- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

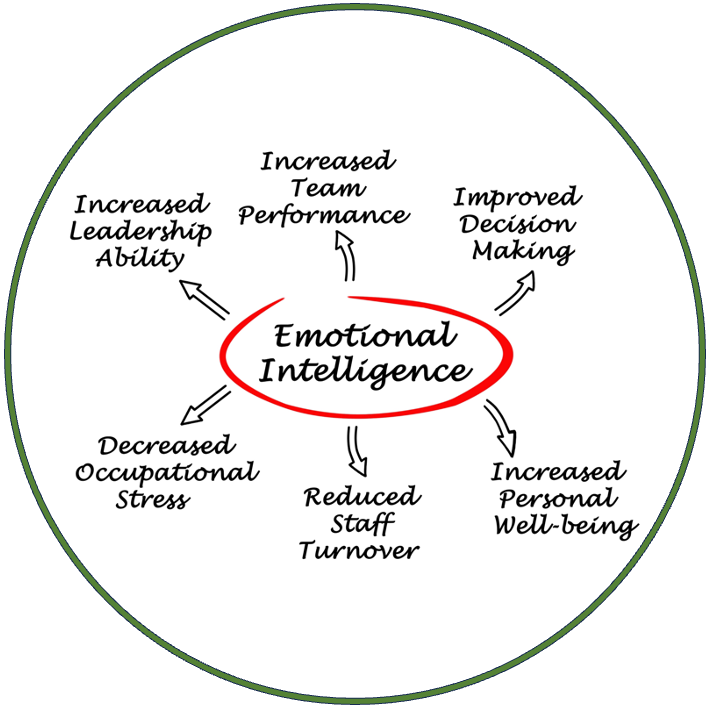

The Essentials of EAP Training Workshop (£750 per course for up to 10 people)

By Buon Consultancy

Employee Assistance Programme Training

First Aid Essentials

By Immerse Medical

Immerse Medical are experienced at teaching first aid to young people within the educational sector. We have designed this workshop style programme specifically for those in KS3/4. The sessions are fun, engaging and focus on fundamental life saving skills. Using interactive gamification, students gain hands on experience, which they will draw upon in real life medical emergencies. These sessions are perfect as part of phase 2 of National Citizenship Service (NCS) and Duke of Edinburgh (DofE) Awards. Key points Meets national curriculum secondary education guidelines– We’ve designed this programme to exceed the requirements of the 2020 guidelines. Training by doctors, nurses and paramedics – We have years of experience working on the front line of emergency medicine; giving us real world knowledge and skills in managing injured or unwell people. Latest equipment & technology – We utilise technology enhanced learning to provide a realistic opportunity to practice fundamental life saving skills in a safe environment. More than first aid – While participating in this workshop young people will also develop their ability to work as part of team, communicate effectively and think critically in high pressure situations leading to an overall increase in personal confidence. Check out the skills included in the videos below. First Aid Courses For Young People Programmes and sessions for young people focusing on how to keep each other safe and what to do if something goes wrong. Sessions are designed with age and national curriculum in mind, from 1 hour tasters to sessions for large groups, perfect as part of NCS and Duke of Edinburgh programmes. Our training for young people is fun, engaging and focuses on fundamental life saving skills. All courses can be delivered at our training centre in Poole, Dorset or we can deliver on-site across Bournemouth, Poole, Dorset, Hampshire and the South of England.

Time Management Skills Course (£395 total for this half-day course for a group of up to 15 people)

By Buon Consultancy

This interactive course has been designed to help participants manage their time more efficiently and to develop the skills for effective workplace planning

Workplace Mediation & Conflict Resolution (£695 total for this 1-day course for a group of up to 12 people)

By Buon Consultancy

Mediation and Conflict Course

Time Management Skills Course (£695 total for this 1-day course for a group of up to 12 people)

By Buon Consultancy

This interactive course has been designed to help participants manage their time more efficiently and to develop the skills for effective workplace planning

PACE: A trauma-informed approach to supporting children and young people

By National Gender Training Ltd

PACE was developed by Dr Dan Hughes (a clinical psychologist specialising in childhood trauma) more than 20 years ago as a central part of attachment-focused family therapy. It was created with the aim of supporting adults to build safe, trusting and meaningful relationships with children and young people who have experienced trauma. The approach focuses on building trusting relationships, emotional connections, containment of emotions and a sense of security. PACE is a way of thinking, feeling, communicating and behaving that aims to make the child feel safe. Its four principles of communication – Playfulness, Acceptance, Curiosity and Empathy – facilitate the building of healthy, secure attachments between caregiver and child. PACE parenting is especially effective for supporting children that lack secure emotional bases. It is ideal for anyone working or living with children, especially those children in the care system Who is this course for? Anyone working with or living with children and young people. Like foster carers, adopting parents, residential carers, social workers but would also benefit parents experiencing difficulties. What will it cost? This is being developed as a video course – please contact us for prices. Face2face courses are £750.00 plus vat per session, plus travel. How will I benefit from this course? You will benefit by building safe, trusting and meaningful relationships with children and young people. What is the course content? Learn about the four principles of the model… communication- Play, Acceptance, Curiosity and Empathy with the add on of Like to make PLACE model and how to implement it…. The therapeutic needs of the children you care for… The fight flight freeze & fawn response Attachment Trauma & effects on the brain Transference/counter transference… Dysfunctional thoughts, beliefs and alternative ways of thinking… Self-help & support How are the courses delivered? Although this is being converted to a video course, it is available face2face for groups of around 15 people Is this course recognised? Yes, it is fully CPD accredited

Advanced financial analysis (In-House)

By The In House Training Company

In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions: all require some degree of financial knowledge. The key financial skills are not as difficult to learn as many people believe and in the hands of an experienced senior executive they can provide a formidable competitive advantage. After completing this course delegates will be able to: Understand fundamental business finance concepts; understand, analyse and interpret financial statements: Profit Statement, Balance Sheet and Cashflow Statement Understand the vital difference between profit and cashflow; identify the key components of working capital and how they can be managed to generate strong cashflow Evaluate pricing decisions based on an understanding of the nature of business costs and their impact on gross margin and break-even sales; managing pricing, discounts and costs to generate strong business profits; understand how lean manufacturing methods improve profit Use powerful analytical tools to measure and improve the performance of their own company and assess the effectiveness of their competitors Apply and interpret techniques for assessing and comparing investment opportunities in capital projects, business acquisitions and other ventures; understand and apply common methods of business valuation Understand the role of business finance in formulating and implementing competitive business strategy; the role of budgeting as part of the planning process and the various approaches to budgeting and performance measurement 1 Basic principles Delivering value to key stakeholders Accounting concepts, GAAP, IFRS and common terms Understanding and using the balance sheet Understanding and using the profit statement Recognising the vital difference between profit and cashflow Understanding and using the cashflow statement What financial statements can and cannot tell us 2 Managing and improving cashflow Sources of finance and their advantages and disadvantages What is working capital and why is it so important? Managing stocks, debtors and creditors Understanding how working capital drives business growth Understanding and avoiding the over-trading trap Unlocking the funds tied up in fixed assets: asset backed loans and leasing 3 Managing and improving profit Understanding how profits generate cashflow The fundamental nature of costs: fixed and variable business costs Understanding gross margin and break-even How common pricing methods affect gross margin and profit Effective strategies to improve gross margin Using value chain analysis to reduce costs Lean manufacturing methodsUnderstanding Just-in-time, 6 Sigma and Kaizen methods Improving profitEffective and defective strategies 4 Measuring and managing business performance Measures of financial performance and strength Investor behaviour: the risk and reward relationship Return on investment (ROI): the ultimate measure of business performance How profit margin and net asset turnover drive return on net assets Why some companies are more profitable that others Understanding competitive advantage: cost and differentiation advantage Why great companies failWhat happened to Kodak? Using a 'Pyramid of Ratios' to improve business performance Using Critical Success Factors to develop Key Performance Indicators 5 Budgeting and forecasting methods Using budgets to support strategy Objectives and methods for effective budgets Using budgets to monitor and manage business performance Alternative approaches to budgeting Developing and implementing Balanced Scorecards Beyond Budgeting Forecasting methods and techniques Identifying key business drivers Using rolling forecasts and 'what-if' models to aid decision-making

Glasgow Street Photography Course (group max 6)

By Ami Strachan

This group workshop for beginner and professional photographer who like to try different genre photography. Glasgow Street Photography Course Place to meet? Waterstone (Bookstore) Coffee Shop (top floor ) 174-176 Argyle St, Glasgow G2 8BT How long does this course take? 3 hours Can I use my SLR camera for this workshop? Definitely, but I don’t teach in SLR, you have to use your ability in using an SLR camera. What do I get from this course? You will gain confidence taking picture of people in public You will understand from my tips and tricks how this photography works for your self grow You will find a hobby that challenging and more… Your hobby should be fun, in my workshops/courses there aren't any strict rules but please note: You must have the willingness to learn No racism It doesn't matter what camera you have - your best tool is your intuition My workshops are friendly environment - be flexible If you are ready to start a different level of photography, this is FOR YOU! FACE YOUR FEARS AND START MOVING FORWARD IN PHOTOGRAPHY Follow the "I Candid You" WhatsApp Channel for an Update here. Join our group on facebook (private) here. Watch my video "Eye contact from random people on random street" here. Watch my video "Tips for Beginner Street Photography"here. My images were taken with Fuji X30, here.

Search By Location

- break, Courses in London

- break, Courses in Birmingham

- break, Courses in Glasgow

- break, Courses in Liverpool

- break, Courses in Bristol

- break, Courses in Manchester

- break, Courses in Sheffield

- break, Courses in Leeds

- break, Courses in Edinburgh

- break, Courses in Leicester

- break, Courses in Coventry

- break, Courses in Bradford

- break, Courses in Cardiff

- break, Courses in Belfast

- break, Courses in Nottingham