- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2650 Courses in Penarth

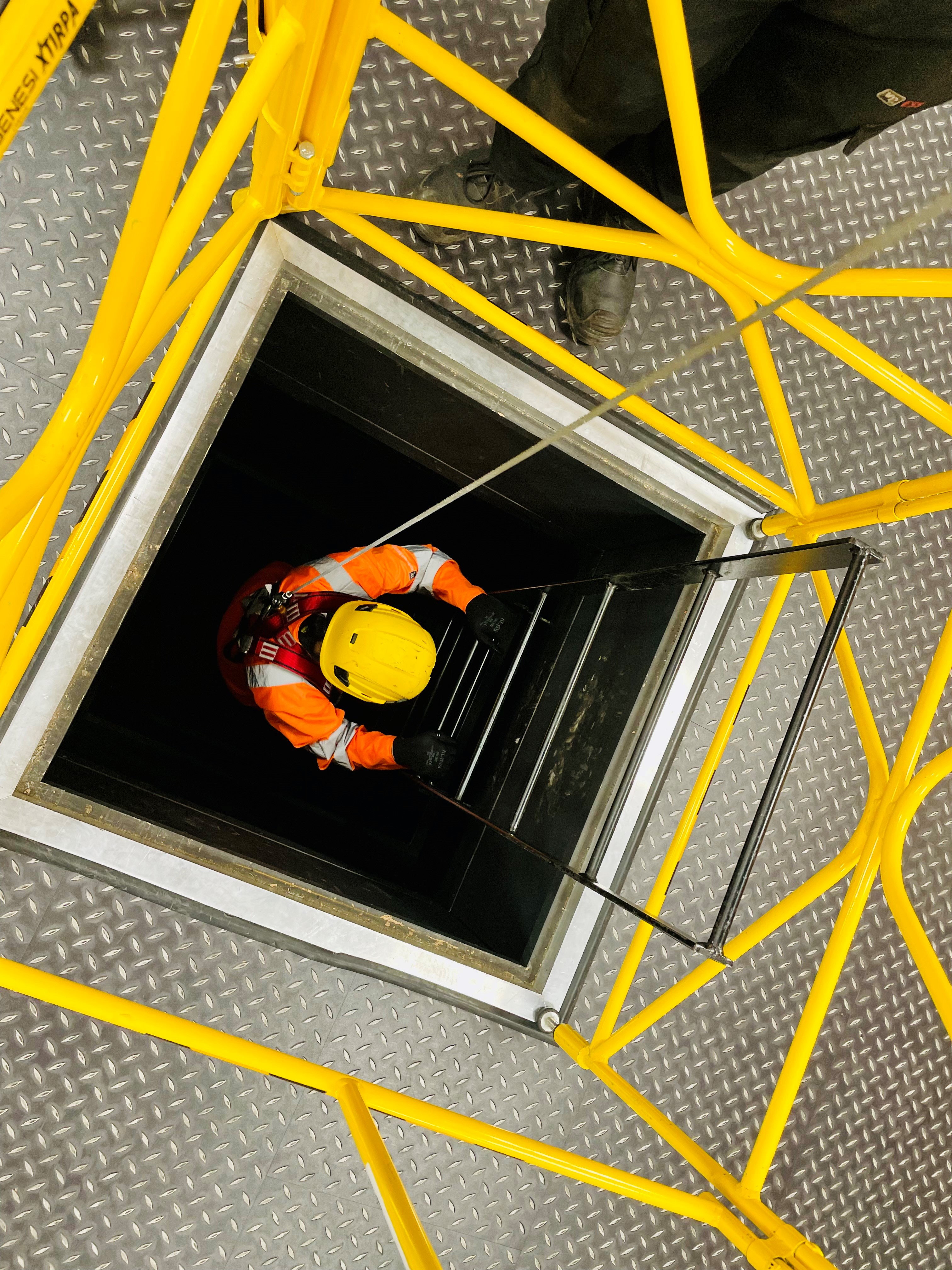

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07

By Vp ESS Training

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07 - This course is designed to introduce delegates to the basics of rescue and recovery of casualties from confined spaces. Understanding emergency arrangements as set by legislation and employers, some of the equipment required to rescue a casualty and safety of the rescue team. Note: A pre-requisite qualification is required to complete this course. Delegates must hold a valid 6160-08 qualification. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-07-level-3-award-in-direct-emergency-rescue-and-recovery-of-casualties-from-cs/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Breathing Apparatus Awareness Training

By Vp ESS Training

The aim of this course is to give delegates who have to use full working breathing apparatus during their working activities a greater understanding of correct operational procedures. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Safe Use of Hand Held Power Tools

By Vp ESS Training

This ESS course is suitable for operatives who during the daily activities have to use power tools. By the end of the course delegates will have an understanding of the correct operational procedures of power tools. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Gas Monitor Awareness

By Vp ESS Training

This ESS course is suitable for operatives who during the daily activities have to use gas monitors By the end of the course delegates will have an understanding of the correct operational procedures of gas monitors. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

CCNSG Safety Passport National

By Vp ESS Training

The aim of the CCNSG Safety Passport is to ensure a basic knowledge of health and safety for all site personnel to enable them, after appropriate site induction, to work on site more safely with lower risk to themselves and others. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346 or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Manual Handling Awareness

By Vp ESS Training

This course is aimed at anyone who has to undertake manual handling duties as part of their work routine, and will give the delegates a basic understanding of the correct manual handling techniques when moving, handling and lifting of loads. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Asbestos awareness

By Vp ESS Training

This course is aimed at anybody who may accidentally encounter asbestos containing materials as part of their job role within maintenance, building and demolition industries. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Abrasive wheels

By Vp ESS Training

This course is designed to provide delegates that need to use abrasive wheels with an in-depth understanding of the requirements of the law, associated regulations and safe working practices when using abrasive wheels. Book via our website @ ESS | Training Courses | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Safe Use of Ladders and Stepladders

By Vp ESS Training

This ESS course is suitable for operatives who during the daily activities have to use Ladders. It will give the delegate an understanding of the safe use and inspection as well as awareness of the regulations. Book via our website @ ESS | Working at Heights training | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham