- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Tableau Desktop Training - Foundation

By Tableau Training Uk

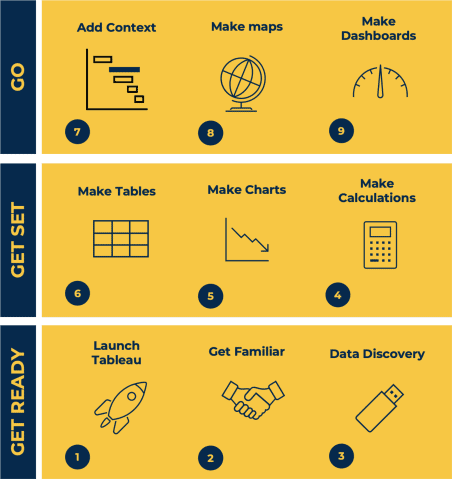

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Health & Safety Awareness

By Prima Cura Training

This Health & Safety in the Care Sector Course works alongside, and helps, learners understand Standard 13 of the Care Certificate. This Standard touches on the legislation, policies & responsibilities relating to Health & Safety in the care sector, as well as looking at accidents and sudden illnesses.

Banking and Risk Management School

By Mindset Resource Consulting

Our banking and risk management courses are aimed at empowering finance professionals with the knowledge and skills needed in banking, risk management, financial services and regulation. Our courses are suitable for a wide range of audience including bank executives/directors, senior managers, financial risk managers, credit officers, relationship managers, bank operational staff, treasury/asset managers, compliance officers, investment bankers, and financial services regulators and supervisors.

Emotional Intelligence for Today’s Leadership and Management

By Dickson Training Ltd

EQ is a pattern of how people's biases in their thinking leads them to think one choice or thing is better than another, as well as their clarity in differentiating within those biases to exercise clear and sound judgement. Where your thinking and responses lie within your biases spectrum, and your ability in adjusting to the situation you find yourself in, will determine responses equating to poor or strong Emotional Intelligence (EI). This course will enhance and promote the skill set necessary for any working leader or manager, allowing our in-depth emotional intelligence knowledge to be applied into your working environment. From an employer's perspective, this award can be a significant long-term return on investment by further developing your leaders and managers. What Does This Course Offer? Our program offers an EQ-SWOT™ assessment and EI Model in detail, and through activity and discussion we explore how applying and possibly adjusting, you may offer an improved Emotional Intelligence. Our learning experiences are successful because the outcomes are quickly embedded and demonstrate an immediate visible impact on the day-to-day working environment. Our engaging learning inspires employees to want to personally add value to the companies they work for. We also offer our Paradigm EQ-SWOT™ online assessment and report as a frame of reference within the program. This assessment should be completed before attending the program, and will be expanded upon during the program delivery. Course Content The Emotional Intelligence for Today’s Leadership and Management course covers the following topics: What makes EI so important within the workplace Self-Awareness and your EQ Profile The EQ unpacked Unconscious Bias & EI How to develop your EI quotient Accreditation Activity Our accredited tutors deliver training that encourages delegates to confidently and practically apply all they have learnt as soon as they get back into the business. To achieve this award, delegates need to prepare and deliver a 3 minute presentation* on the highlights of their learning and immediate application avenues when back in their working environment. *Participants will be given 30 minutes during the program to prepare for their 3 min presentation at the end of the program. Scheduled Course Dates Unfortunately this course is not currently scheduled as an open course as it is primarily run as an in-house programme. For more information, please contact us. In-House Courses This is our own management training course which has been developed and refined over the many years we have been providing it to delegates from organisations in virtually every industry. This means that the course syllabus is extremely flexible and can be tailored to your specific requirements. If you would like to discuss how we can tailor this management training course for you and/or run it at your premises, please contact us.

The 'people side' of projects (In-House)

By The In House Training Company

Running a successful project requires skills in planning, budgeting, tracking deliverables and stakeholder management. An area that can be neglected by project managers is the 'people side' - not the project team themselves but the end-users, those who will be affected by the project. Too often there is a single line at the end of the project plan that says 'Comms and Training'. If people are going to have to work differently and learn some new processes, then there is work to be done by the project team to help them through the emotional side of the change. This session explores why it's important to bring people along when a change is being made. It will provide project teams with the skills and knowledge either to manage the people change plan themselves or to secure the right resources for their project. Understand the importance of the 'people side' of change 8 'Golden Rules' of change management - overview How to create a simple but effective change plan Adoption Benefits of good change management 1 Introduction Objectives and agenda People and projects - why is it important? The Change Curve - the emotional side of change 2 8 'Golden Rules' of change management - including... Role of the sponsor Communication Resistance to change 3 Change plan Elements of a change plan Change impact assessment Alignment with the project plan 4 Adoption Who owns the change? The vital role of the manager Feedback and action loops 5 Benefits Estimating the costs / benefits 6 Next steps Summary of key learning points Reflection on next steps 7 Close

Level 4 Award in Immediate Life Support (ILS) Course

By NR Medical Training

The Level 4 Award in Immediate Life Support (RQF) is ideal for a wide range of healthcare professionals. This includes doctors, dental professionals, medical students, nurses, midwives, and physiotherapists who need an ILS qualification for their registration with regulatory bodies like the GMC, GDC, NMC, and HCPC. It's also perfect for those looking to advance in their careers or needing an ILS certification for new job opportunities.

Agile: an introduction (In-House)

By The In House Training Company

Agility has become a prized business attribute. Although Agile methods were once most associated with software development, they are now applied in a host of different areas. Agile continues to find new applications because it is primarily an attitude. This programme delivers a solid grounding in both the Agile mindset and Agile methods. It covers three methods, illustrates the benefits of each and shows how they can be integrated. It includes practical techniques as well as background knowledge. By the end of the session, participants will be able to: Apply Agile concepts to self-manage their work Understand the roles people take on in Agile teams Use a variety of techniques to help deliver customer satisfaction Focus on delivering against priorities Employ a range of estimating techniques 1 Introduction Overview of the programme Review of participants' needs and objectives 2 The basics of Agile What makes Agile different Agile Manifesto and Principles Using feedback to deliver what is needed 3 Agile teams Multi-disciplinary teams Team size and empowerment Agile values 4 Agile at the team level - Scrum Scrum roles Scrum 'events' Scrum 'artifacts' 5 Agile for teams juggling multiple demands - Kanban Taking control of the work Improving throughput Dealing with bottlenecks 6 Agile in projects - AgilePM The phases of an Agile project Managing change requests Delivering on time 7 Estimating T-shirt / Pebble sizing Yesterday's weather Planning poker 8 Pick 'n' mix - some useful techniques The daily stand-up User stories Retrospectives Work-in-process limits Burndown charts Minimum viable product A / B testing 9 Review and action planning Identify actions to be implemented individually Conclusion

Influencing for Leadership and Management

By Dickson Training Ltd

We often find ourselves working in fast-paced matrix environments, working in/with virtual teams or simply trying to get something done by someone in another part of the business. This common aspect of our working lives has a common challenge: how to influence other people to help us or do something for us, when they don't report to us. Pulling rank or strong nudging might work once, but we need to build a supportive and collaborative relationship over the long term. What Does This Course Offer? Fortunately, there are really effective tips for influencing, and our program offers an influencing model in detail. Through activity and discussion we explore how you can apply these principles and use it when you need help from other people. Even when we are not in a leadership position it can sometimes be extremely difficult to get people's help, especially when we have no authority over them. This is where an approach and an influencing model can help us identify what we and other people value in a given influencing situation. We can then explore that information so that everyone can view and pursue a common purpose. This course will enhance and promote the skill set necessary for any leader or manager, allowing our in-depth influencing knowledge to be applied into your working environment. From an employer's perspective this award can be a significant long-term return on investment by developing your leaders and managers. Our learning experiences are successful because the outcomes are quickly embedded and demonstrate an immediate visible impact on the day-to-day working environment. Our engaging learning inspires employees to want to personally add value to the companies they work for. We also offer our Paradigm Trait-Map™ online assessment and report as a frame of reference for your own influencing styles and that of others. This assessment should be completed before attending the program, and will be expanded upon during the program delivery. Course Content The Influencing for Leadership and Management course covers the following topics: Two key influencing models that you can apply back in your daily work Different types of influencing How to create the right environment for influencing Barriers you may face and how to overcome these barriers Accreditation Activity Our accredited tutors deliver training that encourages delegates to confidently and practically apply all they have learnt as soon as they get back into the business. To achieve this award, delegates need to prepare and deliver a 3 minute presentation* on the highlights of their learning and immediate application avenues when back in their working environment. *Participants will be given 30 minutes during the program to prepare for their 3 min presentation at the end of the program. Scheduled Course Dates Unfortunately this course is not currently scheduled as an open course as it is primarily run as an in-house programme. For more information, please contact us. In-House Courses This is our own management training course which has been developed and refined over the many years we have been providing it to delegates from organisations in virtually every industry. This means that the course syllabus is extremely flexible and can be tailored to your specific requirements. If you would like to discuss how we can tailor this management training course for you and/or run it at your premises, please contact us.

Diabetes Awareness

By Prima Cura Training

Diabetes is serious. It can be life-threatening, however, people with diabetes can live long, healthy lives if their condition is kept well-controlled. In this training course, we explain what diabetes is and what to look out for. We cover how it is diagnosed and how to provide care and support to a person living with diabetes.

Emergency First Aid at Work

By Prima Cura Training

This one-day course will help you meet your regulatory requirements if your risk assessment indicates that first aid training covering emergency protocols only, is sufficient for your workplace.

Search By Location

- knowledge Courses in London

- knowledge Courses in Birmingham

- knowledge Courses in Glasgow

- knowledge Courses in Liverpool

- knowledge Courses in Bristol

- knowledge Courses in Manchester

- knowledge Courses in Sheffield

- knowledge Courses in Leeds

- knowledge Courses in Edinburgh

- knowledge Courses in Leicester

- knowledge Courses in Coventry

- knowledge Courses in Bradford

- knowledge Courses in Cardiff

- knowledge Courses in Belfast

- knowledge Courses in Nottingham