- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

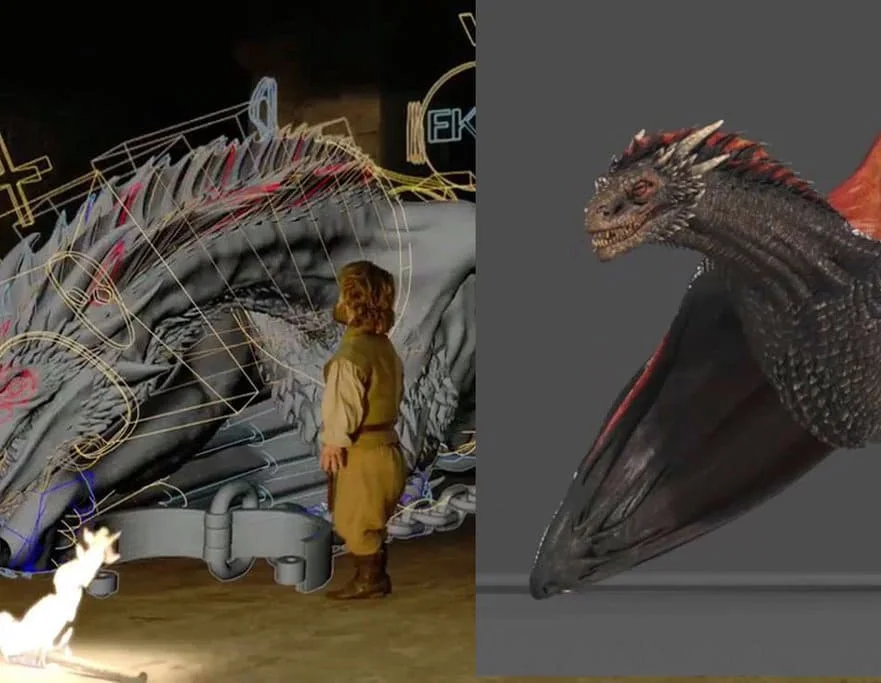

Diploma in Visual Effects for Film and Television Animation

By ATL Autocad Training London

Who is this course for? The Diploma in Visual Effects for Film and Television Animation is tailored for individuals aspiring to work in the Visual Effects, TV, Film, and 3D animation industry. Gain essential skills necessary for a successful career in these fields. Click here for more info: Website Duration: 120 hours of 1-on-1 Training. When can I book: 9 am - 4 pm (Choose your preferred day and time once a week). Monday to Saturday: 9 am - 7 pm (Flexible timing with advance booking). Course Overview for a 120-Hour Diploma Program in Game Design and Development Term 1: Introduction to Game Design and 3D Modeling (40 hours) Module 1: Introduction to Game Design (1 hour) Understanding the game development industry and current trends Exploring game mechanics and fundamental design principles Introduction to the game engines and tools utilized in the program Module 2: 3D Modeling with 3ds Max (25 hours) Familiarization with 3ds Max and its user interface Mastering basic modeling techniques like box modeling and extrusion Advanced modeling skills including subdivision and topology Texturing and shading techniques tailored for game development Module 3: Character Design and Animation (10 hours) Introduction to character design and its developmental process Creating and rigging characters specifically for games Keyframe animation techniques for character movement Term 2: Game Development and Unity 3D (40 hours) Module 4: Unity 3D Basics (20 hours) Navigating Unity 3D and understanding its interface Grasping fundamental game development concepts within Unity Creating game objects, writing scripts, and designing scenes Introduction to scripting using C# Module 5: Advanced Game Development with Unity 3D (10 hours) Constructing game mechanics including UI, scoring, and game states Working with physics and collision systems in Unity Crafting intricate game environments and level designs Module 6: Game Assets with Photoshop (10 hours) Exploring Photoshop tools and features for game asset creation Crafting game elements such as textures, sprites, and icons Optimizing assets for seamless integration into game development Term 3: Advanced Game Design and Portfolio Development (40 hours) Module 7: Advanced Game Design (20 hours) Delving into advanced game design concepts like balancing and difficulty curves Understanding player psychology and methods for engaging audiences Implementing game analytics and user testing for refinement Module 8: Portfolio Development (24 hours) Building a comprehensive portfolio showcasing acquired skills Effective presentation techniques for showcasing work Establishing a professional online presence and networking strategies Final Project: Creating and presenting a collection of best works in collaboration with tutors and fellow students Please note: Any missed sessions or absence without a 48-hour notice will result in session loss and a full class fee charge due to the personalized one-to-one nature of the sessions. Students can request pauses or extended breaks by providing written notice via email. What can you do after this course: Software Proficiency: Master industry-standard design tools for architectural and interior projects. Design Expertise: Develop a deep understanding of design principles and spatial concepts. Visualization Skills: Acquire advanced 2D/3D rendering and virtual reality skills for realistic design representation. Communication and Collaboration: Enhance communication skills and learn to collaborate effectively in design teams. Problem-Solving: Develop creative problem-solving abilities for real-world design challenges. Jobs and Career Opportunities: Architectural Visualizer Interior Designer CAD Technician Virtual Reality Developer 3D Modeler Project Coordinator Freelance Designer Visualization Consultant Students can pursue these roles, applying their expertise in architectural and interior design across various professional opportunities. Course Expectations: Maintain a dedicated notebook to compile your study notes. Schedule makeup sessions for any missed coursework, subject to available time slots. Keep meticulous notes and maintain a design folder to track your progress and nurture creative ideas. Allocate specific time for independent practice and project work. Attain certification from the esteemed professional design team. Post-Course Proficiencies: Upon successful course completion, you will achieve the following: Develop confidence in your software proficiency and a solid grasp of underlying principles. Demonstrate the ability to produce top-tier visuals for architectural and interior design projects. Feel well-prepared to pursue positions, armed with the assurance of your software expertise. Continued Support: We are pleased to offer lifetime, complimentary email and phone support to promptly assist you with any inquiries or challenges that may arise. Software Accessibility: Access to the required software is available through either downloading it from the developer's website or acquiring it at favorable student rates. It is important to note that student software should be exclusively utilized for non-commercial projects. Payment Options: To accommodate your preferences, we provide a range of payment options, including internet bank transfers, credit cards, debit cards, and PayPal. Moreover, we offer installment plans tailored to the needs of our students. Course Type: Certification. Course Level: Basic to Advanced. Time: 09:00 or 4 pm (You can choose your own day and time once a week) (Monday to Friday, 09 am to 7 pm, you can choose anytime by advance booking. Weekends can only be 3 to 4 hrs due to heavy demand on those days). Tutor: Industry Experts. Total Hours: 120 Price for Companies: £3500.00 (With VAT = £4200) For Companies. Price for Students: £3000.00 (With VAT = £3600) For Students.

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Sustainable Excellence

By 4and20Million.

4and20Million run Sustainable Excellence, a course designed to help people unlock their productivity, without resorting to longer hours and unnecessary stress. For full details, further information and learning more about how to boost your career prospects, please contact: dan@4and20million.com alex@4and20million.com

If you have at least 5 years working experience and you would like to attain Gold Card status via the Experienced Worker route by joining the City & Guilds 2346 NVQ Level 3, you will also need to hold the below two pre-requisite qualifications: City & Guilds 2391-52 Inspection and Testing Course C&G 2382-22 BS7671 18th Edition

The Level 3 Diploma in Dental Nursing is internationally recognised qualification. Successful completion will enable you to register as a Dental Care Professional with the General Dental Council (GDC) Dental Nursing Diploma with National Examining Board for Dental Nurses (NEBDN) is an internationally recognised qualification that will allow you to work as a Dental Nurse in hospitals, NHS and private dental practices. Successful completion of Dental Nursing Diploma course will enable you to register as a Dental Care Professional with the General Dental Council (GDC) and practice as a qualified Dental Nurse. Dental Nursing is more than just a job, it’s a profession that allows you to make a real difference in people’s lives. Being a Dental Nurse can be an exciting and fulfilling career that allows you to make a positive impact on people’s lives while enjoying a variety of work and opportunities to learn and grow. You’ll get to work with an amazing dental team and get to know patients, helping them to feel at ease and comfortable during their visit. You’ll be the one behind the scene making sure everything runs smoothly, and you’ll be the one that patients will turn to for assistance. You’ll also get to be a part of the latest advancements in dental technology and treatment. And on top of all that, you get to have a flexible schedule and a good earning potential, with the potential to advance in your career. All in all, being a dental nurse is one of the most exciting and fulfilling career that you can have, and you’ll get to leave work every day knowing you’ve made a real difference in the lives of others. Join a profession that is in demand, fulfilling and financially rewarding. Our dental nursing course will provide you with the necessary knowledge and skills to succeed in a field that is growing in popularity. The course is delivered by Team of Dental Professionals who are examiners, dentists and experienced Dental tutors with years of experience in teaching Dentistry. Dental Nurses are involved in a wide range of procedures, from routine check-ups to complex surgeries, which can make the job interesting and varied. Patient-centered care: Dental Nurses have a direct impact on the patient’s experience and can make a positive difference in people’s lives by providing them with quality care. Professional development: Dental Nurses have the opportunity to continue their education and expand their skills, leading to advancement and new opportunities in the field. Study mode – hybrid/blended mode of study that combines traditional class-based tuition with virtual/livestream learning No previous experience required – we will teach you from A to Z. Do you need a job? Yes, you will have 3 months’ time from the start of your course to find a placement. The Academy provides a list of Private and NHS Dental Surgeries, who are regularly contacting us when looking for more Trainee Dental Nurses, so you can contact them directly as a registered student at the Academy. This is a paid job, unless you would like to work voluntary for personal reasons. We also provide a reference letter to the employer in case you need it. The course is ideal for you if: You are looking for a qualification that leads to employment You intend to participate within dentistry and make a positive contribution to the dental health You wish to learn how to maintain high standards of hygiene, cleanliness, health & safety You enjoy interacting with multidisciplinary team and different people The curriculum is based on the GDC (General Dental Council) registration requirements for dental nurses. It sets out the knowledge, skills and behavioural requirements that should be developed and demonstrated. These are set out in terms of professional competencies, with the assessment method clearly outlined (e.g. how the skills and knowledge will be assessed in the final examinations – via written questions such as multiple choice (MCQ) or extended matching questions (EMQ) or via Objective Structured Clinical Examinations – OSCEs). We are proud to announce that our Dental Nursing students has the highest examination pass rate in OSCE examinations! Free services– workshops, mock exams, eRoE marking and internal moderation. Why join London Waterloo Academy? We are truly proud of what we have already accomplished. Academy has been operating since 2009 with a long list of graduates and successful Dental Professionals. We are continually striving to provide high quality tuition, and by listening to our learners, we are able to make studying at London Waterloo Academy easy and comfortable, which helps our learners to be confident and successful. This is what we can offer to our students. Top Dental Nursing course provider We are regularly contacted by Dental Surgeries to recruit our learners for Trainee Dental Nurse position 98% exam pass rate Small groups designed to keep high quality of tuition and progress Individual support all the way to graduation Earn while you learn Interactive lessons (visual, practical, activities, games, social events) We offer flexible payment plan at no extra charge on top of the instalments We are recognised and consistently approached by private surgeries that are well acquainted with our high teaching standards. These surgeries actively seek out our candidates to fill Trainee Dental Nurse vacancies On completion you will hold National Dental Nursing Diploma (NEBDN) and become General Dental Council (GDC) registered Dental Nurse Regular feedback on progress We have a community feel where each individual values and respects one another. This may be the reason why our graduates, even those who have completed the course many years ago, continue to come back not only for a chat and a cuppa, but also to share personal issues, tell us of their experience and success stories, among many other reasons. Central London – Waterloo/Southwark How will you learn? The course is based on 1 year part time (once a week, 2 hours) class based studies and a minimum of 16 hours per week practical experience, which involves working at a dental surgery. This is a paid job, unless you would like to work voluntary for personal reasons. LWA will also provide a Reference letter to the employee in case if learner finds a job independently. Earn while you learn could be another benefit for doing this course. We provide a list of Private Surgeries who have been working with us for the last 10 years and looking for more Trainee Dental Nurses so learners can contact them as a registered student at the Academy. Working together – Starting a new career isn’t easy and often it can seem like a lonely and impossible process. Our Dental Department always behind each learner, supporting every step of the way, we give you all the tools, skills and assistance you need to succeed. Our success, built on the success of our students and a long list of graduates with successful stories. What Can You Expect to Earn as a Dental Nurse? Compared to other caring professions, Dental Nursing is well paid and offers plenty of opportunity for continued training and development. This is great for those looking on a the long-term plan for their career and those who wish to work their way up the ladder through continued learning, experience & hard work.Trainee Dental Nurse salary for standard working week will be around £23,000 per annum. Average wage for a qualified Dental Nurses between £40,417 to £42,350 p.a. Any workshops or exam preparation? Academy offers 4 revision and mock test sessions prior to the written examination and 3 hour preparation session for OSCE’s examination. When are the exams? There are two exams: 1. Multiple choice theory exam – November and March 2. Practical exam – January and June. Please click here for more information Record of Experience (eROE) To be eligible to sit your first exam, you have to complete your electronic Record of Experience (ROE). The ROE has to be submitted to your tutor by 31st Jan for March exam, and 31st August for November exam. Please click here for more information

Plasma Fibroblast Skin Tightening Training

By Cosmetic College

Plasma skin tightening is a non-invasive precision technique that focuses on lifting and tightening loose skin on the face and body, with long-lasting results. Our plasma pen courses provide aesthetic practitioners with the ability to perform plasma pen treatments to a high standard; as the leading plasma pen training centre, we pride ourselves on training our practitioners to an extremely high standard to ensure their success. Our Plasma Fibroblast course has been structured from start to finish with you in mind to assure that when you complete your training, you will leave with the specialist skills that will help you feel confident in performing Plasma Fibroblast procedures. This intensive course includes theory study via our e-learning portal and practical training with model clients. All courses are kept small and focused, with a maximum of 6 learners in a class. Course prerequisites We accept students aged 18 and over. The student must have good written and spoken English. No prior experience or qualifications are required to enrol on this course. Course Structure Anatomy and physiology of the skin Infection control Sharps and hazardous waste training First aid and anaphylaxis training Pre-study plasma skin tightening theory Skin regeneration Skin tightening for face and neck lifting Reduce the appearance of stretch marks and scarring Full consultation process Faux skin peel practice Non-surgical skin tightening and lifting, including reduction of lines and wrinkles Practical training 1 model Clinical set up Professional live demonstrations Upgrade your training and include a medical-grade Beautier Plasma Pen with probes by Beautier Cosmetics for just 449 saving 550 Frequently Asked Questions How much is the course? Our Plasma Fibroblast training course is normally priced at 2,000. This course sometimes is available at a discounted rate subject to terms and conditions or specific promotional offers. How can I book? We have a few options for you to book. You can book by selecting an available training date above here on our website, by contacting us through email at hello@cosmetic.college or by contacting us on 0333 015 5117. What qualifications do I need to be able to enrol on this course? No previous experience or qualifications are required for you to enrol onto this course. Whether you are a beauty pro, aesthetician, permanent makeup artist or a complete novice, we will give you all the training you need to become a successful Plasma Fibroblast practitioner. What is the course duration? 1 day + pre-study via our online learning platform. Is there a kit included in the price? This course does not include a kit in the training fees however you can upgrade your training and include a medical-grade Beautier Professional Plasma Pen for 449 using our partnership discount exclusively for Cosmetic College students. Which accreditations does this course have? CPD Accreditation Group Certification provided on successful completion of the course Is a deposit required to book? All enrolments are charged an administration fee which is non-refundable. When you enrol you can elect to pay a deposit of 10% plus the administration fee or pay the total training course in full. We have full details of the terms and conditions of training course enrolments here Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

The course is designed to help improve your understanding of the legal requirements, the theoretical and practical principles for both the initial verification and certification of an electrical installation, further your knowledge and practical skills in the testing and inspection of a range of existing electrical installations, and help improve your understanding of the legal requirements, the theoretical and practical principles for the periodic inspect and testing and certification of an electrical installation.

Body Sculpting Training Course

By Cosmetic College

Non-surgical treatments for inch-loss & body contouring. This course is designed to train candidates to provide expert treatments to the highest standards. This will enable you to gain insurance and to commence work legally to perform these treatments in the public sector. Ultrasonic Cavitation & Radio frequency can be used in the following areas: Abdomen Buttocks Arms Inner and Outer Thighs Love Handles Course prerequisites No previous experience or qualifications are necessary to enrol onto this course with a good command of english required. Course structure You are required to complete our online theory study via our accessible e-learning portal and practical training onsite. All courses are kept intimate with a maximum of 6 learners to a class. Areas covered within the course: What are Ultrasonic Cavitation and RF, and how do they work? Benefits of Ultrasonic Cavitation and RF include fat reduction and skin tightening Anatomy and Physiology related to Ultrasonic Cavitation and RF Understanding Fat Cells Client consultation Pre and post-treatment advice Contraindications Treatment contra-actions Treatment process including live model experience for cavitation Frequently Asked Questions How can I book? We have a few options for you to book. You can book by selecting an available training date above here on our website, by contacting us through email at hello@cosmetic.college or by contacting us on 0333 015 5117. Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL Is a deposit required to book? All enrolments are charged an administration fee which is non-refundable. When you enrol you can elect to pay a deposit of 10% plus the administration fee or pay the total training course in full. We have full details of the terms and conditions of training course enrolments here What is the course duration? 1 day + pre-study via our online learning platform. Is there a kit included in this course? The are a few different options we provide for our students on this course. The advertised price is for training only. We stock table-top machines at a separate cost subject to availability as well as provide links to recommended alternative suppliers.

This Level 4 City and Guilds 2396-01 Design and Verification of Electrical Installations course has been designed to help develop the skills and up date the knowledge of the requirements to enable you to professionally design, erect and then verify an electrical installation. This course is aimed at those who will have responsibility for designing, supervising, installing and testing electrical installations. Further information can be found here: C&G 2396 Electrical Design Course — Optima Electrical Training (optima-ect.com)

Search By Location

- 42 Courses in London

- 42 Courses in Birmingham

- 42 Courses in Glasgow

- 42 Courses in Liverpool

- 42 Courses in Bristol

- 42 Courses in Manchester

- 42 Courses in Sheffield

- 42 Courses in Leeds

- 42 Courses in Edinburgh

- 42 Courses in Leicester

- 42 Courses in Coventry

- 42 Courses in Bradford

- 42 Courses in Cardiff

- 42 Courses in Belfast

- 42 Courses in Nottingham