- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Credit Risk Capital Modelling Under Basel Internal Ratings Based Approach (IRB)

5.0(5)By Finex Learning

Overview 2 day applied course in modelling Basel IRB parameters and generating IRB Pillar 1 credit risk capital requirement for a mixed retail and corporate loan book Who the course is for Credit risk management, model validators and quants Loan officers / loan portfolio management ALM staff Bank investors – equity and credit investors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Foundation

By Tableau Training Uk

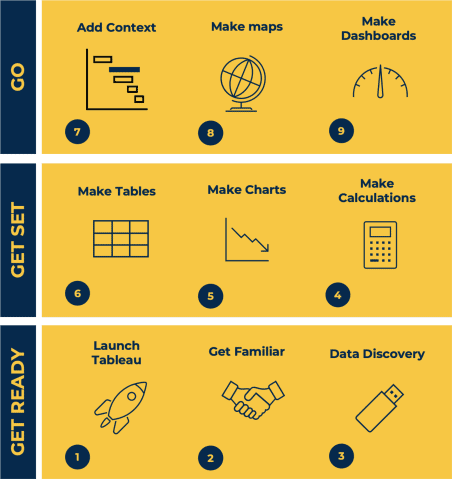

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

How to start a small business and set it up for success

By Accountant Calgary

Starting a small business can be a rewarding journey, but it requires careful planning and the right strategies to succeed. From creating a solid business plan to organizing finances and finding the right support, this guide will help you establish a foundation for a thriving business. For entrepreneurs in Calgary, key resources like reliable bookkeeping services can make a significant difference. Here’s how to start a small business and set it up for lasting success. Developing a business plan A clear, well-researched business plan serves as a roadmap for your business. It outlines your goals, target market, competitive advantage, and financial projections. This plan will also help attract investors or secure loans. To create an effective business plan: Define your mission and vision: Explain why your business exists and what you aim to achieve. Identify your target audience: Determine who your customers are and what problems your business will solve for them. Analyze competitors: Study your competitors to understand what they offer and find ways to differentiate your business. Set realistic financial projections: Estimate costs, revenue, and profits. This will give potential investors confidence in your business. Choosing a business structure Selecting the right business structure is essential, as it affects your taxes, liability, and daily operations. Common options include: Sole proprietorship: Simple to set up, with minimal paperwork, but offers no separation of personal and business liability. Partnership: Ideal for two or more owners, allowing shared responsibilities, but partners share liabilities. Corporation: Provides liability protection, but involves more paperwork and regulatory requirements. LLC (Limited Liability Company): Offers liability protection without the complexity of a corporation. Choose a structure that best suits your needs, and consult a legal professional to ensure compliance with Calgary’s business regulations. Securing funding Most small businesses require some level of funding to get started. Consider various financing options to find the best fit: Personal savings or family support: Often the first source of funding for many entrepreneurs. Business loans: Many banks offer small business loans with varying interest rates. Grants and government programs: Explore government grants and programs specifically designed to support small businesses in Calgary. Angel investors or venture capital: For businesses with high growth potential, attracting investors may be an option. Registering your business To operate legally, you’ll need to register your business. This process involves choosing a unique name, filing the necessary documents, and obtaining a business license in Calgary. You may also need specific permits depending on your industry. Completing these steps ensures that your business complies with all local regulations. Organizing your finances Managing finances effectively is crucial for any small business. Accurate bookkeeping keeps your business organized, tracks income and expenses, and prepares you for tax season. Many small businesses in Calgary choose to hire a bookkeeper in Calgary to handle these responsibilities, allowing owners to focus on growth. Working with one of the best bookkeeping services in Calgary can provide: Accurate financial records: Professional bookkeepers help maintain up-to-date records, which is essential for financial health. Compliance with tax laws: Calgary’s best bookkeeping services are familiar with local tax regulations, ensuring that you file correctly and on time. Insights for decision-making: With accurate records, you can make informed decisions on budgeting, spending, and investments. Creating a strong brand identity Building a brand that resonates with your target audience is essential. Your brand identity includes your business name, logo, colors, and messaging, as well as the experience you offer customers. Developing a consistent brand identity sets you apart from competitors and builds trust with customers. Here are some steps to create a strong brand identity: Design a logo and visual theme: Choose a professional logo, color scheme, and design elements that reflect your brand’s personality. Develop a unique brand voice: Whether it’s friendly, professional, or playful, keep your brand voice consistent in all communications. Focus on customer experience: Aim to provide exceptional service that keeps customers coming back and sharing their positive experiences. Building an online presence In today’s digital world, an online presence is crucial for reaching potential customers. Start by creating a professional website where customers can learn more about your products or services. Next, consider establishing a presence on social media platforms that suit your audience. Key components of a strong online presence include: User-friendly website: Make sure your website is easy to navigate, mobile-friendly, and includes essential information about your business. Social media profiles: Engage with customers and share updates on platforms like Facebook, Instagram, or LinkedIn. Google My Business: Setting up a Google My Business profile helps customers in Calgary find you more easily. Building a support network Running a small business can be challenging, and having a network of support is invaluable. Surround yourself with people who can provide advice, resources, and encouragement. Consider these ways to build a support network: Join local business associations: Groups like the Calgary Chamber of Commerce offer networking opportunities, resources, and workshops. Seek mentorship: Experienced business owners can offer guidance and insights that help you avoid common pitfalls. Hire professionals for specialized tasks: For financial and legal matters, work with professionals like accountants, lawyers, and bookkeepers. Tracking progress and making adjustments As your business grows, it’s essential to review your progress and adjust your strategies. Regularly assessing financial performance, customer feedback, and market trends can help you refine your approach and stay competitive. Working with one of the best bookkeeping services in Calgary can make tracking your financial performance much easier, giving you insight into profit margins, cash flow, and budgeting. Consider these strategies for tracking progress: Set measurable goals: Establish specific goals for growth, such as revenue targets or customer acquisition numbers. Analyze performance data: Use financial statements, sales reports, and customer feedback to assess performance. Stay flexible: Be willing to make changes to products, services, or marketing strategies if they aren’t meeting customer needs. Conclusion Starting a small business takes effort, planning, and ongoing management. By creating a solid business plan, organizing your finances, and developing a strong brand, you can set your business up for success. In Calgary, many new business owners choose to hire a bookkeeper in Calgary to ensure accurate financial management and stay compliant with local regulations. Taking advantage of the best bookkeeping services in Calgary can free up your time, allowing you to focus on growing your business and achieving long-term success. With dedication and the right strategies, your small business can thrive in today’s competitive market.

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Budgeting and control (In-House)

By The In House Training Company

Budgeting is more than mere vague oversight. Budgeting should deliver the corporate strategy, add shareholder value and lead to a well-run business - for the benefit of all involved in it. Effective budgeting leads to real control - effective day-to-day operational control and more. This course demonstrates what proper budgeting and operational control can do. This course will help ensure that participants: Appreciate the importance of the budgeting process Take ownership of it Use it as a daily working tool - not an annual exercise - to help run their part of the operation Improve their reporting against budget Ensure their delivery against budget 1 Objectives of budgets The budget process Stages - what is the prime aim of a budget? What is forecasting? ObjectivesPlanningImplementation 2 Budget and cost control focus Choosing objectives Links with corporate strategy Links with resource management Can the accounting systems cope? 3 Traditional budgeting and control Benefits and drawbacks The process Control and feedback Reporting - what can be expected? 4 Advanced budgeting and control Understanding the business process Taking out costs Cost awareness ZBB - as valid as ever 5 Reports Reports for action The purpose of a report Content - deliverables and feedback Culture is so important

ADVANCED VALUATION FOR INSTITUTIONAL INVESTORS

By Behind The Balance Sheet

This course was developed for one of the largest investment institutions in the world, a multi-trillion household name. We explain in detail our tips and tricks to build an accurate and rolling enterprise value, and then review different valuation methodologies, from DCF, through the sum of the parts and football field analyses to LTV/CAC based methods. We conclude with a series of case studies examining the valuation of individual stocks.

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please request a brochure. To learn more about schedule, pricing & delivery options speak to a course specialist now

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

The core principles gained from this course will help delegates have a better understanding of how to manage the relationships between sales and marketing stakeholders on the demand side and the manufacturing and other operational stakeholders on the supply side. PARTICIPANTS WILL LEARN HOW TO: • Take a different perspective on traditional data such as sales history and forecasts, as well as time-phased inventory projections and production capacity. • Recognise how their forecasts impact manufacturing schedules and inventory levels. • Assess whether they are producing enough products to meet sales demand. • Recognise how production is tied to finance and see the financial impact of production decisions, so appropriate adjustments may be then undertaken. COURSE TOPICS INCLUDE: What is S&OP? – Introduction – Definition and benefits S&OP processes – What information is required? – The stages of the S&OP process (including inputs & outputs) The integration of S&OP into a business – Critical success factors for an effective implementation – Typical roles and responsibility matrix

Search By Location

- Financial Courses in London

- Financial Courses in Birmingham

- Financial Courses in Glasgow

- Financial Courses in Liverpool

- Financial Courses in Bristol

- Financial Courses in Manchester

- Financial Courses in Sheffield

- Financial Courses in Leeds

- Financial Courses in Edinburgh

- Financial Courses in Leicester

- Financial Courses in Coventry

- Financial Courses in Bradford

- Financial Courses in Cardiff

- Financial Courses in Belfast

- Financial Courses in Nottingham