- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

504 Courses in London

Contract management for practitioners (In-House)

By The In House Training Company

This two-day programme gives the key insights and understanding of contracting principles and the impact they have on business and operations. The course is designed for individuals involved in or supporting contracting who want to improve their commercial management skills; individuals in functions such as project management, business development, finance, operations who need practical training in commercial management; general audiences wanting to gain a basic understanding of commercial management. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Associate (CCMA) qualification. The programme addresses 31 different subject areas, across the five stages of the contracting process. By the end of the course the participants will be able, among other things, to: Develop robust contract plans, including scope of work and award strategies Conduct effective contracting activities, including ITT, RFP, negotiated outcomes Negotiate effectively with key stakeholders, making use of the key skills of persuading and influencing and to work with stakeholders to improve outcomes Set up and maintain contract management systems Take a proactive approach to managing contracts Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Develop and monitor appropriate and robust Key Performance Indicators to manage the contractor and facilitate improved performance Understand the approvals process and how to develop and present robust propositions Make appropriate use of best practice contract management tools, techniques and templates DAY ONE 1 Introductions Aims Objectives Plan for the day 2 Commercial context Explaining the contracting context Define the key objective The importance of contact management Impact upon the business 3 Stakeholders How to undertake stakeholder mapping and analysis Shared vision concept, How to engage with HSE, Finance, Operations 4 Roles and responsibilities Exploring the key roles and responsibilities of contract administrators, HSE, Finance, Divisional managers, etc 5 Initiating the contract cycle Overview of the contracting cycle Requirement to tender Methods Rationale and exceptions 6 Specifications Developing robust scope of works Use of performance specifications Output based SOW 7 Strategy and award criteria Developing a robust contract strategy Award submissions/criteria 8 Managing the tender process Review the pre-qualification process Vendor registration rules and processes Creation of bidder lists Evaluation, short listing, and how to use of the 10Cs© model template and app 9 Types of contract Classify the different types of contracts Call-offs Framework agreement Price agreements Supply agreements 10 The contract I: price Understanding contract terms Methods of compensation Lump sum, unit price, cost plus, time and materials, alternative methods Cost plus a fee, target cost, gain share contracts Advanced payments Price escalation clauses DAY TWO 11 Risk How to manage risks Risk classification Mitigation of contractual risks 12 Contractor relationship management session Effectively managing relationships with contractors, Types of relationships Driving forces? Link between type of contract and style of relationship 13 Disputes Dealing with disputes Conflict resolution Negotiation Mediation Arbitration 14 Contract management Measuring and improving contract performance Using KPIs and SLAs Benchmarking Cost controls 15 The contract II: terms and conditions Contract terms and conditions Legal aspects Drafting special terms 16 Managing claims and variations How to manage contract and works variations orders Identifying the causes of variations Contractor claims process 17 Completion Contract close-out process Acceptance/completion Capture the learning/HSE Final payments, evaluation of performance 18 Close Review Final assessment

This Excel Introduction course is a very good introduction to essential fundamental programming concepts using Excel as programming language. These concepts are daily used by professionals and are essential in most jobs. By the end, you'll be comfortable with Excel concepts, ribbons, formulas, and the Functions Wizard. You will gain hands-on practical experience creating a spreadsheet from scratch on your own.

Java Front-ends for desktop and mobile With Java FX Programming Java Front-ends for desktop and mobile With Java FX In this course we create attractive, functional Front-ends using JavaFX. Prerequisites: Delegates already have basic Java Skills. Duration: 2 consecutive days, the first date shows as the booking date Where: Online with Gotomeeting.com Download: Download Java JDK and Eclipse IDE. London classroom: on request locations, bring you own device Location: Online Interactive Instructor-led Webinar. Our Style: This is a very practical course giving you hands-on practice. Included: Course exercises, notes, examples, computers, evaluations Certification: PCWorkshops JavaFX Qualification Java Intermediate and Front-end Course Description Database Concepts Revision: DataBase SQL, database principles and JDBC GUI's with Java FX Building Java FX GUI's Course Contents: GUI's with JavaFX Building Java GUI's. Create a front-end form interface for an application. Working with nodes, labels, inputboxes, prgress bars, etc. Formatting your front-end. Import a Java package to interact with the front-end. Interact with a database via the front-end. Practical Examine the Java SE event model. What is an event. What is event handling. Develop event handlers. Develop Lambda-style event handlers. Practical Create a quotation app. Create a movie booking app. How to create your installer and upload your app Webservices Java Web services What are Web Services? Why Java Web Services? Web Services - Characteristics Web Services - Architecture Web Services - Examples and exercises What is included PCWorkshops Course Certificate on completion Java Course Notes Java Code Examples Practical Java Course exercises, Java Course Revision work After the course: 1-Hour personalised online revision session Book the Java Intermediate and Front-end Course Powered by Eventbrite About us Our experienced trainers are award winners. More about us FAQ's Client Comments

ILM Level 2 Award in Leadership and Team Skills

By Dickson Training Ltd

An accredited qualification to prepare supervisors and team leaders for a future management role. This programme gives Team Leaders & Managers the skills, disciplines and confidence to manage their team effectively and add a great deal more value to the organisation - where they have to apply their learning in order to achieve the highly coveted ILM qualification. In order for a business to obtain maximum results, it is important that employees are motivated and supported in their job roles. It is the responsibility of the team leader or supervisor to lead their team effectively and present feedback to management. This 3-day programme will guarantee to boost your performance as a team leader and help you make the transition from working in a team to leading a team. We use a combination of theory and practical to help you develop yourself, and a toolkit of resources to use in the workplace. This is an internationally accredited course which not only carries kudos but it ensures you apply the learning back into the workplace for an immediate impact. All of our ILM Programmes are provided in partnership with BCF Group Limited, which is the ILM Approved Centre we deliver under. Course Syllabus The syllabus of the ILM Level 2 Award in Leadership and Team Skills course is split into three main modules, covering the following: Module One Developing Yourself as a Team Leader Learning the various roles, functions and responsibilities of a team leader - depending on workplace Recognising limits of authority and accountability, and how these are defined Developing personal skills and abilities for effective team leading Using reflective learning skills to improve performance Identifying areas of strength and possible improvement Finding ways of obtaining feedback from others Receiving and responding positively to feedback Module Two Workplace Communications Learning stages in the communication process Consideration of the recipient's needs Spotting barriers to communication and how to overcome them Establishing a range of direct communication methods relevant to the team Collating a range of direct communication methods relevant to people outside own area of responsibility. This includes written, telephone, e-mail and face-to-face Recognising the aspects of face-to-face communication, including appearance, impact, body language Realising the importance of succinct and accurate records of one-to-one oral communication Reasons for maintaining records of one-to-one communication (e.g. potential disciplinary or legal issues) Module Three Managing Yourself Setting SMART objectives and using them to prioritise own actions Learning simple time management techniques Developing an awareness of own skills and abilities Giving yourself personal objectives in relation to team objectives Developing flexibility and responding to daily changing circumstances Diagnosing the causes and impacts of stress at work Identifying symptoms of stress in yourself Knowing the implications of stress for workplace and non-work activities/relationships Developing simple stress management techniques Available sources of support Action planning and review techniques Accreditation As with all ILM accredited programmes, participants will need to complete the post-programme activity in order to achieve their full ILM Level 2 Award in Team Leading. This element is designed to show to ILM that you are able to apply what you have learned in the workplace. Who Is It For? This programme is ideal for practising or aspiring team leaders, in any industry sector, who is looking to gain a solid foundation or develop their existing skills as a team leader. This internationally recognised course will give you a solid understanding of what is needed to be a successful team leader, how to delegate, motivate and how to implement these skills in to your work place. What Will I Learn? At the end of the course, successful candidates will: Have a good understanding of the team leader role Apply a range of effective communication skills to overcome barriers Know how to motivate, build confidence and gain the best from their teams Identify, build and encourage effective team behaviours Apply practical skills and knowledge to be transferred to the workplace Gain an internationally recognised qualification What Is Required? There are no formal entry requirements, but participants will normally be either practising or aspiring team leaders, with the opportunity to meet the assessment demands and have a background that will enable them to benefit from the programme. Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information about running this course in-house at your premises, please contact us for more information.

Excel Intermediate Course, 1-Day. This course covers the essential Excel Intermediate, in our interactive, instructor led Live Virtual Classroom. You already know your way around Excel e.g. you understand some of the functionality on the Home Ribbons, can move around and format cells. etc. In the Excel intermediate course we cover in-depth functions and Formulae so that you will be able to create fantastic spreadsheets like budgets, forecasts, and more. You will be able to understand and unravel the complicated formulae created by your colleagues. During the course you will excellent spreadsheets so that you have examples to take away. Location: Instructor-led, Online. Our Style: Hands-on, Practical Course. Group Size: Max 4 people per group. Qualification: PCWorkshops Excel Intermediate Certification Hours: 1 Day, 10am-5pm Excel Intermediate Course, Course Outline. Working with Functions and Formulas The Function Wizard Using Functions in Excel: The 5 Popular functions If-else function Working with Names and Ranges Copying formulae Creating Formulae in Excel, general calculations. Lookups: Vlookup, Hlookup, Index, Match. Formatting a Range as a Table: Properties and behaviour of a table. Managing Tables: Working with Tables. Working with Tables: Working with Records and Fields. Filters and Sorting, Freeze panes, split, protecting and unprotecting. Using Excel as a Database: Advanced filter: copy only specified rows and columns from a large data set, auto mate this selective copy. Pivot-tables: Create Pivot Table, Refresh Data. Amend, Filter, Sort, Format Pivot Tables, Add additional Pivot formulae. Pivot Charts: Excel Pivot Charts and Sparklines. Examples and exercises with Pivot Charts and Sparklines. Other Excel Courses Inlcuded with the Excel Intermediate Course PCWorkshops Excel Intermediate Certificate on completion Excel Intermediate Notes Excel Code Examples Practical Excel Intermediate exercises Personal attention in a small group of up to 4 delegates Book the Excel Intermediate Course About us Our experienced trainers are award winners. More about us FAQ's Client Comments

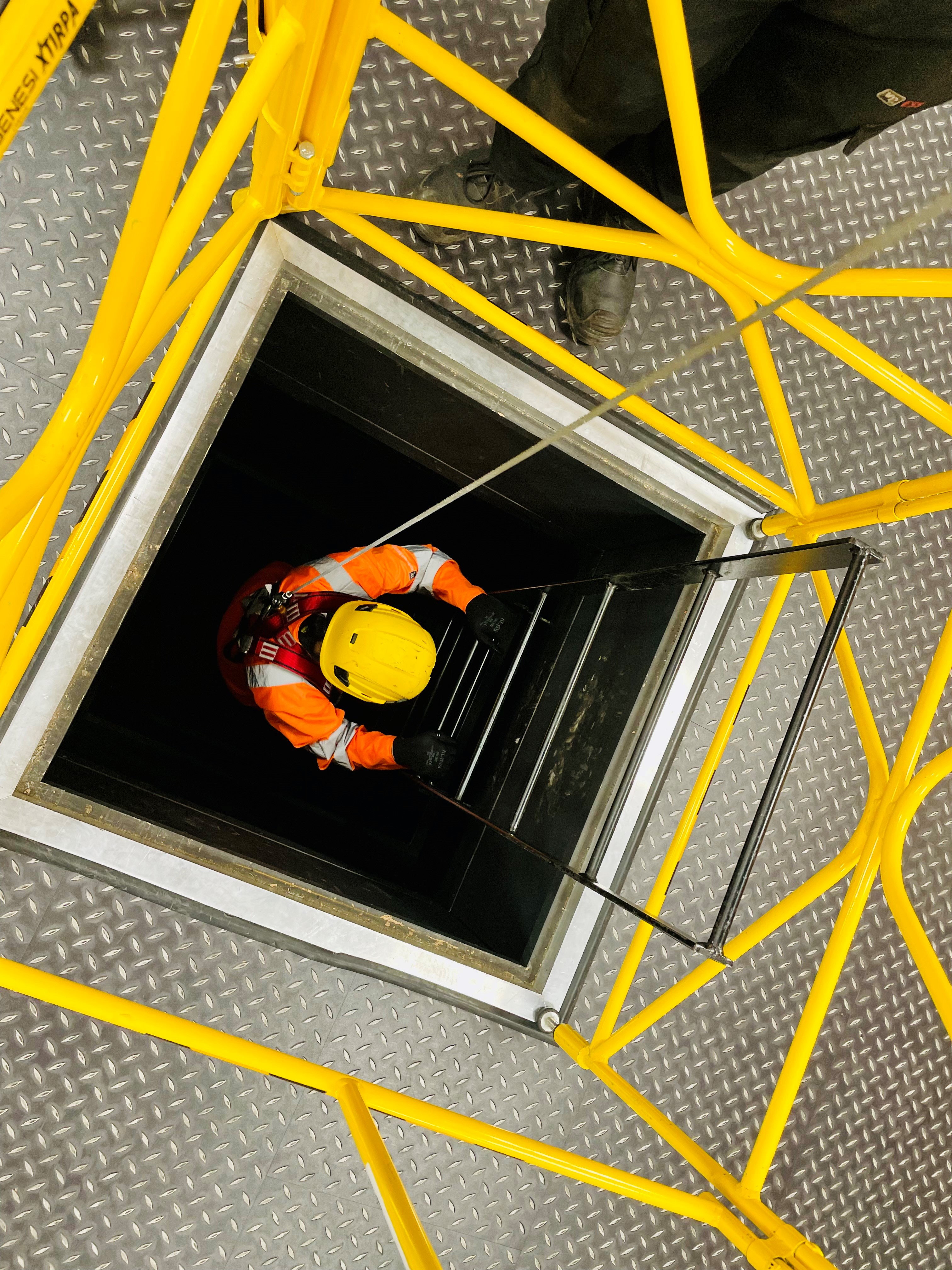

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07

By Vp ESS Training

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07 - This course is designed to introduce delegates to the basics of rescue and recovery of casualties from confined spaces. Understanding emergency arrangements as set by legislation and employers, some of the equipment required to rescue a casualty and safety of the rescue team. Note: A pre-requisite qualification is required to complete this course. Delegates must hold a valid 6160-08 qualification. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-07-level-3-award-in-direct-emergency-rescue-and-recovery-of-casualties-from-cs/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

This course covers the essential Excel data skills. Our course is interactive, instructor-led. This Excel Data course is on offered on intermediate level of Excel and concentrates on the Data Analytical capabilities of Excel. These concepts are daily used by data analysts and is a basic essential skill for data professionals. By the end, you'll be able to use Excel for analytics, data summaries, trends and statistics. You will create Excel data analytical spreadsheets and samples that you can use as examples at work.

DIPLOMA IN TROWEL OCCUPATIONS (CONSTRUCTION)

By Oscar Onsite

REFERENCE CODE 610/0501/0 COURSE LEVEL NVQ Level 3 THIS COURSE IS AVAILABLE IN Course Overview Qualification mandatory units (Mandatory – Credits: 144 Minimum, 144 Maximum) A/650/0295 (VR40V3) Erecting Masonry Structures in the Workplace Level: 2 Credits: 31 D/650/0296 (VR41V3) Setting out to form Masonry Structures in the Workplace Level: 2 Credits: 23 T/650/0293 (VR42V3) Erecting Masonry Cladding in the Workplace Level: 2 Credits: 24 A/503/2772 (209v2) Confirming Work Activities and Resources for an Occupational Work Area in the Workplace Level: 3 Credits: 10 Y/650/1392 (210V3) Developing and maintaining good occupational working relationships in the workplace Level: 3 Credits: 8 R/503/2924 (211v2) Confirming the Occupational Method of Work in the Workplace Level: 3 Credits: 11 A/503/1170 (641) Conforming to General Health, Safety and Welfare in the Workplace Level: 1 Credits: 2 T/650/1391 (49V3) Erecting masonry to form architectural and decorative structures in the workplace Level: 3 Credits: 35 Qualification optional units (Optional – Credits: 19 Minimum, 19 Maximum) H/650/0298 (VR44V3) Erect Thin Joint Masonry Structures in the Workplace Level: 2 Credits: 24 Y/650/0294 (VR50V3) Repairing and Maintaining Masonry Structures in the Workplace Level: 3 Credits: 25 R/650/0292 (VR639V3) Installing Drainage in the Workplace Level: 2 Credits: 19 F/650/0297 (VR810V1) Installing and forming specialist masonry elements in the workplace Level: 3 Credits: 21

Search By Location

- Qualification Courses in London

- Qualification Courses in Birmingham

- Qualification Courses in Glasgow

- Qualification Courses in Liverpool

- Qualification Courses in Bristol

- Qualification Courses in Manchester

- Qualification Courses in Sheffield

- Qualification Courses in Leeds

- Qualification Courses in Edinburgh

- Qualification Courses in Leicester

- Qualification Courses in Coventry

- Qualification Courses in Bradford

- Qualification Courses in Cardiff

- Qualification Courses in Belfast

- Qualification Courses in Nottingham