- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview 2 day applied course with comprehensive case studies covering both Standardized Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course to learn ALM tools to achieve strong and market-resilient, actuarially-resilient Solvency 2 (S2) ratios at Group consolidated level and at key cash-remitting entities to ensure dividend stability. For those not fully familiar with Solvency 2, this course is best taken in conjunction with “Solvency 2” Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course on forensic accounting and analysis to unearth financial manipulation by companies Who the course is for Investors and analysts – equity and credit; public and private Bank loan officers M&A advisors Restructuring advisors Auditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Conflict management (In-House)

By The In House Training Company

Conflict is a word that conjures up many emotions. It is something that most people would prefer to avoid, if possible. Work can be an emotive place. Positive relationships can make your life at work exciting, motivating and challenging, whilst relationships that do not hold value to you could make your life very difficult and stressful, especially if there is conflict between you and your manager. This course is essential for people who want to understand where conflict can be used to positive effect and how to manage conflict in your working relationships and see it as something positive that can stimulate the environment. Research has shown that relationships at work are an extremely high motivational factor, and for a lot of people it has a higher importance that salary! Therefore, it is essential that we invest in relationships and search out new ways to make them better in order to have a more positive influence on our surroundings. By understanding why other people are in conflict we can manage the conversation a lot better, with outcomes managed more effectively so the 'conflict' will add value to the organisation. This participative event will cover a wide variety of exercises and personal stories, and leave course participants with a clear strategy to identify when they are in conflict with someone and how they will structure their approach to get to a satisfactory outcome. This is a workshop that targets anyone where conflict needs to be managed and cannot seem to resolve it, whether internally or externally. At the end of the day, participants will: Know their key relationships and the strength of those relationships Complete the Strengths Deployment Inventory (SDI) to identify where you deploy your strengths Understand what is important to you and your key stakeholders Know how motivational value systems can influence behaviour Tailor your communication style to match that of your opposite party Know conflict strategies to resolve conflict in others Learn to be more assertive when challenging Achieve key personal, departmental and organisational objectives 1 Where are you now? How effective are your current working relationships? Can I work effectively without the input from others? Who do you need to be a success? 2 The Strengths Deployment Inventory (SDI) Completion of the SDI questionnaire An understanding of the theory A 'trip around the triangle' Predicting relationship interaction Your scores and what they mean in your relationships 3 Conflict theory What is conflict? The 3 flags of conflict What are your conflict triggers? Your conflict scores plotted The conflict sequence 4 Conflict resolution strategies Early warning signs Most productive behaviours Least productive behaviours Preventable / unwarranted conflict Review of the dynamic triangle Review of the day, personal learning and action planning

Overview 1 day course on IFRS 9 expected credit loss modelling, both for financial statement and capital stress testing purposes Who the course is for Credit risk management Quants ALM staff Finance Internal audit External auditors Bank investors – equity and credit investors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Creating a culture of teamwork in an Early Years Team.

By The Leadership Wizard

Belonging & Connection

Credit Risk Capital Modelling Under Basel Internal Ratings Based Approach (IRB)

5.0(5)By Finex Learning

Overview 2 day applied course in modelling Basel IRB parameters and generating IRB Pillar 1 credit risk capital requirement for a mixed retail and corporate loan book Who the course is for Credit risk management, model validators and quants Loan officers / loan portfolio management ALM staff Bank investors – equity and credit investors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

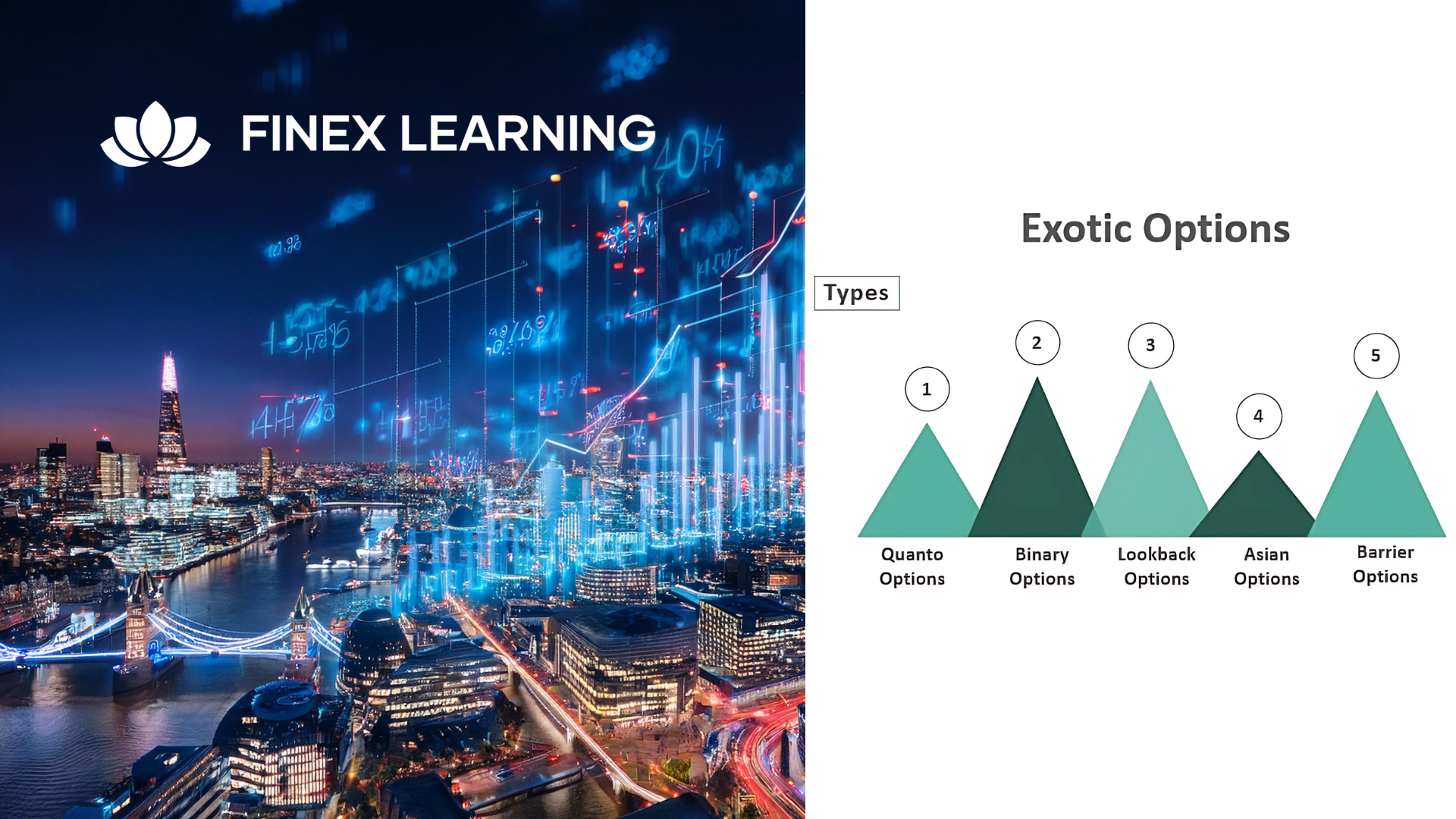

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- course Courses in London

- course Courses in Birmingham

- course Courses in Glasgow

- course Courses in Liverpool

- course Courses in Bristol

- course Courses in Manchester

- course Courses in Sheffield

- course Courses in Leeds

- course Courses in Edinburgh

- course Courses in Leicester

- course Courses in Coventry

- course Courses in Bradford

- course Courses in Cardiff

- course Courses in Belfast

- course Courses in Nottingham