- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

VTCT Level 4 In Ultrasound

By Cosmetic College

The new VTCT (ITEC) Level 4 qualification in Ultrasound has been developed as a result of the move towards regulating non-medical aesthetic therapies to ensure practitioner knowledge, client care and safety is at the forefront of all advanced non-medical aesthetic treatments offered by therapists. This qualification is informed by employers and national occupational standards for Beauty Therapy and includes all the required elements to work effectively as a fully commercial ultrasound practitioner.

AAT Level 3 Certificate in Bookkeeping

By London School of Science and Technology

This qualification will develop complex skills and knowledge necessary to work in a bookkeeping role or to progress to higher level accountancy roles or study. Course Overview This qualification will develop complex skills and knowledge necessary to work in a bookkeeping role or to progress to higher level accountancy roles or study. Students completing this qualification will become competent in financial processes including accounting principles and concepts, advanced bookkeeping and preparing financial statements. They will also be introduced to business issues regarding payroll and value added tax (VAT). Learn enhanced skills and expertise in bookkeeping activities, critical for the smooth and efficient running of all finance departments. The jobs it can lead to: • Professional bookkeeper • Senior bookkeeper • Accounts manager • Ledger manager Entry requirements Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue & Customs. The unit provides students with the knowledge and skills needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principals of payroll. • Report information within the organisation.

GA Level 4 Award in Epilepsy and Buccal Midazolam Instruction

By Guardian Angels Training

Gain advanced knowledge and practical skills in instructing buccal midazolam administration for epilepsy with our Level 4 Award course.

Safeguarding Adults & Children Level 2

By Prima Cura Training

This course provides detailed safeguarding adults & children awareness, including essential knowledge in the recognition and reporting of abuse and neglect, procedures and responsibilities. This is for all workforce involved in Social Care from the health, public, independent, or voluntary sectors. This subject forms standard 10 & 11 in The Care Certificate.

BB Glow Foundation Training

By Cosmetic College

The BB Glow Facial is one of the newer facial treatments to reach the beauty market and is becoming an increasingly popular choice for many clients. A BB Glow Foundation Facial is a highly effective micro-needling treatment with immediate, lasting effects. This safe and intensive skin treatment can improve the facial tone and smooth out imperfections, freckles, and wrinkles. The treatment goal of using the micro-needle therapy system is to lighten and smooth the face's skin tone. In this course, you will learn how to create a semi-permanent foundation lasting for months, which hides facial imperfections. Learn the newest mesotherapy treatment loved by the world, which can also be available in your beauty salon. Course Entry Requirements: This course is available for those that meet at least one of the following: Minimum 18 years NVQ Level 2 Beauty or equivalent desirable Good command of English Needling accredited training Course Pre-Study/Practical & Length: 20 hours of pre-study E-learning and 1 practical day Course Agenda This courses theory knowledge is delivered through our interactive e-learning training portal and completed with either: One day onsite training One day Zoom based training All courses are kept to a reduced size, with a maximum of six attendees per course. Areas covered in this course: Anatomy and physiology of face and skin The choice of colour for the type of skin Written documentation (treatment card) Photographic documentation The principles of hygiene Purpose of the treatment and the obtained effect Assessment of customer expectations Contraindications for BB Glow treatments Preparation of clients and positions for the procedure Application rules for anaesthesia Possible complications after treatments Types of pigments Insurance Practice: Practice on models Demonstration of the procedure on the model Enrolling in our BB Glow Foundation Training Course offers numerous benefits for students, as well as significant advantages for clients and potential earning potential. Let's explore these benefits in detail: Benefits for Students: Expertise in BB Glow Foundation: Our training course equips students with the knowledge and skills to master the BB Glow Foundation technique. You will learn the latest application techniques, colour theory, product selection, and client consultation. This specialised training will set you apart as a skilled BB Glow artist. Practical Hands-on Experience: We prioritise practical learning by providing extensive hands-on training opportunities. Under the guidance of experienced instructors, you will have the chance to practice the BB Glow Foundation technique on models. This practical experience will enhance your confidence and proficiency in delivering excellent results. Professional Advancement: By enrolling in our BB Glow Foundation Training Course, you are investing in your professional advancement. You will expand your skill set, stay updated with industry standards, and gain expertise in the popular BB Glow technique. This will enhance your professional reputation and open doors to new career opportunities. Benefits for Clients: Flawless and Radiant Skin: BB Glow Foundation is a popular semi-permanent makeup technique that creates the appearance of flawless, radiant skin. By enrolling in our training course, you will be able to offer this highly sought-after treatment to your clients. They will benefit from a semi-permanent foundation that evens out skin tone, hides imperfections, and provides a natural-looking glow. Time-saving Solution: Clients who opt for BB Glow Foundation can save time in their daily makeup routine. The semi-permanent nature of the treatment eliminates the need for daily foundation application, saving clients valuable time and effort. They can wake up with a fresh-faced look and feel confident throughout the day. Customised Results: As a trained BB Glow artist, you will have the expertise to customise the treatment to suit each client's skin tone and preferences. By selecting the appropriate pigments and adjusting the intensity, you can achieve personalised results that enhance the client's natural beauty. Clients will appreciate the tailored approach and individualized outcomes. Earning Potential: By offering BB Glow Foundation as part of your services, you can significantly increase your earning potential. The popularity of BB Glow treatments has been growing, and clients are willing to invest in achieving flawless, long-lasting skin. As a skilled BB Glow artist, you can attract a larger clientele and set competitive pricing for your services. Satisfied clients are more likely to become repeat customers and refer others, further boosting your earning potential. Enrolling in our BB Glow Foundation Training Course will not only benefit you as a student but also provide valuable advantages for your clients and potential earning potential in the beauty industry. Begin your journey toward professional excellence and financial success by enrolling today. Frequently Asked Questions (FAQ) about our BB Glow Foundation Training Course: Is this course suitable for beginners or those with prior experience? Our BB Glow Foundation Training Course is designed for both beginners and experienced professionals in the beauty industry. Whether you are new to semi-permanent makeup or already have a background in the field, our course will provide you with the necessary knowledge and skills to master the BB Glow Foundation technique. What qualifications or prerequisites do I need to enrol in the course? No specific qualifications are required to enrol in our BB Glow Foundation Training Course. However, a passion for the beauty industry and a desire to learn and improve your skills are highly recommended. Our course is open to anyone who wants to gain expertise in the BB Glow technique. Will I receive a certification upon completion? Yes, upon successfully completing our training course, you will receive a certification in BB Glow Foundation. This certification recognises your skills and expertise in performing the BB Glow technique. It can enhance your professional credibility and assist you in building your career in the beauty industry. What topics are covered in the course curriculum? Our course curriculum covers a wide range of topics related to BB Glow Foundation, including skin anatomy and physiology, product knowledge, colour theory, sanitation and hygiene, consultation and client assessment, application techniques, aftercare, and touch-up procedures. The curriculum is designed to provide a comprehensive understanding of the technique and its application. Are there any hands-on training opportunities? Absolutely! Our BB Glow Foundation Training Course includes extensive hands-on training sessions. You will have the opportunity to practice the BB Glow technique on models under the guidance of experienced instructors. This practical experience is essential to develop your skills and confidence in performing the treatment effectively. Will I have access to ongoing support after completing the course? Yes, we provide ongoing support to our students even after they complete the training course. Our instructors and support staff are available to answer any questions, provide guidance, and offer assistance as you embark on your career in BB Glow Foundation. We aim to support your continued growth and success. Are there financing options available for the course? We offer flexible payment options and financing plans to make our BB Glow Foundation Training Course more accessible. Please reach out to our admissions team for detailed information on available payment options and financing plans. If you have any additional questions or require further clarification, please feel free to contact us. We are here to assist you throughout your training journey and beyond. Course Benefits Benefits for Students Expertise in BB Glow Foundation: Our training course equips students with the knowledge and skills to master the BB Glow Foundation technique. You will learn the latest application techniques, colour theory, product selection, and client consultation. This specialised training will set you apart as a skilled BB Glow artist. Practical Hands-on Experience: We prioritise practical learning by providing extensive hands-on training opportunities. Under the guidance of experienced instructors, you will have the chance to practice the BB Glow Foundation technique on models. This practical experience will enhance your confidence and proficiency in delivering excellent results. Professional Advancement: By enrolling in our BB Glow Foundation Training Course, you are investing in your professional advancement. You will expand your skill set, stay updated with industry standards, and gain expertise in the popular BB Glow technique. This will enhance your professional reputation and open doors to new career opportunities. Benefits for Clients Flawless and Radiant Skin: BB Glow Foundation is a popular semi-permanent makeup technique that creates the appearance of flawless, radiant skin. By enrolling in our training course, you will be able to offer this highly sought-after treatment to your clients. They will benefit from a semi-permanent foundation that evens out skin tone, hides imperfections, and provides a natural-looking glow. Time-saving Solution: Clients who opt for BB Glow Foundation can save time in their daily makeup routine. The semi-permanent nature of the treatment eliminates the need for daily foundation application, saving clients valuable time and effort. They can wake up with a fresh-faced look and feel confident throughout the day. Customised Results: As a trained BB Glow artist, you will have the expertise to customise the treatment to suit each client's skin tone and preferences. By selecting the appropriate pigments and adjusting the intensity, you can achieve personalised results that enhance the client's natural beauty. Clients will appreciate the tailored approach and individualised outcomes. Earning Potential By offering BB Glow Foundation as part of your services, you can significantly increase your earning potential. The popularity of BB Glow treatments has been growing, and clients are willing to invest in achieving flawless, long-lasting skin. As a skilled BB Glow artist, you can attract a larger clientele and set competitive pricing for your services. Satisfied clients are more likely to become repeat customers and refer others, further boosting your earning potential. Enrolling in our BB Glow Foundation Training Course will not only benefit you as a student but also provide valuable advantages for your clients and potential earning potential in the beauty industry. Begin your journey toward professional excellence and financial success by enrolling today. Frequently Asked Questions Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL How can I book? We have a few options for you to book. You can book by selecting an available training date above here on our website, by contacting us through email at hello@cosmetic.college or by contacting us on 0333 015 5117. Is a deposit required to book? All enrolments are charged an administration fee which is non-refundable. When you enrol you can elect to pay a deposit of 10% plus the administration fee or pay the total training course in full. We have full details of the terms and conditions of training course enrolments here Is this course suitable for beginners or those with prior experience? Our BB Glow Foundation Training Course is designed for both beginners and experienced professionals in the beauty industry. Whether you are new to semi-permanent makeup or already have a background in the field, our course will provide you with the necessary knowledge and skills to master the BB Glow Foundation technique. Will I receive a certification upon completion? Yes, upon successfully completing our training course, you will receive a certification in BB Glow Foundation. This certification recognises your skills and expertise in performing the BB Glow technique. It can enhance your professional credibility and assist you in building your career in the beauty industry. What topics are covered in the course curriculum? Our course curriculum covers a wide range of topics related to BB Glow Foundation, including skin anatomy and physiology, product knowledge, colour theory, sanitation and hygiene, consultation and client assessment, application techniques, aftercare, and touch-up procedures. The curriculum is designed to provide a comprehensive understanding of the technique and its application. Are there any hands-on training opportunities? Absolutely! Our BB Glow Foundation Training Course includes extensive hands-on training sessions. You will have the opportunity to practice the BB Glow technique on models under the guidance of experienced instructors. This practical experience is essential to develop your skills and confidence in performing the treatment effectively. Will I have access to ongoing support after completing the course? Yes, we provide ongoing support to our students even after they complete the training course. Our instructors and support staff are available to answer any questions, provide guidance, and offer assistance as you embark on your career in BB Glow Foundation. We aim to support your continued growth and success. Are there financing options available for the course? We offer flexible payment options and financing plans to make our BB Glow Foundation Training Course more accessible. Please reach out to our admissions team for detailed information on available payment options and financing plans. If you have any additional questions or require further clarification, please feel free to contact us. We are here to assist you throughout your training journey and beyond.

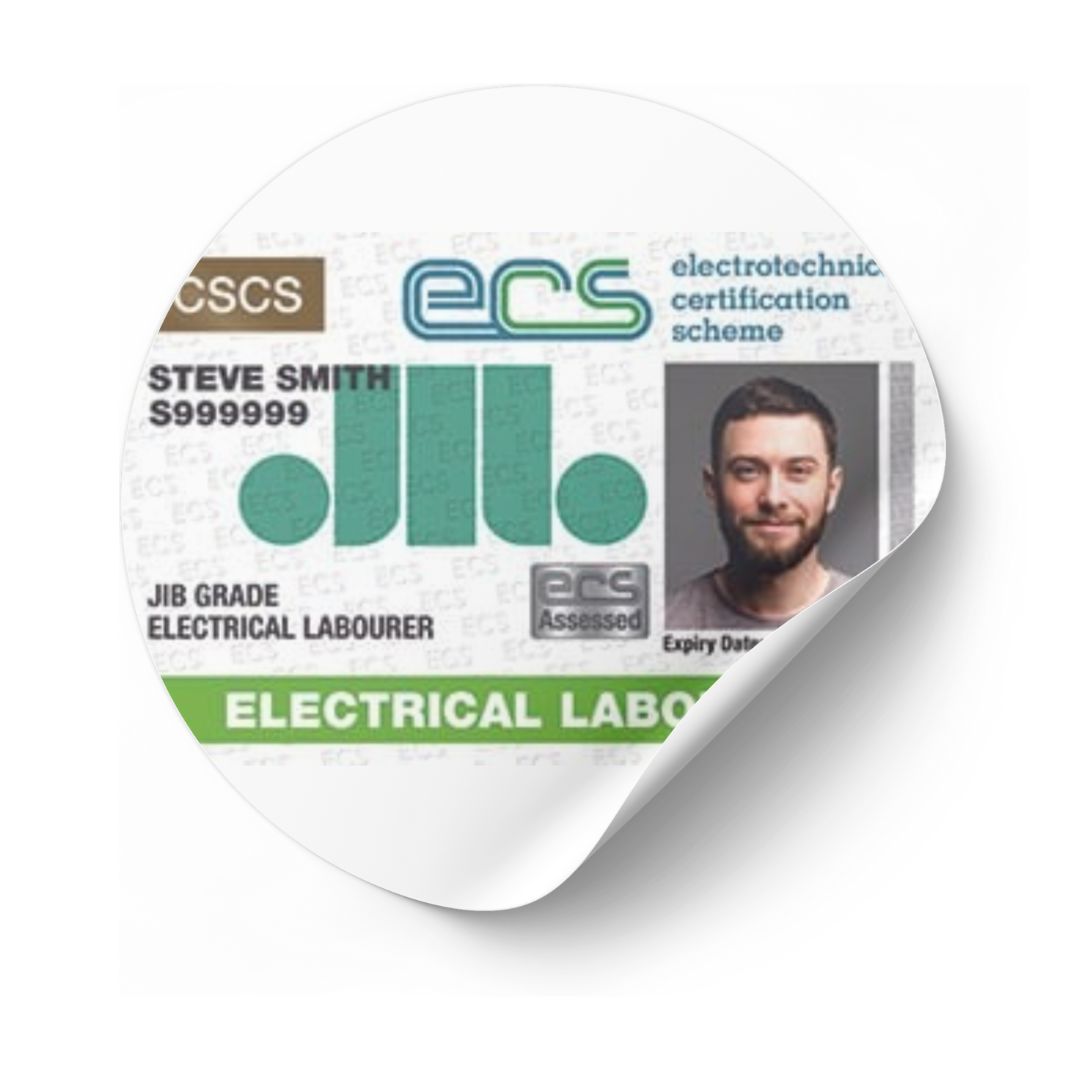

ECS Card Health & Safety Course Kent

By MJ Electrical Training

ECS Health & Safety Course with MJ Electrical Training. Available every week, use this course to complete the application process when applying for an ECS Labourers Card.

Exploration & Production (E&P) Accounting Level 1

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 3-day introductory-level course provides a comprehensive overview of international accounting and finance practices in the E&P industry. It is particularly suitable for finance personnel who are new to the oil and gas industry, or want to gain a broader understanding of oil and gas financial policy, joint venture and cost-control topic areas. Training Objectives After the completion of this training course, participants will be able to: Comprehend an overview of accounting policies and practices in the oil and gas industry Manage project development and operating costs Understand the accounting and financial management implications of exploring for and producing oil and gas Review the background to financial issues like joint ventures that are unique to the E&P industry, and their accounting treatment Target Audience This training course is suitable and will greatly benefit the following specific groups: Finance staff new to the industry who require a grounding in the various specialist discipline areas that typically comprise an oil and gas company finance function Finance personnel who are being developed for broader accounting and financial management responsibilities Audit and information systems staff who have frequent dealings with financial controls and systems Treasury and tax specialists who require a better understanding of E&P finance and accounting Course Level Basic or Foundation Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 3 days in total (21 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Level 3 NVQ Diploma in Formwork

By BAB Business Group

The NVQ Level 3 Diploma in Formwork provides a nationally recognised qualification for those working in the construction and the built environment sector in the specialise in handling, erecting, striking, constructing, maintaining and repairing complex and non-complex formwork to demonstrate their competence and become eligible for the Gold CSCS Card. Our team will discuss the qualification process with you prior to signing up in order to ensure that you will be able to complete the qualification. Upon completion of the qualification, you will be awarded the NVQ Level 3 Diploma in Formwork. CSCS Cards We can provide CSCS tests and CSCS Cards alongside the qualifications without the need to attend the test centre. Just ask for more information.

Thai Yoga Massage works to stimulate, open and balance the flow of energy through the "sen" lines to assist the body in its natural tendency towards self-healing. This is achieved through rhythmic manipulation of sen lines; joint mobilization; passive stretches and applied Yogic postures. Open to all and no specific prerequisites are required. Completion of 5 case studies (4 treatments each) (up to 4 months completion time is allowed after the course) a practical examination lasting two hours. In-class assessment and examinations. Home assignments One day per week, 8 weeks 10.30 - 2.30pm

Auditing in the Exploration & Production (E&P) Industry Level 2

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 5-day intensive training course is designed to improve the skills of those involved in the financial and contractual auditing of upstream Oil & Gas Exploration and Production activities. The objective of this course is to enhance your understanding of the various audit principles and practices being applied in this industry today and to equip you with the knowledge and tools to deal with complex audit cases. The course concentrates on aspects of auditing unique to the E&P business. Training Objectives After the completion of this training course, participants will be able to: Apply a structured methodology for conducting oil industry internal, production sharing and joint venture audits Implement the benefits of a multi-discipline team audit approach Adopt a model of best practice for conducting audits Analyse, interpret and decide complex cases using the contracts and documents, the principles and auditor's judgement Target Audience This training course is suitable and will greatly benefit the following specific groups: Personnel with an Internal audit background who are totally new to the discipline of Joint Venture (JV) or Production Sharing Contract (PSC) audit Experienced audit practitioners who wish to update their auditing techniques Personnel from Finance or any discipline who intend to take part in internal or joint venture audits Personnel with a background in statutory audit in the accountancy profession who require an insight into the internal and joint venture audit areas Course Level Intermediate Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 5 days in total (35 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Search By Location

- Level 2 Courses in London

- Level 2 Courses in Birmingham

- Level 2 Courses in Glasgow

- Level 2 Courses in Liverpool

- Level 2 Courses in Bristol

- Level 2 Courses in Manchester

- Level 2 Courses in Sheffield

- Level 2 Courses in Leeds

- Level 2 Courses in Edinburgh

- Level 2 Courses in Leicester

- Level 2 Courses in Coventry

- Level 2 Courses in Bradford

- Level 2 Courses in Cardiff

- Level 2 Courses in Belfast

- Level 2 Courses in Nottingham