- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4216 Courses in London

DATE: Tuesday 18th February 2025 TIME: 4pm LOCATION: Studio B Get ready to showcase your talent at the CFS Monologue Slam! Whether you're an aspiring actor or a seasoned slammer, this is your chance to shine. Step onto the stage and captivate the audience with your best monologue, in a high-energy competition that celebrates creativity and passion. You are welcome to use any monologue from a film, play, TV series, or else even write your own! Everyone who enters can have their performance filmed and receive a copy of their work, and there will be a CASH PRIZE for the performer voted Number One! The CFS Monologue Slam is the perfect platform to let your talent speak for itself. Don’t miss out—sign up today and show us what you’ve got!

DATE: Tuesday 28th January TIME: 4pm LOCATION: Classroom 2 Every film student can benefit from learning basic first aid skills. Whether they’re needed on a night out or on a film set, this specially tailored session will enable you to get to grips quickly with techniques and practice to help in an emergency. This session is run by a volunteer from Saint John's Ambulance, to whom CFS are greatly appreciative for their time. Book your ticket now to secure your place on this important sessional.

DATE: Wednesday 29th January TIME: 4pm LOCATION: Studio A ‘Film History’ kicks off this month with a favourite classic of both Stephen Spielberg and the Coen Brothers; Sullivan's Travels tells the story of a Hollywood movie director who, in pursuit of absolute truth and accuracy, makes himself homeless in order to better tell a story of life from the wrong side of the tracks. Book your ticket to come along to this exclusive screening and lecture.

DATE: Monday 10th February TIME: 6:30pm LOCATION: Studio A We return to Carpenter’s roots with this low-budget, high-calibre action classic, as five rag-tag individuals must defend a defunct police station from a siege laid by a brutal street gang. Book your ticket below to secure your space.

DATE: Monday 27th January TIME: 6:30pm LOCATION: Studio A We kick off our Carpenter retrospective with a classic of the heist-thriller genre; ruthless mercenary Snake Plissken has to save the president and escape the island-prison of Manhattan, before he’s torn apart by its savage locals. Be sure to book your ticket through the link below.

One to One Private Dog Behaviour Consultations

4.7(12)By The Surrey Ark, Dog Behaviourist, Dog Walker/Sitter/Cat Visits, Claygate/Elmbridge

Fully qualified, positive Dog Behaviourist based in Claygate, Surrey. I offer one to one Private Dog Consultations in your home, a full report, Behaviour Modification Plan and possible vet referral for all types of dog behaviour issues and specialise in foreign rescue dogs.

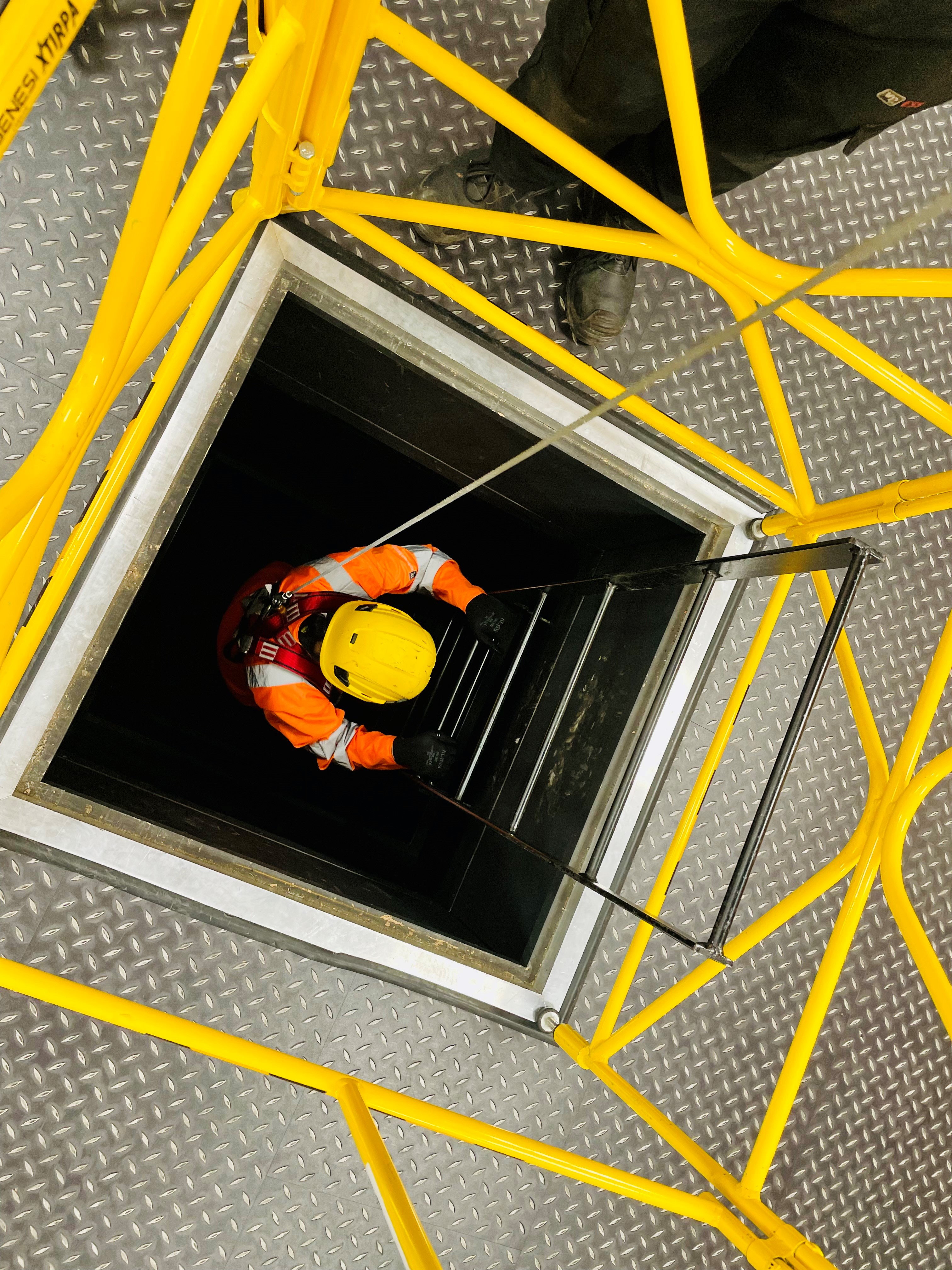

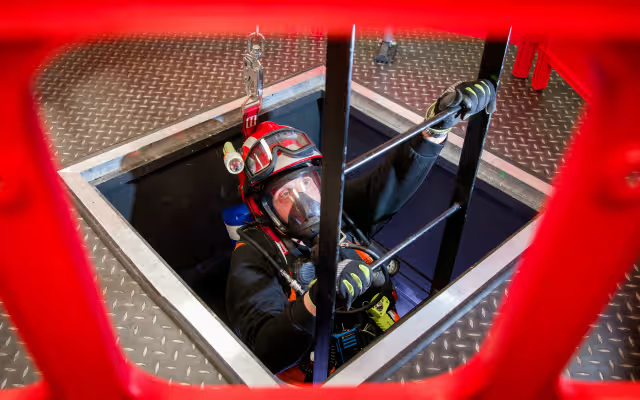

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07

By Vp ESS Training

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07 - This course is designed to introduce delegates to the basics of rescue and recovery of casualties from confined spaces. Understanding emergency arrangements as set by legislation and employers, some of the equipment required to rescue a casualty and safety of the rescue team. Note: A pre-requisite qualification is required to complete this course. Delegates must hold a valid 6160-08 qualification. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-07-level-3-award-in-direct-emergency-rescue-and-recovery-of-casualties-from-cs/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 4 Award in Plan, Manage and Review Legislative and Safety Compliance for Work in Confined Spaces - 6160-06

By Vp ESS Training

City & Guilds Level 4 Award in Plan, Manage and Review Legislative and Safety Compliance for Work in Confined Spaces - 6160-06 - This course focuses on planning, organizing and managing work safely in confined spaces including legislative roles and responsibilities, health and safety considerations and equipment requirements. Designed for managers that are responsible for organizing and planning work activities within a confined space. The manager may or may not supervise the actual job. The manager cannot enter the confined space. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-06-level-4-award-in-plan,-manage-and-review-legislative-and-safety-compliance-in-cs/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 3 Award in Control Entry and Arrangements for Confined Spaces (High Risk) - 6160-04

By Vp ESS Training

City & Guilds Level 3 Award in Control Entry and Arrangements for Confined Spaces (High Risk) - 6160-04 - This course is designed to provide delegates that need to enter medium and high risk confined spaces with an in-depth understanding of legislation, regulations and safe systems of work. This course includes recognising all risk levels of confined spaces. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-04-level-3-award-in-control-entry-and-arrangements-for-confined-spaces-(high-risk)/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham