- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2664 Courses in Halifax

Managing Performance 1 Day Workshop in Wakefield

By Mangates

Managing Performance 1 Day Workshop in Wakefield

Building Better Careers with Soft Skills: 1-Day Workshop in Leeds

By Mangates

10 Soft Skills You Need 1 Day Training in Leeds

Communication Skills 1 Day Training in Leeds

By Mangates

Communication Skills 1 Day Training in Leeds

Boost Customer Satisfaction: Join us 1 Day Training in Leeds

By Mangates

Customer Service Essentials 1 Day Training in Leeds

Public Speaking 1 Day Training in Leeds

By Mangates

Public Speaking 1 Day Training in Leeds

Practical Sales Skills 1 Day Workshop in Leeds

By Mangates

Practical Sales Skills 1 Day Workshop in Leeds

COMMODITY CODES MASTERCLASS

By Export Unlocked Limited

Understanding commodity codes is vital to internationally trading businesses. Commodity codes are used worldwide to determine the customs duty and other charges levied on the goods when importing and exporting. They also determine any preferential treatments or restrictions and prohibitions that may apply to the goods and are used for monitoring trade volumes and applying international trade measures. This virtual half-day course will provide an insight into what commodity codes are and how getting them wrong can have a big impact on your business. By attending this course, we will ensure you: Are aware of what a commodity code is and what it is used for Understand the process of how to classify goods Successfully classify a range of goods Understand the importance of getting your commodity codes correct. Please note: If you are working towards your British Chamber of Commerce (BCC) Foundation Award, this course will count towards 1 of your 6 modules. Please make sure you select the ‘Yes’ option in the dropdown option for BCC when booking.

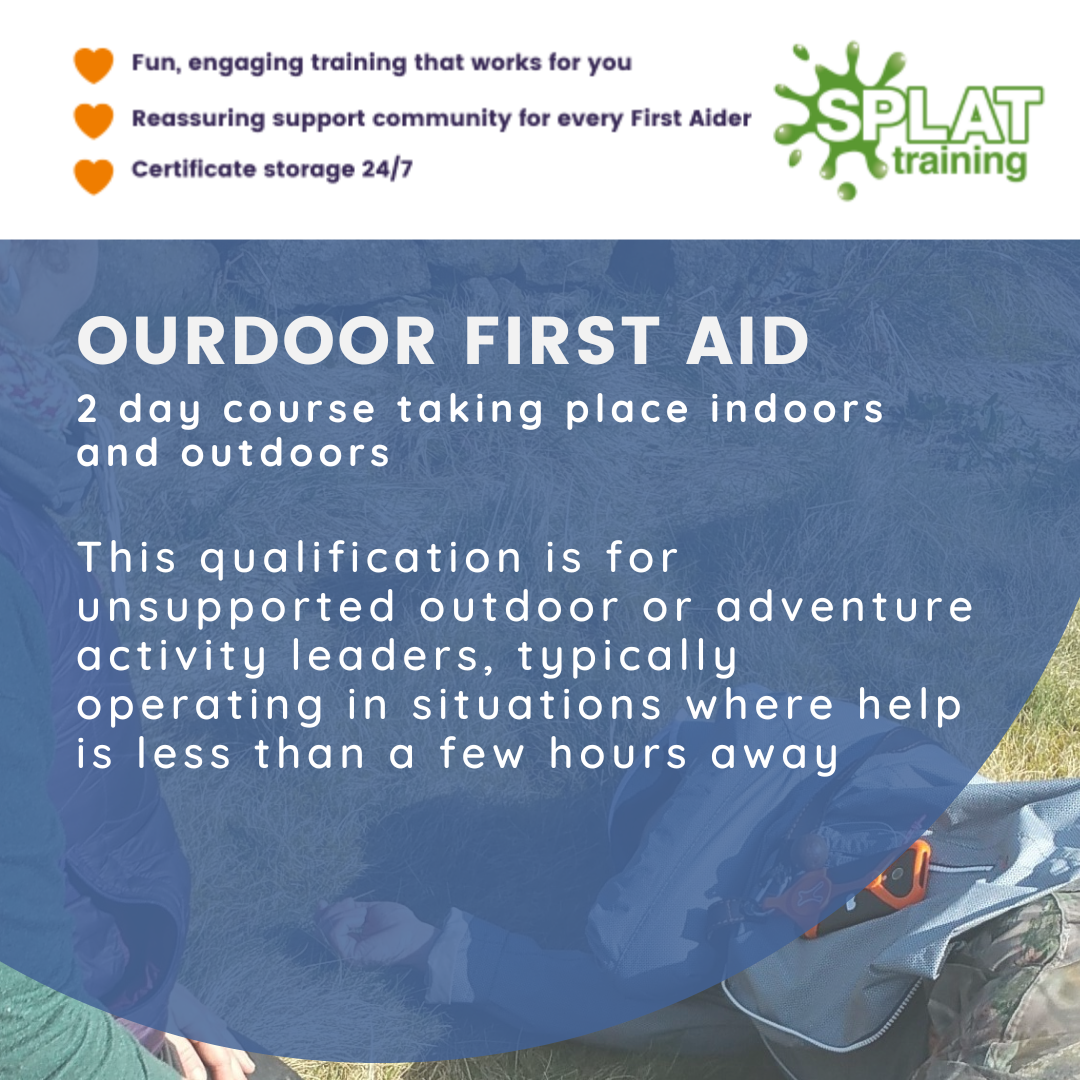

This qualification is for unsupported outdoor or adventure activity leaders, typically operating in situations where help is less than a few hours away, e.g. outdoor instructors, outdoor learning practitioners, mountain leaders, Duke of Edinburgh assessors, bushcraft instructors, forest school leaders, canoe expedition leaders. This list is not exhaustive.

CUSTOMS WAREHOUSING / FREE ZONES / SPECIAL PROCEDURES

By Export Unlocked Limited

This module aims to develop knowledge and understanding of the use of customs warehousing in the export and in import of goods. This includes the use of duty deferral, temporary storage, the processing of merchandise, bonded stock, consolidation and special processes and services.

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham