- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2601 Courses in Ferndown

£ Enquire Highfield Level 3 Award in Delivering Training (RQF) Three day course A practical qualification suitable for new and experienced trainers (external and internal) who wish to improve their classroom skills and obtain a training qualification which will also enable them to deliver regulated qualifications. This qualification provides a good basis to help learners get a ‘foot first’ into training. The focus is on the effective delivery of training, allowing learners to develop planning, preparation and delivery skills, including delivery methods, questioning techniques and time management. It’s mainly aimed at those who will use pre-prepared training materials to deliver training within the workplace, as opposed to a training qualification that is more focused on procedures, protocol and regulatory requirements, such as education and training.

We supply Fire Marshal, Warden, Awareness training at your location and tailor it to your work sector, as such your staff will have no travelling or subsistence expenses minimising disruption for your organisation. Our trainer will bring all materials so you only need to provide a room with a plug socket. There is a practical element with extinguishers outside using our propane burners, which are fully insured and environmentally friendly. We require approximately 4 car parking spaces for this, if you do not have enough space we provide extinguisher discharge only. The training is accredited by the Institute of Fire Safety Managers, all attendees will receive individual Electronic Certificates and our Fire Warden Quick Guide, in addition a Group Certificate will be sent with all names on for audit purposes and your central records.

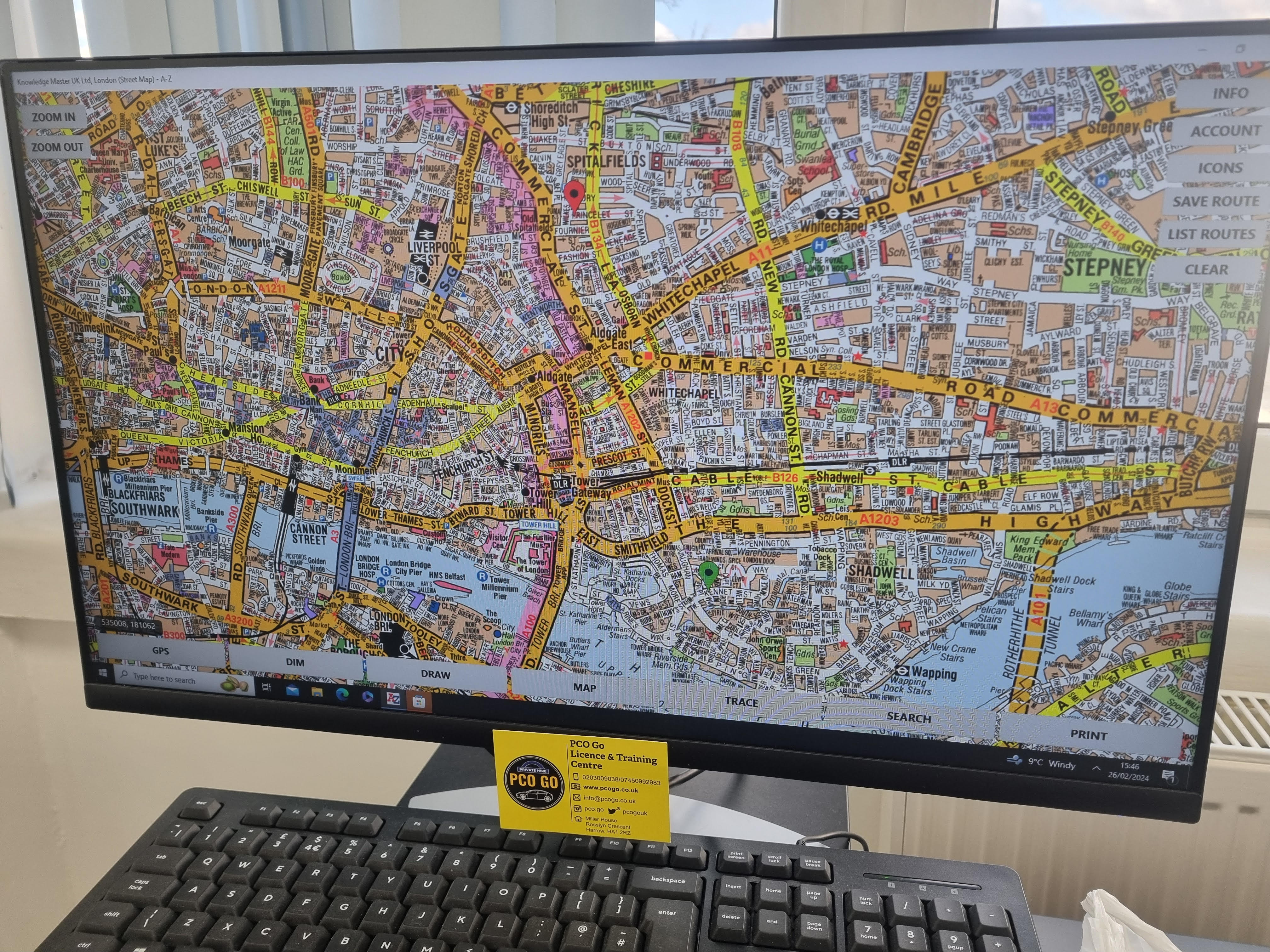

TOPOGRAPHICAL MAP ROUTE PLANNING TRAINING You will use the appropriate software to learn how to plan map routes. We will train you on the routes that you will most likely be tested on in your assessment. Most of our training is provided one to one, so as to give you our undivided attention and prepare you to the best of your ability, thereby giving you the best chance of passing this test. TOPOGRAPHICAL MOCK TEST We will provide you with topographical multiple choice questions mock test based on the actual test questions, to best prepare you. You will use the actual ’Master Atlas of Greater London’ which TfL uses in their test, to best prepare you to answers the multiple choice questions.

M.D.D PERSONAL DATING CONSULTATION (V.I.P)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Introducing Miss Date Doctor’s Personal Dating Consultation: Unlock Your Relationship Potential Are you tired of navigating the complexities of the dating world alone? Do you crave personalized guidance and support to help you find love and build fulfilling relationships? Look no further! Miss Date Doctor offers a comprehensive and Personal Dating Consultation designed to empower you on your journey to relationship success. At Miss Date Doctor, we understand that each individual’s dating journey is unique. That’s why our experienced and qualified dating experts are here to provide you with a tailored approach to dating coaching. With our Personal Dating Consultation, you’ll receive one-on-one attention, expert advice, and actionable strategies to enhance your dating skills and increase your chances of finding meaningful connections. Our Personal Dating Consultation is entirely free, allowing you to experience the value of our services without any financial commitment. During this consultation, our dating experts will delve into your dating history, identify your goals and desires, and provide personalized insights to address your specific challenges. We’ll cover a range of topics, including building self-confidence, effective communication techniques, dating etiquette, and creating a positive dating mindset. Our team of experts stays informed on the latest dating trends, psychology research, and relationship strategies to ensure that you receive the best guidance possible. So why wait? Take the first step towards transforming your dating life and sign up for Miss Date Doctor’s Personal Dating Consultation today. Discover the power of personalized support and unlock your relationship potential. Remember, the consultation is free, giving you the opportunity to experience our expertise without any financial commitment. 40 MINS https://relationshipsmdd.com/product/personal-dating-consultation/

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham