in sustainable building practices and safety protocols. Career path Architect - average salary in the UK: £27,000 - £45,000 Cost Estimator - average salary in the UK: £35,000 -£55,000 LEED Accredited Professional - average salary in the UK: £30,000 -£50,000 Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included