- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2565 Courses in Newark-on-Trent

Overview There are many companies that have designed a creative environment for their employees to help them relax and spark creative thinking to enhance the performance of the people working in the organisation. The creative way help boost the mind of the employees and thereby generate a positive attitude. This course will help organizations to do regular brainstorming sessions when working on a project to allow employees to contribute and build on a project. This will create an immense engagement as their team members are involved in the creative process.

Overview This course will define the scope of work, project goal, project plan, project phase, sequencing and phase relationship Project Planning & Budgeting will provide participants with a demonstrated set of methods, processes, tools and techniques to cultivate a systematic and dynamic project plan to certify progressive monitoring control and reporting of the project cost.

Overview Tendering is a process on which a lot of money relies. When a tender is issued and published, winning that contract is completely depended on how deeply you understand the tender, the key areas of the tender along with how much in-depth knowledge you have about the potential client's need and how you can provide your service to those needs.

Overview This course can offer you a transparent understanding of the credit management method and increase your confidence when handling credit management matters. This course will equip delegates with a range of enhanced communication skills to enable them to effectively collect debt by phone. These skills can be used to make sure that they are not only more effective at collecting money from customers but also maintain positive working relationships.

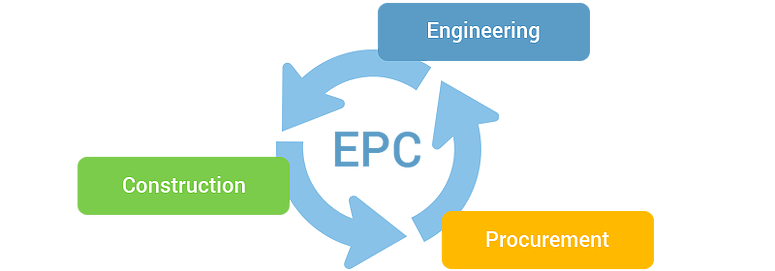

Overview EPC (Engineering, Procurement and Construction) is a very challenging area and is very competitive as well. Companies dealing with large and complex EPC projects are more often get involved in mitigation by complex contract laws and management that lead to huge financial losses. It is very important to Know-how EPC contract laws, and their commercial and financial aspects to gain skills and the ability to deal with complex contract laws and reduces the risk.

Overview Effective way of introducing automation to your project Selecting the best and right automation tool Analysing which test cases need to be automated Effective way of planning, designing and development Benefits of Automation Testing Developing scripts effectively Effectively executing and maintaining test scripts Best practices required to follow for successful automation testing Methods of using the tools to control the execution of the tests Comparing the expected outcomes with the actual outcomes Analysing regression test cases and Load testing scenarios Automating difficult tasks and repetitive tasks How to run scripts quickly and repeatedly

Overview This course will give you a whole tour of how to enhance your skills as a UI/UX Design using Adobe. It is very important to master the basics of web and visual design because that is important for UI design eg designing buttons, typography, drop shadow etc. With having a good foundation in visual and web design become an essential key to become a skilled UI/UX Designer.

Overview This will include lectures, a detailed simulation exercise, and group discussions. Delegates will recognize the elements where their organizations may have the skills and resources to manage a crisis, but the course will help identify where specialist external support may also be required. The course is designed to provide a balanced view of how best to manage specific crisis issues while simultaneously minimizing any negative impact on ongoing business operations. Delegates will develop a list of subjects to address upon returning to their sponsoring organization

Overview EDRMS Electronic Document and Record Management System is basically a kind of IT-based system which is developed to manage the creation, tracking, storage and disposal of all physical and digital documents and records. Through this, we can easily keep track of various documents modified by different users. With the access of one application, many different tasks can be completed that revolve around document management. It enhances the security system where we can easily define whom to have access to what part of the documents. EDRMS is known by many other different names like Enterprise content management systems or digital asset management, document mapping and so on. This course shows participants how to deal with documents in an electronic way to get rid of the paper's hard copy which takes a lot of space and time. It will also update you with the EDRMS system and changes that happen to take place with the passage of time. The advanced technology leads to Advance EDRMS systems with enhanced features.

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham